State Farm auto insurance cost is a crucial consideration for any driver seeking reliable and affordable coverage. Understanding the factors that influence your premiums is essential to making informed decisions. State Farm’s pricing model considers various aspects, such as your driving history, vehicle type, and location, to determine your individual rates.

This guide delves into the intricacies of State Farm auto insurance costs, comparing them to competitors, exploring coverage options, and uncovering discounts and savings opportunities. We’ll also analyze customer reviews and experiences to provide a comprehensive understanding of State Farm’s offerings.

Understanding State Farm Auto Insurance Costs

Getting an accurate estimate for your State Farm auto insurance can be tricky. Several factors influence the price, making it hard to predict the exact cost without a personalized quote. This guide breaks down the key factors that shape your State Farm auto insurance premiums and how the pricing model works.

Factors Influencing State Farm Auto Insurance Costs

Many factors determine the cost of your State Farm auto insurance. Understanding these factors can help you make informed decisions to potentially lower your premiums.

- Driving History: Your driving record is a major factor in determining your insurance costs. Accidents, traffic violations, and even your age can significantly impact your premiums. Drivers with clean records generally enjoy lower rates.

- Vehicle Type: The type of vehicle you drive also influences your insurance costs. Newer, more expensive cars often have higher insurance premiums due to their higher repair costs and potential for greater theft.

- Location: Where you live plays a significant role in your insurance costs. Areas with higher crime rates, traffic congestion, and accident frequency generally have higher premiums.

- Coverage Levels: The amount of coverage you choose directly impacts your premiums. Higher coverage levels, such as comprehensive and collision, provide more protection but come with higher costs.

- Discounts: State Farm offers various discounts that can reduce your premiums. These include discounts for good driving records, safety features in your vehicle, multiple policies, and even your occupation.

State Farm’s Pricing Model

State Farm uses a complex pricing model to determine your insurance premiums. This model considers various factors, including those listed above, to calculate a personalized rate for you.

State Farm’s pricing model is based on the idea that individuals with lower risk profiles should pay lower premiums.

The model analyzes your driving history, vehicle type, location, and other factors to assess your risk of being involved in an accident. Based on this risk assessment, State Farm calculates your insurance premium.

Examples of How Factors Impact Costs, State farm auto insurance cost

Here are some real-world examples of how different factors can influence your State Farm auto insurance costs:

- Driving History: A driver with a clean record for five years might pay a lower premium compared to a driver with a recent speeding ticket.

- Vehicle Type: A new luxury SUV might have a higher insurance premium compared to a used compact car.

- Location: A driver living in a densely populated urban area might pay a higher premium compared to a driver living in a rural area.

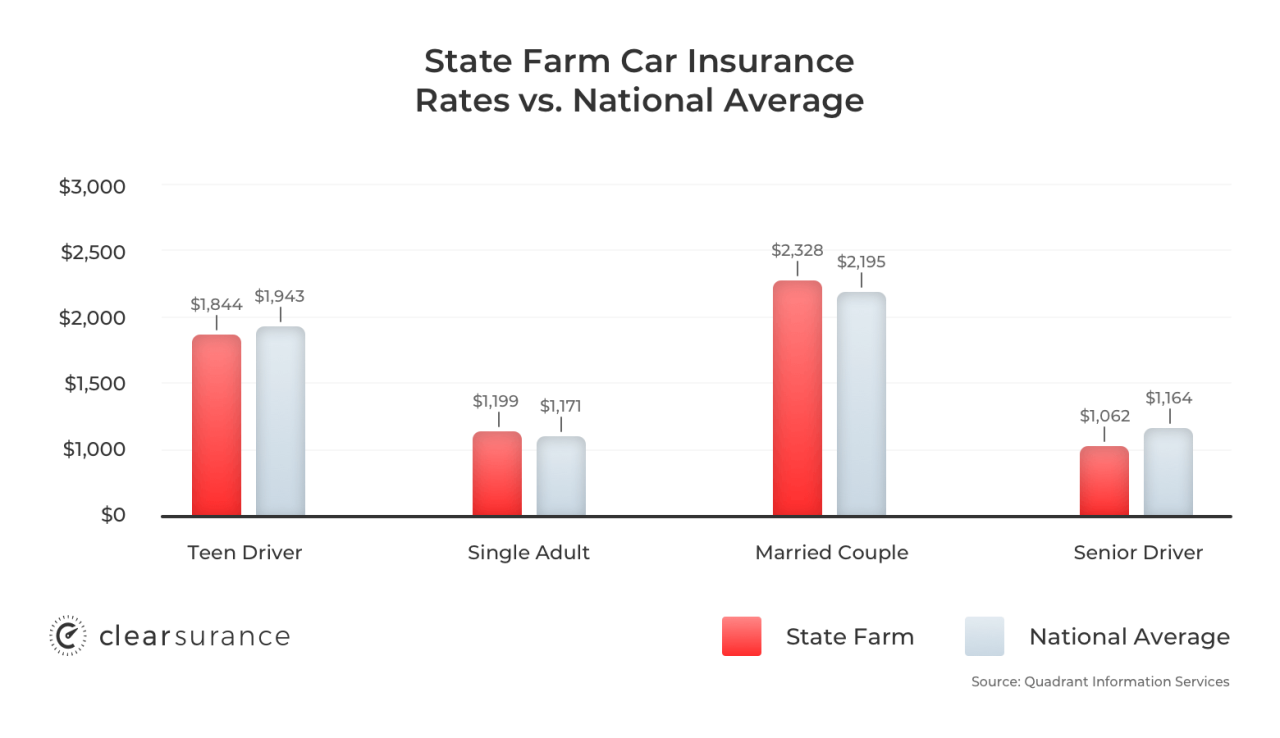

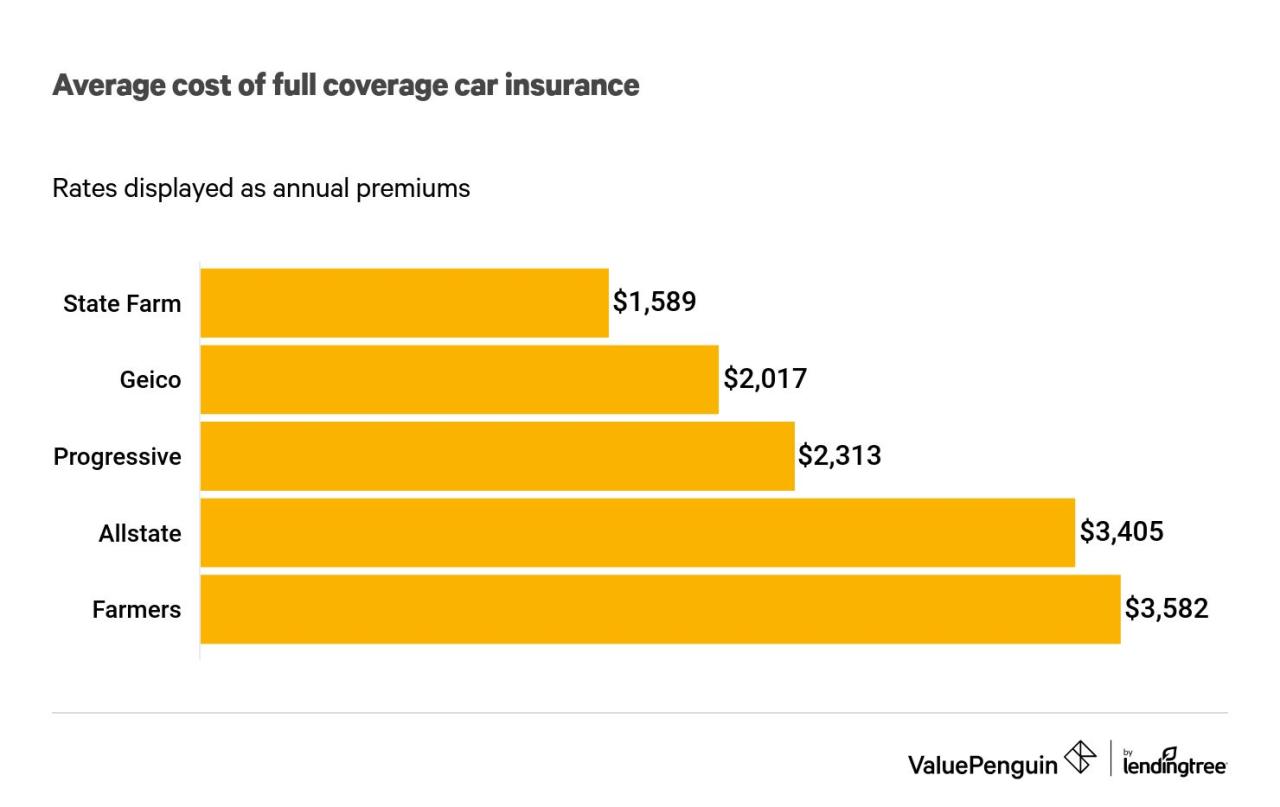

Comparing State Farm Rates to Competitors

It’s essential to compare quotes from multiple insurance providers before choosing a policy. State Farm is a well-known and reputable company, but other insurers might offer more competitive rates or coverage options that better suit your needs.

By comparing quotes, you can identify the best value for your money and ensure you’re getting the coverage you need at a price you can afford.

Key Differences in Coverage and Pricing

To make an informed decision, it’s crucial to understand the key differences in coverage and pricing across various insurance providers. Comparing State Farm’s rates with other major insurers can help you identify the best option for your specific situation.

While State Farm is known for its comprehensive coverage options, other insurers may offer more specialized or niche coverage at potentially lower prices. For example, some companies might provide better rates for drivers with specific driving records or vehicle types.

- Coverage Options: State Farm offers a wide range of coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. However, other insurers may have more specialized coverage options, such as gap insurance or rental car reimbursement, which might be important for certain drivers.

- Pricing: State Farm’s rates are generally competitive, but they can vary significantly depending on factors such as your location, driving history, vehicle type, and coverage options. Other insurers may offer lower rates for certain demographics or risk profiles.

- Discounts: Both State Farm and other insurers offer various discounts, such as safe driver discounts, good student discounts, and multi-policy discounts. Comparing these discounts can help you identify the best overall value.

State Farm Rates Compared to Competitors

State Farm’s rates are generally competitive, but they can vary depending on several factors. It’s essential to compare quotes from multiple insurers to determine the best value for your specific situation.

For example, Progressive and Geico are often known for offering competitive rates, especially for drivers with good driving records. However, other insurers like USAA or Liberty Mutual might provide better rates for certain demographics or specific coverage needs.

Here’s a general overview of how State Farm’s rates compare to other major insurers:

| Insurance Company | Average Annual Premium | Key Strengths | Key Weaknesses |

|---|---|---|---|

| State Farm | $1,450 | Comprehensive coverage options, strong customer service, widespread availability | Rates can be higher than some competitors, limited discounts |

| Progressive | $1,350 | Competitive rates, extensive discounts, innovative technology | Limited customer service options, some coverage limitations |

| Geico | $1,300 | Lowest average premiums, extensive discounts, easy online quoting | Limited customer service options, fewer coverage options |

| USAA | $1,200 | Excellent customer service, competitive rates for military members and families, comprehensive coverage options | Limited availability, only available to military members and families |

| Liberty Mutual | $1,400 | Strong customer service, innovative safety features, personalized coverage options | Higher rates for some drivers, limited discounts |

This table provides a general overview of average annual premiums for different insurers. It’s important to note that these rates can vary significantly based on individual factors, and it’s always recommended to obtain personalized quotes from multiple insurers before making a decision.

Exploring State Farm’s Coverage Options

State Farm offers a wide range of auto insurance coverage options to cater to different needs and budgets. Understanding these options is crucial for selecting the right coverage that provides adequate protection while staying within your financial means. This section will explore the different types of auto insurance coverage offered by State Farm, outlining their benefits and limitations, and providing examples of situations where specific coverage options might be beneficial.

Liability Coverage

Liability coverage is a fundamental aspect of auto insurance, protecting you financially if you are at fault in an accident that causes injury or damage to others. It covers the costs of medical expenses, property damage, and legal fees incurred by the other party involved in the accident.

State Farm offers two primary types of liability coverage:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages related to injuries sustained by the other party in an accident.

- Property Damage Liability: This coverage pays for repairs or replacement of the other party’s vehicle or property damaged in an accident.

The amount of liability coverage you need depends on your individual circumstances, including your driving history, the value of your assets, and the state’s minimum liability requirements.

For instance, if you have significant assets, such as a home or investments, you might consider higher liability limits to protect yourself from potential financial ruin in case of a serious accident.

It’s crucial to consult with a State Farm agent to determine the appropriate liability coverage limits for your specific needs.

Collision Coverage

Collision coverage protects you from financial losses if your vehicle is damaged in an accident, regardless of who is at fault. This coverage pays for repairs or replacement of your vehicle, minus any deductible you have chosen.

Collision coverage is typically optional, and its value depends on factors such as the age and value of your vehicle.

For newer vehicles, collision coverage is often recommended as it can help you recover the full value of your car in case of a major accident. However, for older vehicles with lower values, collision coverage might not be cost-effective, as the cost of the coverage could exceed the value of the vehicle.

Comprehensive Coverage

Comprehensive coverage provides financial protection against damages to your vehicle caused by events other than collisions, such as theft, vandalism, fire, hail, or natural disasters.

Like collision coverage, comprehensive coverage is optional and the decision to purchase it depends on the value of your vehicle and your risk tolerance.

For example, if you live in an area prone to hailstorms or have a high-value vehicle, comprehensive coverage could be beneficial. However, if your vehicle is older and less valuable, the cost of comprehensive coverage might not be justified.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you and your passengers in the event of an accident caused by a driver who is uninsured or has insufficient insurance to cover your losses.

UM/UIM coverage is essential as it can help you recover damages for medical expenses, lost wages, and other losses, even if the at-fault driver cannot afford to pay.

State Farm offers both uninsured and underinsured motorist coverage, and it’s generally recommended to purchase coverage limits that match your liability limits.

Personal Injury Protection (PIP)

Personal injury protection (PIP) coverage, also known as no-fault insurance, covers your medical expenses and lost wages following an accident, regardless of who is at fault. This coverage is mandatory in some states, and it can be beneficial in situations where you are injured in an accident and need medical attention.

PIP coverage provides financial protection for medical expenses, lost wages, and other related costs, helping you recover from the financial burden of an accident.

However, PIP coverage typically has limits, and it might not cover all your losses.

It’s important to understand the specific coverage limits and exclusions of your PIP policy to ensure you have adequate protection.

Other Coverage Options

State Farm offers additional coverage options to provide more comprehensive protection for your vehicle and yourself. These options include:

- Rental Reimbursement: This coverage helps cover the cost of a rental car while your vehicle is being repaired after an accident.

- Roadside Assistance: This coverage provides assistance with services such as towing, flat tire changes, and jump starts.

- Gap Insurance: This coverage helps pay the difference between the actual cash value of your vehicle and the amount you owe on your auto loan if your vehicle is totaled in an accident.

- Custom Equipment Coverage: This coverage protects aftermarket modifications or accessories added to your vehicle, such as sound systems, custom wheels, or performance upgrades.

These additional coverage options can provide valuable peace of mind and financial protection in various situations. However, it’s important to carefully consider the costs and benefits of each option before purchasing them.

State Farm Discounts and Savings

State Farm offers a wide range of discounts to help customers save money on their auto insurance premiums. These discounts are designed to reward safe driving habits, responsible vehicle ownership, and other positive factors.

By taking advantage of these discounts, customers can significantly reduce their insurance costs. Here’s a look at some of the most common State Farm discounts and how to qualify for them.

Good Driver Discounts

State Farm offers discounts for drivers with a clean driving record. This includes discounts for:

- Safe Driving: This discount is typically offered to drivers who have not been involved in any accidents or received any traffic violations for a specified period.

- Defensive Driving Course Completion: Completing a defensive driving course can demonstrate your commitment to safe driving and earn you a discount.

Vehicle Safety Discounts

State Farm recognizes vehicles with safety features that can help prevent accidents. These discounts include:

- Anti-theft Devices: Having an anti-theft system installed in your vehicle, such as an alarm or immobilizer, can qualify you for a discount.

- Airbags and Anti-lock Brakes (ABS): Vehicles equipped with airbags and ABS are generally considered safer and can earn you a discount.

Other Discounts

State Farm offers a variety of other discounts to help customers save, including:

- Multi-policy Discount: Bundling your auto insurance with other insurance policies, such as homeowners or renters insurance, can result in a significant discount.

- Good Student Discount: Students with good grades may qualify for a discount. This encourages academic achievement and responsible behavior.

- Payment Discount: Paying your premium in full or setting up automatic payments can sometimes lead to a discount.

- Military Discount: Active military personnel and veterans may qualify for a discount.

Customer Reviews and Experiences

Customer reviews provide valuable insights into the overall satisfaction and experiences of State Farm auto insurance policyholders. By analyzing both positive and negative feedback, we can gain a comprehensive understanding of what customers appreciate and where improvements can be made.

Customer Satisfaction and Positive Feedback

Positive reviews often highlight State Farm’s excellent customer service, competitive pricing, and comprehensive coverage options.

- Many customers praise State Farm’s agents for their professionalism, responsiveness, and willingness to go the extra mile to meet their needs.

- State Farm’s online platform and mobile app are frequently commended for their user-friendliness and convenience, allowing policyholders to manage their accounts, make payments, and file claims easily.

- Customers also appreciate the wide range of discounts and savings available, which can help reduce the overall cost of insurance.

Common Concerns and Negative Feedback

While State Farm receives positive reviews, there are also some common concerns raised by customers.

- Some customers have reported difficulties in reaching customer service representatives, particularly during peak hours or when filing claims.

- Others have expressed dissatisfaction with the claims process, citing delays or challenges in obtaining fair settlements.

- There have also been instances where customers felt that State Farm’s rates were not competitive compared to other insurance providers.

Analyzing Common Themes

Several common themes emerge from customer reviews, providing valuable insights into State Farm’s strengths and areas for improvement.

- Customer service is a crucial aspect of the insurance experience, and State Farm’s agents are generally well-regarded for their professionalism and responsiveness. However, there is room for improvement in terms of accessibility and wait times during peak periods.

- The claims process is another key area where customer satisfaction can vary. While many customers have positive experiences, others have encountered delays or challenges in obtaining fair settlements. Streamlining the claims process and ensuring prompt and fair resolution are critical for customer satisfaction.

- Pricing remains a major consideration for consumers. While State Farm offers competitive rates in some areas, there are instances where customers have found better deals with other insurers. State Farm should continue to evaluate its pricing strategies and ensure that it remains competitive in the market.

Obtaining a Quote and Getting Started

Getting a quote for State Farm auto insurance is a straightforward process. You can obtain a quote online, over the phone, or through a local State Farm agent.

Getting a Quote

To get a quote, you’ll need to provide some basic information about yourself and your vehicle(s). This typically includes:

- Your name, address, and contact information

- Your driving history, including any accidents or violations

- The year, make, model, and VIN of your vehicle(s)

- Your desired coverage levels

- Any applicable discounts

Once you’ve provided this information, State Farm will generate a quote for your auto insurance. You can then compare this quote to others from different insurance companies to find the best deal for you.

Tips for Getting the Best Rate

- Shop around: Get quotes from multiple insurance companies to compare rates and coverage options.

- Bundle your policies: Consider bundling your auto insurance with other insurance policies, such as homeowners or renters insurance, to potentially save money.

- Improve your driving record: Maintaining a clean driving record can significantly reduce your insurance premiums.

- Consider increasing your deductible: A higher deductible can result in lower monthly premiums.

- Ask about discounts: State Farm offers a variety of discounts, such as good student, safe driver, and multi-car discounts.

Final Wrap-Up

By carefully evaluating your individual needs and exploring State Farm’s comprehensive coverage options, you can find a policy that aligns with your budget and provides peace of mind. Remember to consider factors like your driving history, vehicle type, and location, as they significantly impact your premiums. Don’t hesitate to compare rates with other insurers to ensure you’re getting the best value for your money.

FAQs

How do I get a quote for State Farm auto insurance?

You can get a quote online, over the phone, or by visiting a local State Farm agent. You’ll need to provide information about your driving history, vehicle, and location.

What are the most common discounts offered by State Farm?

State Farm offers a variety of discounts, including good driver, safe driver, multi-car, and bundling discounts. You can find a complete list of discounts on their website.

What are the main differences between State Farm’s coverage options?

State Farm offers various coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. The level of coverage you choose will impact your premium.

How does State Farm’s pricing model compare to other insurance companies?

State Farm’s pricing model is competitive with other major insurance providers. However, it’s important to compare rates from multiple companies to find the best deal for your specific needs.