State Farm auto insurance Colorado is a well-established provider offering a wide range of coverage options to suit the diverse needs of Colorado drivers. With a long history in the state, State Farm has built a reputation for its commitment to customer satisfaction and community involvement. This guide explores the intricacies of State Farm’s offerings in Colorado, providing valuable insights for those seeking reliable auto insurance.

From understanding available coverage options and factors influencing rates to navigating customer experiences and exploring State Farm’s commitment to sustainability, this guide aims to equip you with the knowledge necessary to make informed decisions about your auto insurance needs.

State Farm Auto Insurance in Colorado

State Farm is a major player in the Colorado auto insurance market, offering a wide range of coverage options and services to residents. With a long history in the state and a strong commitment to customer satisfaction, State Farm has earned a reputation for reliability and value.

State Farm’s Presence in Colorado

State Farm has a significant presence in Colorado, with a vast network of agents and offices throughout the state. The company has been serving Colorado residents for decades, establishing itself as a trusted and familiar name in the insurance industry. State Farm’s strong market share in Colorado reflects its widespread popularity and customer loyalty.

Key Offerings

State Farm offers a comprehensive suite of auto insurance products tailored to meet the diverse needs of Colorado drivers. These offerings include:

- Liability coverage: This protects drivers against financial losses arising from accidents they cause, covering medical expenses, property damage, and legal fees.

- Collision coverage: This covers repairs or replacement of the insured vehicle in case of an accident, regardless of fault.

- Comprehensive coverage: This protects against damage to the insured vehicle caused by non-collision events, such as theft, vandalism, or natural disasters.

- Uninsured/underinsured motorist coverage: This provides protection in case of an accident involving a driver who is uninsured or has insufficient insurance.

- Personal injury protection (PIP): This covers medical expenses and lost wages for the insured and their passengers, regardless of fault.

State Farm also offers various discounts and features to enhance policy value, such as:

- Safe driver discounts: These reward drivers with clean driving records and demonstrate a commitment to road safety.

- Multi-policy discounts: These provide savings for bundling auto insurance with other State Farm policies, such as homeowners or renters insurance.

- Good student discounts: These acknowledge the academic achievements of young drivers and encourage responsible behavior.

Commitment to Colorado Communities

State Farm is deeply committed to supporting Colorado communities through various programs and initiatives. These include:

- Community grants: State Farm provides financial support to local organizations that focus on education, safety, and community development.

- Volunteerism: State Farm encourages its employees and agents to participate in community service activities, fostering a culture of giving back.

- Disaster relief: State Farm provides assistance to communities affected by natural disasters, offering financial support and resources to help with recovery efforts.

Available Auto Insurance Coverage Options

State Farm offers a comprehensive range of auto insurance coverage options in Colorado, designed to protect you financially in the event of an accident or other covered incident. Understanding the different types of coverage available is crucial for making informed decisions about your policy and ensuring you have the right protection for your needs.

Liability Coverage

Liability coverage is a fundamental component of auto insurance in Colorado. It protects you financially if you cause an accident that results in injuries or damage to another person or property. It typically includes two main components:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages incurred by the other party due to injuries caused by your negligence. It is expressed as a per-person limit and a per-accident limit, for example, 25/50, meaning $25,000 per person and $50,000 per accident.

- Property Damage Liability: This coverage pays for repairs or replacement of the other party’s vehicle or property damaged in an accident caused by you. It is typically expressed as a single limit, for example, $50,000.

Liability coverage is mandatory in Colorado, with minimum limits set by the state. However, it is generally advisable to carry higher limits than the minimum to protect yourself adequately in the event of a serious accident.

Collision Coverage

Collision coverage protects you against damage to your own vehicle resulting from a collision with another vehicle or object, regardless of fault. This coverage pays for repairs or replacement of your vehicle, minus any deductible you choose.

- Deductible: The deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible typically results in lower premiums.

Collision coverage is optional in Colorado, but it is generally recommended if you have a loan or lease on your vehicle, as lenders often require it. It can also be beneficial if you have an older vehicle with a higher value, as it can help cover the cost of repairs or replacement.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damage caused by events other than collisions, such as theft, vandalism, fire, hail, or natural disasters. Like collision coverage, it pays for repairs or replacement, minus your deductible.

- Deductible: Similar to collision coverage, you choose a deductible for comprehensive coverage, with higher deductibles leading to lower premiums.

Comprehensive coverage is optional in Colorado, but it can be valuable for protecting your vehicle against unforeseen events. It is particularly useful if you have a newer or more expensive vehicle.

Uninsured/Underinsured Motorist Coverage (UM/UIM)

UM/UIM coverage protects you in the event of an accident caused by an uninsured or underinsured driver. It covers your medical expenses, lost wages, and property damage if the other driver does not have sufficient liability insurance or no insurance at all.

- Uninsured Motorist Coverage (UM): This coverage applies when the other driver is uninsured.

- Underinsured Motorist Coverage (UIM): This coverage applies when the other driver has insurance, but their liability limits are insufficient to cover your losses.

UM/UIM coverage is optional in Colorado, but it is highly recommended as it can provide crucial financial protection in situations where the other driver is at fault but lacks adequate insurance.

Personal Injury Protection (PIP)

PIP coverage, also known as “no-fault” insurance, covers your own medical expenses and lost wages, regardless of fault, in the event of an accident. It applies even if you are at fault for the accident.

- Medical Expenses: PIP covers medical expenses for you and your passengers, including doctor visits, hospital stays, and rehabilitation.

- Lost Wages: PIP can also cover lost wages due to your inability to work after an accident.

PIP coverage is optional in Colorado, but it is generally recommended as it provides peace of mind and ensures you have access to necessary medical care and financial support after an accident, regardless of who is at fault.

Other Coverage Options

In addition to the core coverage options discussed above, State Farm offers several other optional coverages in Colorado, including:

- Rental Reimbursement: This coverage helps pay for a rental car while your vehicle is being repaired after an accident.

- Roadside Assistance: This coverage provides assistance for breakdowns, flat tires, and other roadside emergencies.

- Gap Insurance: This coverage covers the difference between your vehicle’s actual cash value and the amount you owe on your loan or lease if your vehicle is totaled.

- Custom Equipment Coverage: This coverage protects your vehicle’s custom modifications, such as aftermarket audio systems or performance upgrades.

Factors Influencing Auto Insurance Rates in Colorado

Auto insurance premiums in Colorado are influenced by a variety of factors, and understanding these factors can help you make informed decisions about your coverage and potentially save money. State Farm, like other insurance companies, uses a complex system to calculate individual premiums, taking into account various aspects of your driving history, vehicle, and personal circumstances.

Driver Demographics

Driver demographics play a significant role in determining insurance rates. This category includes factors like age, gender, and driving experience. Younger drivers, especially those under 25, often face higher premiums due to their statistically higher risk of accidents. This is because young drivers have less experience behind the wheel and may engage in riskier driving behaviors. On the other hand, older drivers may see lower premiums as they tend to have more experience and a lower risk of accidents. Gender can also influence rates, with males typically paying slightly higher premiums than females.

Vehicle Characteristics

The type of vehicle you drive significantly impacts your insurance rates. Factors such as the vehicle’s make, model, year, safety features, and value all contribute to your premium. Higher-performance vehicles or luxury cars with higher replacement costs tend to have higher insurance premiums. Vehicles with advanced safety features, such as anti-lock brakes, airbags, and stability control, can often qualify for discounts.

Driving History

Your driving history is arguably the most significant factor influencing your auto insurance rates. A clean driving record with no accidents or traffic violations will generally result in lower premiums. However, if you have a history of accidents, speeding tickets, or other traffic offenses, your premiums will likely be higher. State Farm uses a points system to evaluate your driving history, with each violation or accident adding points that increase your premium.

Customer Experience and Reviews

Understanding the experiences of State Farm auto insurance customers in Colorado is crucial for making informed decisions. Customer reviews and testimonials offer valuable insights into the company’s strengths and areas for improvement. Analyzing these reviews can provide a comprehensive picture of the customer experience, covering aspects like claims handling, customer service, and overall satisfaction.

Customer Satisfaction and Claims Handling

Customer satisfaction with State Farm’s auto insurance services in Colorado is generally positive, with many reviews highlighting smooth claims processes and responsive customer service. Reviews on platforms like Trustpilot and Google Reviews indicate a high level of satisfaction with the company’s claims handling procedures.

- Many customers praise the company’s promptness in processing claims, with many reporting that they received quick and efficient service.

- Several reviews mention that State Farm representatives were helpful and supportive throughout the claims process, ensuring a smooth and stress-free experience.

- Customers appreciate the transparency and clear communication provided by State Farm during the claims process, allowing them to understand the status of their claims at every step.

Customer Service and Communication

Customer service is a key aspect of the insurance experience, and State Farm’s customer service in Colorado has received generally positive feedback from customers. Reviews emphasize the company’s accessibility, responsiveness, and helpfulness in addressing customer inquiries and concerns.

- Many customers commend the company’s responsive customer service representatives who are readily available to answer questions and provide assistance.

- Several reviews highlight the company’s user-friendly online platforms and mobile apps, which provide convenient access to policy information, claims filing, and customer support.

- Customers appreciate the company’s proactive communication, keeping them informed about policy updates, claims status, and important information related to their coverage.

State Farm’s Competitive Landscape in Colorado

Colorado’s auto insurance market is highly competitive, with numerous companies vying for customers. State Farm is a major player in this market, but it faces stiff competition from other large national insurers as well as regional and local companies.

State Farm’s Market Position

State Farm is one of the largest auto insurers in the United States, and it holds a significant market share in Colorado. The company’s strong brand recognition, extensive agent network, and wide range of coverage options make it a popular choice for many Colorado drivers.

Comparison with Key Competitors

State Farm’s pricing and coverage offerings are competitive with those of its main rivals in Colorado, including:

- Progressive: Progressive is known for its innovative online tools and personalized pricing. The company offers a variety of discounts and features, including its “Name Your Price” tool, which allows customers to set their desired premium and see which coverage options fit within their budget.

- Geico: Geico is another major national insurer with a strong presence in Colorado. The company is known for its competitive rates and its “15 minutes could save you 15% or more” advertising campaign. Geico offers a wide range of coverage options and discounts, including its “multi-car” discount for customers who insure multiple vehicles with the company.

- Allstate: Allstate is a well-established insurer with a strong reputation for customer service. The company offers a variety of coverage options and discounts, including its “Drive Safe & Save” program, which rewards safe drivers with lower premiums.

- USAA: USAA is a highly-rated insurer that specializes in serving active-duty military personnel, veterans, and their families. The company offers competitive rates, excellent customer service, and a wide range of coverage options. However, USAA membership is restricted to eligible individuals and their families.

Factors Influencing Competitive Landscape

The competitive landscape in Colorado’s auto insurance market is influenced by a number of factors, including:

- Economic conditions: Changes in the economy can affect insurance rates and consumer demand. For example, a recession may lead to increased demand for lower-cost insurance options.

- Legislative changes: New laws and regulations can impact insurance rates and coverage options. For example, the implementation of no-fault insurance in Colorado could affect the cost of auto insurance.

- Technological advancements: New technologies, such as telematics devices and driver-assistance systems, are changing the way insurers assess risk and price policies. For example, insurers may offer discounts to drivers who use telematics devices to track their driving behavior.

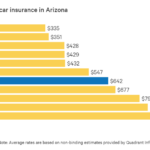

Pricing and Coverage Comparison

State Farm’s pricing and coverage offerings are generally competitive with those of its main competitors in Colorado. However, rates can vary significantly based on factors such as the driver’s age, driving history, vehicle type, and location. It’s important to compare quotes from multiple insurers to find the best rates and coverage for your individual needs.

State Farm’s Commitment to Sustainability and Social Responsibility

State Farm, a leading auto insurance provider in Colorado, demonstrates a strong commitment to sustainability and social responsibility. This commitment extends beyond its core business operations and encompasses initiatives that promote environmental protection, community engagement, and diversity and inclusion.

Environmental Protection, State farm auto insurance colorado

State Farm’s environmental protection efforts in Colorado focus on reducing its carbon footprint and promoting sustainable practices. These initiatives aim to minimize the company’s environmental impact and contribute to a healthier planet.

- Energy Efficiency: State Farm actively promotes energy efficiency in its offices and facilities in Colorado. This includes implementing energy-saving measures such as LED lighting, smart thermostats, and building automation systems. These measures help reduce energy consumption and minimize the company’s carbon footprint.

- Renewable Energy: State Farm has embraced renewable energy sources in its operations. The company has invested in solar panels for its buildings in Colorado, generating clean energy and reducing reliance on fossil fuels. This commitment to renewable energy demonstrates State Farm’s dedication to environmental sustainability.

- Paper Reduction: State Farm is committed to reducing paper consumption in its operations. The company has implemented digital processes and encouraged employees to utilize electronic communication and documentation. This initiative has significantly reduced paper waste and promoted a more sustainable work environment.

Final Wrap-Up: State Farm Auto Insurance Colorado

In conclusion, State Farm auto insurance Colorado presents a compelling option for drivers seeking comprehensive coverage and reliable service. By understanding the various coverage options, factors influencing rates, and the customer experience, individuals can make informed decisions about their auto insurance needs. State Farm’s commitment to sustainability and social responsibility further enhances its standing as a responsible and trustworthy provider in the Colorado market.

FAQ Compilation

What are the minimum auto insurance requirements in Colorado?

Colorado requires drivers to carry liability coverage, including bodily injury liability, property damage liability, and uninsured/underinsured motorist coverage. Specific minimum limits apply.

How can I get a quote for State Farm auto insurance in Colorado?

You can obtain a quote online, over the phone, or by visiting a local State Farm agent. Provide your personal and vehicle information for an accurate estimate.

Does State Farm offer discounts for safe drivers in Colorado?

Yes, State Farm offers various discounts for safe drivers, including good driver discounts, accident-free discounts, and defensive driving course discounts.