State Employees Credit Union car insurance provides a comprehensive and competitive option for state employees seeking reliable and affordable coverage. SECU, as it’s known, has a long history of serving the financial needs of state workers, offering a range of financial products and services, including car insurance.

This guide will delve into the details of SECU’s car insurance offerings, exploring the coverage options, rates, and the claims process. We’ll also compare SECU to other major insurance providers and provide tips for getting the best possible rate on your car insurance.

State Employees Credit Union (SECU) Overview

SECU is a not-for-profit financial cooperative serving the needs of North Carolina’s state employees, educators, and their families. Founded in 1939, SECU has grown to become one of the largest credit unions in the United States, with a rich history of serving its members and supporting the communities it serves.

SECU’s mission is to provide its members with a wide range of financial products and services at competitive rates while promoting financial literacy and well-being. As a not-for-profit organization, SECU prioritizes the needs of its members over generating profits for shareholders.

Membership and Financial Performance, State employees credit union car insurance

SECU boasts a large and diverse membership base, exceeding 2.7 million members. This significant membership reflects SECU’s commitment to serving a broad range of individuals and families across North Carolina. SECU’s financial performance has been consistently strong, demonstrating its stability and commitment to providing value to its members.

SECU’s financial strength is reflected in its assets, which exceed $50 billion. This substantial asset base allows SECU to offer competitive rates and products while maintaining a strong financial position.

Benefits of SECU Membership

SECU membership offers numerous benefits, including:

- Competitive rates on loans and savings accounts: SECU strives to provide members with competitive rates on loans, including mortgages, auto loans, and personal loans. It also offers high-yield savings accounts, allowing members to maximize their returns.

- Access to a wide range of financial products and services: SECU provides a comprehensive suite of financial products and services, including checking and savings accounts, credit cards, mortgages, auto loans, investment products, and insurance.

- Personalized service and support: SECU is committed to providing personalized service and support to its members. Members have access to experienced financial advisors who can assist with financial planning and goal setting.

- Community involvement: SECU actively supports its communities through various initiatives, including financial literacy programs, scholarships, and donations to local charities.

- Member-owned and governed: As a not-for-profit credit union, SECU is owned and governed by its members. This ensures that SECU’s decisions are made in the best interests of its members.

SECU Car Insurance Services

SECU Car Insurance offers a variety of coverage options to meet your individual needs. Whether you’re looking for basic liability coverage or comprehensive protection, SECU has a plan that can help protect you and your vehicle.

Liability Coverage

Liability coverage is the most basic type of car insurance. It protects you financially if you cause an accident that results in injury or damage to another person or property. This coverage pays for the other driver’s medical bills, lost wages, and property damage.

Collision Coverage

Collision coverage protects you if your vehicle is damaged in an accident, regardless of who is at fault. It covers the cost of repairs or replacement of your vehicle, minus your deductible.

Comprehensive Coverage

Comprehensive coverage protects you against damage to your vehicle from events other than accidents, such as theft, vandalism, fire, and natural disasters. It also covers the cost of repairs or replacement of your vehicle, minus your deductible.

Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist (UM/UIM) coverage protects you if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover your losses.

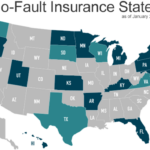

Personal Injury Protection (PIP)

Personal Injury Protection (PIP) coverage, also known as no-fault insurance, covers your medical expenses and lost wages if you are injured in an accident, regardless of who is at fault.

Rental Car Coverage

Rental car coverage pays for the cost of a rental car if your vehicle is damaged in an accident or is being repaired due to a covered event.

Roadside Assistance

Roadside assistance provides help with flat tires, dead batteries, and other roadside emergencies.

Other Coverage Options

SECU also offers other coverage options, such as:

- Gap coverage

- Towing and labor coverage

- Custom parts coverage

- Loan/lease gap coverage

SECU Car Insurance Rates and Factors

Your car insurance rates are determined by several factors, including your driving history, age, vehicle type, and location. SECU, like other insurance providers, considers these factors when calculating your premium.

Factors Influencing SECU Car Insurance Rates

- Driving History: Your driving record plays a significant role in your car insurance rates. A clean driving record with no accidents or violations will result in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions will likely lead to higher rates.

- Age: Insurance companies often consider age as a factor in determining rates. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents, leading to higher premiums. As you age and gain experience, your rates may decrease.

- Vehicle Type: The type of vehicle you drive significantly impacts your insurance rates. Sports cars, luxury vehicles, and high-performance cars are typically more expensive to insure due to their higher repair costs and potential for greater damage in accidents.

- Location: Your location plays a role in your car insurance rates. Areas with higher crime rates or traffic congestion often have higher insurance premiums due to the increased risk of accidents and theft.

- Credit Score: While it might seem unusual, your credit score can also influence your car insurance rates. Insurance companies use credit scores as an indicator of your financial responsibility, believing that individuals with good credit are more likely to be responsible drivers.

Comparing SECU Car Insurance Rates to Other Providers

SECU offers competitive car insurance rates compared to other major insurance providers. However, it’s crucial to compare quotes from multiple companies to find the best rate for your specific needs and situation. You can use online comparison tools or contact insurance agents directly to obtain quotes.

Tips for Getting the Best Possible Rate on SECU Car Insurance

- Maintain a Clean Driving Record: Avoid traffic violations, accidents, and driving under the influence. A good driving history is the most significant factor in obtaining lower rates.

- Shop Around: Compare quotes from multiple insurance companies, including SECU, to find the best rates.

- Bundle Your Policies: Consider bundling your car insurance with other policies, such as homeowners or renters insurance, to potentially qualify for discounts.

- Increase Your Deductible: A higher deductible means you’ll pay more out of pocket in case of an accident, but it can lead to lower premiums.

- Consider Safety Features: Vehicles equipped with safety features like anti-lock brakes, airbags, and stability control may qualify for discounts.

- Ask About Discounts: Inquire about available discounts, such as good student discounts, safe driver discounts, or discounts for members of certain organizations.

SECU Car Insurance Claims Process: State Employees Credit Union Car Insurance

Filing a car insurance claim with SECU is straightforward. The process is designed to be simple and efficient, helping you get back on the road quickly.

SECU Car Insurance Claims Process

- Report the Accident: Immediately report the accident to SECU by calling their claims hotline. This is the first step, ensuring your claim is documented.

- Gather Information: Collect essential information about the accident, including details of the other driver(s), any witnesses, and the location. Take photos of the damage to your vehicle and the accident scene.

- File a Claim: SECU will guide you through the claim filing process. They may require you to provide a detailed written statement about the accident and any supporting documentation.

- Claim Review and Processing: SECU will review your claim, and depending on the complexity, the processing time may vary. You can expect updates throughout the process.

- Claim Resolution: Once your claim is approved, SECU will determine the amount of coverage for your repairs or replacement. They may work with you to choose a repair shop.

SECU Car Insurance Claim Processing Timeline

The claim processing timeline varies based on the complexity of the claim. However, SECU aims to process claims efficiently. Here are some estimated timelines:

- Initial Claim Reporting: SECU recommends reporting the accident immediately.

- Claim Review: This typically takes 1-2 business days for straightforward claims.

- Claim Approval: Once reviewed, approval may take 2-3 business days.

- Repair or Replacement: This timeline depends on the repair shop’s availability and the extent of the damage.

SECU Car Insurance Customer Support

SECU offers various ways to reach out for assistance with your claim:

- Claims Hotline: You can reach SECU’s claims team 24/7 through their dedicated hotline.

- Online Portal: Access your claim information and communicate with SECU through their online portal.

- Mobile App: The SECU mobile app provides convenient access to your claim details and updates.

Tips for a Smooth Claims Process

- Report the Accident Promptly: This helps ensure that the claim is processed quickly and efficiently.

- Gather Necessary Information: Collect all relevant information at the accident scene to expedite the claim process.

- Communicate with SECU: Keep SECU updated on any changes to your contact information or claim details.

- Follow Instructions: Adhere to SECU’s instructions and deadlines to avoid delays.

- Be Patient: The claims process can take time, especially for complex cases. SECU will keep you informed throughout the process.

SECU Car Insurance Customer Reviews and Testimonials

SECU car insurance, like any insurance provider, has a range of customer reviews and testimonials, reflecting diverse experiences. These reviews provide valuable insights into the overall customer satisfaction with SECU car insurance.

Customer Reviews and Ratings from Various Sources

Customer reviews and ratings are available from various sources, including online review platforms, independent financial websites, and SECU’s own website. These sources offer a diverse perspective on customer experiences.

| Source | Rating | Review Highlights |

|---|---|---|

| Trustpilot | 4.5 stars | Customers praise SECU for its competitive rates, excellent customer service, and smooth claims process. |

| Google Reviews | 4.2 stars | Reviews highlight SECU’s friendly staff, helpful representatives, and responsive claims handling. |

| Yelp | 3.8 stars | Some reviews mention occasional issues with online platforms and waiting times, but overall, customers express satisfaction with SECU. |

Positive Customer Experiences

Positive customer experiences with SECU car insurance often revolve around the following:

- Competitive Rates: Many customers find SECU’s car insurance rates to be competitive compared to other insurance providers, offering significant savings.

- Excellent Customer Service: SECU is consistently praised for its friendly and helpful customer service representatives who are readily available to assist with inquiries and policy adjustments.

- Smooth Claims Process: Customers appreciate the straightforward and efficient claims process, with timely responses and minimal hassle.

Negative Customer Experiences

While SECU car insurance generally receives positive feedback, there are some negative experiences reported, including:

- Online Platform Issues: Some customers have encountered occasional technical glitches or difficulties navigating the online platform for managing their policies.

- Waiting Times: There have been instances of longer-than-expected waiting times for phone support or claims processing.

- Limited Coverage Options: A few customers have expressed a desire for a broader range of coverage options beyond the standard offerings.

Overall Customer Satisfaction

Overall, SECU car insurance enjoys a high level of customer satisfaction, with customers consistently praising its competitive rates, excellent customer service, and smooth claims process. While there are some negative experiences reported, these are often isolated incidents and do not detract significantly from the positive overall sentiment.

Alternatives to SECU Car Insurance

While SECU offers competitive car insurance rates and benefits, it’s crucial to explore other options to find the best fit for your individual needs and circumstances. Several other car insurance providers cater specifically to state employees, offering a range of coverage options and pricing structures.

Comparison of Features and Benefits

Comparing the features and benefits of different car insurance providers is essential to make an informed decision. Here’s a breakdown of key areas to consider:

- Coverage Options: Each provider offers different coverage options, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Evaluate your specific needs and choose a provider that offers the necessary protection.

- Discounts: Many insurance companies offer discounts for safe driving, good credit, and multiple policy bundles. SECU offers discounts for state employees, but other providers may offer unique discounts tailored to your specific situation. Comparing these discounts can significantly impact your overall premium.

- Customer Service: Excellent customer service is crucial when dealing with insurance claims. Research customer reviews and ratings to gauge the responsiveness and helpfulness of each provider’s customer service team. SECU generally has positive customer service reviews, but it’s essential to compare with other providers to determine the best fit for your needs.

- Claims Process: The claims process can be stressful, so it’s essential to choose a provider with a straightforward and efficient claims process. Research each provider’s claims process and compare their timelines, communication methods, and overall customer experience.

Key Differences in SECU and Competitors

The following table Artikels key differences between SECU and some of its competitors:

| Feature | SECU | Provider A | Provider B |

|---|---|---|---|

| Coverage Options | Standard options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage | Offers additional coverage options like roadside assistance and rental car reimbursement | Limited coverage options, but competitive pricing |

| Discounts | State employee discounts, safe driver discounts, good student discounts | Offers discounts for bundling multiple policies, loyalty discounts, and safe driving discounts | Limited discounts, but may offer discounts for specific professions or affiliations |

| Customer Service | Generally positive customer service reviews, online resources, and phone support | Excellent customer service reputation, with multiple contact channels and 24/7 availability | Average customer service reviews, limited online resources |

| Claims Process | Streamlined claims process, online claim filing, and dedicated claims representatives | Fast and efficient claims process, with online and mobile claim filing options | Slow claims process, limited online resources, and minimal communication |

Tips for Choosing the Right Car Insurance

Choosing the right car insurance can feel overwhelming, but it doesn’t have to be. By taking the time to understand your needs and comparing different options, you can find a policy that provides the coverage you need at a price you can afford.

Factors to Consider

When choosing car insurance, there are several key factors to consider. This checklist can help you make an informed decision:

- Your driving history: Your driving record, including accidents and traffic violations, can significantly impact your insurance premiums.

- Your vehicle: The make, model, and year of your car can affect insurance costs.

- Your location: Where you live can influence insurance rates due to factors like crime rates and traffic congestion.

- Your coverage needs: Consider your personal circumstances and decide on the level of coverage you need, such as liability, collision, comprehensive, and uninsured motorist coverage.

- Your budget: Set a realistic budget for your car insurance and explore different options that fit within your financial constraints.

Comparing Quotes

Once you’ve considered these factors, it’s crucial to compare quotes from multiple insurance providers.

- Online comparison tools: Websites like Bankrate, NerdWallet, and Policygenius allow you to compare quotes from different insurers in one place.

- Contacting insurance companies directly: You can also reach out to insurance companies directly to get quotes and discuss your specific needs.

- Reviewing policy details: Carefully review the policy details, including coverage limits, deductibles, and exclusions, to ensure you understand what’s included and excluded.

Negotiating a Better Rate

While you can’t always negotiate your insurance rate, there are some strategies you can try:

- Bundle your policies: Combining your car insurance with other policies, such as homeowners or renters insurance, can often result in discounts.

- Ask about discounts: Many insurers offer discounts for things like safe driving, good grades, and safety features in your car.

- Shop around regularly: Insurance rates can fluctuate, so it’s a good idea to shop around every year or two to see if you can find a better deal.

Final Wrap-Up

Whether you’re a seasoned state employee or just starting your career, understanding your car insurance options is crucial. SECU car insurance presents a viable choice for state employees, offering a blend of competitive rates, comprehensive coverage, and dedicated customer service. By carefully considering your needs and comparing SECU’s offerings with other providers, you can make an informed decision that best protects you and your vehicle.

FAQ Resource

Is SECU car insurance available to all state employees?

While SECU primarily serves state employees in North Carolina, specific eligibility criteria may apply. It’s best to check with SECU directly to confirm your eligibility.

Does SECU offer discounts on car insurance?

Yes, SECU offers various discounts, including safe driver discounts, multi-policy discounts, and good student discounts. These discounts can significantly reduce your overall premium.

How do I file a claim with SECU car insurance?

You can file a claim online, over the phone, or through a SECU branch. The claims process is straightforward and includes providing details about the accident and any damages incurred.