State employees car insurance offers a unique opportunity for public servants to access specialized coverage designed to meet their specific needs. These programs often provide a range of benefits and discounts, making them an attractive option for those seeking affordable and reliable car insurance. However, it’s crucial to understand the nuances of these programs to determine if they are the best fit for your individual circumstances.

This guide explores the ins and outs of state employee car insurance, delving into the different types of programs available, their coverage options, premiums, and the benefits they offer. We’ll also compare these programs to private insurance options, helping you make an informed decision about the best car insurance for your situation.

State Employee Insurance Programs

State employees often have access to a variety of car insurance programs designed to meet their specific needs and budgets. These programs are typically offered through partnerships between the state government and reputable insurance companies.

Types of Car Insurance Programs

State employee car insurance programs can vary widely, but common types include:

- Group Plans: These plans offer discounted rates to state employees by leveraging the collective purchasing power of a large group. They often provide standardized coverage options with limited customization.

- Individual Plans: State employees may also have access to individual plans through participating insurance companies. These plans allow for more personalized coverage options, but may not offer the same group discounts.

- State-Sponsored Programs: Some states offer their own car insurance programs, which may be administered by a state agency or a designated insurance company. These programs often prioritize affordability and accessibility for state employees.

Benefits and Drawbacks

Each type of car insurance program offers distinct benefits and drawbacks:

| Program Type | Benefits | Drawbacks |

|---|---|---|

| Group Plans | – Discounted rates due to group purchasing power – Simplified coverage options |

– Limited customization options – May not offer the most competitive rates compared to individual plans |

| Individual Plans | – Personalized coverage options – Potentially lower premiums depending on individual risk profile |

– May not offer group discounts – Requires more research and comparison shopping |

| State-Sponsored Programs | – Affordability and accessibility for state employees – May offer unique coverage options tailored to state employee needs |

– Limited availability depending on the state – May have stricter eligibility requirements |

Eligibility Requirements

Eligibility requirements for state employee car insurance programs vary depending on the specific program and the state. Common requirements may include:

- Employment Status: Active state employee status is typically required.

- Residency: Some programs may require employees to reside in the state or a specific region.

- Driving Record: A clean driving record with no major violations may be necessary.

State Employee Insurance Premiums: State Employees Car Insurance

State employee car insurance programs offer competitive rates designed to meet the needs of public servants. These programs often provide various coverage options and discounts to help state employees find the best value for their insurance needs.

Average Premiums

State employee car insurance premiums are generally lower than those offered by private insurance companies. This is because state programs often have access to lower operating costs and enjoy a lower risk pool, as state employees tend to have a lower accident rate. However, the average premium can vary based on several factors, including the state, coverage options, and individual circumstances.

Premium Variation Factors

- Vehicle Type: Premiums for higher-value vehicles or those with a higher risk of theft or damage are generally higher. For example, a luxury sedan may have a higher premium than a standard economy car.

- Driving History: Drivers with a clean driving record and no recent accidents or violations typically qualify for lower premiums. Conversely, drivers with a history of accidents or traffic violations may face higher premiums.

- Location: Premiums can vary based on the state and even the specific region within a state. Areas with higher population density or a higher frequency of accidents may have higher premiums.

- Coverage Options: The level of coverage selected can significantly impact the premium. For example, comprehensive coverage, which covers damage from events like theft or natural disasters, will generally be more expensive than liability coverage, which only covers damage to other vehicles or property.

Premium Comparison Table

Here’s a hypothetical table comparing premium rates for different state employee insurance plans:

| Plan Name | Coverage | Average Monthly Premium |

|---|---|---|

| Basic Plan | Liability, Collision, Comprehensive | $120 |

| Standard Plan | Liability, Collision, Comprehensive, Uninsured Motorist | $150 |

| Premium Plan | Liability, Collision, Comprehensive, Uninsured Motorist, Rental Car Reimbursement | $180 |

Coverage Options

State employee car insurance programs offer various coverage options to cater to individual needs and financial situations. Understanding the different coverage levels and their associated benefits is crucial for making an informed decision about your insurance policy.

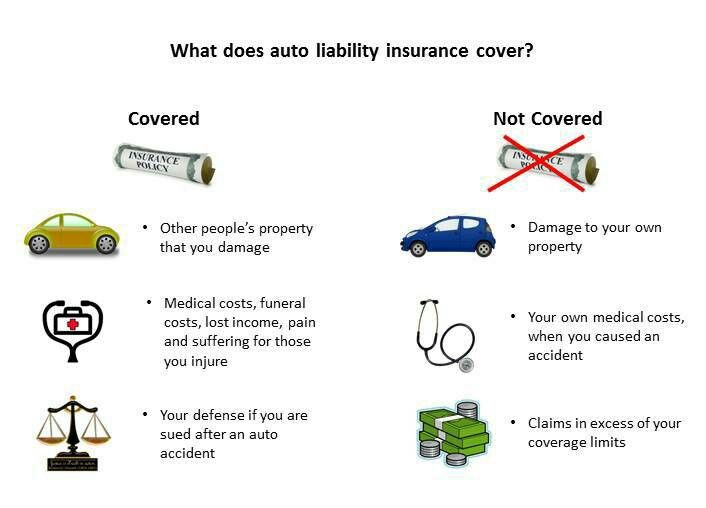

Liability Coverage

Liability coverage protects you financially if you are at fault in an accident that causes injury or damage to another person or their property. This coverage is mandatory in most states and typically includes:

- Bodily Injury Liability: Covers medical expenses, lost wages, and pain and suffering for injuries caused to others in an accident.

- Property Damage Liability: Covers damages to another person’s vehicle or property, such as a fence or building, in an accident.

The amount of liability coverage you need depends on your individual circumstances, including your assets and the potential risk of a significant accident.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. This coverage is optional and is typically recommended for newer or more expensive vehicles.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, fire, or natural disasters. This coverage is also optional and can be beneficial for vehicles that are financed or leased.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you if you are involved in an accident with a driver who is uninsured or has insufficient insurance to cover your losses. This coverage can help pay for medical expenses, lost wages, and property damage.

Personal Injury Protection (PIP)

Personal injury protection (PIP) coverage, also known as no-fault insurance, covers your medical expenses and lost wages, regardless of who is at fault in an accident. PIP coverage is mandatory in some states.

Table of Coverage Options

| Coverage Option | Description | Benefits |

|---|---|---|

| Liability Coverage | Protects you financially if you are at fault in an accident that causes injury or damage to another person or their property. | Covers medical expenses, lost wages, and pain and suffering for injuries caused to others in an accident. Covers damages to another person’s vehicle or property. |

| Collision Coverage | Pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. | Covers repairs or replacement of your vehicle in an accident. |

| Comprehensive Coverage | Protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, fire, or natural disasters. | Covers damages to your vehicle from events other than accidents. |

| Uninsured/Underinsured Motorist Coverage | Protects you if you are involved in an accident with a driver who is uninsured or has insufficient insurance to cover your losses. | Covers medical expenses, lost wages, and property damage if you are involved in an accident with an uninsured or underinsured driver. |

| Personal Injury Protection (PIP) | Covers your medical expenses and lost wages, regardless of who is at fault in an accident. | Covers medical expenses and lost wages, regardless of who is at fault in an accident. |

Discounts and Benefits

State employee car insurance programs often offer a range of discounts and benefits designed to make coverage more affordable and accessible. These programs recognize the unique needs and circumstances of public servants and provide them with tailored options to save money on their car insurance.

Discounts Available

Discounts are a common way to reduce insurance premiums, and state employee car insurance programs often offer a variety of these savings opportunities.

- Good Driver Discount: This discount rewards drivers with a clean driving record, demonstrating their safe driving habits. State employees with a history of safe driving, free from accidents and traffic violations, may qualify for a significant discount.

- Multi-Car Discount: State employees who insure multiple vehicles with the same insurance provider can often benefit from a multi-car discount. This discount is usually applied to the policy as a whole, providing a substantial reduction in overall premiums.

- Safety Features Discount: Vehicles equipped with advanced safety features, such as anti-theft systems, airbags, and anti-lock brakes, can often qualify for a discount. These features are designed to reduce the risk of accidents and injuries, making them attractive to insurers.

- Loyalty Discount: Some insurance programs offer a loyalty discount to long-term customers who have maintained their coverage for a significant period. This reward encourages customer retention and demonstrates the value of long-term relationships with insurance providers.

Benefits of State Employee Car Insurance Programs

State employee car insurance programs are designed to provide unique benefits tailored to the specific needs of public servants. These benefits go beyond discounts and often include:

- Specialized Coverage Options: These programs often offer coverage options specifically designed for the unique needs of state employees, such as coverage for vehicles used for work-related purposes or for personal belongings transported in a state-owned vehicle.

- Convenient Payment Options: Many programs provide flexible payment options, such as payroll deductions or online payment portals, making it easier for state employees to manage their insurance premiums. These convenient options streamline the payment process and reduce administrative burdens.

- Dedicated Customer Service: State employee car insurance programs often provide dedicated customer service representatives who are knowledgeable about the specific needs and concerns of state employees. This personalized approach ensures that employees have access to support and guidance throughout their insurance journey.

Claim Filing Process

Filing a claim under the state employee car insurance program is a straightforward process. It typically involves contacting the insurance provider, providing necessary documentation, and following their instructions. The entire process is designed to be efficient and convenient for policyholders.

Documentation Required for Claim Processing, State employees car insurance

To ensure a smooth and timely claim processing, certain documents are required. These documents provide the insurance provider with the necessary information to assess the claim and determine the extent of coverage.

- Police Report: In case of an accident involving another party, a police report is crucial. It documents the incident and provides valuable information for claim evaluation.

- Driver’s License: A valid driver’s license is essential to verify the identity of the insured and their driving credentials.

- Vehicle Registration: Proof of vehicle registration confirms ownership and provides details about the insured vehicle.

- Insurance Policy: Presenting the insurance policy ensures that the claim falls within the coverage terms and conditions.

- Photographs of Damage: Visual evidence of the damage is crucial. Clear photographs of the vehicle’s damage help assess the extent of repairs required.

- Repair Estimates: Estimates from reputable repair shops provide an initial assessment of the cost of repairs.

- Medical Records: If injuries are involved, medical records are required to document the extent of the injuries and related expenses.

Contacting Customer Service

State employee car insurance programs offer dedicated customer service representatives to assist policyholders with their claims.

- Phone: Policyholders can contact customer service by phone, providing them with a direct line of communication for initial inquiries and claim reporting.

- Email: An email address is provided for more detailed inquiries and claim-related documentation.

- Online Portal: Many insurance providers offer secure online portals where policyholders can access their policy information, track claim status, and submit required documentation.

Comparison to Private Insurance Options

Choosing the right car insurance can be a complex decision, and it’s essential to weigh the benefits and drawbacks of both state employee and private insurance options. This section compares and contrasts these two types of insurance to help you make an informed decision.

Factors Favoring State Employee Insurance

State employee car insurance programs often offer several advantages, making them a compelling choice for some individuals. Here are some key factors that might make state employee insurance a better option:

- Lower Premiums: State employee programs often offer lower premiums than private insurance companies. This is because they benefit from economies of scale and lower administrative costs. For example, a state employee program might offer a premium of $100 per month, while a private insurer might charge $120 for similar coverage.

- Exclusive Discounts and Benefits: State employee programs often provide exclusive discounts and benefits not available through private insurers. These might include discounts for safe driving, good credit, or membership in specific organizations. Additionally, they may offer benefits like roadside assistance, rental car reimbursement, or accident forgiveness.

- Stability and Security: State employee programs are backed by the financial stability of the state government, providing a sense of security that might be lacking with private insurers. In case of financial difficulties, state programs are less likely to experience instability or insolvency, ensuring continued coverage.

Factors Favoring Private Insurance

While state employee programs offer attractive features, private insurance options also have their own advantages. Here are some factors that might make private insurance a better choice:

- Wider Coverage Options: Private insurers often offer a wider range of coverage options, including specialized coverage for specific needs, such as high-value vehicles or exotic cars. For example, a private insurer might offer comprehensive coverage for a classic car, while a state employee program might not.

- More Flexibility and Customization: Private insurance companies often provide more flexibility in customizing coverage and choosing deductibles to suit individual needs and budgets. For example, a private insurer might allow you to choose a higher deductible in exchange for a lower premium, while a state employee program might offer limited options.

- Competitive Market and Choice: The private insurance market is highly competitive, with multiple companies vying for customers. This competition can lead to better rates and more innovative products. For example, you might find better discounts or specialized coverage options by comparing quotes from different private insurers.

Comparison Table

The following table summarizes the key features and costs of state employee programs versus private insurance:

| Feature | State Employee Insurance | Private Insurance |

|---|---|---|

| Premiums | Often lower due to economies of scale | Can be higher but may offer more competitive rates with comparison shopping |

| Coverage Options | May offer limited coverage options | Often offer a wider range of coverage options |

| Discounts and Benefits | May offer exclusive discounts and benefits | May offer a variety of discounts and benefits, including specialized options |

| Flexibility and Customization | May offer limited customization options | Often provide more flexibility in customizing coverage and choosing deductibles |

| Stability and Security | Backed by the financial stability of the state government | May be subject to market fluctuations and financial instability |

Final Summary

Navigating the world of car insurance can be a complex endeavor, especially when considering the unique benefits offered by state employee programs. By understanding the various aspects of these programs, including their coverage options, premiums, and discounts, state employees can make informed choices that best suit their individual needs. Ultimately, whether you opt for a state employee program or private insurance, the key is to select a plan that provides adequate coverage at a price that fits your budget.

FAQ Compilation

What are the typical eligibility requirements for state employee car insurance programs?

Eligibility requirements vary by state and program, but typically include being an active state employee, working a certain number of hours per week, and residing in the state. Some programs may also require a clean driving record.

Are there any specific discounts available for state employees through car insurance programs?

Yes, state employee car insurance programs often offer discounts for things like safe driving, good credit, multi-car insurance, and being a member of certain organizations. Some programs may also offer discounts for driving a hybrid or electric vehicle.

How can I file a claim under a state employee car insurance program?

The claim filing process typically involves contacting the insurance provider, providing details of the accident, and submitting the necessary documentation. It’s best to check with your specific program for their detailed claim filing procedures.