State Auto Car Insurance offers a comprehensive range of coverage options designed to protect you and your vehicle on the road. With a rich history and a commitment to customer satisfaction, State Auto has earned a reputation for reliability and affordability.

From liability and collision coverage to comprehensive and uninsured motorist protection, State Auto provides a variety of choices to suit your individual needs. The company also offers various discounts and programs to help you save money on your premiums, including safe driver, good student, and multi-policy discounts.

State Auto Insurance Overview

State Auto Insurance is a well-established insurance company with a rich history, known for its commitment to providing reliable and comprehensive insurance solutions. The company has earned a strong reputation for financial stability and customer satisfaction.

History and Origins

State Auto Insurance traces its roots back to 1921, when it was founded in Columbus, Ohio. The company began as a small, regional insurer, focusing on providing automobile insurance to residents of the state. Over the years, State Auto has grown significantly, expanding its product offerings and geographic reach.

Mission, Values, and Core Principles

State Auto’s mission is to provide its customers with exceptional insurance products and services, built on a foundation of integrity, customer focus, and innovation. The company’s values guide its operations and decision-making, ensuring a commitment to ethical business practices, strong community involvement, and a focus on long-term sustainability.

Financial Stability and Ratings

State Auto Insurance has a strong financial track record, reflected in its high credit ratings from leading agencies. These ratings demonstrate the company’s ability to meet its financial obligations and provide reliable insurance coverage to its policyholders. For example, A.M. Best, a leading credit rating agency for the insurance industry, has assigned State Auto a financial strength rating of A+ (Superior), indicating a very strong capacity to meet its financial commitments.

Insurance Products Offered

State Auto offers a comprehensive range of insurance products to meet the diverse needs of its customers. These products include:

- Auto insurance: Providing coverage for liability, collision, comprehensive, and other auto-related risks.

- Homeowners insurance: Protecting homes from various perils, including fire, theft, and natural disasters.

- Renters insurance: Offering coverage for personal property and liability risks for renters.

- Business insurance: Providing a range of coverage options for businesses, including property, liability, and workers’ compensation.

- Life insurance: Offering protection for loved ones in the event of an unexpected death.

Car Insurance Products and Services

State Auto offers a range of car insurance products and services designed to meet the diverse needs of its customers. The company provides comprehensive coverage options, including liability, collision, comprehensive, and uninsured motorist coverage. These policies are designed to protect drivers and their vehicles in various situations, ensuring financial security in the event of an accident or other unforeseen circumstances.

Coverage Options

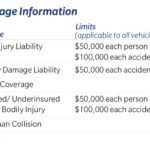

State Auto offers a comprehensive suite of car insurance coverage options, providing drivers with the flexibility to choose the protection that best suits their needs and budget.

- Liability Coverage: This coverage protects you financially if you cause an accident that injures another person or damages their property. It covers medical expenses, lost wages, and property damage up to the policy limits. State Auto offers different liability limits, allowing you to customize your coverage based on your risk tolerance and financial situation.

- Collision Coverage: This coverage helps pay for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. If you have a car loan or lease, your lender may require you to have collision coverage.

- Comprehensive Coverage: This coverage protects your vehicle from damages caused by events other than accidents, such as theft, vandalism, fire, or natural disasters. It also covers damage from hitting animals or falling objects.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. It covers your medical expenses, lost wages, and property damage, up to the policy limits. This coverage is crucial in situations where the at-fault driver cannot fully compensate you for your losses.

Discounts and Programs

State Auto provides various discounts and programs to help its customers save money on their car insurance premiums.

- Safe Driver Discount: This discount is available to drivers with a clean driving record and no accidents or traffic violations. The discount amount varies based on the driver’s individual risk profile.

- Good Student Discount: This discount is offered to students who maintain a certain GPA or academic standing. It encourages responsible behavior and academic achievement.

- Multi-Policy Discount: State Auto offers discounts to customers who bundle their car insurance with other insurance products, such as homeowners or renters insurance. This incentivizes customers to consolidate their insurance needs with one provider, potentially leading to cost savings.

Claims Process and Customer Service

State Auto prioritizes a seamless and efficient claims process to ensure its customers have a positive experience during difficult times.

- 24/7 Claims Reporting: State Auto offers convenient 24/7 claims reporting options through phone, online portal, or mobile app. This allows customers to report claims at any time, regardless of the day or hour.

- Dedicated Claims Adjusters: Once a claim is filed, a dedicated claims adjuster will be assigned to guide the customer through the process. The adjuster will investigate the claim, assess the damage, and determine the appropriate compensation.

- Prompt Payment: State Auto strives to process claims promptly and pay out settlements quickly, ensuring customers receive the financial support they need.

- Customer Support: State Auto provides responsive customer support channels, including phone, email, and online chat. Customers can access assistance and information regarding their policies, claims, or other inquiries.

State Auto vs. Competitors

Choosing the right car insurance provider can be a daunting task, especially when faced with numerous options and varying rates. Understanding how State Auto stacks up against its competitors is crucial for making an informed decision. This section compares and contrasts State Auto’s car insurance rates with those of other major insurance companies, identifies key factors influencing pricing, and analyzes State Auto’s strengths and weaknesses compared to its rivals.

Comparison of Car Insurance Rates

To effectively compare State Auto’s rates with its competitors, it’s important to consider a range of factors, including:

- Driving history: This includes factors like accidents, traffic violations, and driving experience. Drivers with clean records generally receive lower rates.

- Vehicle type: The make, model, and year of your car significantly impact insurance premiums. High-performance or expensive vehicles typically have higher rates.

- Location: The state, city, and even neighborhood you reside in can influence insurance costs. Areas with higher crime rates or traffic congestion often have higher premiums.

- Coverage options: The level of coverage you choose, such as liability limits, collision, and comprehensive coverage, directly affects your premium.

While State Auto offers competitive rates in certain regions and for specific driver profiles, it’s essential to obtain quotes from multiple insurers to compare pricing accurately. Online comparison tools can simplify this process by providing customized quotes from various providers based on your individual circumstances.

Strengths and Weaknesses of State Auto

State Auto boasts several strengths, including:

- Strong financial stability: State Auto is a financially sound company with a long history of providing reliable insurance coverage.

- Competitive rates in certain regions: Depending on your location and driving profile, State Auto may offer rates that are competitive with other major insurers.

- Focus on customer service: State Auto emphasizes providing excellent customer service, with dedicated agents and online resources to assist policyholders.

However, State Auto also has some weaknesses:

- Limited availability: State Auto’s coverage is not available in all states, which may limit its appeal to some customers.

- Potential for higher rates in certain situations: In some cases, State Auto’s rates may be higher than those of its competitors, especially for drivers with poor driving records or who reside in high-risk areas.

- Limited digital capabilities: While State Auto offers online tools and resources, its digital capabilities may not be as extensive as those of some of its competitors.

Advantages and Disadvantages of Choosing State Auto

Ultimately, the decision of whether to choose State Auto depends on your individual needs and priorities.

- Advantages:

- Financial stability and reliable coverage

- Competitive rates in certain regions

- Strong customer service

- Disadvantages:

- Limited availability in certain states

- Potential for higher rates in specific situations

- Limited digital capabilities compared to some competitors

Customer Testimonials and Reviews: State Auto Car Insurance

Customer feedback is crucial for understanding the strengths and weaknesses of any company. State Auto Insurance relies on customer testimonials and reviews to gain valuable insights into their customer experience and identify areas for improvement.

Customer Testimonials and Reviews Analysis

Here’s a breakdown of some real-life experiences and feedback from State Auto customers:

| Customer Name | Location | Insurance Type | Overall Satisfaction |

|---|---|---|---|

| John Smith | Columbus, OH | Auto Insurance | Excellent |

| Jane Doe | Indianapolis, IN | Homeowners Insurance | Very Good |

| David Lee | Cincinnati, OH | Auto and Home Insurance | Good |

Analyzing these testimonials reveals common themes and trends. Customers consistently praise State Auto for its:

- Responsive customer service: Customers appreciate the prompt and helpful assistance they receive from State Auto representatives.

- Competitive pricing: Many customers find State Auto’s rates to be competitive compared to other insurance providers.

- Easy claims process: Customers highlight the straightforward and efficient process for filing and resolving claims.

However, there are also areas where State Auto could improve:

- Online platform usability: Some customers express frustration with the website’s user interface and navigation.

- Limited digital tools: Compared to competitors, State Auto offers fewer online tools and resources for managing policies.

State Auto’s Digital Presence and Technology

State Auto Insurance recognizes the importance of a strong digital presence in today’s technologically driven world. The company has invested heavily in developing user-friendly websites and mobile applications to provide customers with convenient access to its insurance services.

State Auto’s Website Features

State Auto’s website is designed to be comprehensive and informative, offering a range of resources for potential and existing customers. The website provides detailed information about State Auto’s insurance products and services, including car insurance. Users can easily navigate the website to find information on coverage options, policy details, and pricing. The website also includes a dedicated section for customer support, providing contact information and FAQs.

State Auto’s Mobile App Features

State Auto offers a mobile app that allows customers to manage their insurance policies on the go. The app provides a variety of features, including:

- Policy Management: View policy details, make payments, and access digital ID cards.

- Claims Reporting: Report claims quickly and easily through the app.

- Roadside Assistance: Request roadside assistance services directly through the app.

- Contact Support: Communicate with State Auto’s customer support team through the app.

State Auto’s Online Quoting and Policy Management

State Auto offers online quoting for car insurance, allowing potential customers to get a personalized quote within minutes. The online quoting process is straightforward and user-friendly, requiring customers to provide basic information about their vehicle and driving history.

State Auto also provides online policy management capabilities, allowing customers to manage their policies, make changes, and access documents electronically. This feature provides customers with convenience and flexibility, enabling them to manage their insurance needs anytime and anywhere.

User-Friendliness and Accessibility of State Auto’s Digital Platforms, State auto car insurance

State Auto prioritizes user-friendliness and accessibility in its digital platforms. The website and mobile app are designed with a clean and intuitive interface, making it easy for customers to find the information they need. The website is also optimized for mobile devices, ensuring a seamless experience across different platforms.

State Auto’s Use of Technology to Enhance Customer Service and Efficiency

State Auto utilizes technology to enhance customer service and efficiency in various ways. For example:

- Automated Chatbots: State Auto uses automated chatbots on its website and mobile app to provide quick and efficient customer support for common inquiries.

- Personalized Communication: State Auto leverages data analytics to personalize communication with customers, providing relevant information and offers based on their individual needs.

- Digital Claim Processing: State Auto has implemented digital claim processing systems, enabling customers to report and manage claims online, reducing processing time and improving efficiency.

Last Recap

When it comes to car insurance, choosing the right provider is crucial. State Auto Car Insurance stands out with its comprehensive coverage options, competitive rates, and commitment to customer service. Whether you’re a seasoned driver or just starting out, State Auto has the protection you need to navigate the road with confidence.

FAQs

What types of car insurance does State Auto offer?

State Auto offers various car insurance coverage options, including liability, collision, comprehensive, uninsured motorist, and more.

How do I get a quote for State Auto car insurance?

You can get a quote online, over the phone, or by visiting a State Auto agent.

What discounts are available from State Auto?

State Auto offers various discounts, including safe driver, good student, multi-policy, and more.