Getting a quote for State Farm insurance is a crucial step in securing your financial future. State Farm, a renowned insurance provider, offers a comprehensive range of coverage options to meet diverse needs. From auto and home insurance to life and health plans, State Farm provides peace of mind through its reliable protection and exceptional customer service. This guide will delve into the intricacies of obtaining a State Farm insurance quote, empowering you to make informed decisions about your coverage.

Whether you’re a seasoned policyholder or a first-time insurance seeker, understanding the process of obtaining a quote is essential. This guide will explore the various factors that influence your quote, including your driving history, credit score, and the type of coverage you require. We’ll also highlight the benefits of using State Farm’s digital tools and resources, such as their mobile app and online portal, to streamline the quoting process.

State Farm Insurance Overview

State Farm Insurance is a renowned insurance company with a rich history and a strong commitment to providing reliable and comprehensive insurance solutions. Founded in 1922 by George J. Mecherle, State Farm has grown to become one of the largest insurance providers in the United States.

History and Background, Quote for state farm insurance

State Farm was initially established as a mutual company, meaning that policyholders are also the owners of the company. This unique structure ensures that the company prioritizes the interests of its policyholders. Mecherle’s vision was to provide affordable and accessible insurance to individuals, families, and businesses across the country. State Farm’s early success can be attributed to its focus on customer service, innovative products, and a strong network of agents. The company expanded its operations rapidly, offering a wide range of insurance products, including auto, home, life, and health insurance.

Mission, Values, and Core Services

State Farm’s mission is to help people manage the risks of everyday life, recover from the unexpected, and realize their dreams. The company’s core values are integrity, customer focus, respect, responsibility, and teamwork. These values guide State Farm’s operations and ensure that customers receive the highest level of service and support.

State Farm offers a comprehensive range of insurance products and services, including:

- Auto Insurance: State Farm provides auto insurance coverage for a wide range of vehicles, including cars, trucks, motorcycles, and RVs. The company offers various coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Home Insurance: State Farm offers homeowners insurance to protect against damage to homes and personal property caused by various perils, such as fire, theft, and natural disasters.

- Life Insurance: State Farm provides a variety of life insurance products, including term life, whole life, and universal life insurance. These policies offer financial protection to beneficiaries in the event of the insured’s death.

- Health Insurance: State Farm offers health insurance plans through its partnership with Blue Cross Blue Shield. These plans provide coverage for medical expenses, including doctor visits, hospital stays, and prescription drugs.

- Other Insurance Products: State Farm also offers insurance products for businesses, including commercial property, liability, and workers’ compensation insurance.

Key Benefits and Features

State Farm Insurance products offer several key benefits and features that make them attractive to customers.

- Competitive Pricing: State Farm is known for its competitive pricing, making insurance accessible to a wide range of customers. The company offers discounts for good driving records, multiple policies, and safety features.

- Excellent Customer Service: State Farm is committed to providing excellent customer service. The company has a large network of agents who are available to assist customers with their insurance needs. State Farm also offers online and mobile services for convenient policy management.

- Financial Strength and Stability: State Farm is a financially strong and stable company with a long history of paying claims promptly and fairly. This financial stability provides customers with peace of mind knowing that their insurance needs will be met.

- Wide Range of Coverage Options: State Farm offers a wide range of coverage options to meet the diverse needs of its customers. The company provides customizable insurance policies that can be tailored to individual circumstances.

- Innovative Products and Services: State Farm is constantly innovating and developing new products and services to enhance the customer experience. The company offers mobile apps, online portals, and other digital tools to make insurance more convenient and accessible.

Types of Insurance Offered

State Farm offers a comprehensive range of insurance products designed to protect individuals, families, and businesses against various risks. From auto and home insurance to life and health coverage, State Farm provides tailored solutions to meet diverse needs.

Types of Insurance Offered by State Farm

| Insurance Type | Coverage Details | Key Features | Benefits |

|---|---|---|---|

| Auto Insurance | Liability coverage, collision and comprehensive coverage, uninsured/underinsured motorist coverage, personal injury protection (PIP), medical payments coverage, and more. | Customizable coverage options, accident forgiveness, safe driver discounts, and 24/7 roadside assistance. | Financial protection in case of an accident, peace of mind knowing you’re covered, and potential cost savings with discounts. |

| Home Insurance | Dwelling coverage, personal property coverage, liability coverage, and additional living expenses coverage. | Coverage for natural disasters, theft, vandalism, and other perils. | Protection against financial losses due to damage or destruction of your home, peace of mind knowing your belongings are insured, and assistance with rebuilding or repairing your home. |

| Life Insurance | Term life insurance, whole life insurance, universal life insurance, and variable life insurance. | Financial protection for your loved ones in the event of your death, customizable coverage options, and potential tax benefits. | Provides financial security for your family, helps cover funeral expenses and outstanding debts, and ensures your loved ones’ financial well-being. |

| Health Insurance | Individual health insurance plans, family health insurance plans, and employer-sponsored health insurance plans. | Coverage for medical expenses, prescription drugs, preventive care, and more. | Access to quality healthcare, financial protection against high medical costs, and peace of mind knowing you’re covered. |

| Renters Insurance | Personal property coverage, liability coverage, and additional living expenses coverage. | Protection against theft, fire, and other perils, coverage for personal belongings, and financial assistance in case of damage or loss. | Protects your belongings while renting, provides financial security in case of an unexpected event, and offers peace of mind knowing you’re covered. |

| Business Insurance | General liability insurance, property insurance, workers’ compensation insurance, and more. | Customizable coverage options, risk management services, and 24/7 support. | Financial protection for your business, legal and financial defense in case of a claim, and peace of mind knowing your business is protected. |

| Motorcycle Insurance | Liability coverage, collision and comprehensive coverage, uninsured/underinsured motorist coverage, and more. | Coverage for accidents, theft, and damage to your motorcycle, accident forgiveness, and roadside assistance. | Financial protection in case of an accident, peace of mind knowing your motorcycle is covered, and potential cost savings with discounts. |

| Boat Insurance | Liability coverage, hull coverage, and personal property coverage. | Coverage for accidents, theft, and damage to your boat, and 24/7 assistance in case of an emergency. | Financial protection in case of an accident, peace of mind knowing your boat is covered, and potential cost savings with discounts. |

Customer Experience and Reviews: Quote For State Farm Insurance

State Farm Insurance is known for its commitment to customer satisfaction and has consistently received positive feedback for its services. The company has a strong reputation for providing reliable insurance solutions, coupled with responsive and helpful customer support.

Customer Service Reputation

State Farm has built a reputation for providing excellent customer service, consistently ranking high in customer satisfaction surveys. The company has been recognized for its friendly and knowledgeable agents, efficient claims processing, and commitment to resolving customer issues promptly.

Customer Testimonials and Reviews

Numerous online platforms, including Trustpilot, ConsumerAffairs, and the Better Business Bureau, showcase a wealth of customer testimonials and reviews that reflect State Farm’s commitment to customer satisfaction.

- On Trustpilot, State Farm boasts an overall rating of 4.5 out of 5 stars, with many customers praising the company’s responsive customer service, fair pricing, and efficient claims handling.

- ConsumerAffairs also highlights State Farm’s positive customer experiences, with a 4.3 out of 5-star rating. Customers frequently commend the company’s accessibility, helpful agents, and transparent communication.

- The Better Business Bureau (BBB) awards State Farm an A+ rating, signifying the company’s strong commitment to ethical business practices and customer satisfaction.

Commitment to Customer Satisfaction

State Farm’s dedication to customer satisfaction is evident in its numerous initiatives and practices:

- Agent Network: State Farm has a vast network of local agents who are readily available to provide personalized service and guidance to customers.

- Online Resources: The company offers a user-friendly website and mobile app, allowing customers to manage their policies, file claims, and access account information conveniently.

- Customer Feedback: State Farm actively encourages customer feedback through surveys and online reviews, using this input to continuously improve its services.

- Claims Process: The company prioritizes a smooth and efficient claims process, aiming to resolve claims promptly and fairly.

Pricing and Cost Factors

State Farm’s insurance pricing is determined by a complex interplay of factors, including your individual circumstances, the type of coverage you need, and the overall risk associated with insuring you. Understanding these factors can help you make informed decisions about your insurance policy and potentially save money.

Factors Influencing State Farm Insurance Pricing

Several factors contribute to the cost of your State Farm insurance policy. These factors are used to assess your individual risk and determine the premium you’ll pay.

- Location: Your address plays a significant role in pricing. Areas with higher crime rates, traffic congestion, or natural disaster risks typically have higher insurance premiums. For example, living in a coastal region with frequent hurricanes might result in a higher premium compared to living in an inland area.

- Vehicle: The make, model, year, and safety features of your vehicle significantly impact your insurance cost. Newer cars with advanced safety features generally have lower premiums than older cars with fewer safety features. Similarly, luxury or high-performance vehicles often have higher premiums due to their higher repair costs and greater risk of theft.

- Driving History: Your driving record, including accidents, traffic violations, and driving experience, significantly influences your premium. Drivers with a clean record and significant driving experience usually receive lower premiums than those with a history of accidents or violations.

- Credit Score: In many states, insurance companies, including State Farm, use your credit score as a factor in determining your premium. Individuals with higher credit scores generally receive lower premiums. However, this practice is not permitted in all states, and it’s essential to check your state’s regulations.

- Coverage and Deductible: The type and amount of coverage you choose and your deductible directly impact your premium. Comprehensive and collision coverage, which protect against damage from non-accident events and accidents, respectively, will increase your premium. Similarly, a higher deductible, the amount you pay out-of-pocket before insurance kicks in, will typically result in a lower premium.

- Discounts: State Farm offers various discounts that can lower your premium. These discounts can include safe driver discounts, multi-policy discounts (for bundling multiple insurance policies), and discounts for safety features in your vehicle, such as anti-theft devices or airbags.

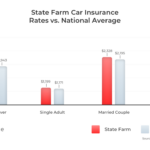

Comparing State Farm’s Pricing

State Farm is one of the largest insurance providers in the United States, but it’s essential to compare its pricing with other major insurance companies to find the best value for your needs. You can use online comparison tools or contact multiple insurance companies directly to obtain quotes. Factors to consider when comparing prices include:

- Coverage options: Ensure you compare quotes for similar coverage levels across different insurance providers. Don’t just focus on the lowest premium; ensure you’re getting the right coverage for your needs.

- Customer service and claims handling: While price is an important factor, consider the reputation and customer service of the insurance company. Look for companies known for their responsiveness, fair claims handling, and overall customer satisfaction.

- Financial stability: Choose an insurance company with a strong financial rating, ensuring they can meet their obligations if you need to file a claim. Websites like A.M. Best provide financial ratings for insurance companies.

Customizing Policies and Managing Costs

State Farm offers various options for customizing your insurance policy and managing costs.

- Bundling: Bundling your auto and home insurance policies with State Farm can often result in significant discounts, potentially saving you money on your overall insurance premiums.

- Deductible: Choosing a higher deductible can lower your premium, but it means you’ll pay more out-of-pocket in the event of a claim. Consider your financial situation and risk tolerance when selecting your deductible.

- Coverage options: Carefully review your coverage options and ensure you have the appropriate level of coverage for your needs. You may be able to reduce your premium by removing unnecessary coverage.

- Discounts: Take advantage of any discounts offered by State Farm, such as safe driver discounts, multi-policy discounts, or discounts for safety features in your vehicle.

- Shop around: Regularly compare insurance quotes from different providers, including State Farm, to ensure you’re getting the best value for your money.

Claims Process and Customer Support

When you need to file a claim with State Farm, the process is designed to be straightforward and efficient. They offer various channels for customer support, ensuring you have the assistance you need throughout the claims journey.

Filing a Claim

State Farm provides multiple ways to file a claim, making it convenient for policyholders. You can initiate the process online, through the mobile app, or by contacting a customer service representative over the phone.

- Online Claim Filing: You can file a claim directly through the State Farm website. This option is available 24/7 and allows you to track the progress of your claim online.

- Mobile App: The State Farm mobile app provides a convenient platform for filing claims, managing your policy, and accessing other services. You can also use the app to upload photos and documents related to your claim.

- Phone: If you prefer to speak with a representative, you can call State Farm’s customer service line. Their agents are available to assist you with filing your claim and answer any questions you may have.

Customer Support Channels

State Farm offers a comprehensive range of customer support channels to ensure prompt and efficient assistance:

- Online Resources: State Farm’s website provides a wealth of information on claims, policies, and other services. You can find frequently asked questions, helpful guides, and online tools to manage your insurance needs.

- Phone Lines: State Farm has dedicated phone lines for claims, policy inquiries, and general customer support. You can reach a representative 24/7 for assistance.

- Mobile App: The State Farm mobile app offers a convenient way to contact customer support directly through the app. You can access live chat, send messages, and receive updates on your claims.

- Local Agents: State Farm has a vast network of local agents who can provide personalized assistance and guidance. You can visit your local agent’s office or contact them directly for support.

Claims Handling Process

State Farm’s claims handling process is designed to be efficient and responsive. They aim to resolve claims quickly and fairly, keeping policyholders informed throughout the process.

- Initial Assessment: Once you file a claim, State Farm will assess the details and determine the next steps. This may involve reviewing the policy, gathering information, and contacting any necessary parties.

- Investigation: In some cases, State Farm may conduct an investigation to gather more information about the claim. This could involve reviewing evidence, interviewing witnesses, or obtaining expert opinions.

- Claim Evaluation: Based on the information gathered, State Farm will evaluate the claim and determine the amount of coverage. They will also consider any applicable deductibles or limitations.

- Claim Settlement: Once the claim is evaluated, State Farm will work to settle the claim promptly. This may involve paying benefits directly to the policyholder or arranging for repairs or replacements.

Digital Tools and Resources

State Farm recognizes the importance of digital convenience in today’s world. They offer a suite of digital tools and resources designed to make managing your insurance policies easier and more efficient. These tools are accessible through both the State Farm mobile app and the online portal, providing policyholders with 24/7 access to their insurance information and services.

Mobile App Features

The State Farm mobile app is a comprehensive platform that allows policyholders to manage their insurance needs on the go.

- View Policy Information: Access your policy details, including coverage limits, deductibles, and payment history.

- Make Payments: Easily manage your payments, view payment history, and set up automatic payments.

- File Claims: Report claims directly through the app, upload photos and documents, and track claim progress.

- Manage ID Cards: Access and manage your insurance ID cards digitally.

- Roadside Assistance: Request roadside assistance services directly through the app.

- Contact Customer Support: Connect with State Farm customer service representatives through live chat or phone call.

Industry Recognition and Awards

State Farm has a long and distinguished history of receiving accolades for its commitment to customer service, financial strength, and innovation. These awards and recognitions are a testament to the company’s dedication to excellence and its position as a leading provider of insurance products and services.

These awards reflect State Farm’s commitment to providing excellent customer service, financial stability, and innovative products and services. They also highlight the company’s strong reputation within the insurance industry and its dedication to serving its customers.

Awards and Recognitions

State Farm has consistently been recognized for its financial strength and stability by independent rating agencies. These ratings are based on factors such as the company’s capital reserves, claims-paying ability, and overall financial performance. Some of the notable awards and recognitions include:

- A.M. Best: State Farm has consistently received an A++ (Superior) rating from A.M. Best, a leading credit rating agency specializing in the insurance industry. This rating signifies State Farm’s exceptional financial strength and ability to meet its policyholder obligations.

- Standard & Poor’s: State Farm holds an AA+ (Very Strong) rating from Standard & Poor’s, another prominent credit rating agency. This rating reflects State Farm’s strong financial position and its ability to manage risks effectively.

- Moody’s: Moody’s, a globally recognized credit rating agency, has assigned State Farm an Aa1 (Excellent) rating. This rating underscores State Farm’s robust financial stability and its ability to withstand economic challenges.

Last Recap

Obtaining a quote for State Farm insurance is a simple and straightforward process. By utilizing State Farm’s online resources, mobile app, or contacting their customer service team, you can quickly gather the information needed to receive a personalized quote. Remember to compare different coverage options and consider your individual needs and budget to ensure you’re securing the most suitable protection for your assets and loved ones.

Questions Often Asked

How do I get a quote for State Farm insurance?

You can obtain a quote online, through their mobile app, or by contacting their customer service team.

What factors affect my State Farm insurance quote?

Factors such as your driving history, credit score, age, location, and the type of coverage you require influence your quote.

Can I customize my State Farm insurance policy?

Yes, State Farm offers various customization options to tailor your policy to your specific needs and budget.

How long does it take to get a State Farm insurance quote?

You can typically receive a quote within minutes, depending on the method you choose.