Quote for car insurance State Farm sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. State Farm is one of the largest and most well-known car insurance providers in the United States. They offer a wide range of coverage options and discounts, making them a popular choice for many drivers. This article will delve into the intricacies of obtaining a quote for State Farm car insurance, exploring factors that influence pricing, available discounts, and customer experiences.

Understanding the key features of State Farm car insurance policies is essential for making informed decisions. From liability coverage to comprehensive and collision, State Farm offers a variety of options to cater to different needs and risk profiles. The company also boasts a reputation for excellent customer service and claims processing, ensuring a smooth and hassle-free experience for policyholders.

Understanding State Farm Car Insurance

State Farm is one of the largest and most well-known insurance companies in the United States, offering a wide range of insurance products, including car insurance. Their car insurance policies are designed to provide comprehensive coverage and peace of mind to their policyholders.

Key Features of State Farm Car Insurance

State Farm car insurance policies are known for their comprehensive coverage and customizable options. Some of the key features include:

- Liability Coverage: This covers damages to other people’s property or injuries caused by an accident that you are at fault for.

- Collision Coverage: This covers damages to your own vehicle if it’s involved in a collision, regardless of fault.

- Comprehensive Coverage: This covers damages to your vehicle from events like theft, vandalism, fire, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This protects you if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover your damages.

- Personal Injury Protection (PIP): This covers medical expenses and lost wages for you and your passengers, regardless of fault.

- Roadside Assistance: This provides assistance for situations like flat tires, dead batteries, and lockouts.

- Discounts: State Farm offers a variety of discounts, such as good driver discounts, multi-policy discounts, and safe driver discounts.

Types of Coverage Offered

State Farm offers various types of car insurance coverage to meet the specific needs of their policyholders.

- Basic Coverage: This includes liability coverage and personal injury protection (PIP), which are required by law in many states.

- Full Coverage: This includes basic coverage, collision coverage, and comprehensive coverage, providing more comprehensive protection for your vehicle.

- Customizable Coverage: State Farm allows you to customize your policy by adding or removing specific coverages to fit your individual needs and budget.

Customer Service and Claims Process

State Farm is known for its excellent customer service and claims process. They offer a variety of ways to contact them, including online, phone, and in-person at their local offices. Their claims process is designed to be straightforward and efficient, with experienced claims adjusters available to assist you.

- 24/7 Claims Service: You can report a claim anytime, anywhere, through their website, mobile app, or by phone.

- Direct Claims Payment: State Farm often pays claims directly to repair shops, making the process convenient for policyholders.

- Dedicated Claims Adjusters: They have experienced claims adjusters who are available to answer your questions and guide you through the claims process.

Factors Influencing State Farm Car Insurance Quotes

Your State Farm car insurance quote is tailored to your specific circumstances. Various factors are considered to ensure you pay a fair price for the coverage you need. Understanding these factors can help you make informed decisions about your insurance and potentially save money.

Driving History

Your driving history is a major factor in determining your State Farm car insurance quote. A clean driving record with no accidents or violations will generally lead to lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions will likely result in higher premiums. This is because your driving history reflects your risk of being involved in an accident.

State Farm uses a points system to assess your driving history. Each violation or accident earns points, and a higher point total generally translates to higher premiums.

Vehicle Type

The type of vehicle you drive also influences your insurance quote. Certain vehicles are considered more expensive to repair or replace, and their safety features might vary. For example, luxury cars, sports cars, or vehicles with advanced safety features may cost more to insure than standard sedans or hatchbacks.

State Farm considers factors like the vehicle’s make, model, year, and safety ratings when calculating your premium.

Location, Quote for car insurance state farm

Your location plays a significant role in your State Farm car insurance quote. Areas with higher crime rates, traffic congestion, or more frequent severe weather events tend to have higher insurance premiums. This is because insurance companies assess the likelihood of accidents and claims based on geographic factors.

State Farm considers factors like the population density, accident history, and weather patterns in your area when determining your premium.

Obtaining a State Farm Car Insurance Quote

Getting a quote for State Farm car insurance is straightforward and can be done through various methods. You can receive a personalized quote based on your specific circumstances and needs.

Methods for Obtaining a Quote

There are several ways to get a State Farm car insurance quote:

- Online: The easiest and most convenient way to get a quote is online through State Farm’s website. You can enter your information, such as your driving history, vehicle details, and desired coverage, and receive an instant quote. This method allows you to compare different coverage options and customize your policy based on your preferences.

- Phone: You can also call State Farm’s customer service line to get a quote. A representative will ask you questions about your driving history, vehicle, and desired coverage. This method allows you to speak directly with a representative and clarify any questions you might have.

- In-Person: You can visit a local State Farm agent to get a quote. This allows you to meet with an agent in person, discuss your insurance needs, and receive personalized advice.

Information Required for a Quote

To receive a personalized quote, State Farm will need some information from you, including:

- Your Personal Information: This includes your name, address, date of birth, and contact information.

- Driving History: You will need to provide details about your driving history, including your driving record, any accidents or violations, and your years of driving experience.

- Vehicle Information: You will need to provide information about your vehicle, including the year, make, model, and VIN (Vehicle Identification Number).

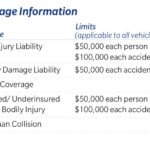

- Desired Coverage: You will need to specify the type and amount of coverage you want, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Other Factors: State Farm may also ask about other factors that could affect your premium, such as your credit score, your location, and any safety features in your vehicle.

State Farm’s Discounts and Promotions

State Farm offers a wide range of discounts and promotions to help you save money on your car insurance. These discounts are designed to reward safe driving habits, responsible vehicle ownership, and other positive factors. By taking advantage of these discounts, you can significantly reduce your insurance premiums and make your policy more affordable.

Understanding State Farm’s Discounts

State Farm’s discounts are categorized into several groups, each addressing specific aspects of your driving habits, vehicle, and overall profile. These discounts can be combined, allowing you to maximize your savings.

Discounts Based on Driving Habits

- Safe Driver Discount: This discount is awarded to drivers with a clean driving record, free from accidents and traffic violations. The discount amount varies depending on the duration of your accident-free history.

- Defensive Driving Course Discount: Completing an approved defensive driving course demonstrates your commitment to safe driving practices. This discount can be substantial, especially for drivers with previous violations.

- Good Student Discount: Students maintaining a certain GPA or academic standing can qualify for this discount. It rewards academic excellence and responsible behavior, reflecting a lower risk profile.

- Multi-Policy Discount: Bundling your car insurance with other State Farm policies, such as homeowners or renters insurance, can lead to significant savings. This discount incentivizes customers to consolidate their insurance needs with State Farm.

Discounts Based on Vehicle Features

- Anti-theft Device Discount: Installing anti-theft devices, such as alarms or tracking systems, reduces the risk of theft, making your vehicle less attractive to criminals. This discount rewards proactive measures to protect your car.

- New Car Discount: New cars often come equipped with advanced safety features, reducing the risk of accidents and injuries. This discount reflects the lower risk associated with newer vehicles.

- Vehicle Safety Features Discount: Cars with safety features like airbags, anti-lock brakes, and electronic stability control are generally safer to drive. This discount recognizes the benefits of these safety features.

Discounts Based on Other Factors

- Drive Safe & Save Discount: This program utilizes telematics technology to monitor your driving habits, rewarding safe driving behaviors with personalized discounts. The discount is based on factors like speed, braking, and mileage.

- Paid-in-Full Discount: Paying your insurance premium in full upfront can earn you a discount. This reflects the reduced administrative costs associated with handling payments.

- Early Bird Discount: Some State Farm policies offer discounts for renewing your insurance early. This encourages proactive planning and minimizes the risk of coverage lapses.

Maximizing Savings with State Farm

To maximize your savings with State Farm, it’s essential to understand the eligibility criteria for each discount and actively pursue them.

- Maintain a Clean Driving Record: Avoid accidents and traffic violations to qualify for the Safe Driver Discount. Practice defensive driving techniques and stay alert while driving.

- Bundle Your Insurance Policies: Combine your car insurance with other State Farm policies to qualify for the Multi-Policy Discount. This can lead to substantial savings on your overall insurance costs.

- Invest in Vehicle Safety Features: Consider purchasing a car with advanced safety features, such as airbags, anti-lock brakes, and electronic stability control. This can earn you discounts and enhance your overall safety.

- Explore Telematics Programs: Enroll in State Farm’s Drive Safe & Save program to track your driving habits and earn personalized discounts. This program encourages safe driving practices and rewards responsible behavior.

- Pay Your Premium in Full: Consider paying your insurance premium upfront to qualify for the Paid-in-Full Discount. This can save you money on administrative fees and interest charges.

- Renew Your Insurance Early: Take advantage of early bird discounts by renewing your insurance before the renewal date. This can help you save money and ensure continuous coverage.

Customer Reviews and Experiences

Customer reviews and testimonials play a crucial role in understanding the overall experience of State Farm car insurance policyholders. These insights provide valuable information about the company’s strengths, weaknesses, and areas for improvement.

Customer Reviews and Testimonials

Many online platforms, such as Trustpilot, Google Reviews, and Yelp, host a wide range of customer reviews for State Farm car insurance. These reviews offer firsthand accounts of policyholders’ experiences with the company, covering aspects like customer service, claims handling, pricing, and overall satisfaction.

For example, on Trustpilot, State Farm has an average rating of 3.5 out of 5 stars, with over 14,000 reviews. Positive reviews often highlight the company’s friendly and helpful customer service representatives, prompt claims processing, and competitive pricing.

However, some reviews express dissatisfaction with certain aspects, such as lengthy wait times, difficulty reaching customer support, and challenges in resolving claims.

Comparison of Customer Satisfaction Ratings

To gain a broader perspective on customer satisfaction, it’s helpful to compare State Farm’s ratings with those of other major car insurance providers.

The J.D. Power 2023 U.S. Auto Insurance Satisfaction Study provides valuable insights into customer satisfaction across the industry. Based on this study, here’s a comparison of customer satisfaction ratings for State Farm and its competitors:

| Insurance Provider | Overall Customer Satisfaction Score |

|---|---|

| State Farm | 809 |

| USAA | 867 |

| Geico | 843 |

| Progressive | 828 |

While State Farm performs well, USAA consistently ranks highest in customer satisfaction, followed by Geico and Progressive.

Analysis of Common Themes in Customer Feedback

A closer examination of customer reviews reveals several recurring themes and trends.

- Positive Feedback:

- Excellent customer service and helpful representatives

- Efficient claims processing and timely payouts

- Competitive pricing and discounts

- Wide range of coverage options and customization

- Strong brand reputation and trust

- Negative Feedback:

- Long wait times for customer service

- Difficulty reaching customer support representatives

- Challenges in resolving claims or disputes

- Limited online tools and digital capabilities

- Inconsistent experiences across different branches or agents

It’s important to note that individual experiences can vary significantly, and these themes represent common trends observed across numerous reviews.

Concluding Remarks: Quote For Car Insurance State Farm

Navigating the world of car insurance can be daunting, but obtaining a quote for State Farm car insurance is a straightforward process. By understanding the factors that influence pricing, exploring available discounts, and considering customer reviews, you can make an informed decision that best suits your individual needs and budget. With its comprehensive coverage options, competitive pricing, and commitment to customer satisfaction, State Farm stands out as a reputable and reliable choice for car insurance.

Popular Questions

What types of coverage does State Farm offer?

State Farm offers a variety of coverage options, including liability, collision, comprehensive, uninsured/underinsured motorist, and personal injury protection.

How can I get a quote for State Farm car insurance?

You can get a quote online, over the phone, or by visiting a local State Farm agent.

What factors affect my car insurance quote?

Your driving history, vehicle type, location, and coverage options all impact your car insurance quote.

Does State Farm offer discounts?

Yes, State Farm offers a variety of discounts, such as good driver, safe driver, and multi-policy discounts.