PA State Minimum Car Insurance sets the stage for this comprehensive guide, providing drivers with a clear understanding of the legal requirements and crucial information to ensure they are adequately protected on the road.

Pennsylvania law mandates that all drivers carry specific types of car insurance to protect themselves and others in case of an accident. This guide will delve into the details of these requirements, including the types of coverage, minimum limits, and the consequences of driving without insurance. It will also explore factors that influence insurance premiums and provide valuable tips for choosing the right insurance provider.

Pennsylvania Minimum Car Insurance Requirements

Driving a car in Pennsylvania requires you to have the minimum amount of car insurance required by law. This ensures that you are financially protected in case of an accident, and it also protects other drivers on the road.

Required Coverage Types

Pennsylvania law mandates that all drivers carry specific types of car insurance to ensure financial responsibility in case of accidents. These mandatory coverage types include:

- Liability Coverage: This coverage protects you financially if you cause an accident that injures another person or damages their property. Liability coverage is divided into two parts:

- Bodily Injury Liability: This covers medical expenses, lost wages, and other damages for injuries sustained by the other driver or passengers in their vehicle. The minimum coverage limit in Pennsylvania is $15,000 per person and $30,000 per accident. This means that your insurance will pay up to $15,000 for injuries to any one person involved in the accident and up to $30,000 for all injuries in the accident, regardless of the number of people injured.

- Property Damage Liability: This coverage pays for repairs or replacement costs for damage to the other driver’s vehicle or property. The minimum coverage limit in Pennsylvania is $5,000. This means that your insurance will pay up to $5,000 for damage to the other driver’s vehicle or property.

For example, if you are at fault in an accident that causes $10,000 in damage to the other driver’s vehicle and $20,000 in medical expenses for the other driver, your liability coverage will pay up to $5,000 for the vehicle damage and $15,000 for the medical expenses, leaving you responsible for the remaining $5,000 in medical expenses.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who is uninsured or has insufficient insurance. It covers your medical expenses, lost wages, and property damage. The minimum coverage limit in Pennsylvania is $15,000 per person and $30,000 per accident for bodily injury, and $5,000 for property damage.

For instance, if you are hit by an uninsured driver and sustain $20,000 in medical expenses, your uninsured motorist coverage will pay up to $15,000, leaving you responsible for the remaining $5,000. However, it’s important to note that this coverage does not apply to hit-and-run accidents. - No-Fault Coverage: This coverage, also known as Personal Injury Protection (PIP), covers your medical expenses and lost wages regardless of who is at fault in an accident. It also covers medical expenses for passengers in your vehicle. The minimum coverage limit in Pennsylvania is $5,000. This means that your insurance will pay up to $5,000 for your medical expenses and lost wages.

For example, if you are injured in an accident and your medical expenses amount to $7,000, your no-fault coverage will pay up to $5,000, leaving you responsible for the remaining $2,000. You can choose to have higher coverage limits for PIP, which can provide more comprehensive coverage.

Financial Responsibility Law in Pennsylvania

Pennsylvania’s Financial Responsibility Law aims to ensure that drivers are financially responsible for any damages or injuries they cause while operating a vehicle. This law requires all drivers to maintain adequate car insurance coverage to protect themselves and others on the road.

Consequences of Driving Without Minimum Car Insurance

Driving without the minimum required car insurance in Pennsylvania has serious consequences. These consequences are designed to deter drivers from operating vehicles without financial protection and to hold them accountable for their actions.

- License Suspension: Driving without insurance is a serious offense, and the Pennsylvania Department of Transportation (PennDOT) will suspend your driver’s license. The suspension period varies depending on the severity of the offense.

- Vehicle Registration Suspension: Your vehicle registration may also be suspended, preventing you from legally driving your car on public roads.

- Fines and Penalties: You could face substantial fines and penalties for driving without insurance. The exact amount of the fine may vary depending on the circumstances.

- Jail Time: In some cases, driving without insurance could lead to jail time, especially if you are involved in an accident that results in injuries or property damage.

- Financial Responsibility: Even if you are not at fault in an accident, you will be held financially responsible for any damages or injuries caused if you do not have insurance. This could result in significant financial burdens, including medical expenses, property repairs, and legal fees.

Obtaining a Certificate of Financial Responsibility

If you have been involved in an accident and do not have the required car insurance, you may be required to obtain a Certificate of Financial Responsibility (CFR) from PennDOT.

- Purpose: The CFR serves as proof that you are financially responsible for any future accidents.

- Requirements: To obtain a CFR, you must provide PennDOT with evidence of financial responsibility, such as proof of insurance coverage or a surety bond.

- Duration: The CFR is typically valid for a specified period, and you may be required to renew it periodically.

Factors Influencing PA Minimum Car Insurance Premiums

Your car insurance premiums in Pennsylvania are determined by several factors. Understanding these factors can help you make informed decisions about your insurance coverage and potentially save money on your premiums.

Factors Influencing PA Minimum Car Insurance Premiums

Several factors influence your car insurance premiums in Pennsylvania. These factors are considered by insurance companies to assess your risk and determine the cost of your coverage.

- Age and Driving Experience: Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. As you gain more driving experience and age, your premiums generally decrease.

- Driving History: Your driving record, including any accidents, traffic violations, or DUI convictions, significantly impacts your premiums. A clean driving record can lead to lower premiums, while a history of incidents will likely result in higher premiums.

- Vehicle Type: The type of vehicle you drive influences your premiums. More expensive or high-performance vehicles are generally considered riskier and thus have higher premiums.

- Location: Where you live impacts your premiums. Areas with higher rates of accidents or theft tend to have higher insurance premiums.

- Credit Score: In some states, insurance companies may consider your credit score as a factor in determining your premiums. A higher credit score may lead to lower premiums.

- Coverage Levels: The amount of coverage you choose, such as liability limits, collision coverage, and comprehensive coverage, directly affects your premiums. Higher coverage levels generally lead to higher premiums.

- Deductibles: The deductible you choose is the amount you pay out of pocket in the event of an accident. Higher deductibles typically result in lower premiums.

Choosing the Right Car Insurance Provider in PA

Finding the right car insurance provider in Pennsylvania is crucial to ensure you have adequate coverage at a reasonable price. You’ll need to consider several factors to make an informed decision, including your individual needs, budget, and driving history.

Reputable Car Insurance Providers in Pennsylvania

A multitude of reputable car insurance providers operate in Pennsylvania, each offering a unique set of features, benefits, and pricing.

- State Farm: Known for its extensive network of agents, customer service, and comprehensive coverage options. They offer various discounts, including good driver, multi-policy, and safe driver discounts.

- Geico: Renowned for its competitive rates and online convenience. They offer a wide range of coverage options, including collision, comprehensive, and liability coverage. They also provide discounts for good drivers, multiple vehicle insurance, and military service.

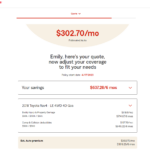

- Progressive: Known for its innovative features, including its Name Your Price tool, which allows customers to set their desired premium and find coverage options that match. They offer discounts for good drivers, safe driving, and bundling insurance policies.

- Erie Insurance: A regional provider with a strong reputation for customer service and financial stability. They offer a wide range of coverage options and discounts, including multi-policy, good driver, and safe driver discounts.

- Allstate: Known for its comprehensive coverage options and its Drive Safe & Save program, which rewards safe drivers with discounts. They also offer discounts for good drivers, multi-policy, and bundling insurance policies.

Comparing and Contrasting Features, Benefits, and Pricing

When choosing a car insurance provider, comparing and contrasting the features, benefits, and pricing offered by different providers is crucial.

- Coverage Options: Compare the types of coverage offered by each provider, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Consider your individual needs and driving habits to determine the appropriate level of coverage.

- Discounts: Each provider offers a variety of discounts, including good driver, multi-policy, and safe driver discounts. Compare the discounts offered by each provider and consider which ones you qualify for.

- Customer Service: Consider the provider’s reputation for customer service. Look for providers with a history of responding promptly to customer inquiries and resolving issues efficiently.

- Pricing: Obtain quotes from multiple providers to compare their pricing. Remember that the lowest price may not always be the best option. Consider the coverage offered and the provider’s reputation for customer service when making your decision.

The Importance of Customer Reviews and Ratings

Customer reviews and ratings can provide valuable insights into a provider’s performance and customer satisfaction.

- Websites: Websites like Consumer Reports, J.D. Power, and the Better Business Bureau offer independent reviews and ratings of car insurance providers. These websites can help you identify providers with a history of providing excellent customer service and resolving issues efficiently.

- Online Forums: Online forums and social media platforms can provide additional insights into customer experiences with different car insurance providers. Look for forums where customers share their experiences with specific providers and their satisfaction with the provider’s services.

Understanding Your Car Insurance Policy

Your car insurance policy is a legal contract that Artikels the terms and conditions of your coverage. It’s crucial to understand what your policy covers, the limitations, and how to file a claim. This knowledge empowers you to make informed decisions and navigate potential situations effectively.

Policy Sections and Clauses

Car insurance policies in Pennsylvania typically include several sections outlining different aspects of coverage.

- Declarations Page: This page summarizes your policy details, including your name, address, vehicle information, coverage types, and premium amounts.

- Coverages: This section details the specific types of coverage you’ve purchased, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage. It Artikels the financial limits and conditions for each coverage.

- Exclusions: This section specifies situations or events not covered by your policy. Understanding these exclusions is vital to avoid unexpected costs.

- Conditions: This section Artikels your responsibilities as a policyholder, including notifying your insurer of changes, cooperating with investigations, and providing required documentation.

- Definitions: This section defines key terms used throughout the policy, ensuring clarity and consistency in interpretation.

Filing a Claim

When you need to file a claim, it’s essential to understand the process and documentation required.

- Contact Your Insurer: Immediately contact your insurance company and report the incident. Provide detailed information about the accident, including the date, time, location, and parties involved.

- Gather Documentation: Collect all relevant documentation, including police reports, witness statements, photographs of the damage, and medical bills. This documentation will support your claim and expedite the process.

- Complete Claim Forms: Your insurer will provide claim forms that you must complete and submit, providing all the necessary information and documentation.

- Cooperate with Investigations: Be prepared to cooperate with your insurer’s investigations. This may involve providing additional information, attending interviews, or allowing access to your vehicle for inspections.

Policy Limitations and Exclusions

Understanding the limitations and exclusions of your policy is crucial to avoid unexpected costs and ensure you have adequate coverage.

“For example, your policy may not cover damages caused by wear and tear, acts of God, or driving under the influence of alcohol or drugs.”

- Deductibles: This is the amount you pay out-of-pocket for each covered claim before your insurance coverage kicks in. A higher deductible usually means a lower premium, but you’ll pay more in case of a claim.

- Coverage Limits: These limits specify the maximum amount your insurer will pay for each covered claim. It’s important to ensure your coverage limits are sufficient for your needs and potential risks.

- Exclusions: As mentioned earlier, your policy will exclude certain situations or events from coverage. These exclusions are clearly Artikeld in the policy document. For instance, driving without a valid license or driving a vehicle not listed on your policy may be excluded.

Additional Coverage Options in Pennsylvania

Pennsylvania’s minimum car insurance requirements provide basic protection, but they may not be enough to cover all potential expenses in the event of an accident. Many drivers choose to purchase additional coverage options to enhance their protection and peace of mind. These optional coverages can help safeguard your financial well-being and protect you from unexpected costs.

Collision Coverage

Collision coverage helps pay for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. It covers damage caused by collisions with another vehicle, an object, or even a pothole. This coverage is particularly important for newer vehicles, as the cost of repairs can be substantial.

- Benefits: Collision coverage provides financial assistance for vehicle repairs or replacement after an accident, regardless of fault.

- Drawbacks: Collision coverage is an optional coverage, so you’ll have to pay an additional premium. You’ll also have to pay a deductible, which is the amount you’ll pay out of pocket before your insurance kicks in.

- When it’s necessary: Collision coverage is recommended for drivers with newer vehicles or those who have a significant amount of equity in their car. It’s also a good idea to consider this coverage if you have a loan or lease on your vehicle, as your lender may require it.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damages caused by events other than collisions, such as theft, vandalism, fire, hail, or natural disasters. This coverage helps pay for repairs or replacement of your vehicle if it’s damaged by these perils.

- Benefits: Comprehensive coverage provides financial assistance for vehicle repairs or replacement due to events other than collisions.

- Drawbacks: Comprehensive coverage is an optional coverage, so you’ll have to pay an additional premium. You’ll also have to pay a deductible, which is the amount you’ll pay out of pocket before your insurance kicks in.

- When it’s necessary: Comprehensive coverage is recommended for drivers with newer vehicles, those who live in areas prone to natural disasters, or those who have a significant amount of equity in their car.

Uninsured/Underinsured Motorist Coverage (UM/UIM), Pa state minimum car insurance

UM/UIM coverage protects you and your passengers if you’re involved in an accident with a driver who is uninsured or underinsured. This coverage can help pay for medical expenses, lost wages, and other damages that you may incur.

- Benefits: UM/UIM coverage provides financial protection if you’re involved in an accident with an uninsured or underinsured driver. It can help cover medical expenses, lost wages, and other damages.

- Drawbacks: UM/UIM coverage is an optional coverage, so you’ll have to pay an additional premium.

- When it’s necessary: UM/UIM coverage is highly recommended for all drivers, as you never know when you might be involved in an accident with an uninsured or underinsured driver.

Other Optional Coverages

In addition to the standard optional coverages, there are several other coverage options available in Pennsylvania, such as:

- Rental Reimbursement Coverage: This coverage helps pay for a rental car while your vehicle is being repaired after an accident.

- Towing and Labor Coverage: This coverage helps pay for towing and labor costs if your vehicle breaks down or needs to be towed.

- Roadside Assistance Coverage: This coverage provides assistance with services like jump-starts, flat tire changes, and lockout assistance.

- Gap Insurance: This coverage helps pay the difference between your vehicle’s actual cash value and the amount you owe on your loan or lease if your vehicle is totaled.

- Medical Payments Coverage (Med Pay): This coverage helps pay for medical expenses for you and your passengers, regardless of fault, up to the policy limit.

Assessing Your Individual Needs

When deciding whether or not to purchase additional coverage, it’s important to consider your individual needs and circumstances. Factors to consider include:

- Your vehicle’s value: If you have a newer or more expensive vehicle, collision and comprehensive coverage may be more beneficial.

- Your financial situation: If you can afford to pay for repairs or replacement out of pocket, you may not need collision or comprehensive coverage.

- Your driving history: If you have a history of accidents or traffic violations, you may be more likely to need additional coverage.

- Your location: If you live in an area with a high risk of theft or vandalism, comprehensive coverage may be a good idea.

Resources for Pennsylvania Drivers

Navigating the world of car insurance in Pennsylvania can feel overwhelming, but you don’t have to go it alone. A wealth of resources exists to help you understand your options, compare prices, and make informed decisions. This section will guide you to reliable sources that can provide valuable information and support.

Government Websites

Government agencies play a crucial role in regulating the insurance industry and protecting consumer rights. Here are some key websites to explore:

- Pennsylvania Insurance Department (PID): The PID is the primary regulatory body for insurance in Pennsylvania. Their website provides information about insurance laws, consumer rights, and complaint procedures. You can also find resources on how to choose an insurer, understand your policy, and file a claim.

- Website: https://www.insurance.pa.gov/

- Phone: (800) 441-2410

- Pennsylvania Department of Transportation (PennDOT): PennDOT is responsible for vehicle registration and driver licensing. Their website provides information about the state’s Financial Responsibility Law, which Artikels minimum car insurance requirements. You can also access driver’s license information, vehicle registration details, and safety resources.

- Website: https://www.penndot.gov/

- Phone: (717) 787-3000

Consumer Advocacy Groups

Consumer advocacy groups are dedicated to protecting the rights of consumers and advocating for fair insurance practices. These organizations can provide valuable information, guidance, and support if you have an insurance dispute.

- Pennsylvania Insurance Consumer Advocate (PICA): PICA is an independent agency that assists consumers with insurance-related issues. They offer free mediation services to resolve disputes between consumers and insurance companies. PICA also provides educational materials and resources on various insurance topics.

- Website: https://www.insurance.pa.gov/Pages/PICA.aspx

- Phone: (800) 441-2410

- Consumer Federation of America (CFA): CFA is a national consumer advocacy group that works to protect consumers from unfair business practices. Their website provides information about insurance issues, including consumer rights, fraud prevention, and policy reviews.

- Website: https://www.consumerfed.org/

- Phone: (202) 387-6121

Insurance Industry Associations

Insurance industry associations represent the interests of insurance companies and provide information about industry trends and best practices. While their primary focus is on the industry, they can offer insights into insurance coverage and policy options.

- Pennsylvania Insurance Federation (PIF): PIF is a trade association representing property and casualty insurance companies in Pennsylvania. Their website provides information about insurance issues, including legislative updates, industry news, and consumer resources.

- Website: https://www.pif.org/

- Phone: (717) 238-5177

- National Association of Insurance Commissioners (NAIC): NAIC is a non-profit organization that represents state insurance regulators across the United States. Their website provides information about insurance laws, regulations, and consumer protection initiatives. You can also access model insurance laws and regulations that may be adopted by individual states.

- Website: https://www.naic.org/

- Phone: (202) 797-8500

Closing Summary: Pa State Minimum Car Insurance

Navigating the world of car insurance can be complex, but understanding Pennsylvania’s minimum requirements is essential for all drivers. This guide has provided a solid foundation, equipping you with the knowledge to make informed decisions and ensure you are properly covered on the road. Remember to review your policy regularly and consult with your insurance provider if you have any questions.

Clarifying Questions

What happens if I get into an accident without the minimum required car insurance?

You could face serious consequences, including fines, license suspension, and even jail time. You may also be held personally liable for any damages or injuries caused.

Can I choose to have higher coverage limits than the minimum required?

Yes, you can. It is generally recommended to consider higher coverage limits, especially if you have a higher risk profile or own a valuable vehicle.

How often should I review my car insurance policy?

It’s a good idea to review your policy at least once a year, or whenever there are significant life changes, such as buying a new car, getting married, or having a child.