Out of state insurance coverage – Out-of-state insurance coverage is a crucial aspect of navigating life’s uncertainties, particularly when venturing beyond your home state. Whether you’re relocating, traveling for an extended period, or simply taking a road trip, understanding the intricacies of out-of-state insurance can save you from unexpected financial burdens and legal complications.

This comprehensive guide delves into the complexities of out-of-state insurance coverage, providing insights into the different types of coverage, the factors influencing availability, and the steps involved in obtaining and managing this essential protection. From exploring the potential benefits and limitations to offering practical tips for navigating claims and procedures, this resource empowers you to make informed decisions and ensure you have the right coverage wherever life takes you.

What is Out-of-State Insurance Coverage?

Out-of-state insurance coverage refers to the protection you receive from your insurance policy when you are traveling or residing outside your home state. It’s essential for ensuring you have the necessary financial support in case of an accident, injury, or other unforeseen events while away from your usual location.

Out-of-state insurance coverage is crucial because your home state’s insurance regulations might not apply in other states. This means that your policy might not cover certain incidents or expenses, leaving you financially vulnerable.

Examples of Scenarios Requiring Out-of-State Insurance Coverage

It’s important to understand the situations where out-of-state insurance coverage becomes vital. Here are some examples:

- Road Trips and Vacations: When you travel by car to another state, your insurance policy should ideally provide coverage for accidents, injuries, and property damage, even if you are not in your home state.

- Relocation: If you move to a new state for work, school, or other reasons, your existing insurance policy might not fully cover you in your new location. You may need to adjust your coverage or obtain a new policy that complies with the regulations of your new state.

- Business Travel: Employees traveling for work outside their home state require adequate insurance coverage to protect them in case of accidents or unforeseen events while on business trips.

- Medical Emergencies: In case of a medical emergency while traveling or residing outside your home state, your insurance policy should provide coverage for medical expenses, including hospitalization, treatment, and transportation.

Challenges and Complexities of Out-of-State Coverage

While out-of-state insurance coverage offers essential protection, there are potential challenges and complexities that you should be aware of:

- State-Specific Regulations: Each state has its own set of insurance regulations, which can vary significantly. Your home state’s policy might not meet the minimum requirements of another state, potentially leaving you with gaps in coverage.

- Reciprocity Agreements: Some states have reciprocity agreements with others, meaning that certain insurance policies are recognized and valid in both states. However, these agreements might not cover all types of insurance or all situations.

- Claims Processing: Filing a claim for an out-of-state incident can be more complex than filing one within your home state. You might need to deal with different insurance companies, regulations, and procedures.

- Coverage Limitations: Out-of-state coverage might have limitations or exclusions, such as certain types of accidents or specific medical treatments. It’s crucial to carefully review your policy and understand any restrictions.

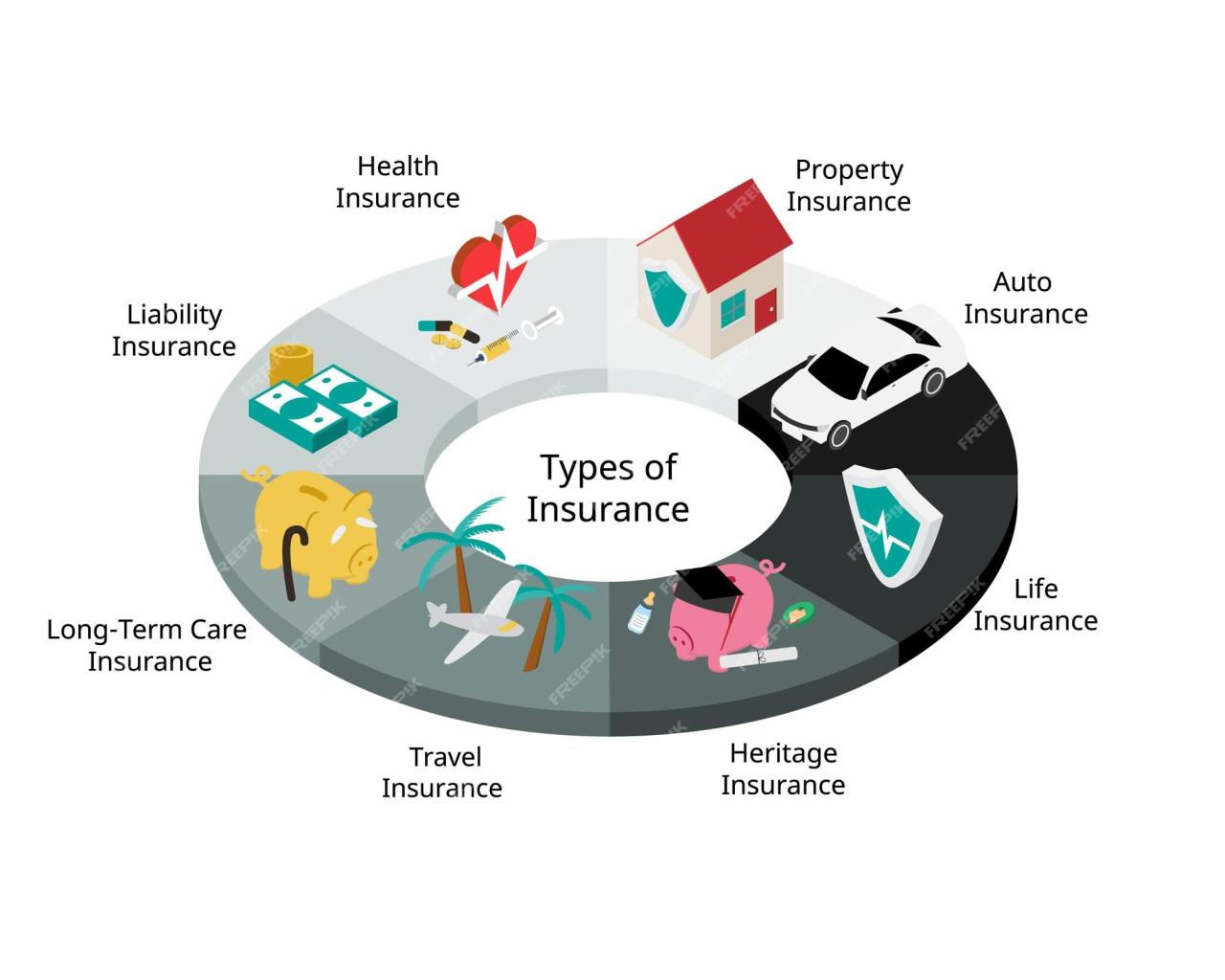

Types of Out-of-State Insurance Coverage

When traveling or relocating to another state, it’s crucial to understand the different types of insurance coverage you might need. Out-of-state insurance coverage ensures that you’re protected against unforeseen events while away from your home state.

Types of Out-of-State Insurance Coverage

Here’s a breakdown of the main types of insurance coverage that might be necessary when you’re out of state:

| Coverage Type | Purpose | Key Considerations |

|---|---|---|

| Auto Insurance | Provides financial protection in case of accidents, injuries, or property damage involving your vehicle. |

|

| Health Insurance | Covers medical expenses in case of illness or injury while out of state. |

|

| Travel Insurance | Provides financial protection against unexpected events during your trip, such as trip cancellation, medical emergencies, lost luggage, or flight delays. |

|

| Homeowners or Renters Insurance | Provides coverage for your belongings and your home or rental property against damage or theft, even if you’re away from home. |

|

It’s important to note that specific insurance requirements and coverage options can vary significantly from state to state. Always contact your insurance provider to discuss your specific needs and ensure you have adequate coverage while traveling or residing out of state.

Factors Affecting Out-of-State Coverage

The availability and extent of out-of-state insurance coverage can vary significantly depending on several factors. These factors can influence whether your insurance policy will cover you in another state and the extent of the coverage provided.

State Regulations

State regulations play a crucial role in determining out-of-state coverage. Each state has its own set of insurance laws and regulations, which can affect the coverage you receive when traveling or residing in another state.

For example, some states have laws that require insurers to provide coverage for accidents that occur within their borders, even if the policyholder’s primary residence is in another state. Other states may have reciprocal agreements with neighboring states, allowing policyholders to access coverage in those states as if they were residents.

It’s important to understand the specific regulations of the state you’re traveling to or residing in to ensure you have adequate coverage.

Obtaining Out-of-State Insurance Coverage

Securing out-of-state insurance coverage often involves a straightforward process, though the specific steps may vary depending on the state and type of insurance you require. This section Artikels the general steps involved in obtaining out-of-state insurance coverage.

Steps Involved in Obtaining Out-of-State Insurance Coverage

Obtaining out-of-state insurance coverage generally involves the following steps:

- Research and Compare Insurance Providers: Begin by researching and comparing insurance providers in the state where you need coverage. This involves looking at different companies, their coverage options, premiums, and customer reviews. Online comparison tools can help streamline this process.

- Contact Insurance Providers: Once you’ve identified potential insurance providers, contact them directly to discuss your specific needs and obtain quotes. Be prepared to provide information about your vehicle, driving history, and other relevant details.

- Review and Compare Quotes: Carefully review the quotes you receive from different providers, paying attention to coverage details, deductibles, premiums, and any additional fees.

- Choose an Insurance Provider: After comparing quotes and considering your needs, choose the insurance provider that offers the best value and coverage for your situation.

- Complete the Application Process: Complete the insurance application with the chosen provider, providing accurate and complete information. This may involve submitting documents like your driver’s license, proof of vehicle ownership, and any other required documentation.

- Pay Premiums: Once your application is approved, you’ll need to pay the initial premium to activate your coverage.

- Receive Policy Documents: You’ll receive your insurance policy documents, including details about your coverage, premium amounts, and payment schedule.

Required Documents and Information

The specific documents and information required for out-of-state insurance coverage may vary depending on the state and insurance provider. However, you can generally expect to provide the following:

- Driver’s License: A valid driver’s license from your current state of residence.

- Proof of Vehicle Ownership: Documents like a vehicle title or registration that demonstrate ownership of the vehicle.

- Vehicle Identification Number (VIN): The unique identification number for your vehicle.

- Driving History: Information about your driving record, including any accidents or violations.

- Proof of Insurance: If you currently have insurance, you may need to provide proof of coverage from your existing provider.

- Contact Information: Your name, address, phone number, and email address.

- Payment Information: Details about your preferred payment method, such as credit card or bank account information.

Timelines and Procedures, Out of state insurance coverage

The timeline for obtaining out-of-state insurance coverage can vary depending on factors such as the complexity of your application, the insurance provider’s processing time, and the state’s regulations. Generally, it can take a few days to a few weeks to obtain coverage.

- Initial Contact: Contacting insurance providers and obtaining quotes can usually be done within a few days.

- Application Processing: Once you submit an application, the insurance provider will review it and process your request. This can take a few days to a week or more, depending on the provider’s processing time.

- Policy Issuance: After your application is approved, you will receive your insurance policy documents. This process can take a few days to a week.

Benefits and Limitations of Out-of-State Coverage

Out-of-state insurance coverage can offer advantages and disadvantages depending on your specific needs and circumstances. Understanding these aspects is crucial for making informed decisions about your insurance coverage.

Benefits of Out-of-State Coverage

Out-of-state insurance coverage can provide several benefits, especially for individuals who frequently travel or relocate.

- Extended Coverage: Out-of-state insurance coverage extends your protection beyond your home state’s boundaries, ensuring you have coverage in case of an accident or incident while traveling. This can be particularly beneficial for frequent travelers, people with second homes in other states, or individuals who relocate frequently.

- Potential Cost Savings: Depending on the state and insurer, you might find that out-of-state insurance premiums are lower than those in your home state. This could be due to variations in state regulations, competition among insurers, or risk profiles of the insured population.

- Access to Specialized Coverage: Some states offer unique or specialized insurance coverage options that might not be available in your home state. For instance, if you require specific coverage for a high-risk activity or unique property, out-of-state insurance might provide better options.

Limitations of Out-of-State Coverage

While out-of-state coverage offers benefits, it also comes with potential limitations and drawbacks.

- Complexity and Regulations: Navigating out-of-state insurance regulations and requirements can be complex, involving understanding different state laws, claim processes, and coverage details. This can lead to confusion and potential challenges in managing your coverage.

- Limited Network Access: Out-of-state insurance might have a smaller network of healthcare providers or repair shops compared to your home state. This could limit your choices when seeking medical treatment or repairs after an accident.

- Potential for Higher Deductibles: Some out-of-state insurance plans might have higher deductibles than your home state’s plans, leading to greater out-of-pocket expenses in case of a claim.

- Difficulty with Claims: Filing claims with an out-of-state insurer can be more challenging, as you might need to deal with unfamiliar procedures, contact different representatives, or navigate different communication channels.

Tips for Managing Out-of-State Insurance Coverage: Out Of State Insurance Coverage

Managing out-of-state insurance coverage can be complex, but with careful planning and proactive measures, you can navigate the process effectively. Here are some essential tips to ensure smooth and efficient handling of your insurance needs while traveling or residing temporarily in another state.

Understanding Your Coverage

It’s crucial to understand the specifics of your insurance policy’s out-of-state coverage. Familiarize yourself with the following:

- Coverage limits: Understand the maximum amounts your policy will cover for medical expenses, property damage, or liability in another state.

- Deductibles: Be aware of the amount you’ll need to pay out-of-pocket before your insurance kicks in for claims.

- Exclusions: Review any specific exclusions or limitations that apply to your coverage in other states, such as certain types of medical treatments or specific activities.

Communicating with Your Insurer

Maintaining clear and consistent communication with your insurance company is essential.

- Notify your insurer: Inform them of your travel plans or temporary relocation to another state, including the dates and location.

- Request updates: Ask your insurer for any relevant updates or changes to your policy that might impact your out-of-state coverage.

- Document interactions: Keep records of all conversations, emails, or letters with your insurer to ensure you have a clear understanding of your coverage and any relevant agreements.

Navigating Out-of-State Claims

Filing a claim while out of state can require specific steps and procedures.

Understanding the Claims Process

- Contact your insurer: Immediately report any accidents or incidents to your insurance company, even if you are not sure if a claim is necessary.

- Gather information: Collect all relevant details, such as the date, time, location, and names and contact information of all parties involved. Take photographs or videos of any damage or injuries.

- Follow instructions: Adhere to your insurer’s instructions regarding the claim process, including deadlines for filing and providing documentation.

Seeking Assistance

- Use your insurer’s network: If possible, seek medical treatment or repair services from providers within your insurer’s network for out-of-state claims. This can help streamline the claims process and ensure coverage.

- Contact a claims representative: Speak with a claims representative from your insurance company to understand the specific procedures for filing and managing your claim in the other state.

- Consult a lawyer: If you encounter any difficulties or disputes with your insurer regarding your out-of-state claim, consider consulting with an attorney specializing in insurance law.

Resources and Contact Information

For additional information and assistance with out-of-state insurance coverage, you can consult the following resources:

- Your insurance company: Contact your insurance provider’s customer service department for specific information and guidance on your policy’s out-of-state coverage.

- State insurance departments: Each state has an insurance department that can provide information and assistance with insurance-related matters, including out-of-state coverage.

- National Association of Insurance Commissioners (NAIC): The NAIC is a national organization that works with state insurance regulators to promote consumer protection and uniformity in insurance laws and regulations. Their website provides information on various insurance topics, including out-of-state coverage.

Final Thoughts

Navigating the realm of out-of-state insurance coverage requires a proactive approach. By understanding the key considerations, factors influencing availability, and steps involved in obtaining coverage, you can make informed decisions and ensure you have the right protection wherever you go. Remember to consult with your insurance provider, research state regulations, and explore resources available to guide you through the process. With careful planning and a proactive mindset, you can confidently embrace the opportunities that lie beyond your home state, knowing that your insurance needs are adequately addressed.

Essential FAQs

What happens if I get into an accident in another state?

Your insurance company will likely cover the accident, but you should check your policy for specific coverage details and limitations for out-of-state incidents. It’s also a good idea to report the accident to the local authorities in the state where it occurred.

Do I need to notify my insurance company if I’m moving to another state?

Yes, it’s essential to inform your insurance company about your move, as state regulations and coverage requirements can vary significantly. They can help you adjust your policy accordingly to ensure you have adequate coverage in your new state.

What are some common out-of-state insurance coverage requirements?

Common requirements include proof of insurance, minimum liability coverage limits, and specific coverage for certain types of vehicles or situations. These requirements can vary by state, so it’s crucial to research the specific regulations for your destination.