Out of state car insurance coverage – Out-of-state car insurance coverage is a crucial aspect of responsible driving, ensuring you’re protected when venturing beyond your home state. Whether you’re planning a road trip, relocating, or simply driving across state lines for work, understanding the differences in insurance requirements and coverage is essential. This guide delves into the intricacies of out-of-state car insurance, exploring minimum coverage requirements, factors influencing costs, and tips for managing your coverage effectively.

Navigating the world of out-of-state car insurance can seem complex, but with the right information, you can ensure you’re adequately protected on the road. This guide aims to demystify the process, providing clear explanations and practical advice to help you make informed decisions about your coverage.

Understanding Out-of-State Car Insurance Coverage

When you drive your car outside your home state, you’re subject to the laws and regulations of the state you’re visiting. This includes your car insurance coverage. While your in-state policy might provide some basic protection, it’s crucial to understand how it differs from out-of-state coverage and what additional steps you might need to take to ensure you’re adequately protected.

Understanding the Differences Between In-State and Out-of-State Coverage

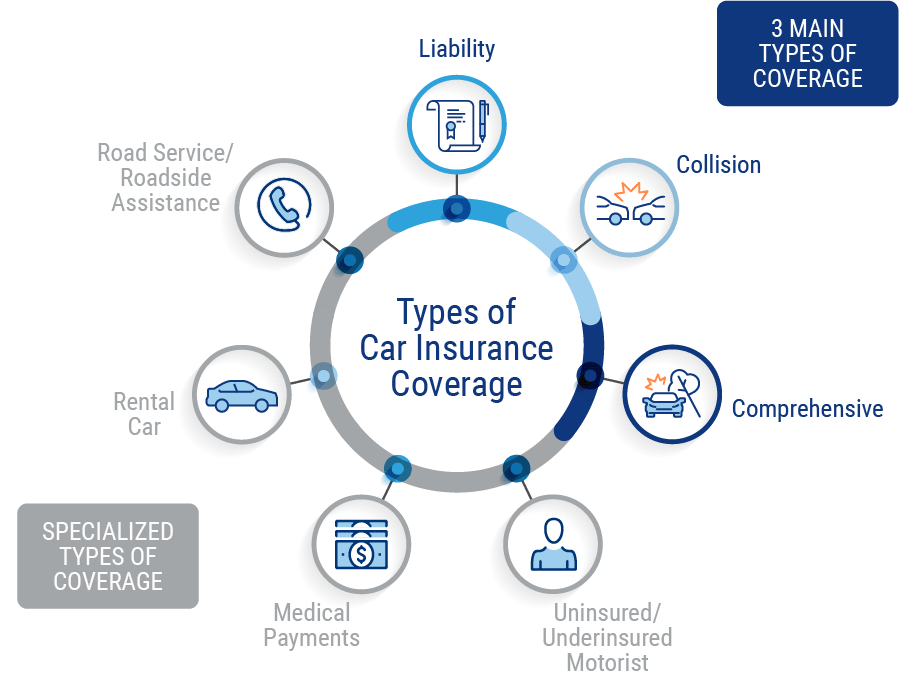

Your in-state car insurance policy is designed to meet the minimum requirements of your home state. However, other states may have different minimum coverage requirements, which could leave you underinsured if you’re involved in an accident. For example, some states require higher liability limits or coverage for specific types of damages, such as uninsured motorist coverage. It’s important to review your policy and compare it to the requirements of the state you’re visiting.

Minimum Coverage Requirements in Different States

It’s crucial to understand the minimum car insurance requirements in each state you drive in. These requirements can vary significantly, and driving without adequate coverage can lead to hefty fines and other penalties.

Minimum Coverage Requirements by State

Each state mandates minimum insurance coverage for drivers, typically encompassing liability, personal injury protection (PIP), and uninsured/underinsured motorist (UM/UIM) coverage. Here’s a table comparing minimum requirements across various states:

| State | Bodily Injury Liability per Person | Bodily Injury Liability per Accident | Property Damage Liability |

|—|—|—|—|

| Alabama | $25,000 | $50,000 | $25,000 |

| Alaska | $50,000 | $100,000 | $25,000 |

| Arizona | $25,000 | $50,000 | $15,000 |

| Arkansas | $25,000 | $50,000 | $25,000 |

| California | $15,000 | $30,000 | $5,000 |

| Colorado | $25,000 | $50,000 | $15,000 |

| Connecticut | $20,000 | $40,000 | $10,000 |

| Delaware | $30,000 | $60,000 | $10,000 |

| Florida | $10,000 | $20,000 | $10,000 |

| Georgia | $25,000 | $50,000 | $25,000 |

Out-of-State Driver Requirements

Most states require out-of-state drivers to meet their minimum insurance coverage requirements, even if their home state has lower limits. For instance, if you’re driving in California, you must have at least $15,000 in bodily injury liability per person, even if your home state only requires $10,000.

Penalties for Inadequate Coverage

Driving without adequate car insurance in another state can result in various penalties, including:

* Fines: You may face significant fines, ranging from hundreds to thousands of dollars.

* License Suspension: Your driver’s license may be suspended in the state where you were driving without adequate coverage.

* Impoundment: Your vehicle could be impounded until you provide proof of adequate insurance.

* Court Costs: You may be required to pay court costs associated with the violation.

* Higher Insurance Premiums: Your insurance premiums may increase after a violation.

* Coverage Denial: Your insurance company may deny coverage for an accident if you were driving without adequate insurance in another state.

Factors Influencing Out-of-State Coverage Costs: Out Of State Car Insurance Coverage

When you’re driving in a state other than your home state, your car insurance premiums can be influenced by a variety of factors. These factors determine your risk profile and ultimately affect how much you pay for out-of-state coverage.

Vehicle Type

The type of vehicle you drive significantly impacts your insurance premiums. Insurance companies assess the risk associated with different vehicle types based on factors such as safety features, repair costs, and theft risk.

- Luxury and high-performance vehicles are often more expensive to insure due to their higher repair costs and the likelihood of being targeted by theft.

- Older vehicles might have lower premiums, but they may lack modern safety features, increasing the potential for accidents and higher insurance claims.

- Vehicles with safety features like anti-lock brakes, airbags, and stability control are generally considered safer and may result in lower premiums.

Driving History, Out of state car insurance coverage

Your driving history is a critical factor in determining your insurance premiums. Insurance companies consider your driving record to assess your risk of accidents and claims.

- Accidents and violations on your record, such as speeding tickets, DUI offenses, or accidents, can significantly increase your premiums.

- A clean driving record, on the other hand, can qualify you for lower premiums and discounts.

Age

Your age plays a significant role in determining your insurance premiums. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents, leading to higher premiums. However, as you gain experience and age, your premiums generally decrease.

- Young drivers often face higher premiums due to their lack of experience and higher risk of accidents.

- Older drivers may also face higher premiums due to potential health concerns and decreased reaction times.

- Mature drivers, typically in their mid-30s to 50s, generally have lower premiums as they have more experience and a lower risk profile.

State-Specific Regulations

State-specific regulations can significantly impact your insurance premiums. Each state has its own set of minimum insurance requirements, and these regulations can influence the coverage options and costs you face.

- Minimum liability coverage requirements vary by state, and higher minimums can result in higher premiums.

- State-mandated benefits, such as personal injury protection (PIP) or uninsured/underinsured motorist coverage (UM/UIM), can also affect premiums.

- State-specific discounts may be available for things like good driving records, safety features, or driver education courses.

Average Out-of-State Insurance Premiums

Average out-of-state insurance premiums can vary significantly depending on the region, state, and specific factors discussed above.

- Urban areas tend to have higher premiums due to higher traffic density and increased risk of accidents.

- Rural areas often have lower premiums due to lower traffic volume and a lower risk of accidents.

- States with higher costs of living generally have higher insurance premiums due to higher repair costs and medical expenses.

Obtaining Out-of-State Coverage Options

Navigating the world of out-of-state car insurance can feel like a maze, but it doesn’t have to be. Understanding your options and knowing where to look for coverage can make the process smoother. Whether you’re planning a short trip or a permanent move, there are different ways to ensure you’re properly insured.

Temporary Out-of-State Coverage

If you’re planning a temporary trip out of state, your existing car insurance policy might provide some level of coverage. However, the extent of this coverage can vary. Some policies might automatically offer limited coverage in other states, while others may require you to purchase additional temporary coverage.

Longer-Term Out-of-State Coverage Options

For those moving to a new state or staying for an extended period, you’ll need to obtain a more permanent insurance policy. There are several options to consider:

1. Transferring Your Existing Policy

You might be able to transfer your existing policy to your new state. This can be a convenient option, especially if you’re happy with your current insurer. However, it’s important to note that your premiums might change depending on the insurance regulations and risk factors in your new state.

2. Purchasing a New Policy from an Out-of-State Insurer

You can choose to purchase a new policy from an insurance company that operates in your new state. This allows you to explore different insurance options and potentially find a better rate. However, you’ll need to research insurers that operate in your new state and compare their coverage and pricing.

3. Using a National Insurance Company

National insurance companies operate in multiple states, making them a convenient option for out-of-state coverage. They offer consistent coverage across different states, potentially simplifying the process of switching your insurance. However, national insurers might not always offer the most competitive rates compared to regional insurers.

Comparing Out-of-State Coverage Options

- Existing Policy Transfer: This can be a convenient option, but your premiums might change based on your new state’s regulations and risk factors.

- New Policy from an Out-of-State Insurer: Allows for exploring different insurance options and potentially finding a better rate, but requires research and comparison of insurers.

- National Insurance Company: Offers consistent coverage across states, simplifying the process of switching insurance, but might not offer the most competitive rates.

Tips for Managing Out-of-State Coverage

Ensuring you have adequate car insurance coverage while driving in another state is crucial for protecting yourself financially in case of an accident. Here are some essential tips for managing your out-of-state car insurance.

Ensuring Adequate Coverage

It’s essential to understand the minimum insurance requirements in the state you’re driving in. These requirements can vary significantly from state to state. For example, some states require only liability coverage, while others mandate comprehensive and collision coverage. To ensure you have adequate coverage, you can:

- Contact your insurance company and inquire about the specific coverage requirements in the state you’re visiting.

- Review your current policy to determine if it meets the minimum requirements of the state you’re traveling to.

- Consider purchasing additional coverage, such as uninsured/underinsured motorist coverage, which can protect you in case you’re involved in an accident with a driver who doesn’t have sufficient insurance.

Handling Accidents or Claims

In the unfortunate event of an accident, it’s crucial to stay calm and follow these steps:

- Contact the authorities: Call the police to report the accident and obtain a police report. This document will be essential for filing a claim with your insurance company.

- Exchange information: Exchange contact and insurance information with the other parties involved in the accident. This includes their name, address, phone number, insurance company, and policy number.

- Document the accident: Take pictures of the damage to your vehicle and the other vehicles involved. Note down the location of the accident, the date and time, and any witness information.

- Contact your insurance company: Immediately notify your insurance company about the accident. They will guide you through the claims process and provide assistance with filing a claim.

Preparing for a Trip

Before embarking on a trip that involves driving in another state, consider the following checklist:

- Review your current policy: Ensure your current car insurance policy meets the minimum requirements of the state you’re traveling to. Consider adding additional coverage if necessary.

- Contact your insurance company: Inform your insurance company about your travel plans and confirm your coverage details. They can provide you with specific information about your coverage while driving out of state.

- Obtain emergency contact information: Keep your insurance company’s emergency contact information readily available in case of an accident or other unforeseen circumstances.

- Pack a roadside assistance kit: This kit should include essential items like jumper cables, a flashlight, a first-aid kit, and a warning triangle. Roadside assistance can be invaluable in case of a breakdown or accident.

Closing Summary

Driving out of state without proper insurance can lead to hefty fines, legal complications, and potentially even the inability to drive. By understanding the nuances of out-of-state car insurance coverage, you can navigate the roads with confidence, knowing you’re protected in the event of an accident or other unforeseen circumstances. Remember to review your policy regularly, update your coverage as needed, and always prioritize safety on the road.

Answers to Common Questions

What happens if I get into an accident in another state?

Your out-of-state car insurance coverage will typically cover you in the event of an accident. However, it’s crucial to understand the specific terms and conditions of your policy, as coverage limits and claim procedures may vary depending on the state where the accident occurred.

Can I use my existing car insurance policy while driving out of state?

In most cases, yes. Your existing car insurance policy should provide coverage in other states, but it’s essential to confirm this with your insurer. They may have specific requirements or limitations for out-of-state driving.

How do I get temporary out-of-state car insurance?

Many insurance companies offer temporary out-of-state car insurance policies, which can be purchased for a specific period. These policies typically provide the minimum coverage required in the state you’re visiting. Contact your insurer or a specialized insurance broker for more information.