Online auto insurance quote State Farm sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. State Farm, a well-known insurance provider, offers a convenient online platform for obtaining auto insurance quotes. This digital approach simplifies the process, allowing potential customers to quickly explore various coverage options and compare rates without the need for phone calls or in-person visits.

The online quoting process is straightforward and user-friendly, guiding individuals through a series of questions to gather the necessary information. This information includes personal details, driving history, vehicle information, and desired coverage levels. State Farm then utilizes this data to generate personalized quotes, providing transparency and allowing customers to make informed decisions.

State Farm’s Online Auto Insurance Quoting Process

Getting an auto insurance quote from State Farm online is a straightforward process. You can get a personalized quote in minutes by providing some basic information about yourself and your vehicle.

Information Required for Online Quotes

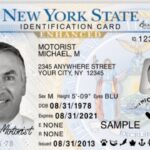

The information you’ll need to provide during the online quoting process is generally the same as what you’d provide over the phone or in person. This includes:

- Your personal information (name, address, date of birth, etc.)

- Your driving history (including any accidents or violations)

- Information about your vehicle (make, model, year, mileage, etc.)

- Details about your desired coverage (liability limits, comprehensive and collision coverage, etc.)

Comparison of Online and Traditional Quoting Methods

The online quoting process offers several advantages over traditional methods:

- Convenience: You can get a quote anytime, anywhere, without having to schedule an appointment or wait on hold.

- Speed: The online process is typically much faster than getting a quote over the phone or in person.

- Transparency: You can see exactly what factors are affecting your quote, and you can adjust your coverage options to find the best price.

However, there are also some disadvantages to consider:

- Limited customization: You may not be able to get as much personalized advice online as you would from an agent.

- Technical difficulties: You may encounter technical difficulties with the online quoting system.

Advantages of Obtaining an Online Quote

Online auto insurance quotes offer several benefits:

- Accessibility: You can access the quoting system anytime, anywhere, from any device with internet access.

- Speed: The process is generally faster than traditional methods, allowing you to quickly compare different quotes.

- Convenience: You can get a quote without leaving your home or office, saving you time and effort.

- Transparency: You can see the factors influencing your quote and adjust your coverage to find the best price.

Features and Benefits of State Farm Auto Insurance

State Farm offers a comprehensive range of auto insurance policies designed to meet the diverse needs of drivers. Their policies provide financial protection and peace of mind in the event of an accident or other unforeseen circumstances.

Coverage Options

State Farm’s auto insurance policies include a variety of coverage options to tailor your protection to your specific requirements.

- Liability Coverage: This coverage protects you financially if you are at fault in an accident that causes damage to another person’s property or injuries. It covers the other driver’s medical expenses, lost wages, and property damage up to the limits of your policy.

- Collision Coverage: Collision coverage pays for repairs to your vehicle if it is damaged in an accident, regardless of who is at fault. This coverage is optional but highly recommended, especially if you have a financed or leased vehicle.

- Comprehensive Coverage: Comprehensive coverage protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, fire, or natural disasters. This coverage is also optional but can be valuable for protecting your investment in your vehicle.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. It helps cover your medical expenses, lost wages, and property damage.

- Personal Injury Protection (PIP): PIP coverage, also known as “no-fault” coverage, pays for your medical expenses and lost wages regardless of who is at fault in an accident. This coverage is required in some states.

- Rental Car Coverage: If your vehicle is damaged in an accident and is unusable, rental car coverage helps pay for a rental car while your vehicle is being repaired.

- Roadside Assistance: Roadside assistance provides help in case of a flat tire, dead battery, or other roadside emergencies. It can include towing, jump starts, and lockout services.

Discounts

State Farm offers a variety of discounts to help you save on your auto insurance premiums.

- Safe Driver Discount: Drivers with a clean driving record may qualify for a safe driver discount. This discount rewards drivers who have not been involved in accidents or received traffic violations.

- Good Student Discount: Students with good grades may qualify for a good student discount. This discount recognizes students who maintain high academic performance.

- Multi-Policy Discount: If you bundle your auto insurance with other State Farm insurance policies, such as homeowners or renters insurance, you may qualify for a multi-policy discount.

- Anti-theft Device Discount: Installing anti-theft devices in your vehicle, such as an alarm system or GPS tracking, can qualify you for a discount.

- Defensive Driving Course Discount: Completing a defensive driving course can help you learn safe driving practices and qualify you for a discount.

- Vehicle Safety Feature Discount: Vehicles equipped with safety features, such as airbags, anti-lock brakes, and electronic stability control, may qualify for a discount.

Value Proposition

State Farm’s auto insurance policies provide comprehensive protection and peace of mind, offering a range of coverage options and discounts to meet the diverse needs of drivers. State Farm is known for its excellent customer service, financial stability, and commitment to providing fair and affordable insurance solutions.

Factors Influencing Auto Insurance Quotes

Getting an auto insurance quote is like getting a custom-tailored suit – it’s unique to you and your driving habits. State Farm considers several factors to determine your premium, ensuring you get the right coverage at the right price.

Driving History

Your driving history is a significant factor in determining your insurance premium. A clean driving record with no accidents or violations translates into lower premiums. However, if you’ve been involved in accidents or received traffic tickets, your premium will likely be higher.

- Accidents: Each accident, regardless of fault, increases your risk profile, leading to higher premiums. The severity of the accident also matters. A minor fender bender might have a smaller impact than a major collision.

- Traffic Violations: Speeding tickets, DUI convictions, and other traffic violations indicate a higher risk of future accidents, leading to increased premiums.

- Driving Record: State Farm reviews your driving history through your motor vehicle report (MVR). This report contains information about your accidents, violations, and other driving-related incidents.

Vehicle Type, Online auto insurance quote state farm

The type of vehicle you drive also plays a significant role in determining your insurance premium. Certain vehicles are more expensive to repair or replace, and some are statistically more likely to be involved in accidents.

- Make and Model: A high-performance sports car or a luxury SUV will likely have higher insurance premiums than a basic sedan or a compact car due to their higher repair costs and potential for greater damage in accidents.

- Safety Features: Vehicles equipped with advanced safety features like anti-lock brakes, airbags, and lane departure warnings can qualify for discounts, as these features help reduce the severity of accidents and claims.

- Vehicle Age: Newer vehicles are generally more expensive to repair or replace, leading to higher premiums. Older vehicles may have higher premiums due to increased risk of mechanical failures or safety concerns.

Location

Your location is another crucial factor affecting your auto insurance premiums. State Farm considers factors like the density of population, traffic congestion, crime rates, and weather conditions in your area to assess your risk.

- Urban vs. Rural: Urban areas with heavy traffic and higher population density tend to have higher insurance premiums due to the increased risk of accidents. Rural areas with lower population density and fewer vehicles on the road generally have lower premiums.

- Climate: Areas prone to severe weather conditions, such as hurricanes, earthquakes, or tornadoes, might have higher premiums due to the increased risk of damage to vehicles.

- Crime Rates: Areas with high crime rates, particularly auto theft, may have higher insurance premiums due to the increased risk of vehicle theft or vandalism.

Other Factors

Besides the factors mentioned above, other factors can influence your auto insurance quote, including:

- Age and Gender: Younger drivers and male drivers often have higher premiums due to their higher risk of accidents.

- Credit Score: In some states, insurance companies may consider your credit score as a factor in determining your premium. This is because a good credit score is often associated with responsible financial behavior, which can translate into lower risk for insurance companies.

- Usage: How often you drive and for what purposes impacts your premium. If you only use your car for commuting to work, your premium will likely be lower than if you use it for long-distance travel or frequent errands.

- Coverage Options: The type and amount of coverage you choose will also affect your premium. For example, comprehensive and collision coverage will generally cost more than liability coverage alone.

Customer Experience and Reviews

State Farm’s online auto insurance quoting process has been met with mixed reactions from customers. While some have praised its user-friendliness and speed, others have expressed concerns about the accuracy of quotes and the overall customer service experience.

Customer Satisfaction with Online Quoting

To gain a comprehensive understanding of customer satisfaction with State Farm’s online quoting system, we can analyze reviews and feedback from various platforms. This includes customer testimonials on State Farm’s website, independent review sites like Trustpilot and ConsumerAffairs, and social media platforms like Facebook and Twitter.

Comparison with Competitors: Online Auto Insurance Quote State Farm

State Farm is a major player in the auto insurance market, and its online quoting process and auto insurance offerings are comparable to those of other major insurance providers. However, there are key differentiators that set State Farm apart from its competitors, and its strengths and weaknesses are worth considering.

Strengths and Weaknesses of State Farm

State Farm’s strengths include its strong brand recognition, extensive agent network, and comprehensive range of insurance products. However, it faces competition from online-only insurers that offer lower prices and more streamlined digital experiences.

- Strengths:

- Strong brand recognition and customer loyalty

- Extensive agent network for personalized service

- Comprehensive range of insurance products beyond auto insurance

- High financial stability and strong claims handling reputation

- Innovative digital tools and mobile app for policy management

- Weaknesses:

- Prices may be higher compared to online-only insurers

- Digital experience can be less streamlined compared to some competitors

- Limited customization options for online quotes

- Customer service can be inconsistent depending on the agent

Market Position of State Farm

State Farm is a major player in the traditional auto insurance market, but it faces increasing competition from online-only insurers. These competitors are gaining market share by offering lower prices, simpler online quoting processes, and more streamlined digital experiences.

- State Farm holds a significant market share in the traditional auto insurance market, but it is facing pressure from online-only insurers. These competitors are gaining market share by offering lower prices, simpler online quoting processes, and more streamlined digital experiences.

- State Farm is responding to this competition by investing in its digital capabilities and expanding its online offerings. However, it remains to be seen whether State Farm can successfully compete with these new entrants in the long term.

Key Differentiators

State Farm’s key differentiators include its strong brand reputation, extensive agent network, and comprehensive range of insurance products. These factors can be particularly attractive to customers who value personalized service and the peace of mind that comes with a well-established insurance provider.

- Strong brand reputation: State Farm has a long history of providing reliable insurance coverage and excellent customer service. This reputation is a major asset for the company, and it helps to build trust with potential customers.

- Extensive agent network: State Farm has a vast network of agents across the country, providing customers with access to personalized service and advice. This is a key differentiator for State Farm, as it allows the company to provide a more human touch than many of its online-only competitors.

- Comprehensive range of insurance products: State Farm offers a wide range of insurance products beyond auto insurance, including home, life, and health insurance. This can be attractive to customers who are looking for a single provider for all of their insurance needs.

Last Word

Obtaining an online auto insurance quote from State Farm offers a streamlined and efficient approach to exploring coverage options. The process is designed to be user-friendly and transparent, empowering individuals to compare rates and make informed decisions. State Farm’s online quoting system provides a valuable resource for those seeking auto insurance, allowing them to quickly access personalized quotes and explore various coverage options.

Expert Answers

How long does it take to get an online quote from State Farm?

The online quoting process is typically quick, often taking just a few minutes to complete.

Can I customize my coverage options when getting an online quote?

Yes, State Farm’s online platform allows you to customize your coverage options to meet your specific needs. You can choose different levels of liability, collision, and comprehensive coverage.

Are there any discounts available for online quotes?

State Farm may offer discounts for online quotes, such as discounts for bundling multiple policies or for maintaining a good driving record.

What if I need to speak to a representative after getting an online quote?

State Farm provides contact information on their website and within the online quoting system if you have questions or need further assistance.