NY State Insurance Identification Card is your vital proof of coverage, serving as a pocket-sized document that verifies your insurance status. It’s a critical piece of information you should always carry, as it can make a difference in various situations, from seeking medical care to dealing with a car accident.

The card contains essential details about your insurance policy, including your name, policy number, and the type of coverage you have. It can be for health, auto, or even homeowner’s insurance, and serves as a quick reference for insurance providers and other relevant entities.

What is a New York State Insurance Identification Card?: Ny State Insurance Identification Card

A New York State Insurance Identification Card, often referred to as an insurance card, is a small, pocket-sized card that serves as proof of insurance coverage. It contains essential information about your insurance policy and is typically required to demonstrate that you have the necessary insurance coverage for various purposes.

Purpose and Function

The primary purpose of a New York State Insurance Identification Card is to provide quick and easy verification of your insurance coverage. It acts as a readily available document that can be presented to various entities, such as:

- Healthcare providers: When seeking medical treatment, you will often need to present your health insurance card to verify your coverage and determine the amount of co-payments or deductibles you may be responsible for.

- Law enforcement officials: In the event of a traffic stop or an accident, you may be required to show your auto insurance card to demonstrate that you have the necessary coverage.

- Other individuals: In situations where proof of insurance is needed, such as renting a car or signing a lease, having your insurance card readily available can simplify the process.

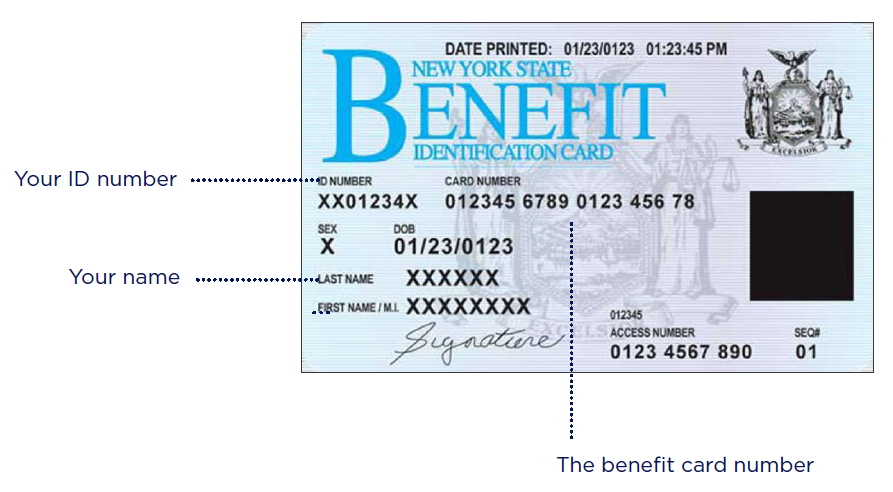

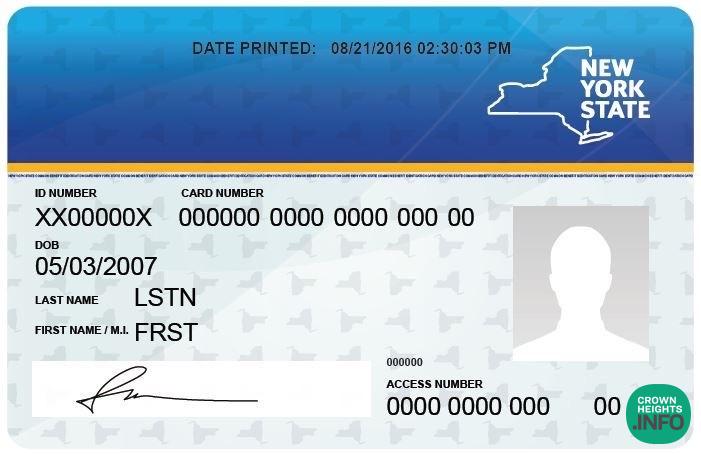

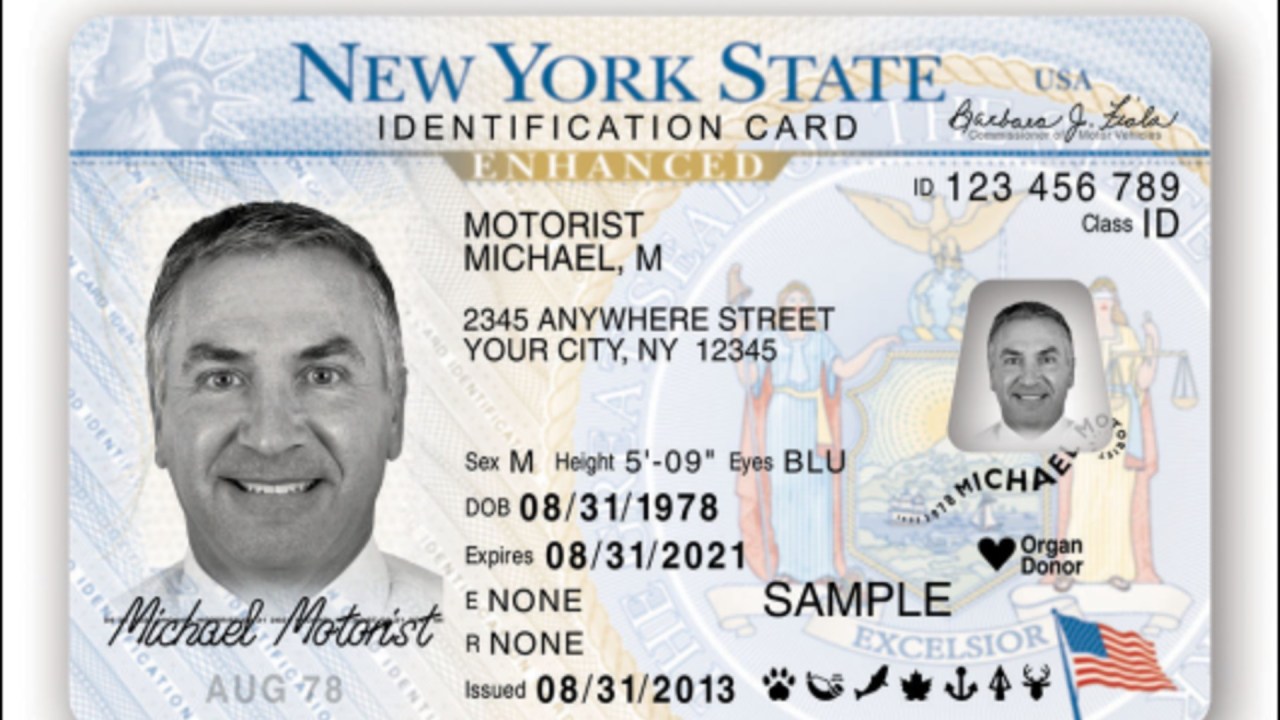

Information Typically Included

A New York State Insurance Identification Card typically includes the following information:

- Your name and policyholder number

- The name of your insurance company

- Your insurance policy number

- The type of insurance coverage (e.g., health, auto, homeowners)

- The effective dates of your coverage

- Contact information for your insurance company

Types of Insurance Cards

There are various types of insurance cards issued in New York State, each corresponding to a specific type of insurance coverage. Here are some common examples:

- Health insurance card: This card provides proof of coverage for medical expenses and may include information about your health plan, co-payments, and deductibles.

- Auto insurance card: This card verifies your coverage for vehicle accidents and liability. It typically includes information about your vehicle, coverage limits, and the effective dates of your policy.

- Homeowners insurance card: This card confirms your coverage for damages to your home and belongings. It may include information about your policy limits and deductibles.

How to Obtain a New York State Insurance Identification Card

A New York State Insurance Identification Card is a crucial document for verifying your insurance coverage. This card provides essential information like your policy number, coverage details, and the name of your insurance company. To obtain a card, you can follow these steps:

Applying Through Your Insurance Agent

The most common method to acquire your New York State Insurance Identification Card is through your insurance agent. They are your direct point of contact for all insurance-related matters, including obtaining your insurance card.

- Contact your insurance agent either by phone, email, or in person.

- Inform them that you need a new insurance identification card.

- Provide any necessary information, such as your policy number, name, and address.

- Your agent will process your request and send you the card either by mail or email.

Obtaining Your Card Online

Many insurance companies offer online platforms for managing your insurance policies. You can access your insurance card through these platforms.

- Log in to your insurance company’s website using your account credentials.

- Navigate to the “My Account” or “Policy” section.

- Locate the option to download or print your insurance identification card.

- You can save the card electronically or print a physical copy.

Requesting Your Card by Mail

If you prefer a physical copy of your insurance identification card and cannot obtain it through your agent or online, you can request it by mail.

- Contact your insurance company by phone or email.

- Request a new insurance identification card and provide your policy number, name, and address.

- The insurance company will mail you a new card.

Required Documentation

To obtain a New York State Insurance Identification Card, you will typically need the following documentation:

- Your policy number.

- Your name and address.

- Your date of birth.

Importance of Carrying a New York State Insurance Identification Card

Carrying your New York State Insurance Identification Card is crucial for various reasons. It serves as proof of your insurance coverage and can be essential in numerous situations, potentially saving you from financial burdens and legal complications.

Potential Consequences of Not Having the Card

Not carrying your insurance identification card can lead to significant consequences, particularly in situations requiring proof of insurance. You may face fines, penalties, or even legal repercussions if you cannot provide valid insurance documentation.

- Traffic Stops: If you are pulled over by a police officer and cannot provide proof of insurance, you could face fines, license suspension, or even vehicle impoundment.

- Accidents: In the event of an accident, being unable to provide proof of insurance can delay or complicate the claims process, potentially leading to additional costs and legal issues.

- Medical Emergencies: If you are involved in an accident or require medical attention, healthcare providers may require proof of insurance before providing treatment, potentially delaying or hindering your access to care.

Scenarios Where the Card Is Essential

Here are some scenarios where carrying your insurance identification card is essential:

- Traffic Stops: As mentioned earlier, police officers may request proof of insurance during routine traffic stops.

- Accidents: In the event of an accident, whether you are at fault or not, it is crucial to provide proof of insurance to the other parties involved and to the authorities.

- Medical Emergencies: If you require medical attention due to an accident or other unforeseen circumstances, healthcare providers will likely ask for your insurance information.

- Rental Agreements: Some rental companies require proof of insurance before allowing you to rent a vehicle.

- Other Legal Matters: In certain legal situations, such as property disputes or legal proceedings, proof of insurance may be necessary.

Verification and Use of a New York State Insurance Identification Card

The New York State Insurance Identification Card serves as proof of insurance coverage, ensuring that individuals have access to necessary medical care and can fulfill legal requirements. This card is verified by various entities, including healthcare providers, law enforcement officials, and insurance companies.

The card is typically verified by comparing the information on the card with the insurer’s records. This may involve checking the cardholder’s name, date of birth, insurance policy number, and other relevant details. In some cases, the card may be scanned using a barcode reader or other electronic devices to verify its authenticity.

Common Situations Where the Card is Used

The New York State Insurance Identification Card is commonly used in various situations to verify insurance coverage. Some of the most common instances include:

- Doctor’s Office or Hospital Visits: When seeking medical treatment, patients are typically required to present their insurance card to verify coverage and determine the amount of co-payment or deductible they are responsible for.

- Emergency Room Visits: In case of an emergency, individuals may be required to present their insurance card to facilitate prompt medical care. Healthcare providers often verify insurance information to ensure the patient’s ability to cover the costs associated with emergency services.

- Prescription Refills: Pharmacies may require insurance verification to ensure coverage for prescription medications. Patients often present their insurance card to determine the co-pay or deductible for the prescribed drugs.

- Traffic Stops: Law enforcement officers may request to see proof of insurance during traffic stops. This verification ensures that drivers are compliant with state regulations and have the necessary insurance coverage in case of an accident.

Security and Privacy of a New York State Insurance Identification Card

Your New York State Insurance Identification Card contains sensitive personal information that needs to be protected. Just like you would safeguard your driver’s license or credit cards, it’s crucial to take steps to prevent unauthorized access to your insurance information.

Protecting Your Card’s Information

Safeguarding your New York State Insurance Identification Card is vital to protect your personal and financial information. Here are some key tips to ensure your card’s security:

- Store your card securely: Keep your card in a safe place, like your wallet or purse, where it won’t be easily lost or stolen. Avoid leaving it in plain sight, especially in public places.

- Do not share your card information: Only share your card details with authorized healthcare providers or insurance representatives. Never provide your card information to strangers or over the phone unless you’re certain of the legitimacy of the request.

- Report lost or stolen cards immediately: If your card is lost or stolen, contact your insurance company immediately to report the loss and request a replacement card. This will help prevent unauthorized use of your insurance information.

- Shred old cards: When you receive a new card or no longer need an old one, be sure to shred it before discarding it. This will prevent identity thieves from accessing your personal information.

Risks Associated with Sharing or Disclosing Card Information

Sharing or disclosing your New York State Insurance Identification Card information can have serious consequences, putting your personal and financial security at risk.

- Identity theft: Thieves can use your card information to access your medical records, claim fraudulent benefits, or even open new credit accounts in your name.

- Medical fraud: Sharing your card details with unauthorized individuals can lead to medical fraud, where someone else uses your insurance to access healthcare services or obtain prescription drugs.

- Financial loss: If your card information falls into the wrong hands, you may face financial losses due to unauthorized medical expenses or fraudulent claims filed against your insurance policy.

- Privacy breaches: Disclosing your card information can compromise your privacy, as it contains sensitive details like your name, date of birth, and insurance policy number.

Updates and Changes to a New York State Insurance Identification Card

Your New York State Insurance Identification Card is a crucial document that provides proof of your health insurance coverage. As life changes, it’s important to keep your card updated to reflect any changes in your personal information or insurance plan.

Updating Information on the Card

To ensure your insurance information is accurate and up-to-date, you’ll need to notify your insurance provider of any changes. This is crucial for receiving the right benefits and avoiding any potential issues when accessing healthcare services.

- Address Changes: If you move, it’s essential to update your address with your insurance provider. This ensures that you receive important communications, such as renewal notices and benefit statements, at the correct address. You can typically update your address online through your insurance provider’s website, by phone, or by mail.

- Name Changes: In the event of a name change due to marriage, divorce, or legal name change, you’ll need to notify your insurance provider. Provide them with the necessary documentation, such as a marriage certificate or court order, to update your name on your insurance card.

- Insurance Plan Changes: If you change your insurance plan, you’ll receive a new insurance identification card with the updated plan details. Make sure to keep this new card and discard the old one.

Replacing a Lost or Damaged Card

Losing or damaging your insurance identification card can be inconvenient, but it’s important to act quickly to replace it.

- Contact Your Insurance Provider: The first step is to contact your insurance provider and report the lost or damaged card. They will guide you through the process of requesting a replacement card.

- Provide Necessary Information: You’ll likely need to provide your name, date of birth, insurance policy number, and contact information. You may also need to provide details about the circumstances of the loss or damage.

- Replacement Card Delivery: Your insurance provider will typically mail you a replacement card within a few business days. You can also inquire about expedited delivery options if needed.

Changes to the Card’s Format or Design

While the basic information on the insurance identification card remains consistent, the format or design may be subject to occasional changes.

- New Security Features: Insurance providers may introduce new security features to prevent fraud and protect your information. These features could include holograms, watermarks, or unique barcodes.

- Updated Information Layout: The layout of the information on the card may be rearranged to improve readability or incorporate new regulations.

- Digital Versions: Some insurance providers offer digital versions of the insurance identification card, which can be accessed through their mobile app or website. This provides convenience and eliminates the need for a physical card.

Additional Information and Resources

This section provides you with access to essential resources and contact information related to New York State insurance identification cards. These resources can help you understand your insurance rights, find answers to your questions, and stay informed about any changes or updates.

Official New York State Insurance Websites

Here are some official websites where you can find comprehensive information about New York State insurance:

- New York State Department of Financial Services (DFS): https://www.dfs.ny.gov/ – The DFS is the primary regulatory body for insurance in New York State. This website offers information about insurance laws, consumer protection, and filing complaints.

- New York State Insurance Exchange (NYSHIP): https://www.nyship.com/ – NYSHIP provides health insurance plans for state employees and their families. The website offers details about plans, coverage, and enrollment.

- New York State Health Insurance Marketplace: https://nystateofhealth.ny.gov/ – This marketplace helps individuals and families find affordable health insurance plans that meet their needs.

Contact Information for Insurance Agencies and Organizations, Ny state insurance identification card

For assistance or inquiries related to your insurance identification card or insurance matters in general, you can contact the following agencies or organizations:

- New York State Department of Financial Services (DFS):

- Phone: (212) 480-6400

- Email: customer.services@dfs.ny.gov

- New York State Insurance Exchange (NYSHIP):

- Phone: (800) 697-4477

- Email: info@nyship.com

- New York State Health Insurance Marketplace:

- Phone: (855) 355-5777

- Email: info@nystateofhealth.ny.gov

Additional Resources and Information

Here are some additional resources and information that may be helpful:

- Consumer Reports: https://www.consumerreports.org/ – This website provides comprehensive reviews and information about insurance companies and plans, helping you make informed decisions.

- National Association of Insurance Commissioners (NAIC): https://www.naic.org/ – The NAIC is a national organization of insurance regulators. Their website offers information about insurance regulations and consumer protection.

- National Council on Compensation Insurance (NCCI): https://www.ncci.com/ – The NCCI provides data and research on workers’ compensation insurance. Their website offers information about insurance rates, claims, and safety.

Final Summary

Carrying your NY State Insurance Identification Card is a simple yet essential practice. It can prevent unnecessary delays, protect you from financial burdens, and ensure you receive the coverage you need when you need it. Remember to keep your card safe, update it when necessary, and be prepared to present it whenever required.

FAQ Overview

How do I replace a lost or damaged NY State Insurance Identification Card?

Contact your insurance provider directly. They will guide you through the process of requesting a replacement card. You may need to provide personal information and pay a small fee.

What happens if I don’t have my NY State Insurance Identification Card when I need it?

You might face delays or complications. Some entities, like hospitals or law enforcement, may require proof of insurance. In such cases, you may need to provide alternative documentation or contact your insurance provider for verification.