Navigating the world of NY state car insurance companies can feel like driving through a maze. With a plethora of options, understanding the complexities of coverage, and finding the best rates can be overwhelming. But fear not, this comprehensive guide will equip you with the knowledge and tools to make informed decisions about your car insurance.

New York State boasts a robust car insurance market, with numerous companies vying for your business. This diverse landscape presents both opportunities and challenges. Understanding the market dynamics, regulatory landscape, and factors influencing rates is crucial for securing the most suitable and affordable coverage.

Overview of New York State Car Insurance Market: Ny State Car Insurance Companies

The New York State car insurance market is one of the largest and most complex in the United States. It is characterized by a high density of population, a diverse driving population, and a unique regulatory environment. The market is constantly evolving, driven by factors such as technological advancements, changing consumer preferences, and regulatory changes.

Market Size and Growth

The New York State car insurance market is substantial, with a large number of insured vehicles and a significant amount of premium revenue. The market is expected to continue growing in the coming years, driven by factors such as population growth and an increasing number of vehicles on the road. The New York State Department of Financial Services (DFS) regulates the car insurance market. The DFS sets rates, licenses insurers, and oversees the financial solvency of insurance companies.

Key Players in the Market

The New York State car insurance market is dominated by a few large national insurance companies, including:

- State Farm

- Geico

- Progressive

- Allstate

- Liberty Mutual

These companies account for a significant portion of the market share. However, there are also a number of smaller regional and local insurers operating in the state.

Regulatory Environment

New York State has a comprehensive regulatory framework for car insurance. The DFS sets minimum coverage requirements for all drivers, including liability, uninsured/underinsured motorist, and personal injury protection. The DFS also regulates the rates that insurance companies can charge for car insurance. This regulatory framework aims to ensure that drivers have adequate coverage and that insurance companies are financially sound.

Impact of Regulations on Insurance Companies

The regulatory environment in New York State has a significant impact on car insurance companies. The DFS’s rate regulation can limit the ability of insurance companies to charge higher premiums. The minimum coverage requirements can also increase the cost of insurance for some drivers. However, the regulatory framework also provides a level of stability and predictability for insurance companies, which can help them to manage their risks and plan for the future.

Impact of Regulations on Consumers

The regulatory environment in New York State also has a significant impact on consumers. The minimum coverage requirements ensure that drivers have adequate protection in case of an accident. The DFS’s rate regulation can help to keep insurance premiums affordable. However, the regulations can also make it more difficult for some drivers to find affordable insurance, particularly those with a history of accidents or violations.

Top Car Insurance Companies in New York State

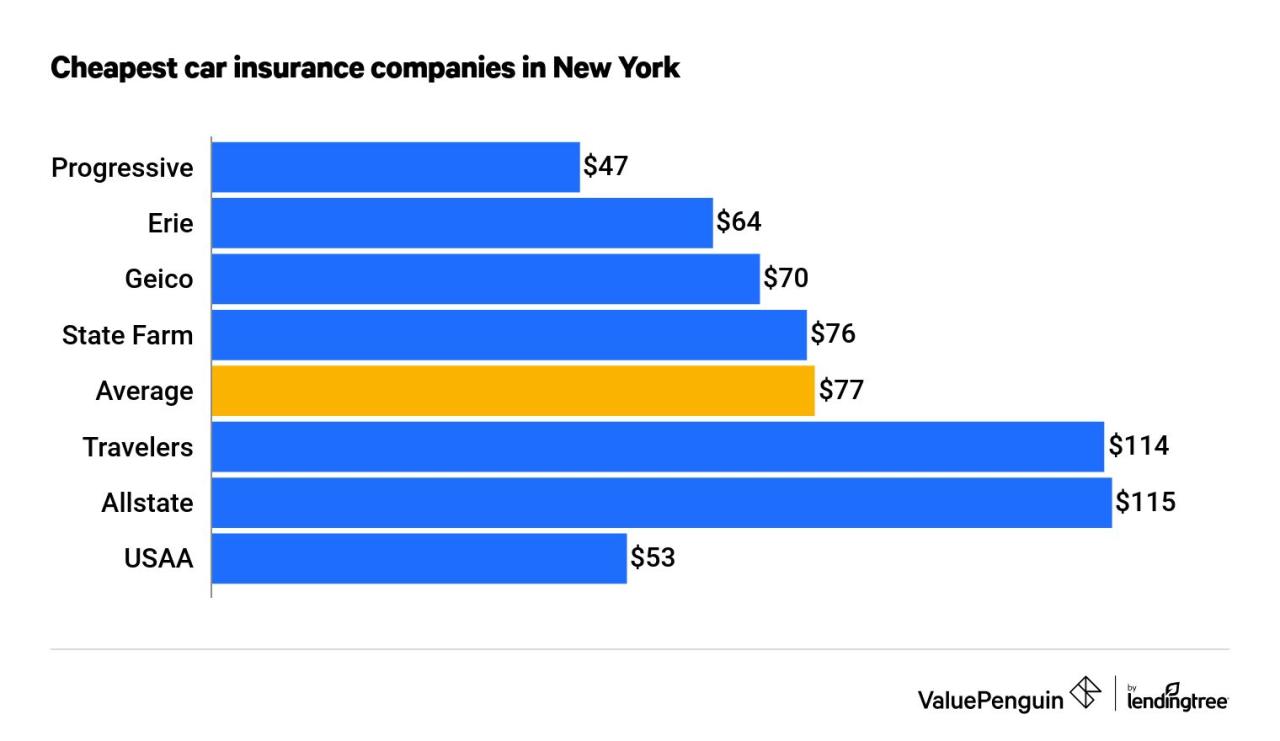

New York State has a diverse car insurance market with numerous companies vying for customers. Determining the top companies requires considering various factors, including market share, financial performance, customer satisfaction, and product offerings. This section delves into the top 10 car insurance companies in New York State, providing insights into their key features and market presence.

Top Car Insurance Companies in New York State

The following table Artikels the top 10 car insurance companies in New York State based on market share and other relevant metrics. Each company’s profile includes its history, key products and services, and financial performance.

| Company Name | Market Share | Key Products | Financial Performance | Website URL |

|---|---|---|---|---|

| Geico | 15.2% | Auto insurance, motorcycle insurance, renters insurance, homeowners insurance | Strong financial performance with consistent profitability | https://www.geico.com/ |

| State Farm | 13.5% | Auto insurance, homeowners insurance, life insurance, health insurance | Solid financial performance with a strong track record of profitability | https://www.statefarm.com/ |

| Progressive | 11.8% | Auto insurance, motorcycle insurance, renters insurance, homeowners insurance | Strong financial performance with consistent growth in premiums | https://www.progressive.com/ |

| Allstate | 9.7% | Auto insurance, homeowners insurance, life insurance, renters insurance | Solid financial performance with a focus on customer satisfaction | https://www.allstate.com/ |

| Liberty Mutual | 8.4% | Auto insurance, homeowners insurance, renters insurance, life insurance | Strong financial performance with a focus on innovation and technology | https://www.libertymutual.com/ |

| Nationwide | 7.2% | Auto insurance, homeowners insurance, life insurance, financial services | Solid financial performance with a focus on customer loyalty | https://www.nationwide.com/ |

| New York Central Mutual | 6.5% | Auto insurance, homeowners insurance, business insurance | Solid financial performance with a focus on customer service | https://www.nycm.com/ |

| USAA | 5.8% | Auto insurance, homeowners insurance, life insurance, financial services | Strong financial performance with a focus on serving military families | https://www.usaa.com/ |

| Travelers | 5.2% | Auto insurance, homeowners insurance, business insurance, life insurance | Strong financial performance with a focus on risk management | https://www.travelers.com/ |

| MetLife | 4.9% | Auto insurance, life insurance, health insurance, retirement planning | Solid financial performance with a focus on financial stability | https://www.metlife.com/ |

Factors Affecting Car Insurance Rates in New York State

Car insurance rates in New York State are determined by a complex interplay of factors. These factors are designed to reflect the risk associated with insuring a particular driver and vehicle. Understanding these factors can help drivers make informed decisions to potentially lower their premiums.

Driver Demographics

Driver demographics play a significant role in determining car insurance rates. These factors are often used to assess the likelihood of a driver being involved in an accident.

- Age: Younger drivers, particularly those under 25, are generally considered higher risk due to inexperience and a higher propensity for accidents. Conversely, older drivers, typically over 65, often have lower rates as they have more experience and may drive less frequently.

- Gender: Historically, men have been associated with higher risk due to their tendency for speeding and aggressive driving. However, this trend has been narrowing in recent years.

- Marital Status: Married drivers often have lower rates compared to single drivers. This is attributed to greater stability and responsibility often associated with marriage.

- Credit Score: While not directly related to driving ability, credit score is increasingly being used by insurers as an indicator of financial responsibility. Drivers with good credit scores may receive lower rates.

Vehicle Type

The type of vehicle you drive is another significant factor influencing your insurance rates. This is because different vehicles have varying levels of safety features, repair costs, and theft risk.

- Make and Model: Some car models are known for their safety features, while others are more prone to accidents or theft. For example, a high-performance sports car will generally have higher insurance rates than a compact sedan due to its higher speed capabilities and potential for more expensive repairs.

- Vehicle Age: Older vehicles may have lower insurance rates due to depreciation. However, older cars may lack modern safety features, potentially leading to higher rates in some cases.

- Vehicle Value: The market value of your vehicle is directly related to the cost of replacement in case of an accident. More expensive vehicles will generally have higher insurance premiums.

Driving History

Your driving history is a major factor in determining your car insurance rates. Insurers carefully analyze your driving record to assess the risk you pose.

- Accidents: Any accidents you’ve been involved in, regardless of fault, will likely increase your premiums. The severity of the accident, the number of accidents, and the time since the accident will all be considered.

- Traffic Violations: Speeding tickets, reckless driving, and other traffic violations can significantly increase your rates. Insurers view these violations as indicators of risky driving behavior.

- Driving Record: A clean driving record with no accidents or violations will generally lead to lower premiums.

Geographic Location

Where you live can also significantly impact your car insurance rates. This is because insurance companies consider factors like population density, crime rates, weather conditions, and the frequency of accidents in different areas.

- Urban vs. Rural: Urban areas with higher population density and traffic congestion often have higher insurance rates due to a greater risk of accidents. Rural areas with lower population density and fewer cars on the road may have lower rates.

- Weather Conditions: Areas with extreme weather conditions, such as frequent snowstorms or hurricanes, may have higher rates due to the increased risk of accidents.

- Crime Rates: Areas with high crime rates may have higher insurance rates due to the increased risk of theft and vandalism.

Types of Car Insurance Coverage in New York State

New York State requires drivers to carry a minimum amount of car insurance to protect themselves and others on the road. Understanding the different types of coverage available is crucial for choosing the right policy and ensuring adequate financial protection in case of an accident.

Liability Coverage

Liability coverage is essential in New York State and covers the financial responsibility for damages and injuries caused to others in an accident. This coverage protects you from lawsuits and financial losses arising from accidents you cause.

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages incurred by the other driver and passengers in an accident you caused. New York State mandates a minimum of $25,000 per person and $50,000 per accident for bodily injury liability coverage.

- Property Damage Liability: This coverage pays for repairs or replacement of damaged property, such as vehicles, buildings, or other objects, if you are at fault in an accident. The minimum requirement in New York State is $10,000 per accident.

For example, if you cause an accident that results in $30,000 in medical expenses for the other driver, your bodily injury liability coverage would pay up to $25,000. If you cause an accident that damages the other driver’s car, your property damage liability coverage would pay up to $10,000.

Collision Coverage

Collision coverage protects your vehicle from damage in an accident, regardless of who is at fault. This coverage pays for repairs or replacement of your vehicle, less your deductible.

- Collision coverage is optional in New York State, but it is often recommended, especially if you have a loan or lease on your car.

- If you are in an accident and your car is damaged, collision coverage will pay for the repairs or replacement, minus your deductible.

For example, if you are involved in an accident with another car and your vehicle sustains $5,000 in damage, your collision coverage will pay for the repairs, minus your deductible, which could be $500 or $1,000.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damages caused by events other than collisions, such as theft, vandalism, fire, hail, or floods. This coverage pays for repairs or replacement of your vehicle, less your deductible.

- Comprehensive coverage is also optional in New York State.

- It is typically recommended if you have a newer or more expensive car.

For example, if your car is stolen and you have comprehensive coverage, the insurance company will pay for the replacement of your vehicle, minus your deductible.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you and your passengers if you are involved in an accident with a driver who is uninsured or has insufficient insurance to cover your damages.

- UM/UIM coverage is required in New York State, and it covers medical expenses, lost wages, and other damages you or your passengers may incur in an accident.

- The minimum requirement is $25,000 per person and $50,000 per accident.

For example, if you are hit by an uninsured driver and suffer $40,000 in medical expenses, your UM/UIM coverage would pay up to $25,000 per person, or $50,000 per accident, depending on your policy.

Tips for Finding Affordable Car Insurance in New York State

Navigating the car insurance market in New York State can be a daunting task, especially when you’re looking for the most affordable option. However, with some strategic planning and effort, you can find a policy that fits your budget without compromising on essential coverage. Here are some key tips to help you find affordable car insurance in New York.

Comparing Quotes from Multiple Insurers, Ny state car insurance companies

It’s crucial to compare quotes from several insurers to find the best deal. Many online comparison tools and websites allow you to enter your information once and receive quotes from multiple companies. This saves you time and effort while ensuring you have a comprehensive understanding of the market.

Negotiating Rates with Your Insurer

Don’t be afraid to negotiate with your insurer. Many factors can influence your premium, and you may be able to negotiate a lower rate by discussing these factors with your insurer. For instance, you might be able to lower your premium by:

- Improving your credit score

- Taking a defensive driving course

- Bundling your car insurance with other policies, such as homeowners or renters insurance

Exploring Discounts

Car insurance companies offer various discounts to their policyholders. Some common discounts include:

- Good student discount

- Safe driver discount

- Multi-car discount

- Loyalty discount

By exploring these discounts and ensuring you qualify for them, you can significantly reduce your premium.

Maintaining a Good Driving Record

One of the most significant factors affecting your car insurance rates is your driving record. Maintaining a clean driving record is crucial for securing affordable insurance. Avoid traffic violations, accidents, and other driving infractions that could lead to increased premiums.

Benefits of Bundling Insurance Policies

Bundling your car insurance with other policies, such as homeowners or renters insurance, can often result in substantial savings. Insurance companies often offer discounts for bundling multiple policies, as it indicates a long-term commitment to their services.

Consumer Resources and Advocacy Groups

Navigating the complexities of car insurance in New York State can be challenging. Fortunately, numerous consumer resources and advocacy groups are available to provide guidance, support, and protection for policyholders. These organizations offer valuable information, assistance with claims, and advocacy in resolving disputes with insurance companies.

Key Consumer Resources and Advocacy Groups

These organizations offer a wide range of services to help consumers understand their insurance rights, file complaints, and resolve disputes with insurance companies.

- New York State Department of Financial Services (DFS): The DFS is the primary regulator of the insurance industry in New York State. They provide information on consumer rights, insurance regulations, and resources for filing complaints.

https://www.dfs.ny.gov/ - New York State Insurance Department (NYSD): The NYSD is responsible for overseeing the insurance industry in the state, including consumer protection. They offer information on insurance policies, claims processes, and dispute resolution.

https://www.ny.gov/services/find-state-insurance-department - National Association of Insurance Commissioners (NAIC): The NAIC is a national organization that represents state insurance regulators. They provide information on consumer rights, insurance regulations, and resources for filing complaints.

https://www.naic.org/ - Consumer Reports: Consumer Reports is a non-profit organization that provides independent reviews and ratings of products and services, including car insurance companies. They offer information on car insurance rates, coverage options, and consumer satisfaction.

https://www.consumerreports.org/ - Better Business Bureau (BBB): The BBB is a non-profit organization that promotes ethical business practices. They offer information on businesses, including car insurance companies, and provide a platform for consumers to file complaints.

https://www.bbb.org/

Wrap-Up

From comprehending the intricacies of coverage types to discovering strategies for finding the best rates, this guide has equipped you with the knowledge to navigate the world of NY state car insurance companies. Armed with this understanding, you can confidently choose the right coverage, secure competitive rates, and drive with peace of mind.

Quick FAQs

What is the minimum car insurance coverage required in New York State?

New York State mandates liability coverage, which protects you financially if you cause an accident. This includes bodily injury liability, property damage liability, and uninsured/underinsured motorist coverage.

How often should I review my car insurance policy?

It’s advisable to review your car insurance policy at least annually, or whenever significant life changes occur, such as moving, getting married, or adding a new driver to your household.

What are some common car insurance discounts available in New York State?

Common discounts include good driver discounts, safe driver discounts, multi-car discounts, and bundling discounts for combining your car insurance with other policies.

Can I switch car insurance companies during my policy term?

Yes, you can usually switch car insurance companies during your policy term. However, you may be subject to cancellation fees or prorated premiums depending on your current insurer’s policies.