NY State car insurance sets the stage for this exploration, offering readers a glimpse into a world of mandatory coverages, premium factors, and navigating the insurance landscape. New York’s unique requirements, like the mandatory Personal Injury Protection (PIP), ensure drivers are protected in the event of an accident, regardless of fault.

This guide delves into the key factors that affect insurance rates, including driving history, vehicle type, age, location, and even credit score. It provides valuable insights into choosing the right policy for individual needs, understanding insurance claims and processes, and accessing essential resources for navigating the complexities of New York car insurance.

Understanding New York State Car Insurance

Driving in New York State requires you to have car insurance, and understanding the specific requirements is crucial. New York has a unique set of rules and regulations that differ from other states. This guide will help you navigate the complexities of New York car insurance, ensuring you have the right coverage to protect yourself and others.

Mandatory Coverages

New York State mandates several types of car insurance coverage to ensure financial protection in case of an accident. These coverages are designed to address the costs associated with injuries, property damage, and legal expenses.

- Liability Coverage: This coverage protects you financially if you cause an accident that results in injury or property damage to another person. It covers the costs of medical bills, lost wages, and property repairs up to the limits of your policy. New York State requires a minimum liability coverage of $25,000 per person/$50,000 per accident for bodily injury and $10,000 for property damage.

- Personal Injury Protection (PIP): This coverage provides medical benefits for you and your passengers, regardless of who caused the accident. It covers medical expenses, lost wages, and other related costs. New York State requires a minimum PIP coverage of $50,000 per person.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you in case you are involved in an accident with a driver who has no insurance or insufficient insurance. It covers your medical expenses, lost wages, and property damage up to the limits of your policy.

The Role of the New York State Department of Financial Services (DFS)

The New York State Department of Financial Services (DFS) plays a crucial role in regulating the insurance industry within the state. Its responsibilities include:

- Licensing and Supervision: The DFS licenses and supervises insurance companies operating in New York State, ensuring they meet specific financial and operational standards.

- Consumer Protection: The DFS protects consumers from unfair or deceptive insurance practices by investigating complaints, enforcing regulations, and educating the public about their rights.

- Market Oversight: The DFS monitors the insurance market to identify potential problems and ensure fair competition among insurance companies.

Factors Affecting Car Insurance Rates in New York

Your car insurance premium in New York is determined by various factors. These factors are used to assess your risk as a driver, and the higher your risk, the higher your premium. Let’s delve into the key factors that influence your car insurance rates in New York.

Driving History

Your driving history is a major factor in determining your car insurance premium. This includes your driving record, which reflects your past driving behavior.

- Accidents: A history of accidents, especially those deemed your fault, will significantly increase your premium. Insurance companies consider accidents a strong indicator of future risk.

- Traffic Violations: Violations such as speeding tickets, reckless driving, and DUI/DWI convictions can also lead to higher premiums. These violations demonstrate a disregard for traffic laws and increase your likelihood of future accidents.

- Driving Record Cleanliness: A clean driving record, free from accidents and violations, is a significant advantage. Insurance companies often reward drivers with good driving records with lower premiums.

Vehicle Type

The type of vehicle you drive plays a crucial role in your car insurance rates. This is because different vehicles have varying levels of safety features, repair costs, and theft risks.

- Vehicle Value: More expensive vehicles generally cost more to insure. This is because the cost of repairs and replacements is higher for luxury or high-performance vehicles.

- Safety Features: Vehicles equipped with advanced safety features like anti-lock brakes, airbags, and stability control are often associated with lower premiums. These features reduce the severity of accidents and potentially lower repair costs.

- Vehicle Age: Older vehicles may have higher premiums due to increased risk of mechanical failures and lower safety standards. Newer vehicles often have better safety features and are generally considered safer.

- Vehicle Make and Model: Certain car makes and models are known for their safety records and repair costs. Insurance companies have data on accident rates and repair costs for different vehicles, which influences their premium calculations.

Age

Your age is a significant factor in determining your car insurance rates. This is because younger drivers are statistically more likely to be involved in accidents.

- Young Drivers: Drivers under the age of 25 are often considered higher risk due to lack of experience and poor judgment. Insurance companies may charge higher premiums for young drivers, particularly those with limited driving experience.

- Mature Drivers: Drivers over the age of 65 may also face higher premiums. This is because older drivers may have age-related health issues that can affect their driving abilities.

- Experienced Drivers: Drivers with many years of safe driving experience often receive lower premiums. Insurance companies recognize the value of experience and safe driving habits.

Location

Where you live significantly impacts your car insurance rates. Insurance companies consider factors like the density of traffic, crime rates, and weather conditions in your area.

- Urban Areas: Driving in densely populated urban areas often leads to higher premiums due to increased traffic congestion, higher accident rates, and potential for theft.

- Rural Areas: Insurance premiums may be lower in rural areas with less traffic and lower crime rates. However, factors like long distances and wildlife encounters can also affect premiums.

- Weather Conditions: Areas prone to severe weather events like hurricanes, tornadoes, or blizzards may have higher premiums due to the increased risk of accidents and property damage.

Credit Score

In New York, your credit score can affect your car insurance rates. This is because insurance companies use credit scores as an indicator of your financial responsibility.

- Credit Score as a Risk Factor: Insurance companies believe that individuals with good credit scores are more likely to be financially responsible and less likely to file fraudulent claims. A higher credit score can often lead to lower premiums.

- Impact of Poor Credit: If you have a poor credit score, you may face higher car insurance premiums. This is because insurance companies perceive you as a higher risk due to your financial history.

Risk Factors

Insurance companies use a variety of risk factors to determine your car insurance rates. These factors are used to assess your likelihood of being involved in an accident.

- Driving History: As mentioned earlier, your driving record is a significant risk factor. Accidents, violations, and other driving-related incidents can increase your premium.

- Vehicle Type: The type of vehicle you drive, its value, safety features, and age are all considered risk factors. Higher-value vehicles and those with fewer safety features are often associated with higher premiums.

- Age: Your age is a risk factor, as younger and older drivers are statistically more likely to be involved in accidents.

- Location: The area where you live, including its traffic density, crime rates, and weather conditions, is a key risk factor.

- Credit Score: In New York, your credit score is considered a risk factor, as it reflects your financial responsibility.

- Driving Habits: Your driving habits, such as the number of miles you drive annually, the time of day you drive, and whether you use your vehicle for business purposes, can also affect your premium.

Choosing the Right Car Insurance Policy

Finding the right car insurance policy can feel like navigating a maze. With so many options and factors to consider, it’s easy to feel overwhelmed. But don’t worry, understanding your needs and options can make the process much smoother. This guide will help you choose a policy that provides the coverage you need at a price that fits your budget.

Understanding Your Needs

Your insurance needs are unique to you and your situation. Here are some key factors to consider:

- Your Driving History: A clean driving record with no accidents or violations will likely result in lower premiums.

- Your Vehicle: The type of car you drive, its age, and its value can influence your insurance costs.

- Your Location: Where you live can affect your insurance rates. Areas with higher crime rates or more traffic congestion may have higher premiums.

- Your Coverage Needs: Consider the type of coverage you need based on your individual circumstances.

Types of Coverage

Car insurance policies offer various types of coverage, each designed to protect you in specific situations. Here’s a breakdown of the most common types:

- Liability Coverage: This is the most basic type of coverage, and it’s required by law in New York. It covers damages to other people’s property or injuries to other people if you cause an accident.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault.

- Comprehensive Coverage: This coverage protects your vehicle from damages caused by events other than accidents, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages.

- Rental Reimbursement Coverage: This coverage helps pay for a rental car if your vehicle is damaged in an accident and is being repaired.

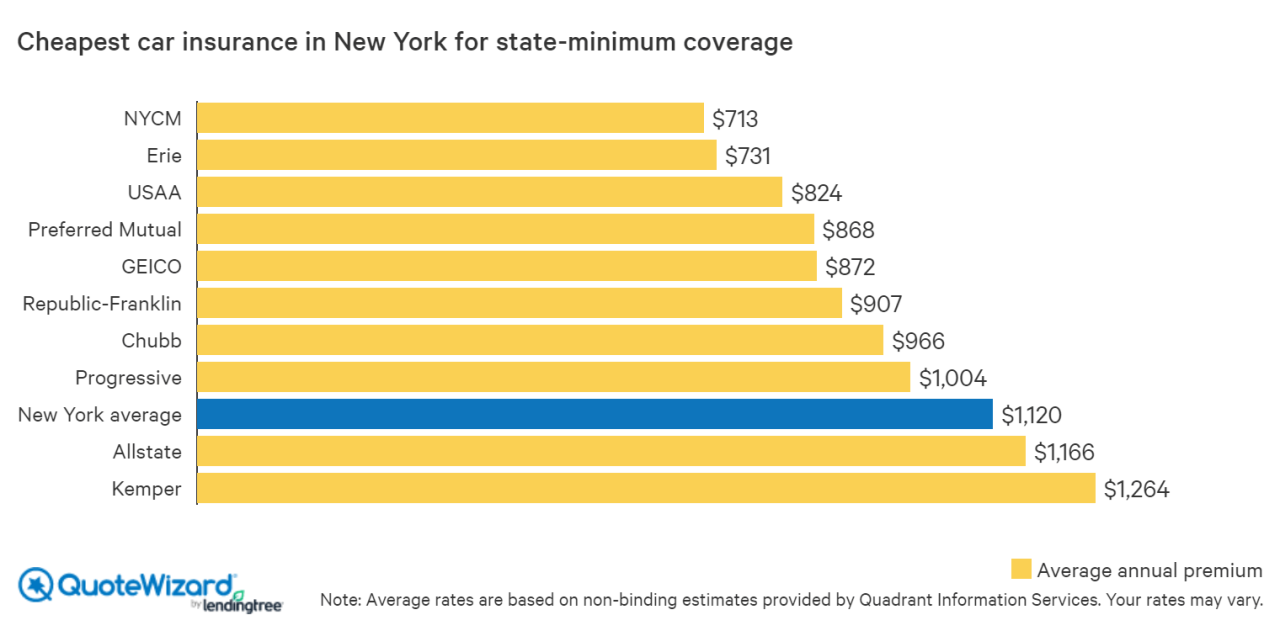

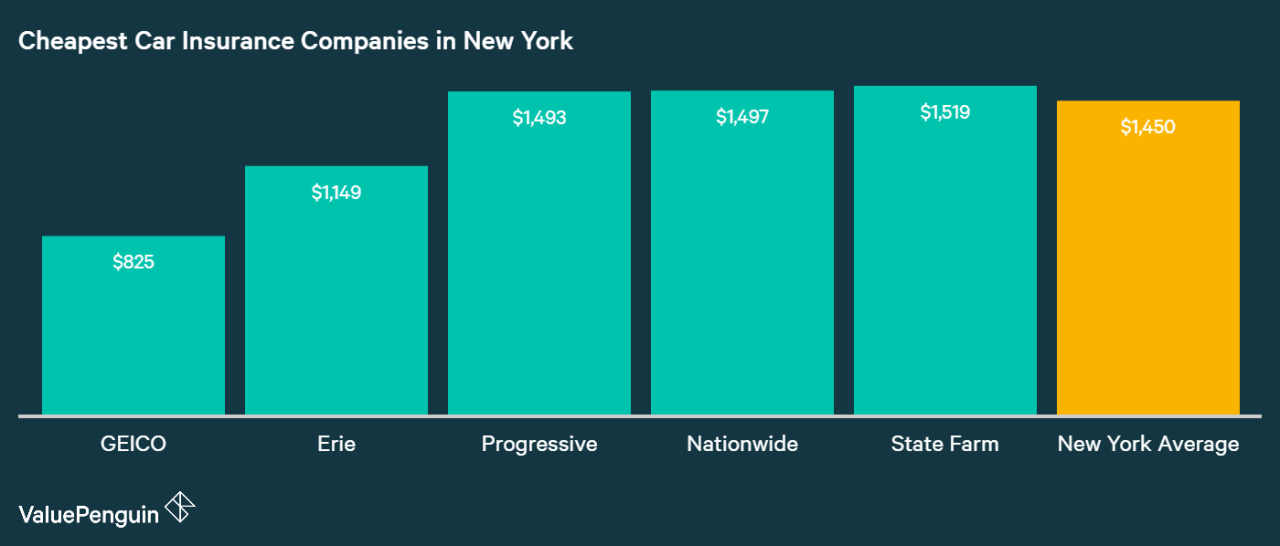

Comparing Quotes

Once you understand your needs and the available coverage options, you can start comparing quotes from different insurance companies. Here are some tips for getting the best deal:

- Get Multiple Quotes: Don’t settle for the first quote you receive. Shop around and compare quotes from at least three different companies.

- Ask About Discounts: Many insurance companies offer discounts for safe driving, good grades, multiple policies, and other factors. Be sure to ask about any available discounts.

- Read the Fine Print: Before you choose a policy, carefully review the terms and conditions. Pay attention to deductibles, coverage limits, and any exclusions.

- Consider Bundling: If you have other insurance policies, such as homeowners or renters insurance, you may be able to bundle them with your car insurance and save money.

Understanding Insurance Claims and Processes

Navigating the process of filing a car insurance claim in New York can feel overwhelming, but understanding the steps involved and your rights as a policyholder can make the process smoother. This section will guide you through the process, discuss different types of claims, and offer advice on navigating potential disputes with your insurance company.

Filing a Car Insurance Claim, Ny state car insurance

When you’re involved in an accident, theft, or vandalism, promptly notifying your insurance company is crucial. Here’s a step-by-step guide to filing a car insurance claim in New York:

- Report the Incident: Immediately contact your insurance company to report the incident. Provide details like the date, time, location, and nature of the event.

- File a Claim: Your insurance company will provide you with a claim form, which you’ll need to complete and submit.

- Gather Documentation: Collect any relevant documentation, including police reports, witness statements, photos of the damage, and medical records if applicable.

- Provide Information: Your insurance company will likely request additional information to process your claim. Be prepared to provide details about the incident, your vehicle, and any other relevant information.

- Claim Review and Investigation: The insurance company will review your claim and may conduct an investigation. This could involve inspecting your vehicle, interviewing witnesses, or reviewing police reports.

- Negotiation and Settlement: Once the investigation is complete, your insurance company will present you with a settlement offer. You have the right to negotiate this offer. If you disagree with the amount offered, you can appeal the decision.

Types of Car Insurance Claims

Understanding the different types of claims can help you navigate the process effectively:

- Accident Claims: These are the most common type of car insurance claim. They occur when your vehicle is involved in a collision with another vehicle, object, or pedestrian.

- Theft Claims: If your vehicle is stolen, you can file a theft claim with your insurance company. You’ll need to provide evidence of the theft, such as a police report.

- Vandalism Claims: If your vehicle is damaged due to vandalism, you can file a vandalism claim. You’ll need to provide documentation of the damage, such as photos or police reports.

Negotiating with Insurance Companies

While your insurance company is obligated to act in good faith, it’s essential to understand your rights and be prepared to negotiate:

- Know Your Policy: Thoroughly review your policy to understand your coverage limits and any applicable deductibles.

- Gather Evidence: Document everything related to your claim, including photos, videos, witness statements, and repair estimates.

- Be Prepared to Negotiate: Don’t be afraid to negotiate with your insurance company. If you disagree with their initial offer, explain your reasoning and present evidence to support your position.

- Seek Legal Counsel: If you’re unable to reach a satisfactory settlement, consider seeking legal advice from an attorney specializing in insurance law.

Resolving Disputes

If you’re unable to resolve a dispute with your insurance company through negotiation, you have several options:

- File a Complaint: You can file a complaint with the New York State Department of Financial Services (DFS), which regulates insurance companies.

- Mediation: Mediation is a process where a neutral third party helps you and your insurance company reach a settlement.

- Arbitration: Arbitration is a process where a neutral third party makes a binding decision on your claim.

- Litigation: As a last resort, you can file a lawsuit against your insurance company.

Resources for New York Car Insurance Consumers

Navigating the world of car insurance in New York can be a complex endeavor. Fortunately, there are various resources available to help consumers make informed decisions and protect their interests. These resources provide valuable information, tools, and assistance to ensure a smooth and successful car insurance experience.

Government Websites

Government websites offer a wealth of information regarding car insurance regulations, consumer rights, and complaint procedures.

- New York State Department of Financial Services (DFS): The DFS is the primary regulator of the insurance industry in New York. Its website provides information on insurance laws, consumer protection, and how to file complaints. You can also find a directory of licensed insurance companies and agents.

- New York State Insurance Fund (SIF): The SIF is a state-run insurance company that provides workers’ compensation insurance to employers. It also offers a variety of other insurance products, including car insurance. Its website provides information on its insurance offerings and services.

Consumer Advocacy Groups

Consumer advocacy groups play a crucial role in protecting consumer rights and promoting fair insurance practices.

- Consumer Reports: Consumer Reports is a non-profit organization that provides independent testing and ratings of consumer products and services, including car insurance. Its website offers valuable information on car insurance, including how to compare quotes and choose the right policy.

- National Association of Insurance Commissioners (NAIC): The NAIC is a non-profit organization that represents insurance regulators from all 50 states, the District of Columbia, and five U.S. territories. Its website provides information on insurance laws, consumer protection, and how to file complaints. You can also find a directory of licensed insurance companies and agents.

Insurance Industry Associations

Insurance industry associations represent the interests of insurance companies and agents.

- Insurance Information Institute (III): The III is a non-profit organization that provides information on insurance issues and trends. Its website offers a variety of resources, including information on car insurance, how to choose the right policy, and how to file a claim.

- New York Insurance Association (NYA): The NYA is a trade association that represents the interests of insurance companies in New York. Its website provides information on insurance laws, regulations, and consumer protection.

Free Insurance Consultations and Legal Assistance

For those seeking personalized advice and assistance, free insurance consultations and legal aid programs are available.

- Legal Aid Society: The Legal Aid Society is a non-profit organization that provides free legal assistance to low-income New Yorkers. It offers a variety of services, including assistance with insurance disputes.

- New York Legal Assistance Group (NYLAG): NYLAG is a non-profit organization that provides legal assistance to low- and moderate-income New Yorkers. It offers a variety of services, including assistance with insurance disputes.

Online Tools and Calculators

Online tools and calculators can help consumers estimate their insurance costs and compare different policies.

- InsuranceQuotes.com: InsuranceQuotes.com is a website that allows consumers to compare car insurance quotes from multiple insurance companies. It also offers a variety of resources, including information on car insurance, how to choose the right policy, and how to file a claim.

- Bankrate.com: Bankrate.com is a website that provides financial information and tools, including a car insurance calculator. The calculator allows consumers to estimate their insurance costs based on their driving history, vehicle, and other factors.

Conclusive Thoughts

Navigating the world of New York car insurance can seem daunting, but with the right information and resources, drivers can make informed decisions and secure the coverage they need. By understanding the nuances of New York’s insurance regulations, comparing quotes from different companies, and knowing how to file claims effectively, drivers can navigate the road with confidence and peace of mind.

FAQ Corner: Ny State Car Insurance

What are the minimum car insurance requirements in New York?

New York requires drivers to carry liability insurance, PIP (Personal Injury Protection), and uninsured/underinsured motorist coverage.

How often can I expect my car insurance rates to change?

Rates can change annually, or even more frequently, based on factors like driving history, claims, and changes in your coverage.

What is a “no-fault” insurance system?

New York operates under a “no-fault” system, where your own insurance company covers your medical expenses and lost wages, regardless of who caused the accident.

What are some tips for lowering my car insurance premiums?

Consider increasing your deductible, maintaining a clean driving record, bundling insurance policies, and taking defensive driving courses.