No fault states auto insurance – No-fault states auto insurance, a system where drivers are compensated for their own losses regardless of fault, has become increasingly popular in the United States. This approach aims to simplify the claims process and reduce legal costs, offering a potential alternative to traditional fault-based systems.

In no-fault states, drivers are required to carry Personal Injury Protection (PIP) coverage, which covers their own medical expenses and lost wages, regardless of who caused the accident. This eliminates the need for lengthy legal battles to determine fault, allowing for faster claim processing and potential cost savings.

What are No-Fault States?

No-fault auto insurance is a system where drivers involved in an accident file claims with their own insurance company, regardless of who was at fault. This system aims to streamline the claims process and reduce litigation.

Key Principles of No-Fault Auto Insurance

No-fault insurance operates on several key principles:

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other related costs for the insured driver and passengers, regardless of fault. The amount of PIP coverage varies by state.

- Limited Tort: This restricts the right to sue for pain and suffering unless the injuries meet certain thresholds, such as a specific amount of medical expenses or a permanent disability.

- No-Fault Thresholds: These determine the severity of injuries that trigger the right to sue. Some states have a “serious injury” threshold, while others have a “minor injury” threshold.

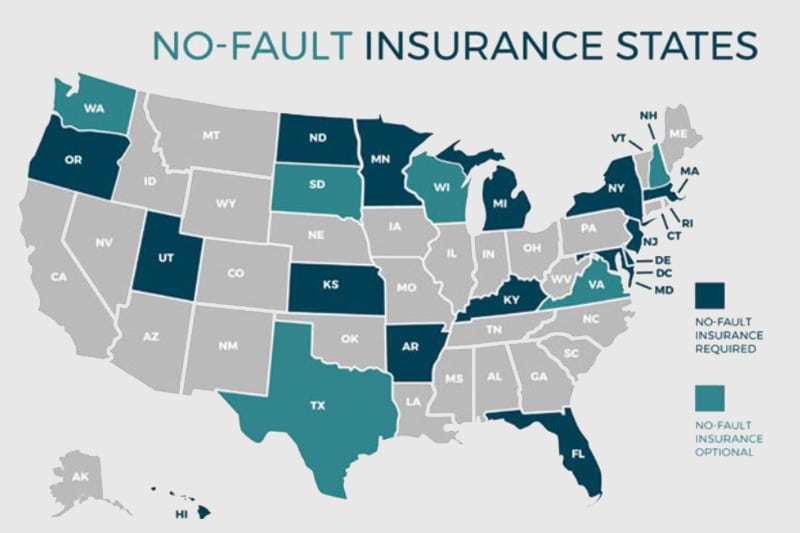

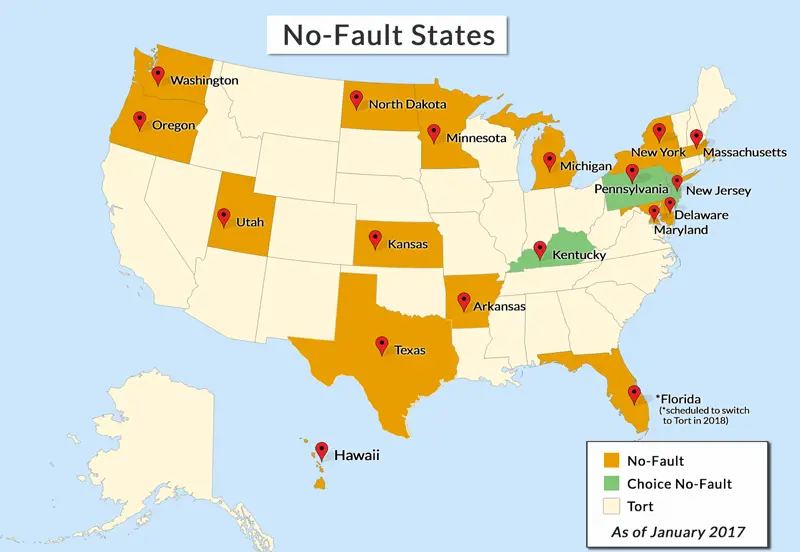

States with No-Fault Auto Insurance

As of 2023, 12 states and the District of Columbia operate under a no-fault system:

- Florida

- Hawaii

- Kansas

- Kentucky

- Massachusetts

- Michigan

- Minnesota

- New Jersey

- New York

- North Dakota

- Pennsylvania

- Rhode Island

- District of Columbia

Comparison of No-Fault and Fault-Based Systems

No-fault insurance differs significantly from traditional fault-based systems. In fault-based systems, the at-fault driver’s insurance company is responsible for covering the damages of the other party. Here’s a comparison:

| Feature | No-Fault System | Fault-Based System |

|---|---|---|

| Liability | Each driver files a claim with their own insurance company, regardless of fault. | The at-fault driver’s insurance company is responsible for covering the damages of the other party. |

| Claims Process | Generally faster and simpler, as there’s no need to determine fault. | Can be more complex and time-consuming, as fault needs to be determined. |

| Litigation | Limited litigation, as lawsuits are typically restricted to serious injuries. | More potential for litigation, as parties can sue for damages. |

| Premiums | May be lower than in fault-based states, as insurance companies have fewer claims to handle. | May be higher than in no-fault states, as insurance companies face a higher risk of lawsuits. |

Benefits of No-Fault Auto Insurance

No-fault insurance can offer several benefits for individuals involved in car accidents. By streamlining the claims process and reducing the potential for legal disputes, no-fault systems can provide faster and more efficient compensation for accident victims.

Streamlined Claims Process

No-fault insurance aims to simplify the claims process by eliminating the need to determine fault in minor accidents. This means that after an accident, drivers can file a claim with their own insurance company, regardless of who caused the accident. This process can significantly reduce the time and effort involved in obtaining compensation for medical expenses, lost wages, and other damages.

Reduced Legal Costs and Litigation

No-fault insurance systems are designed to minimize the need for lawsuits and reduce legal costs associated with car accidents. By eliminating the need to prove fault in many cases, no-fault insurance reduces the likelihood of costly and time-consuming legal battles. This can lead to lower insurance premiums for all drivers, as insurance companies can allocate fewer resources to legal expenses.

Drawbacks of No-Fault Auto Insurance

While no-fault insurance offers several benefits, it’s crucial to understand its potential drawbacks. No-fault systems can create limitations in the availability of compensation for serious injuries and raise concerns about the cost of insurance for drivers.

Limited Compensation for Serious Injuries

In no-fault systems, individuals are typically limited to recovering compensation for medical expenses and lost wages from their own insurance company, regardless of fault. This can be problematic for individuals who sustain severe injuries and require extensive medical treatment or long-term care. In these situations, the limited coverage provided by no-fault insurance may not be sufficient to cover all their expenses.

Higher Insurance Costs

No-fault insurance can lead to higher insurance premiums for drivers. This is because the system eliminates the need for lengthy and expensive lawsuits, which can reduce insurance company costs. However, the increased coverage provided under no-fault systems can also lead to higher claims payouts, which can ultimately result in higher premiums for drivers.

Potential for Abuse

No-fault insurance systems can be susceptible to abuse. For example, individuals might exaggerate their injuries or claim expenses that are not related to the accident. This can lead to increased costs for insurance companies, which can be passed on to all policyholders in the form of higher premiums.

Limited Choice of Medical Providers, No fault states auto insurance

Some no-fault systems restrict individuals to using specific medical providers within their network. This can limit their choices and may not allow them to seek treatment from specialists they prefer.

Difficulty in Obtaining Legal Representation

Since no-fault systems often discourage lawsuits, it can be challenging for individuals to find legal representation if they believe they have a valid claim. Attorneys may be hesitant to take on cases where the potential for compensation is limited.

Key Features of No-Fault Insurance Policies

No-fault insurance policies are characterized by several key features that distinguish them from traditional fault-based systems. These features aim to simplify the claims process, reduce litigation, and provide quicker compensation to injured parties.

Personal Injury Protection (PIP) Coverage

Personal Injury Protection (PIP) coverage is a crucial element of no-fault insurance policies. This coverage provides compensation for medical expenses, lost wages, and other related costs incurred due to injuries sustained in a car accident, regardless of who was at fault.

Types of Coverage Included in No-Fault Insurance Policies

No-fault insurance policies typically include a range of coverages beyond PIP. These coverages may vary depending on the state and insurance provider, but commonly include:

- Collision Coverage: Covers damage to your vehicle caused by a collision with another vehicle or object, regardless of fault.

- Comprehensive Coverage: Covers damage to your vehicle caused by non-collision events such as theft, vandalism, fire, or natural disasters.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): Provides coverage for injuries or damages caused by an uninsured or underinsured driver.

- Property Damage Liability Coverage: Covers damage to other people’s property caused by your vehicle, up to a certain limit.

Coverage Limits and Deductibles

No-fault insurance policies have coverage limits and deductibles that dictate the maximum amount of coverage and the amount you pay out of pocket before insurance kicks in.

- PIP Coverage Limits: States set minimum PIP coverage limits, which determine the maximum amount of benefits you can receive for medical expenses, lost wages, and other related costs.

- Deductibles: Deductibles are the amount you pay out of pocket for each claim before insurance coverage kicks in. Deductibles can vary depending on the type of coverage and the insurer.

Navigating No-Fault Insurance Claims

No-fault insurance claims can seem complex, but understanding the process can make it smoother. In no-fault states, you file a claim with your own insurer, regardless of who caused the accident.

The No-Fault Claim Filing Process

You will typically need to report the accident to your insurer within a specific timeframe, usually 24-48 hours. This can be done online, by phone, or in person. You will need to provide information about the accident, including the date, time, location, and the other drivers involved.

You should also gather documentation, such as:

- Police report

- Photos of the accident scene and vehicle damage

- Contact information for all parties involved

- Medical records and bills

The Insurance Company’s Role in Evaluating and Processing Claims

Once you file a claim, your insurer will review the information you provided and may request additional documentation. They will investigate the accident and determine if it meets the criteria for coverage under your policy.

Your insurer will then process your claim and pay benefits, such as medical expenses and lost wages, within a specified timeframe. However, the amount of coverage and the processing time may vary depending on your policy and the specific circumstances of the accident.

Tips for Maximizing Benefits and Resolving Claims Effectively

- File your claim promptly. Most states have strict deadlines for filing claims, so don’t delay.

- Be accurate and complete in your reporting. Provide all the necessary information to your insurer to avoid delays.

- Seek medical attention promptly. Document all your injuries and medical expenses to ensure you receive full coverage.

- Keep detailed records. Maintain copies of all correspondence, medical bills, and other relevant documentation.

- Be patient. The claims process can take time, so be prepared for delays.

- Communicate effectively with your insurer. Ask questions and clarify any uncertainties you have about the process.

The Future of No-Fault Auto Insurance: No Fault States Auto Insurance

The no-fault insurance system, while established to streamline claims and reduce litigation, is constantly evolving to address emerging trends and challenges. As technology advances and societal needs shift, no-fault insurance is poised for significant transformations.

Potential Changes in No-Fault Insurance Laws and Regulations

No-fault insurance laws are not static and are subject to ongoing reviews and adjustments. These changes can stem from various factors, including technological advancements, societal shifts, and economic considerations. For example, the increasing prevalence of autonomous vehicles might necessitate modifications to existing no-fault laws to accommodate unique liability scenarios.

The Impact of Autonomous Vehicles on No-Fault Insurance

The rise of autonomous vehicles is likely to have a profound impact on no-fault insurance. Autonomous vehicles are programmed to prioritize safety and adhere to traffic regulations, potentially reducing the frequency of accidents. This shift could lead to a decrease in insurance premiums for autonomous vehicle owners. However, determining liability in accidents involving autonomous vehicles presents a new challenge. For instance, if a self-driving car is involved in an accident due to a software malfunction, who would be held responsible – the manufacturer, the software developer, or the owner?

The Future Direction of No-Fault Insurance

The future of no-fault insurance is intertwined with evolving societal needs. As healthcare costs rise and the demand for alternative dispute resolution methods increases, no-fault insurance may play a more prominent role in managing accidents and providing compensation.

Final Thoughts

No-fault auto insurance presents a unique approach to handling car accidents, offering both benefits and drawbacks. Understanding the intricacies of this system, including its features, advantages, and limitations, is crucial for drivers in no-fault states. While it simplifies the claims process and can reduce legal costs, it’s essential to consider the potential impact on compensation for serious injuries and the overall cost of insurance.

Question Bank

How does no-fault insurance work in practice?

In no-fault states, you file a claim with your own insurance company, regardless of who caused the accident. Your PIP coverage pays for your medical bills and lost wages, up to the policy limits. The other driver’s insurance may be responsible for covering property damage.

Can I still sue the other driver in a no-fault state?

In most no-fault states, you can sue the other driver if your injuries meet certain thresholds, such as a specific amount of medical expenses or a permanent disability. However, the rules vary by state.

Is no-fault insurance more expensive than traditional insurance?

The cost of no-fault insurance can vary depending on factors such as your driving record, vehicle type, and the specific coverage you choose. It’s important to compare quotes from different insurers to find the best rates.