No fault car insurance states – No-fault car insurance states, often referred to as “no-fault” states, operate on a system where drivers file claims with their own insurance companies regardless of who caused an accident. This approach contrasts with traditional fault-based systems, where the at-fault driver’s insurance is responsible for covering damages. No-fault systems are designed to simplify the claims process, potentially reduce insurance premiums, and expedite medical treatment.

The concept of no-fault insurance has been adopted by various states across the United States, each with its own specific rules and regulations. These systems vary in their implementation, with some states employing “pure” no-fault, where drivers are always limited to their own insurance coverage, while others utilize “modified” no-fault, allowing for lawsuits in certain circumstances. Understanding the nuances of these systems is crucial for drivers residing in no-fault states.

What is No-Fault Car Insurance?

No-fault car insurance is a type of auto insurance system where drivers are primarily responsible for covering their own losses after an accident, regardless of who caused the accident. This contrasts with traditional fault-based systems, where the at-fault driver is responsible for covering the other driver’s damages.

No-fault insurance systems aim to simplify the claims process and reduce the number of lawsuits arising from car accidents.

Examples of No-Fault Car Insurance Systems

No-fault insurance systems vary in their implementation across different states. Here are some examples:

- Michigan: Michigan has a pure no-fault system, meaning that drivers are required to carry personal injury protection (PIP) coverage, which covers their own medical expenses and lost wages regardless of fault. Drivers can only sue for pain and suffering in limited circumstances, such as when they have sustained a serious injury.

- Florida: Florida has a modified no-fault system. Drivers are required to carry PIP coverage, but they can sue the at-fault driver for pain and suffering if their medical expenses exceed a certain threshold.

- New York: New York has a no-fault system that allows drivers to sue for pain and suffering only if their medical expenses exceed a certain threshold, similar to Florida.

Benefits of No-Fault Car Insurance

- Faster Claims Processing: No-fault systems can lead to faster claims processing since drivers file claims with their own insurance companies, eliminating the need to determine fault before receiving benefits.

- Reduced Litigation: By limiting the ability to sue for pain and suffering, no-fault systems can reduce the number of lawsuits arising from car accidents, leading to lower legal costs and fewer court backlogs.

- Guaranteed Benefits: Under a no-fault system, drivers are guaranteed to receive benefits for their own injuries and losses, regardless of who caused the accident.

Drawbacks of No-Fault Car Insurance

- Higher Premiums: Some argue that no-fault insurance systems can lead to higher premiums, as insurance companies have to cover more claims.

- Limited Compensation: In some cases, drivers may not be able to recover full compensation for their losses, especially for pain and suffering, under a no-fault system.

- Potential for Abuse: Some people argue that no-fault systems can lead to fraud, as drivers may be tempted to exaggerate their injuries to receive higher benefits.

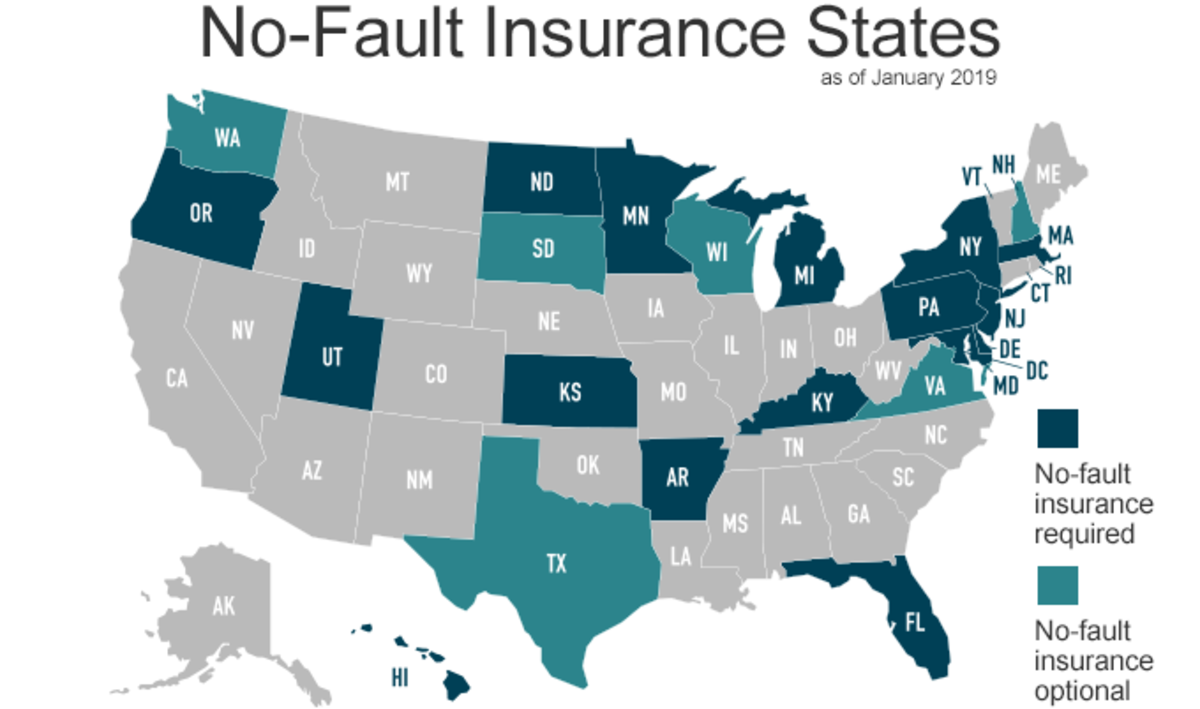

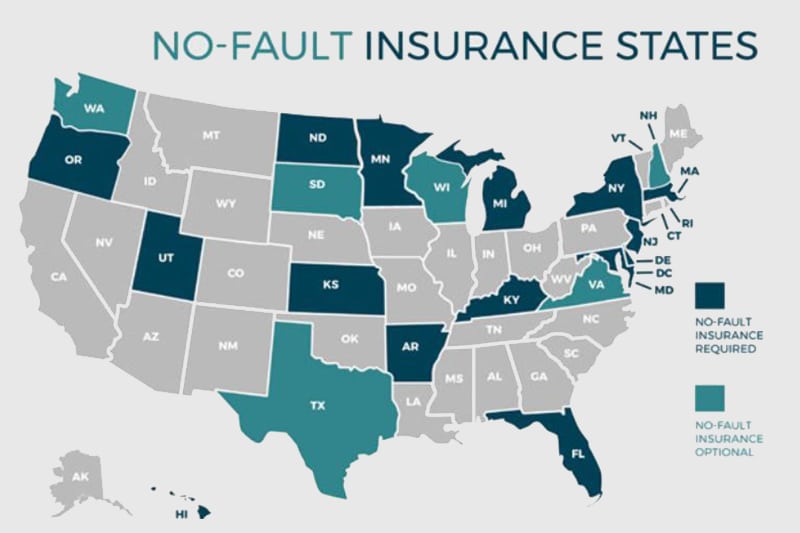

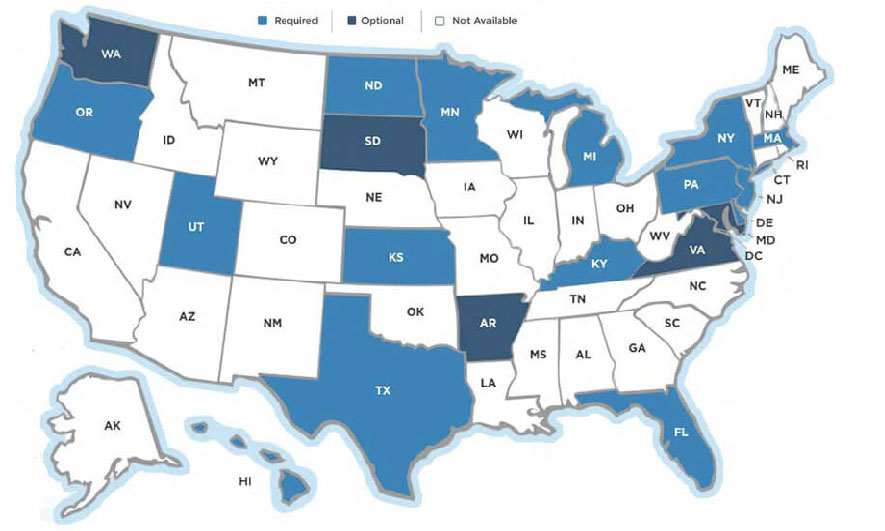

States with No-Fault Car Insurance Laws

No-fault insurance is a type of car insurance that allows drivers to file claims with their own insurance company, regardless of who is at fault for an accident. This can simplify the claims process and potentially lead to faster payouts. However, not all states have no-fault insurance laws.

No-fault insurance laws are designed to simplify the claims process and reduce the number of lawsuits filed after car accidents. They generally require drivers to file claims with their own insurance companies, regardless of who is at fault for the accident. This can help to speed up the claims process and reduce the overall cost of car insurance. However, no-fault laws can also have drawbacks, such as limiting the amount of compensation available to accident victims. The type of no-fault system implemented in a state can also vary, impacting the benefits and limitations available to drivers.

States with No-Fault Laws

The following table lists all states with no-fault car insurance laws, including the year the law was enacted and the type of no-fault system used:

| State | Year Enacted | Type of No-Fault System |

|---|---|---|

| Florida | 1971 | No-Fault |

| Hawaii | 1974 | No-Fault |

| Kansas | 1974 | Modified No-Fault |

| Kentucky | 1975 | Modified No-Fault |

| Michigan | 1973 | No-Fault |

| Minnesota | 1974 | No-Fault |

| New Jersey | 1973 | No-Fault |

| New York | 1973 | No-Fault |

| North Dakota | 1975 | No-Fault |

| Pennsylvania | 1975 | No-Fault |

| Rhode Island | 1971 | No-Fault |

| Utah | 1973 | No-Fault |

Types of No-Fault Systems

There are three main types of no-fault systems: pure, modified, and add-on. Each type of system has its own unique set of rules and benefits.

The type of no-fault system implemented in a state can significantly impact the benefits and limitations available to drivers. Understanding the differences between these systems is crucial for making informed decisions about your car insurance.

Pure No-Fault

In a pure no-fault system, drivers are required to file claims with their own insurance company, regardless of who is at fault for the accident. This means that drivers cannot sue the other driver for damages, even if the other driver was at fault.

Pure no-fault systems are designed to simplify the claims process and reduce the number of lawsuits filed after car accidents.

Modified No-Fault

In a modified no-fault system, drivers are still required to file claims with their own insurance company, but they can sue the other driver for damages if their injuries meet certain thresholds. These thresholds can vary from state to state.

Modified no-fault systems offer a balance between the benefits of pure no-fault and the right to sue for damages.

Add-On No-Fault

In an add-on no-fault system, drivers can choose to purchase no-fault coverage in addition to their traditional liability coverage. This type of system allows drivers to choose the level of coverage they want and can be a good option for drivers who want the benefits of no-fault but also want to retain the right to sue for damages.

Add-on no-fault systems provide drivers with greater flexibility and choice.

Benefits of No-Fault Car Insurance: No Fault Car Insurance States

No-fault car insurance, also known as personal injury protection (PIP), offers several benefits to drivers and passengers involved in car accidents. It simplifies the claims process, reduces insurance premiums, and potentially leads to quicker medical treatment and rehabilitation.

Simplified Claims Process

No-fault car insurance streamlines the claims process by eliminating the need to determine fault in an accident. Instead of engaging in lengthy legal battles to establish liability, drivers file claims with their own insurance companies. This eliminates the complexities of proving fault, which can be time-consuming and expensive.

Reduced Insurance Premiums

By removing the need for extensive litigation, no-fault insurance systems generally lead to lower insurance premiums. The absence of expensive legal battles and settlements allows insurance companies to reduce their costs, which they often pass on to policyholders in the form of lower premiums.

Quicker Medical Treatment and Rehabilitation

No-fault insurance provides immediate access to medical treatment and rehabilitation services without waiting for a lengthy investigation into fault. This ensures that injured individuals receive prompt care, which can contribute to faster recovery and reduced long-term complications.

Drawbacks of No-Fault Car Insurance

While no-fault insurance offers advantages, it’s crucial to acknowledge potential drawbacks that could impact your experience. This system, while designed to simplify claims, can have unintended consequences, and it’s essential to weigh these factors before deciding if no-fault insurance is right for you.

Higher Insurance Premiums

No-fault insurance can sometimes lead to higher insurance premiums compared to traditional liability-based systems. This is because the system requires insurers to cover medical expenses for all parties involved in an accident, regardless of fault. As a result, insurers may need to charge higher premiums to cover the increased costs associated with this broader coverage.

For example, in states with no-fault insurance, drivers may see their premiums increase due to the broader coverage offered, even if they have a clean driving record.

Limited Coverage for Medical Expenses

While no-fault insurance covers medical expenses for all parties involved in an accident, there are limitations to this coverage. These limitations can vary by state but may include caps on the amount of medical expenses covered, restrictions on the types of treatment covered, or a time limit for filing claims.

For instance, a no-fault system may have a limit on the amount of medical expenses covered, such as $50,000 per person. If your medical bills exceed this limit, you may be responsible for the remaining costs.

Increased Litigation

Despite the aim of reducing litigation, no-fault insurance can sometimes lead to increased litigation in certain circumstances. This can happen when:

- Disputes arise over the amount of medical expenses covered. If an insurer disputes the amount of medical expenses you claim, you may need to take legal action to resolve the dispute.

- An individual’s injuries exceed the coverage limits. If your injuries are severe and exceed the limits of your no-fault coverage, you may need to file a lawsuit against the other driver to seek additional compensation.

- The accident involves a hit-and-run driver. In such cases, you may be unable to pursue a claim against the other driver and may need to file a lawsuit against your own insurer to recover compensation.

No-Fault Car Insurance and Personal Injury Protection (PIP)

No-fault insurance systems often include Personal Injury Protection (PIP) coverage, a crucial component that helps policyholders recover from injuries sustained in car accidents. This coverage, also known as “no-fault benefits,” acts as a safety net, providing financial assistance for medical expenses, lost wages, and other related costs, regardless of who caused the accident.

PIP Coverage Benefits

PIP coverage is designed to provide financial assistance to policyholders following a car accident, regardless of fault. This coverage typically includes:

* Medical Expenses: Covers reasonable and necessary medical expenses, including doctor visits, hospital stays, surgeries, and rehabilitation therapies.

* Lost Wages: Provides compensation for lost income during the period of recovery from injuries.

* Other Related Costs: May cover other expenses related to the accident, such as funeral costs, disability benefits, and transportation expenses.

PIP Coverage Limits in Different No-Fault States

No-fault states vary significantly in their PIP coverage limits. These limits determine the maximum amount of benefits that a policyholder can receive under their PIP coverage.

* Coverage Limits: States like New York have a relatively high PIP coverage limit of $50,000, while states like Michigan have a lower limit of $1,000 per person.

* Deductibles: Some states also require policyholders to pay a deductible before PIP benefits kick in. This deductible amount can vary significantly between states.

* Co-pays: Similar to deductibles, some states require policyholders to pay a co-pay for medical expenses, which can be a percentage of the total cost.

It’s essential to understand the specific PIP coverage limits, deductibles, and co-pays in your state to make informed decisions about your car insurance policy.

No-Fault Car Insurance and Liability Coverage

No-fault insurance, as the name suggests, focuses on covering your own losses after an accident, regardless of who was at fault. However, this doesn’t mean liability coverage becomes irrelevant. In fact, it plays a crucial role in certain situations within no-fault systems.

Liability Coverage in No-Fault States

In no-fault states, liability coverage works differently compared to traditional systems. While you can still file a claim against the at-fault driver for your own damages, it’s often limited. No-fault insurance primarily covers your medical expenses and lost wages, regardless of fault. However, you can use liability coverage to seek compensation for damages beyond your own medical bills and lost wages.

When Liability Coverage is Needed in No-Fault States

- Damages Exceeding Your PIP Coverage: No-fault insurance, specifically Personal Injury Protection (PIP), typically has limits on the amount of coverage. If your medical expenses or lost wages exceed your PIP coverage, you may need to turn to the at-fault driver’s liability coverage to cover the remaining costs.

- Property Damage: No-fault insurance usually doesn’t cover property damage to your vehicle or other property. You’ll need to rely on the at-fault driver’s liability coverage to seek compensation for repairs or replacement.

- Non-Economic Damages: No-fault systems often limit compensation for non-economic damages like pain and suffering, emotional distress, or loss of consortium. You may need to file a claim against the at-fault driver’s liability coverage to seek compensation for these types of damages.

- Accidents Involving Uninsured or Underinsured Drivers: If you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage, your own liability coverage can help cover your losses.

Choosing the Right No-Fault Coverage

No-fault insurance is a complex system, and choosing the right coverage can be challenging. Understanding your needs and the various options available is crucial to ensure you have adequate protection without paying for unnecessary coverage.

Factors to Consider When Choosing No-Fault Insurance Coverage

When selecting no-fault insurance, it’s essential to consider various factors that impact your coverage and costs. This includes:

- Your driving history: Your driving record significantly influences your insurance premiums. A clean driving history with no accidents or violations generally leads to lower rates.

- Your vehicle: The type, age, and value of your vehicle affect your insurance premiums. Newer, more expensive vehicles typically require higher premiums.

- Your location: The state you live in and the specific region within that state can impact your insurance rates. Areas with higher accident rates or crime rates may have higher premiums.

- Your coverage needs: Consider your personal financial situation and the level of protection you require. If you have a high-risk job or a family that relies heavily on your income, you might need higher coverage limits.

- Your budget: Determine how much you can afford to spend on insurance premiums. Consider the trade-off between affordability and the level of coverage you need.

Understanding Your Coverage Options

No-fault insurance plans vary in the benefits they offer. Understanding the different options available can help you make an informed decision:

- Basic Coverage: This plan provides essential coverage for medical expenses and lost wages, but it may have limited coverage for pain and suffering.

- Enhanced Coverage: This plan offers more comprehensive coverage, including higher limits for medical expenses and lost wages. It may also cover pain and suffering, but with a cap.

- Full Coverage: This plan provides the highest level of protection, covering all medical expenses, lost wages, and pain and suffering without any limits. However, it also comes with the highest premiums.

Comparing No-Fault Insurance Plans

The following table compares different no-fault insurance plans, highlighting key features and costs:

| Plan | Medical Expense Coverage | Lost Wage Coverage | Pain and Suffering Coverage | Premium Costs |

|---|---|---|---|---|

| Basic | $10,000 | $5,000 | Limited | Low |

| Enhanced | $25,000 | $10,000 | Capped at $25,000 | Moderate |

| Full | Unlimited | Unlimited | Unlimited | High |

The Future of No-Fault Car Insurance

No-fault insurance has been a staple of the auto insurance landscape for decades, but like any system, it is subject to evolution. The future of no-fault insurance is likely to be shaped by a combination of factors, including evolving societal needs, technological advancements, and the changing nature of the auto industry itself.

Potential Changes in No-Fault Insurance Laws

The future of no-fault insurance laws will likely see a combination of adjustments and potential shifts in the existing framework.

- Increased Focus on Cost Containment: As healthcare costs continue to rise, there is a growing need for mechanisms to control the expenses associated with no-fault insurance claims. This could involve changes to the way benefits are structured, such as caps on certain types of treatment or a shift towards more cost-effective care options.

- Potential for Hybrid Systems: Some states may explore hybrid systems that combine elements of no-fault and traditional tort-based systems. This could involve a threshold for pursuing a tort claim, such as a minimum injury severity level, or a system where drivers can choose between no-fault and tort options.

- Emerging Technologies and Automation: Advancements in artificial intelligence (AI) and automation could lead to more efficient claims processing and potentially even automated assessments of injury severity. This could help to reduce administrative costs and potentially streamline the claims process.

Impact of New Technologies and Trends

New technologies and trends are already beginning to impact the no-fault insurance landscape.

- Telematics and Usage-Based Insurance: Telematics devices that track driving behavior can provide insurers with valuable data about driver risk, potentially leading to personalized premiums and incentives for safe driving. This could have implications for no-fault coverage, as insurers might be able to offer lower premiums to drivers with good driving records.

- Autonomous Vehicles: The widespread adoption of autonomous vehicles could significantly reduce the number of accidents, potentially leading to lower insurance premiums and changes to the structure of no-fault insurance. However, the liability landscape for accidents involving autonomous vehicles is still evolving, and it is unclear how no-fault insurance will adapt to these changes.

- Evolving Healthcare Landscape: The rise of telehealth and remote healthcare could lead to changes in the way no-fault insurance benefits are delivered and accessed. Insurers may need to adapt their coverage to accommodate these new options.

Emerging Challenges and Opportunities, No fault car insurance states

No-fault insurance systems face a number of emerging challenges and opportunities in the years ahead.

- Balancing Cost Containment and Access to Care: Striking a balance between controlling costs and ensuring access to necessary medical treatment will be a critical challenge for no-fault insurance systems.

- Addressing Fraud and Abuse: No-fault systems are susceptible to fraud and abuse, and insurers will need to continue to invest in measures to prevent and detect these activities.

- Adapting to Changes in the Auto Industry: The rapid evolution of the auto industry, with the rise of electric vehicles, autonomous vehicles, and ride-sharing services, will present significant challenges and opportunities for no-fault insurance systems.

End of Discussion

No-fault car insurance presents a unique approach to handling car accidents, offering both potential benefits and drawbacks. While it aims to streamline the claims process and reduce premiums, it also raises concerns about potential limitations in coverage and the possibility of increased litigation in specific situations. Choosing the right no-fault insurance coverage requires careful consideration of individual needs and risk factors. As technology and trends continue to evolve, the future of no-fault insurance remains an area of ongoing discussion and development.

Query Resolution

What are the advantages of no-fault car insurance?

No-fault insurance can streamline the claims process, potentially reduce insurance premiums, and expedite medical treatment by eliminating the need for lengthy legal battles.

Can I sue the other driver in a no-fault state?

In some no-fault states, you can sue the other driver for pain and suffering or other damages beyond your PIP coverage limits. This is typically allowed in “modified” no-fault states.

What happens if my medical expenses exceed my PIP coverage?

If your medical expenses exceed your PIP coverage, you may have to pursue additional coverage through your own health insurance or potentially file a lawsuit against the at-fault driver in certain circumstances.

How do I choose the right no-fault insurance coverage?

Consider factors like your driving history, medical needs, and budget. It’s crucial to compare different no-fault insurance plans and their coverage options to find the best fit for your individual needs.