NJ State car insurance is a crucial aspect of driving in New Jersey, ensuring financial protection in case of accidents. This guide delves into the intricacies of New Jersey’s car insurance requirements, providing valuable insights for both new and seasoned drivers.

From understanding mandatory coverage to navigating claims, this comprehensive resource covers everything you need to know about securing the right car insurance policy in New Jersey. We’ll explore factors that influence premiums, tips for finding affordable options, and the nuances of New Jersey’s no-fault system.

Understanding New Jersey Car Insurance Requirements

Driving a car in New Jersey comes with certain responsibilities, including having the necessary car insurance coverage. Understanding the state’s requirements is crucial to ensure you are legally protected and financially responsible on the road.

Mandatory Car Insurance Coverage in New Jersey

New Jersey law mandates that all drivers carry specific types of car insurance coverage to protect themselves and others in case of an accident. These coverages are designed to address different aspects of potential financial losses.

Types of Car Insurance Coverage, Nj state car insurance

- Liability Coverage: This coverage protects you financially if you cause an accident that results in injuries or property damage to others. It covers the costs of medical expenses, lost wages, and property repairs for the other party involved in the accident.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, fire, or natural disasters.

- Personal Injury Protection (PIP): This coverage, also known as “no-fault” insurance, covers your own medical expenses, lost wages, and other related costs, regardless of who is at fault in an accident.

Minimum Coverage Limits

New Jersey law sets minimum coverage limits for liability and PIP coverage. These limits are the minimum amounts of financial protection you must have to meet the state’s requirements.

The minimum coverage limits in New Jersey are:

- Liability Coverage:

- Bodily Injury Liability: $15,000 per person/$30,000 per accident

- Property Damage Liability: $5,000 per accident

- PIP Coverage: $15,000 per person

Factors Affecting Car Insurance Premiums in New Jersey: Nj State Car Insurance

Car insurance premiums in New Jersey are influenced by various factors that insurers consider to assess the risk of insuring a particular driver. These factors are categorized and evaluated differently by each insurance company, leading to variations in premium calculations.

Driving History

Your driving history is a significant factor in determining your car insurance premiums. A clean driving record with no accidents or violations typically results in lower premiums. Conversely, a history of accidents, traffic violations, or DUI convictions will likely increase your rates. Insurance companies view drivers with a history of risky behavior as higher risk, leading to higher premiums.

Age

Age is another crucial factor that influences car insurance rates. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. This higher risk profile leads to higher premiums for young drivers. As drivers gain experience and age, their risk profile decreases, and their premiums tend to become more affordable.

Vehicle Type

The type of vehicle you drive also impacts your car insurance premiums. Sports cars, luxury vehicles, and high-performance cars are generally considered more expensive to repair and replace, leading to higher insurance premiums. Conversely, older, less expensive vehicles typically have lower premiums.

Location

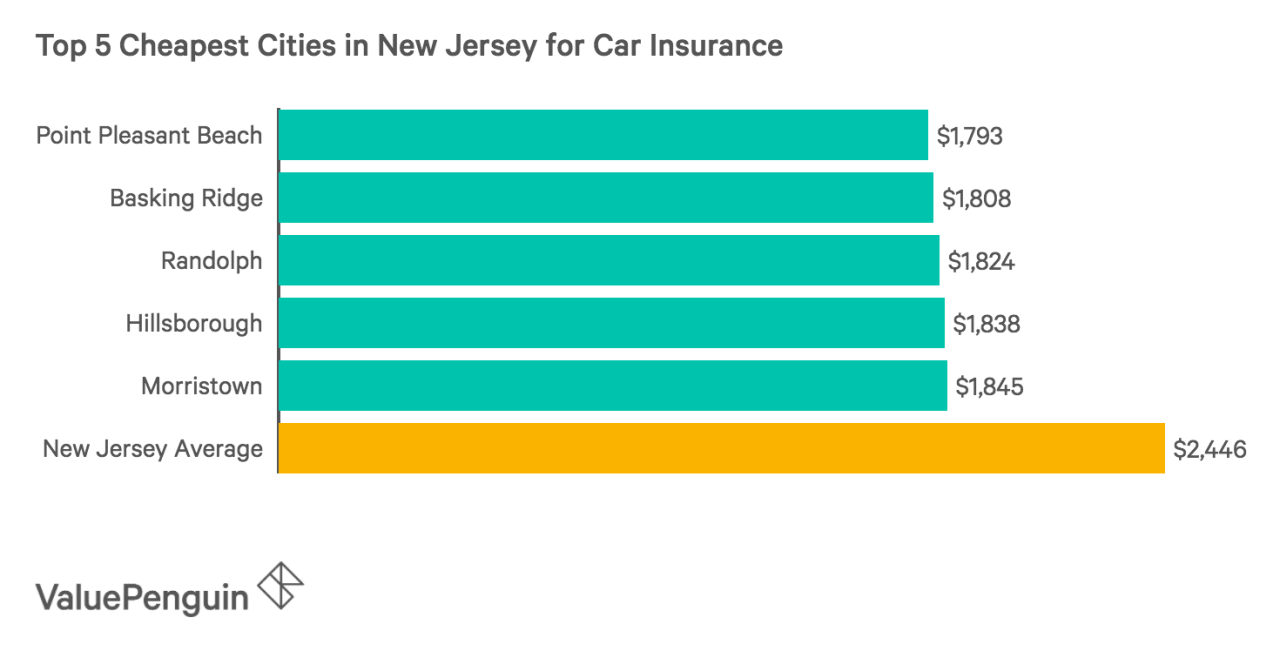

Your location, specifically your ZIP code, plays a role in determining your car insurance rates. Insurance companies analyze accident statistics and crime rates in different areas to assess the risk of insuring drivers in those locations. Areas with higher accident rates or crime rates generally have higher premiums.

Credit Score

While it might seem surprising, your credit score can impact your car insurance rates in New Jersey. Insurance companies use credit scores as a proxy for risk assessment. Drivers with good credit scores are generally considered more responsible and less likely to file claims, leading to lower premiums. Conversely, drivers with poor credit scores may face higher premiums.

Finding Affordable Car Insurance in New Jersey

Finding affordable car insurance in New Jersey can seem like a daunting task, but with some strategic planning and research, you can secure a policy that fits your budget without compromising on essential coverage.

Comparing Quotes from Multiple Insurers

Getting quotes from multiple insurers is a crucial step in finding affordable car insurance. This allows you to compare prices, coverage options, and discounts offered by different companies.

- Online comparison websites: Websites like Insurance.com, The Zebra, and Policygenius can help you compare quotes from various insurers simultaneously, saving you time and effort.

- Directly contacting insurance companies: You can also contact insurance companies directly to request quotes. This allows you to ask specific questions and discuss your individual needs.

Negotiating Discounts

Insurance companies often offer discounts to policyholders who meet certain criteria. By understanding these discounts, you can negotiate a lower premium.

- Good driving record: Maintaining a clean driving record with no accidents or traffic violations can significantly reduce your premiums.

- Safety features: Cars equipped with safety features like anti-theft devices, airbags, and anti-lock brakes often qualify for discounts.

- Bundling policies: Combining your car insurance with other insurance policies, such as homeowners or renters insurance, can lead to substantial savings.

- Loyalty discounts: Some insurance companies offer discounts to long-term customers who have maintained their policies for a certain period.

Exploring Different Coverage Options

The amount of coverage you need will directly impact your premium. Carefully consider your needs and choose a policy that offers adequate protection without unnecessary extras.

- Liability coverage: This coverage is required in New Jersey and protects you financially if you cause an accident that results in injury or property damage to others.

- Collision coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who’s at fault.

- Comprehensive coverage: This coverage protects your vehicle against damage from events other than accidents, such as theft, vandalism, or natural disasters.

Average Car Insurance Premiums in New Jersey

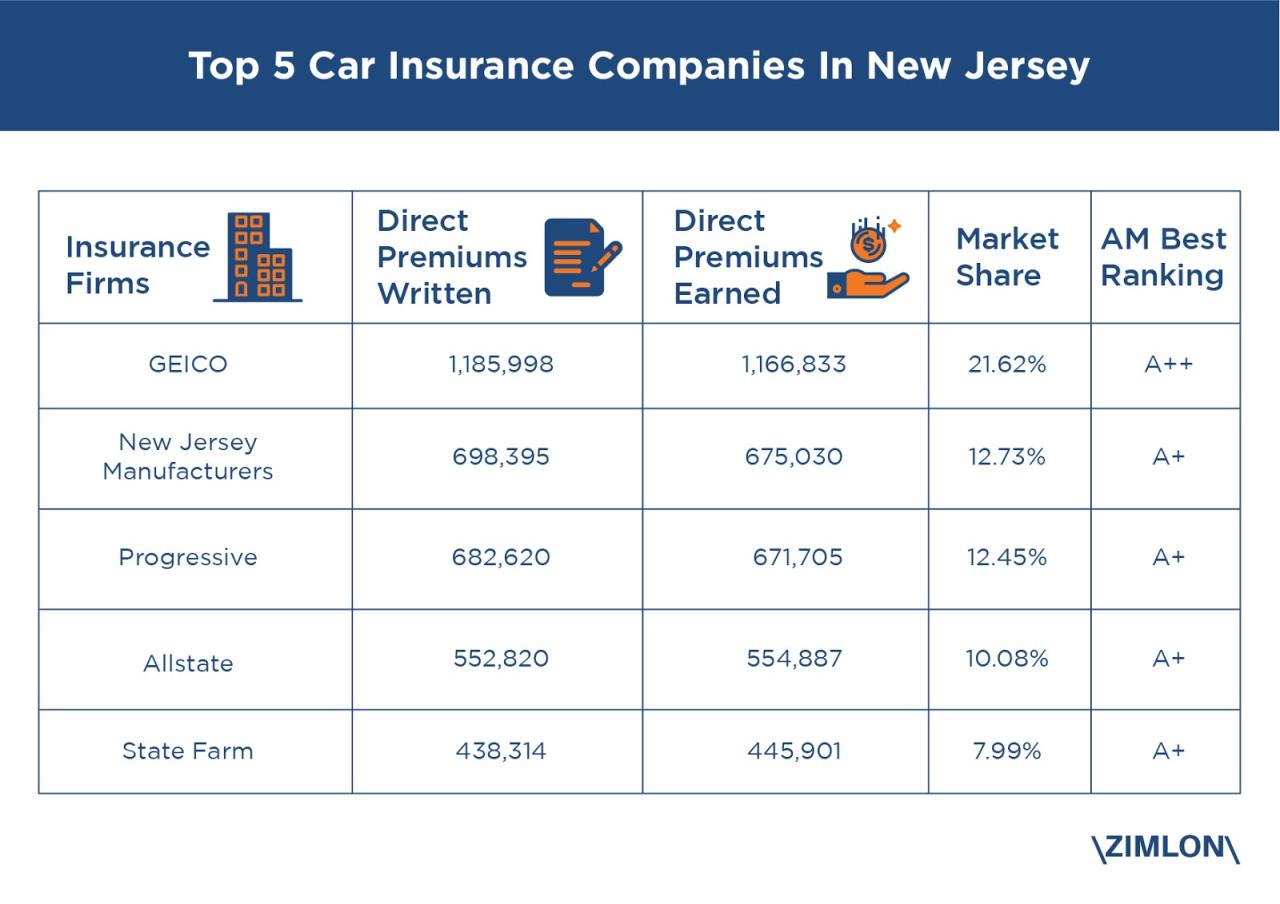

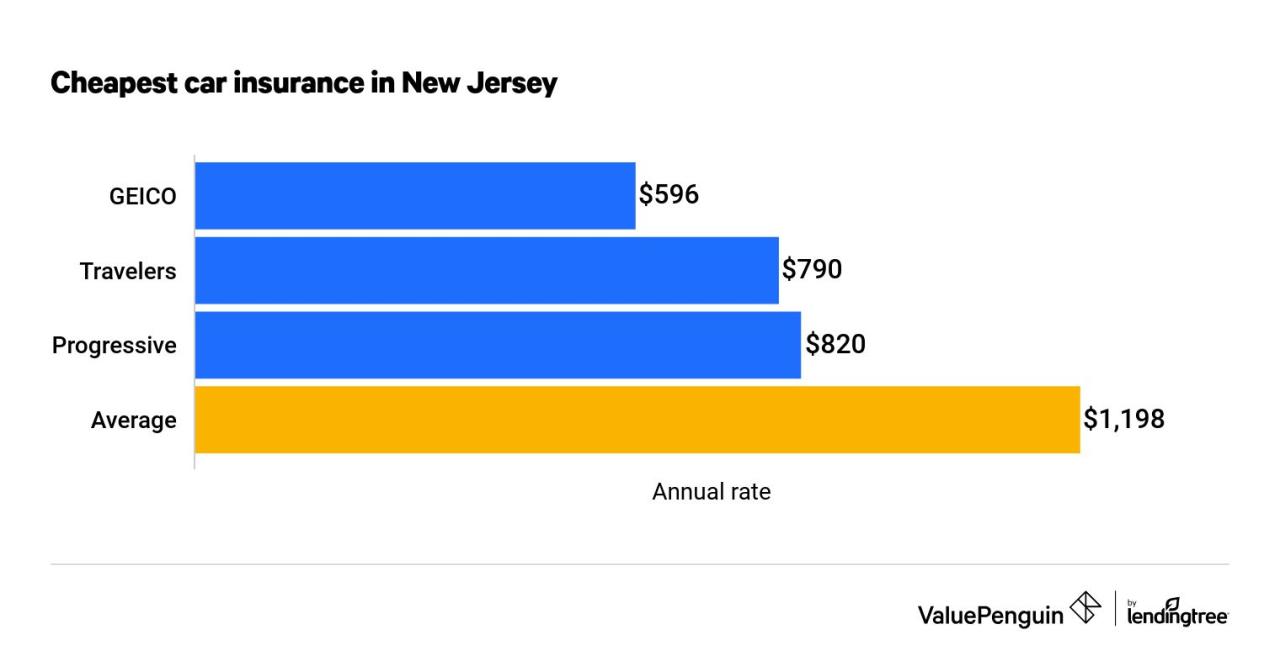

The table below provides a general overview of average car insurance premiums across different insurance companies in New Jersey. It’s important to note that these rates are estimates and can vary based on individual factors such as age, driving history, and vehicle type.

| Insurance Company | Average Annual Premium |

|---|---|

| Geico | $1,200 |

| Progressive | $1,350 |

| State Farm | $1,400 |

| Allstate | $1,500 |

| Liberty Mutual | $1,600 |

Benefits and Drawbacks of Online Insurance Comparison Websites

Online insurance comparison websites offer a convenient and efficient way to compare quotes from multiple insurers.

- Benefits:

- Convenience: You can compare quotes from the comfort of your home, without the need to contact individual insurance companies.

- Time-saving: These websites streamline the quote comparison process, saving you time and effort.

- Transparency: You can easily compare prices and coverage options from different insurers side-by-side.

- Drawbacks:

- Limited information: Online comparison websites may not always provide all the information you need, such as details about specific discounts or coverage options.

- Potential bias: Some websites may prioritize certain insurers over others, potentially influencing your decision.

- Lack of personalized advice: Online comparison websites cannot provide personalized advice or answer specific questions about your insurance needs.

Understanding New Jersey’s No-Fault System

New Jersey operates under a no-fault insurance system, which means that after an accident, drivers primarily file claims with their own insurance companies, regardless of who caused the accident. This system is designed to streamline the claims process and reduce the need for lawsuits.

Personal Injury Protection (PIP) Coverage

PIP coverage is a mandatory component of New Jersey car insurance policies. It helps cover medical expenses and lost wages for you and your passengers, regardless of who was at fault in the accident. The amount of PIP coverage you choose can vary, and it’s crucial to select an amount that adequately meets your potential needs.

Filing a Claim Under the No-Fault System

If you’re involved in an accident, you should promptly report it to your insurance company. You will need to provide them with details about the accident, including the date, time, location, and the other parties involved. Your insurance company will then process your claim and determine the extent of your coverage.

If your medical expenses exceed your PIP coverage limits, you may be able to file a lawsuit against the other driver if they were at fault.

How the No-Fault System Works in Practice

Consider a scenario where you are involved in an accident with another driver. Both drivers have PIP coverage. Under the no-fault system, you would file a claim with your own insurance company, even if the other driver was at fault. Your PIP coverage would then help cover your medical expenses and lost wages. The other driver would also file a claim with their own insurance company.

The no-fault system aims to reduce the number of lawsuits after accidents, but it doesn’t mean that you can never sue the other driver.

Exceptions to the No-Fault System

There are certain exceptions to the no-fault system. If your injuries are severe, you may be able to file a lawsuit against the other driver, even if they were not at fault. For example, if you suffer a serious injury like a broken bone, you may be able to file a lawsuit for pain and suffering.

You should consult with an attorney to determine if you have a valid claim outside of the no-fault system.

Navigating Car Insurance Claims in New Jersey

Dealing with a car accident can be stressful, and navigating the insurance claim process adds another layer of complexity. Fortunately, understanding the steps involved and your rights as a policyholder in New Jersey can help you through this process.

Filing a Car Insurance Claim in New Jersey

Filing a claim with your insurance company is the first step in getting compensation for damages or injuries resulting from a car accident. Here’s a step-by-step guide:

- Contact Your Insurance Company: Immediately notify your insurance company about the accident. Most insurers have 24/7 claim reporting services.

- Provide Initial Information: Be prepared to share details about the accident, including the date, time, location, and the parties involved.

- File a Claim: Your insurance company will guide you through the claim filing process, which may involve completing forms and providing additional information.

- Gather Documentation: Collect all relevant documentation, such as a copy of the police report, photos of the damage, medical records, and witness statements.

- Cooperate with the Adjuster: The insurance company will assign a claims adjuster to investigate the accident. Be cooperative and provide them with the necessary information.

- Negotiate a Settlement: Once the adjuster has completed their investigation, they will present you with a settlement offer. You have the right to negotiate the offer or reject it and pursue further action.

Reporting an Accident to the Insurance Company

Promptly reporting an accident to your insurance company is crucial for initiating the claims process.

- Contact Information: Your insurance company will provide you with a dedicated phone number or online portal to report accidents.

- Accident Details: Be ready to provide the date, time, location, and a description of the accident, including the parties involved and any injuries.

- Policy Information: Have your insurance policy number and other relevant details readily available.

Gathering Necessary Documentation

Thorough documentation is essential for supporting your insurance claim.

- Police Report: If the accident involved property damage or injuries, a police report is crucial.

- Photos of Damage: Take clear photos of the damage to your vehicle and the accident scene.

- Medical Records: If you sustained injuries, gather medical records from your doctor or hospital.

- Witness Statements: If there were witnesses to the accident, obtain their contact information and statements.

Types of Claims and Procedures

New Jersey car insurance claims can be categorized into different types, each with specific procedures.

- Property Damage Claims: These involve damage to your vehicle or other property, such as a fence or street sign.

- Bodily Injury Claims: These cover medical expenses, lost wages, and pain and suffering resulting from injuries sustained in the accident.

- Uninsured/Underinsured Motorist Claims: These apply when you are involved in an accident with a driver who has no insurance or insufficient coverage.

- Personal Injury Protection (PIP) Claims: In New Jersey, all drivers are required to have PIP coverage, which covers medical expenses and lost wages for you and your passengers, regardless of fault.

Important Resources for New Jersey Drivers

Navigating the world of car insurance in New Jersey can be complex, but there are valuable resources available to help you understand your rights and obligations. This section will guide you to key organizations that can assist you with your insurance needs.

New Jersey Department of Banking and Insurance

The New Jersey Department of Banking and Insurance (DOBI) is your primary resource for all things related to car insurance in the state. It oversees the insurance industry, ensuring that companies operate fairly and transparently.

Here’s what you can find on the DOBI website:

- Consumer Guides: DOBI provides comprehensive guides on various insurance topics, including car insurance. These guides explain your rights, responsibilities, and important considerations.

- Complaint Filing: If you have a dispute with your insurance company, you can file a complaint with DOBI. They will investigate your claim and attempt to resolve the issue.

- Insurance Company Information: DOBI’s website provides information about licensed insurance companies operating in New Jersey, including their financial stability and customer satisfaction ratings.

New Jersey Motor Vehicle Commission

The New Jersey Motor Vehicle Commission (MVC) is responsible for driver licensing, vehicle registration, and other related services. It plays a crucial role in ensuring the safe operation of vehicles on New Jersey roads.

Here’s what you can find on the MVC website:

- Driver’s License Information: The MVC website provides information on driver’s license requirements, renewal procedures, and other related matters. It also offers online services for license renewal and other transactions.

- Vehicle Registration Information: You can find information on vehicle registration requirements, fees, and procedures on the MVC website. It also offers online services for vehicle registration and other transactions.

- Traffic Safety Resources: The MVC website provides valuable resources on traffic safety, including information on driving laws, safe driving practices, and road conditions.

Consumer Protection Organizations

Consumer protection organizations advocate for the rights of consumers and provide valuable resources for navigating complex issues like insurance.

Here are some key organizations that can help:

- Consumer Reports: This organization provides independent reviews and ratings of car insurance companies, helping you make informed decisions.

- National Association of Insurance Commissioners (NAIC): The NAIC is a national organization that works to protect consumers and regulate the insurance industry. Their website offers resources on insurance topics and provides information on state insurance departments.

- Better Business Bureau (BBB): The BBB provides information on businesses, including insurance companies, and their customer satisfaction ratings. They also offer dispute resolution services.

| Resource | Website |

|---|---|

| New Jersey Department of Banking and Insurance (DOBI) | https://www.nj.gov/dobi/ |

| New Jersey Motor Vehicle Commission (MVC) | https://www.njmvc.gov/ |

| Consumer Reports | https://www.consumerreports.org/ |

| National Association of Insurance Commissioners (NAIC) | https://www.naic.org/ |

| Better Business Bureau (BBB) | https://www.bbb.org/ |

Closing Notes

Navigating the world of car insurance in New Jersey can be complex, but with the right information and resources, finding the best policy for your needs is achievable. By understanding the state’s regulations, comparing quotes, and leveraging available resources, you can secure affordable and adequate car insurance coverage to drive with confidence.

Essential Questionnaire

What are the penalties for driving without car insurance in New Jersey?

Driving without car insurance in New Jersey can result in fines, license suspension, and even vehicle impoundment. The specific penalties may vary depending on the circumstances.

How often should I review my car insurance policy?

It’s recommended to review your car insurance policy at least annually, or even more frequently if you experience significant life changes, such as a new car purchase, a change in your driving record, or a move to a different location.