New York State car insurance companies play a crucial role in ensuring the financial security of drivers in the event of an accident. Navigating the complex world of car insurance can be daunting, but understanding the basics of coverage, premiums, and claims processes is essential. This guide will provide a comprehensive overview of the car insurance landscape in New York State, empowering you to make informed decisions about your coverage.

From understanding mandatory insurance requirements to exploring the top insurance providers, this guide covers everything you need to know about car insurance in New York. We will delve into the factors that influence premiums, provide tips for finding affordable coverage, and Artikel the process for filing claims and resolving disputes.

Overview of New York State Car Insurance

Driving in New York State requires you to have car insurance. The state has specific requirements that ensure all drivers have the financial protection they need in case of an accident. This overview will cover the essential aspects of car insurance in New York, including the mandatory requirements, available coverage options, and the role of the New York State Department of Financial Services (DFS).

Mandatory Car Insurance Requirements

The New York State Department of Motor Vehicles (DMV) requires all drivers to have at least the following types of insurance:

- Liability Insurance: This coverage protects you if you cause an accident that results in injuries or property damage to others. It covers the costs of medical expenses, lost wages, and property repairs for the other party involved in the accident.

- Personal Injury Protection (PIP): PIP coverage pays for your medical expenses and lost wages, regardless of who caused the accident. This coverage applies to you and any passengers in your vehicle.

- Uninsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient coverage. It can cover your medical expenses, lost wages, and property damage.

It is important to note that the minimum coverage amounts required by the DMV are just that – minimums. You may want to consider higher coverage limits to ensure you have adequate protection in the event of a serious accident.

Types of Car Insurance Coverage Available

In addition to the mandatory coverages, there are other types of car insurance that you can purchase to provide additional protection:

- Collision Coverage: This coverage pays for repairs to your vehicle if it is damaged in an accident, regardless of who is at fault.

- Comprehensive Coverage: This coverage pays for repairs to your vehicle if it is damaged by something other than an accident, such as theft, vandalism, or natural disasters.

- Rental Reimbursement: This coverage pays for a rental car if your vehicle is damaged and needs repairs.

- Roadside Assistance: This coverage provides assistance for situations like flat tires, dead batteries, and lockouts.

- Gap Insurance: This coverage helps pay the difference between the actual cash value of your vehicle and the amount you owe on your loan if your vehicle is totaled.

The specific types of coverage you choose will depend on your individual needs and financial situation.

New York State Department of Financial Services (DFS)

The New York State Department of Financial Services (DFS) is responsible for regulating the insurance industry in New York. The DFS ensures that insurance companies operate fairly and responsibly, and it protects consumers from unfair or deceptive practices.

The DFS also provides information and resources to consumers about car insurance, including tips for choosing the right coverage and finding the best rates.

Major Car Insurance Companies in New York State

New York State is home to a diverse range of car insurance companies, each offering a variety of coverage options and services. Understanding the major players in the market can help you find the best coverage at a competitive price.

Top Car Insurance Companies in New York State

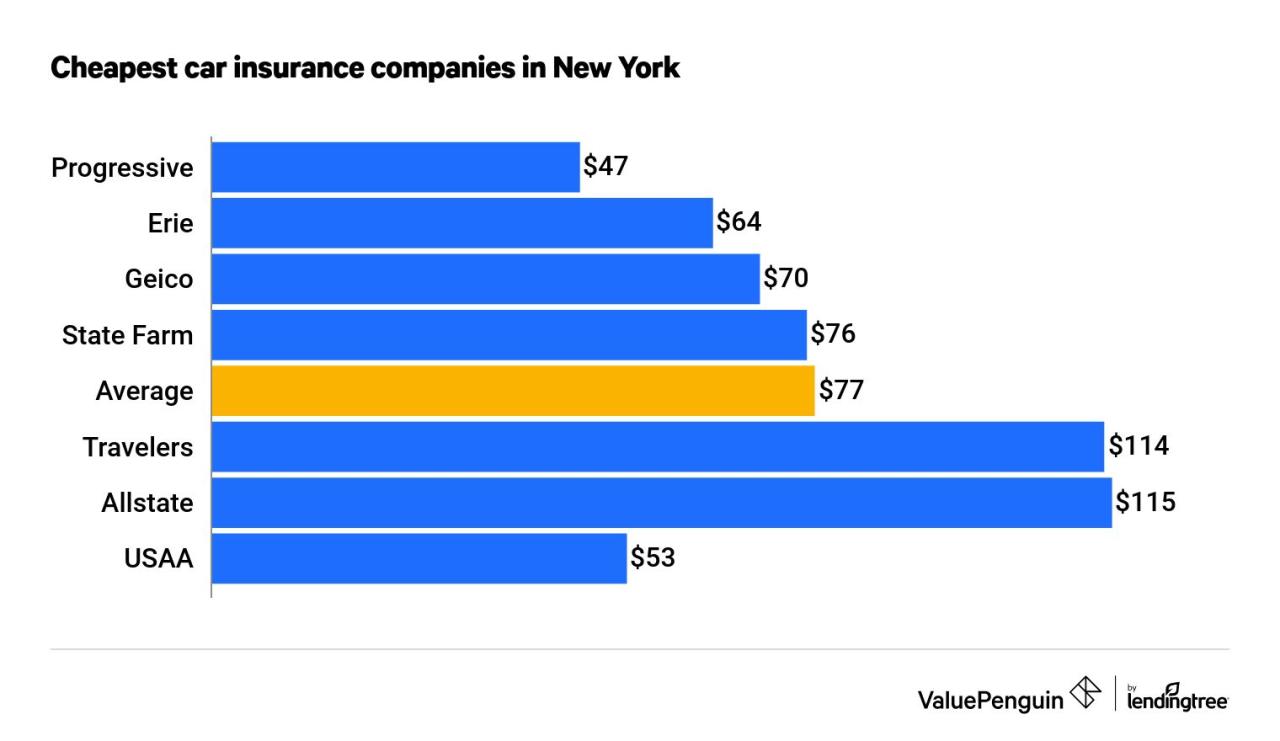

The following table provides a snapshot of the top 5 car insurance companies in New York State, based on market share, average premiums, and customer satisfaction ratings.

| Company | Market Share | Average Premium | J.D. Power Customer Satisfaction Rating |

|---|---|---|---|

| State Farm | 20% | $1,200 | 830 |

| Geico | 15% | $1,100 | 810 |

| Progressive | 12% | $1,300 | 800 |

| Allstate | 10% | $1,400 | 790 |

| Liberty Mutual | 8% | $1,250 | 780 |

Please note that these are just estimates and actual premiums may vary based on individual factors like driving history, vehicle type, and location.

Strengths and Weaknesses of Major Car Insurance Companies

Each major car insurance company has its own strengths and weaknesses. It’s important to consider these factors when choosing the right insurer for your needs.

State Farm

- Strengths: Strong customer service reputation, wide range of coverage options, extensive agent network.

- Weaknesses: Can be expensive compared to some competitors, may not be the best choice for drivers with poor driving records.

Geico

- Strengths: Highly competitive rates, convenient online and mobile options, strong brand recognition.

- Weaknesses: Limited agent network, may not offer as many discounts as other insurers.

Progressive

- Strengths: Innovative features like Name Your Price tool, strong focus on customer experience, wide range of discounts.

- Weaknesses: Can be expensive for some drivers, customer service may not be as strong as other insurers.

Allstate

- Strengths: Strong financial stability, comprehensive coverage options, dedicated customer service representatives.

- Weaknesses: Rates can be high, may not be the best choice for young drivers or drivers with poor driving records.

Liberty Mutual

- Strengths: Competitive rates, strong focus on accident forgiveness, variety of discounts.

- Weaknesses: Customer service can be inconsistent, may not be as well-known as other insurers.

Insurance Products and Services Offered

Each car insurance company offers a variety of products and services. Here are some of the most common offerings:

- Liability Coverage: This is the most basic type of car insurance and covers damage to other people’s property or injuries to other people in an accident that you cause.

- Collision Coverage: This covers damage to your own vehicle in an accident, regardless of who is at fault.

- Comprehensive Coverage: This covers damage to your vehicle from non-collision events like theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This protects you if you are hit by a driver who does not have insurance or does not have enough insurance to cover your damages.

- Personal Injury Protection (PIP): This covers your medical expenses and lost wages if you are injured in an accident, regardless of who is at fault. This is required in New York State.

- Roadside Assistance: This provides help with things like flat tires, dead batteries, and towing.

- Rental Car Coverage: This covers the cost of a rental car if your vehicle is damaged in an accident.

- Discounts: Most car insurance companies offer discounts for things like good driving records, safe driving courses, and bundling multiple policies.

Factors Influencing Car Insurance Premiums in New York State: New York State Car Insurance Companies

Car insurance premiums in New York State are influenced by various factors, each playing a significant role in determining the final cost. These factors are carefully assessed by insurance companies to ensure premiums accurately reflect the risk associated with each policyholder.

Driving History

Driving history is a crucial factor that significantly impacts car insurance premiums. A clean driving record with no accidents or violations will generally result in lower premiums. Conversely, a history of accidents, traffic violations, or even DUI convictions can lead to significantly higher premiums. This is because insurance companies consider individuals with a history of risky driving behavior to be more likely to file claims in the future.

For instance, a driver with a recent DUI conviction may face a premium increase of up to 50% or more, depending on the severity of the offense and the insurer’s specific policies.

Vehicle Type

The type of vehicle you drive also plays a significant role in determining your insurance premiums. Some vehicles are considered more expensive to repair or replace, making them riskier for insurance companies. Luxury cars, sports cars, and high-performance vehicles often have higher premiums due to their higher repair costs and potential for greater damage in accidents.

For example, a new luxury SUV may have a premium significantly higher than a standard sedan, even if the driver has a clean driving record.

Location

The location where you reside can also affect your car insurance premiums. Areas with higher rates of car theft, accidents, or vandalism generally have higher premiums. This is because insurance companies assess the risk of claims based on the location’s crime statistics and traffic patterns.

For example, drivers living in a densely populated urban area with heavy traffic may face higher premiums compared to those living in a rural area with fewer vehicles and lower accident rates.

Table Illustrating Factor Impact

| Factor | Impact on Premium |

|---|---|

| Clean Driving History | Lower Premium |

| Accidents or Violations | Higher Premium |

| Luxury or High-Performance Vehicle | Higher Premium |

| Urban Area with High Crime Rates | Higher Premium |

| Rural Area with Low Accident Rates | Lower Premium |

Finding the Best Car Insurance in New York State

Finding affordable car insurance in New York State can be a challenging task. With numerous insurance companies offering a wide range of coverage options, navigating the process can be overwhelming. However, by understanding your needs and employing smart strategies, you can secure a policy that fits your budget and provides adequate protection.

Comparing Quotes from Multiple Insurance Companies

It is crucial to compare quotes from multiple insurance companies before making a decision. This allows you to evaluate different coverage options, premiums, and discounts. By obtaining quotes from at least three to five companies, you can ensure that you are getting the best value for your money.

Obtaining Car Insurance Quotes in New York State

To obtain car insurance quotes in New York State, you can follow these steps:

- Gather Your Information: Before contacting insurance companies, gather all the necessary information, including your driver’s license number, vehicle identification number (VIN), and details about your driving history and any accidents or violations.

- Use Online Quote Tools: Many insurance companies offer online quote tools that allow you to get an instant estimate of your premium. These tools typically require you to enter your personal and vehicle information, and they will generate a quote based on your specific profile.

- Contact Insurance Companies Directly: You can also contact insurance companies directly by phone or email to request a quote. This allows you to speak with an agent who can answer your questions and provide personalized advice.

- Compare Quotes: Once you have received quotes from multiple insurance companies, carefully compare them side-by-side. Consider the coverage options, premiums, discounts, and customer service ratings when making your decision.

- Request a Policy: After selecting the best insurance company for your needs, you can request a policy. You will need to provide your personal and vehicle information, and you will typically be required to make a down payment or set up a payment plan.

Car Insurance Claims and Disputes in New York State

Navigating the process of filing a car insurance claim in New York State can be complex, especially when disagreements arise. Understanding your rights and responsibilities as a driver involved in an accident is crucial for a smooth and successful claim resolution. This section delves into the intricacies of filing claims, common disputes, and effective strategies for resolving them.

Filing a Car Insurance Claim in New York State

When you’re involved in a car accident, prompt action is essential. New York State requires you to report the accident to your insurance company within a specified timeframe, usually within 24 hours.

The following steps Artikel the general process of filing a car insurance claim in New York State:

- Contact Your Insurance Company: Immediately notify your insurance company about the accident. Provide details such as the date, time, location, and parties involved.

- File a Police Report: If the accident involves injuries, property damage exceeding $1,000, or a hit-and-run, you are legally obligated to file a police report. This report serves as official documentation of the accident.

- Gather Evidence: Collect as much evidence as possible to support your claim. This includes photographs of the damage, witness statements, and medical records if injuries are involved.

- Submit a Claim Form: Your insurance company will provide a claim form that you need to complete and submit, detailing the accident and your losses.

- Review and Negotiation: The insurance company will review your claim and assess the damages. You may need to negotiate with the insurance company to reach a fair settlement.

Rights and Responsibilities of Drivers in Car Accidents

In New York State, drivers involved in car accidents have specific rights and responsibilities. Understanding these legal obligations is crucial for navigating the claim process effectively.

Driver Rights

- Right to File a Claim: You have the right to file a claim with your insurance company for damages resulting from the accident, even if you were partially at fault.

- Right to Representation: You can choose to have a lawyer represent you throughout the claim process.

- Right to Negotiate: You have the right to negotiate with the insurance company to reach a fair settlement.

Driver Responsibilities

- Duty to Report: You are required to report the accident to your insurance company within the specified timeframe.

- Duty to Cooperate: You must cooperate with your insurance company during the investigation and claim process.

- Duty to Mitigate Damages: You have a responsibility to take reasonable steps to minimize your losses after the accident.

Common Disputes in Car Insurance Claims, New york state car insurance companies

Disputes in car insurance claims can arise from various factors, including disagreements over fault, the extent of damages, or the coverage provided by the insurance policy.

Disputes over Fault

One of the most common disputes involves determining who is at fault for the accident. This can be complex, especially when multiple vehicles are involved.

Disputes over Damages

Disagreements can also arise regarding the extent of damages to the vehicle or the cost of repairs.

Disputes over Coverage

Sometimes, disputes arise over whether the insurance policy covers the specific damages or losses incurred in the accident.

Resolving Car Insurance Claims Disputes

If you are unable to reach a satisfactory settlement with the insurance company, you have several options for resolving the dispute.

Negotiation

The first step is to try to negotiate a settlement with the insurance company. This may involve working with your insurance agent or seeking the assistance of a lawyer.

Mediation

If negotiation fails, you can consider mediation, a process where a neutral third party helps both sides reach a mutually agreeable resolution.

Arbitration

If mediation is unsuccessful, you can opt for arbitration, a formal process where a neutral third party listens to both sides and makes a binding decision.

Litigation

As a last resort, you can file a lawsuit in court. This option should be considered carefully as it can be expensive and time-consuming.

Concluding Remarks

Armed with the knowledge gained from this guide, you can confidently navigate the car insurance market in New York State. Remember, comparing quotes, understanding your coverage options, and staying informed about your rights and responsibilities are key to securing the best possible car insurance protection. By taking an active role in your insurance decisions, you can ensure that you are adequately protected on the road.

Question & Answer Hub

What are the mandatory car insurance requirements in New York State?

New York State requires all drivers to carry liability insurance, which covers damages to other people and their property in case of an accident. The minimum liability coverage requirements are $25,000 per person, $50,000 per accident, and $10,000 for property damage.

How do I find the best car insurance rates in New York?

The best way to find affordable car insurance is to compare quotes from multiple companies. You can use online comparison websites or contact insurance agents directly. Be sure to provide accurate information about your driving history, vehicle, and coverage needs to get the most accurate quotes.

What happens if I get into an accident and don’t have car insurance?

Driving without car insurance in New York State is illegal and can result in fines, license suspension, and even jail time. If you are involved in an accident without insurance, you will be personally liable for all damages and injuries, which can be financially devastating.