New York State car insurance sets the stage for this comprehensive guide, offering readers a detailed look into the complex world of car insurance in the Empire State. Navigating the intricacies of New York’s insurance landscape can be challenging, but this guide provides a clear understanding of the requirements, factors influencing rates, and strategies for finding affordable coverage.

From understanding mandatory coverage to exploring the no-fault insurance system, this guide covers all the essential aspects of car insurance in New York. It delves into key factors that impact premiums, including driving history, vehicle type, age, location, and even credit score.

Understanding New York State Car Insurance Requirements

Driving a car in New York State is a privilege, and it comes with certain responsibilities, including having adequate car insurance. New York State requires all drivers to carry a minimum amount of car insurance to protect themselves and others on the road. Understanding these requirements is crucial for all drivers in New York.

Mandatory Coverage Requirements

New York State mandates that all drivers carry specific types of car insurance to ensure financial protection in case of an accident. These requirements are designed to cover potential damages and injuries caused by a driver.

- Liability Coverage: This is the most crucial type of car insurance in New York State. It covers the costs of damages and injuries to other people and their property if you are at fault in an accident. Liability coverage includes two components:

- Bodily Injury Liability (BI): Covers medical expenses, lost wages, and other related costs for injuries to other people in an accident you cause.

- Property Damage Liability (PD): Covers damages to other people’s vehicles or property if you are at fault in an accident.

- Personal Injury Protection (PIP): This coverage is required in New York State and covers your medical expenses and lost wages, regardless of who is at fault in an accident. It applies to you, your passengers, and family members who live in your household and use your vehicle.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient coverage. It covers your medical expenses and other damages, even if the other driver is at fault.

Minimum Liability Coverage Limits

New York State law requires drivers to maintain a minimum amount of liability coverage. These limits are:

- Bodily Injury Liability (BI): $25,000 per person / $50,000 per accident. This means that your insurance policy will cover up to $25,000 for injuries to one person in an accident you cause, and up to $50,000 for all injuries in a single accident.

- Property Damage Liability (PD): $10,000 per accident. This means that your insurance policy will cover up to $10,000 in damages to another person’s vehicle or property in an accident you cause.

Types of Coverage

While the minimum liability coverage is required, many drivers choose to purchase additional coverage for greater protection. Here’s a breakdown of the common types of coverage:

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault.

- Comprehensive Coverage: This coverage protects your vehicle from damages caused by events other than accidents, such as theft, vandalism, fire, or natural disasters.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient coverage. It covers your medical expenses and other damages, even if the other driver is at fault.

- Rental Reimbursement Coverage: This coverage pays for a rental car if your vehicle is damaged and unable to be driven.

- Roadside Assistance Coverage: This coverage provides assistance in case of a breakdown, flat tire, or other roadside emergencies.

Factors Influencing Car Insurance Rates in New York

Your car insurance premium in New York is determined by a variety of factors, and understanding these factors can help you make informed decisions to potentially lower your costs.

Driving History

Your driving history is a significant factor in determining your car insurance premium. A clean driving record with no accidents or violations will generally result in lower rates. Conversely, having a history of accidents, traffic violations, or even a DUI can significantly increase your premium.

For example, a speeding ticket or a careless driving violation can lead to an increase in your premium for several years.

Vehicle Type

The type of vehicle you drive plays a crucial role in your insurance rates. Luxury cars, sports cars, and vehicles with powerful engines are generally more expensive to insure due to their higher repair costs and increased risk of accidents.

For example, a 2023 Tesla Model S will likely have a higher insurance premium than a 2023 Honda Civic, even if both drivers have the same driving history.

Age

Your age is another factor that insurance companies consider. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. This higher risk translates to higher premiums.

For example, a 19-year-old driver with a clean driving record may pay a significantly higher premium than a 40-year-old driver with a similar record.

Location

The location where you live can significantly impact your insurance rates. Areas with higher crime rates, denser traffic, or a greater number of accidents tend to have higher insurance premiums.

For example, a driver living in New York City might pay a higher premium than a driver living in a rural area of upstate New York.

Credit Score, New york state car insurance

Surprisingly, your credit score can also influence your car insurance premium in New York. Insurance companies use credit scores as a proxy for financial responsibility, believing that people with good credit are more likely to pay their premiums on time.

For example, a driver with a credit score of 750 may qualify for a lower premium than a driver with a credit score of 550, even if their driving histories are identical.

Finding Affordable Car Insurance in New York: New York State Car Insurance

Securing affordable car insurance in New York is crucial, given the state’s high average premiums. This section will explore various strategies for finding competitive rates and maximizing savings.

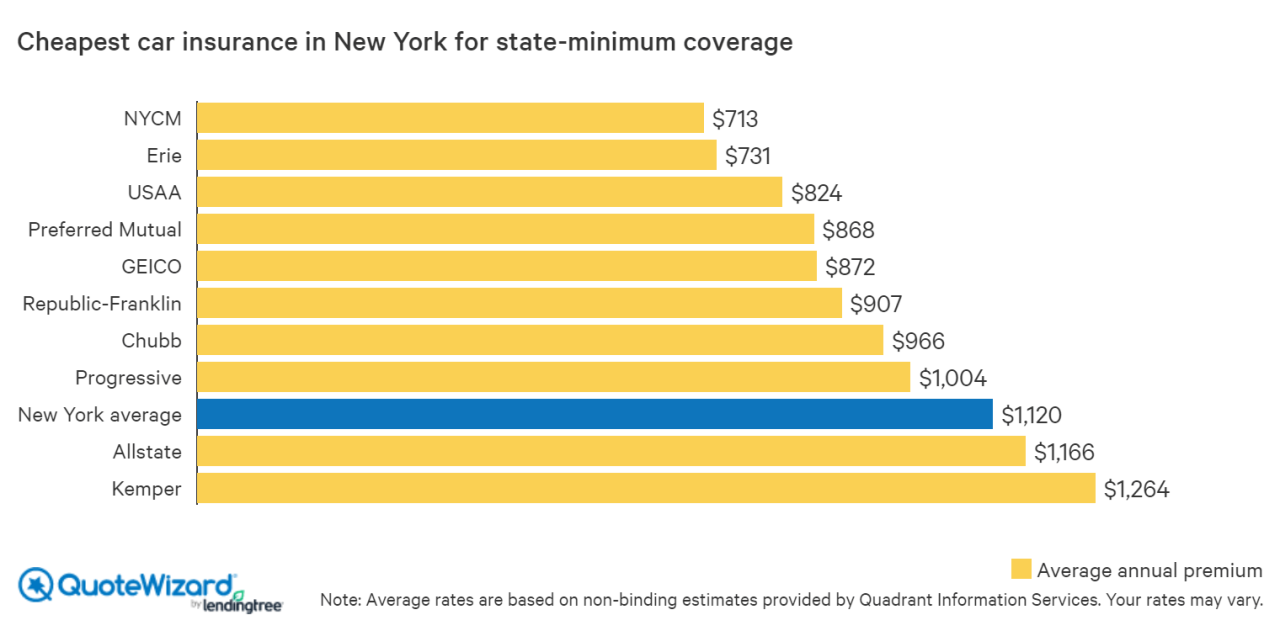

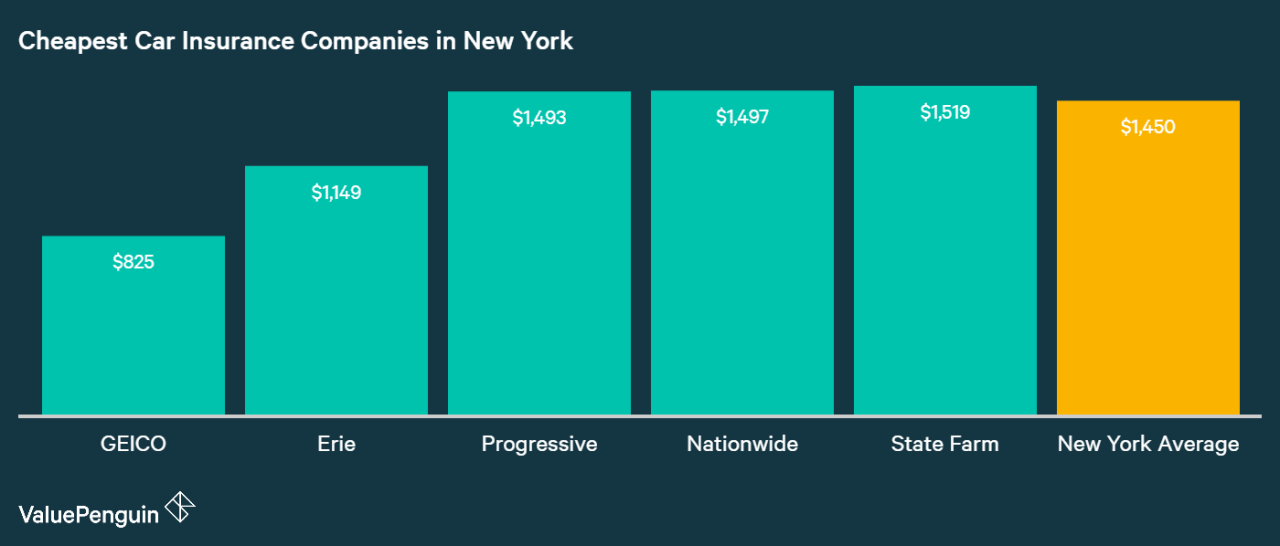

Comparing Insurance Companies and Their Offerings

Understanding the diverse offerings of various insurance companies is essential for finding the most suitable and cost-effective policy. A thorough comparison of different insurers and their coverage options can lead to significant savings.

- Online Comparison Tools: Websites like Policygenius, Insurify, and Compare.com allow you to compare quotes from multiple insurance companies simultaneously, simplifying the process of finding the best deals.

- Direct vs. Independent Agents: Direct insurers like Geico and Progressive operate solely online, while independent agents represent multiple companies. Direct insurers often offer lower premiums, while independent agents provide personalized advice and broader coverage options.

- Discounts and Bundling: Many insurance companies offer discounts for safe driving, good credit scores, multiple car insurance, and bundling with home or renters insurance. Exploring these discounts can substantially reduce your premiums.

Understanding New York’s No-Fault Insurance System

New York State operates under a no-fault insurance system, which means that your own insurance company will cover your medical expenses and lost wages, regardless of who caused the accident. This system is designed to simplify the claims process and reduce the number of lawsuits.

Benefits of the No-Fault System

The no-fault system in New York offers several advantages, including:

- Faster Claims Processing: Since you file claims with your own insurance company, the process is often quicker and less complex than pursuing a claim against another driver’s insurance.

- Reduced Litigation: The no-fault system aims to minimize lawsuits by covering your losses directly, reducing the need for legal battles.

- Lower Premiums: The no-fault system can potentially lead to lower insurance premiums for all drivers, as it reduces the overall cost of insurance claims.

Limitations of the No-Fault System

While the no-fault system has its advantages, it also has some drawbacks:

- Limited Coverage: The no-fault system only covers certain types of losses, such as medical expenses and lost wages. It does not cover all damages, such as pain and suffering.

- Potential for Abuse: Some individuals might attempt to exploit the system by exaggerating their injuries or claiming unnecessary expenses.

- Limited Compensation for Serious Injuries: If you sustain a serious injury, the no-fault system may not provide sufficient compensation for your losses.

Situations Where the No-Fault System Applies

The no-fault system applies to a wide range of situations, including:

- Car Accidents: The system covers medical expenses and lost wages for injuries sustained in car accidents, regardless of fault.

- Pedestrian Accidents: If you are injured as a pedestrian in an accident, the no-fault system covers your medical expenses and lost wages.

- Motorcycle Accidents: The system also covers motorcycle accidents, providing similar benefits for injured riders.

When to File a Lawsuit

While the no-fault system is designed to handle most accident-related claims, there are situations where you may need to file a lawsuit. These situations include:

- Serious Injuries: If you sustain a serious injury that exceeds the no-fault system’s coverage limits, you may need to file a lawsuit to recover additional compensation.

- Significant Property Damage: If the damage to your vehicle or other property exceeds the no-fault coverage limits, you may need to file a lawsuit to recover the full amount.

- Uninsured or Underinsured Motorists: If you are involved in an accident with an uninsured or underinsured driver, you may need to file a lawsuit against them to recover your losses.

Navigating Car Insurance Claims in New York

Filing a car insurance claim in New York can be a stressful experience, but understanding the process can help you navigate it smoothly. Here’s a breakdown of the steps involved and important considerations to keep in mind.

Filing a Car Insurance Claim

After a car accident, it’s crucial to file a claim with your insurance company promptly. The process typically involves these steps:

- Contact your insurance company: Inform them about the accident, including the date, time, location, and details of the other driver(s) involved.

- File a claim: Your insurance company will provide you with a claim form or guide you through their online filing process. Ensure you provide accurate and complete information.

- Gather necessary documentation: This includes your driver’s license, registration, insurance policy information, and any relevant police reports. You may also need to provide photographs of the damage to your vehicle and the accident scene.

- Provide a statement: Your insurance company will likely ask you to provide a written or recorded statement about the accident. Be honest and detailed in your account.

- Get your vehicle inspected: If your car is damaged, you’ll need to have it inspected by an insurance-approved mechanic. The mechanic will assess the damage and provide an estimate for repairs.

- Negotiate the settlement: Once the damage is assessed, you and your insurance company will discuss the settlement amount. If you disagree with the initial offer, you have the right to negotiate.

Documenting a Car Accident

Proper documentation is crucial for a smooth claim process. Here are some key steps to follow:

- Take photographs: Capture images of the accident scene, including any damage to your vehicle and the other vehicles involved. Photograph the surrounding area, road signs, traffic signals, and any potential contributing factors.

- Exchange information with the other driver(s): Obtain their name, address, phone number, insurance company, and policy number.

- Report the accident to the police: This is especially important if there are injuries or significant property damage. Obtain a copy of the police report for your records.

- Seek medical attention: If you’re injured, seek immediate medical attention. Document your injuries and treatment with medical records.

- Keep a detailed record: Maintain a log of all communication with your insurance company, including dates, times, and the content of conversations.

The Role of the New York State Department of Financial Services

The New York State Department of Financial Services (DFS) plays a significant role in resolving insurance disputes. If you encounter issues with your insurance company, you can contact the DFS for assistance.

- File a complaint: You can file a complaint with the DFS online or by phone. Be sure to provide detailed information about the dispute and any attempts you’ve made to resolve it with your insurance company.

- Mediation: The DFS may offer mediation services to help you reach a resolution with your insurance company.

- Investigation: If mediation fails, the DFS may investigate the complaint and take action against the insurance company if they find a violation of state regulations.

Tips for Safe Driving and Reducing Insurance Costs

In New York, safe driving practices not only protect you and others on the road but also have a significant impact on your car insurance premiums. By adhering to safe driving habits and maintaining a clean driving record, you can significantly reduce your insurance costs. This section will delve into various aspects of safe driving, providing valuable tips to help you save money on your insurance.

Maintaining a Clean Driving Record

A clean driving record is crucial for keeping your insurance premiums low. Any traffic violations or accidents can lead to higher premiums.

- Avoid Speeding: Speeding is one of the most common traffic violations. Not only is it dangerous, but it can also result in hefty fines and points on your license, which can significantly increase your insurance rates.

- Obey Traffic Laws: Always adhere to traffic signals, stop signs, and other traffic regulations. Failing to do so can lead to accidents and increase your insurance premiums.

- Drive Defensively: Be aware of your surroundings and anticipate potential hazards. This includes being aware of other drivers, pedestrians, cyclists, and road conditions.

- Avoid Distracted Driving: Distracted driving, including using your phone, eating, or applying makeup, can lead to accidents. Always focus on the road while driving.

- Maintain a Safe Distance: Maintain a safe following distance from other vehicles to allow for adequate braking time in case of emergencies.

Ultimate Conclusion

Armed with the knowledge gained from this guide, New York residents can confidently navigate the car insurance landscape, making informed decisions to secure the right coverage at the best possible price. By understanding the intricacies of the system and utilizing the strategies Artikeld, individuals can protect themselves financially while ensuring they meet the legal requirements for car insurance in New York.

FAQ Overview

What are the penalties for driving without car insurance in New York?

Driving without car insurance in New York is illegal and can result in fines, license suspension, and even vehicle impoundment.

How often should I review my car insurance policy?

It’s recommended to review your car insurance policy annually to ensure it still meets your needs and that you’re getting the best possible rates.

Can I lower my car insurance premiums by taking a defensive driving course?

Yes, completing a defensive driving course can often lead to lower insurance premiums, as it demonstrates your commitment to safe driving practices.