New York State auto insurance companies navigate a complex landscape, shaped by unique regulations and factors influencing rates. Understanding this environment is crucial for drivers seeking the best coverage and value.

From the types of insurance companies available to the key factors that impact premiums, navigating the New York auto insurance market requires knowledge and informed decision-making. This guide provides insights into the different players, coverage options, and strategies for finding the right insurance for your needs.

New York State Auto Insurance Landscape

New York State has a unique and complex auto insurance market, distinguished by its no-fault system and a focus on affordability and access to coverage. The state’s insurance landscape is shaped by a combination of factors, including regulatory oversight, market competition, and consumer demand. This comprehensive overview will delve into the intricacies of the New York auto insurance market, exploring its defining characteristics, regulatory framework, and key rate-influencing factors.

The No-Fault System in New York

New York State operates under a no-fault insurance system, which means that drivers involved in an accident are primarily responsible for covering their own medical expenses and lost wages, regardless of who caused the accident. This system aims to streamline the claims process and reduce litigation. Under the no-fault system, drivers are required to carry Personal Injury Protection (PIP) coverage, which pays for medical expenses, lost wages, and other related costs.

Role of the New York State Insurance Department

The New York State Insurance Department (NYSDIF) plays a critical role in regulating the auto insurance market, ensuring fair and competitive practices. The NYSDIF sets rates, approves insurance policies, and investigates complaints against insurers. It also promotes consumer education and awareness about auto insurance. The NYSDIF’s primary objectives are to:

- Protect consumers from unfair or deceptive insurance practices.

- Ensure that insurers are financially sound and able to pay claims.

- Promote competition and affordability in the auto insurance market.

Factors Influencing Auto Insurance Rates in New York

Several factors contribute to the calculation of auto insurance rates in New York State, reflecting the unique aspects of the state’s insurance landscape. These factors are carefully considered by insurers to assess risk and determine premiums:

- Driving Record: Drivers with a history of accidents, traffic violations, or DUIs will typically face higher premiums. This is a key factor as it reflects the likelihood of future claims.

- Vehicle Type: The type of vehicle you drive significantly influences your insurance rate. Higher-performance vehicles, luxury cars, and SUVs generally cost more to insure due to their higher repair costs and potential for greater damage in accidents.

- Age and Gender: Younger drivers and males tend to have higher insurance rates due to their higher risk profiles. This is often attributed to factors such as inexperience, higher risk-taking behavior, and a greater likelihood of accidents.

- Location: Where you live impacts your insurance rate. Urban areas with higher traffic density and crime rates often have higher insurance premiums compared to rural areas. This reflects the increased risk of accidents and theft in urban environments.

- Credit Score: In some cases, your credit score can be considered when determining your insurance rate. This practice is controversial, but insurers argue that individuals with lower credit scores tend to have higher insurance claims. However, this factor is not universally applied across all insurance companies in New York.

Types of Auto Insurance Companies in New York

New York’s auto insurance market is diverse, offering various types of companies to meet the needs of different drivers. Understanding these company types is crucial for finding the best insurance policy for your situation.

Types of Auto Insurance Companies in New York

This section explores the primary types of auto insurance companies operating in New York, comparing their key features and providing examples.

| Company Type | Key Features | Examples |

|---|---|---|

| Independent Insurance Agents |

|

|

| Direct Writers |

|

|

| Captive Insurance Companies |

|

|

| Mutual Insurance Companies |

|

|

Choosing the Right Auto Insurance Company

Finding the best auto insurance company in New York can feel overwhelming, especially with so many options available. But it’s crucial to do your research and choose a company that meets your specific needs and budget. This section will guide you through the process of making an informed decision, helping you find the right fit for your insurance needs.

Factors to Consider When Choosing an Auto Insurance Company

Choosing the right auto insurance company involves several key considerations. You need to carefully evaluate your needs, budget, and the features offered by different companies to make an informed decision.

- Coverage Options: Different companies offer varying levels of coverage. You need to decide what level of protection is essential for you. For example, do you need comprehensive and collision coverage for your car, or will liability coverage suffice? Consider your car’s value, your driving history, and your financial situation to determine the appropriate coverage level.

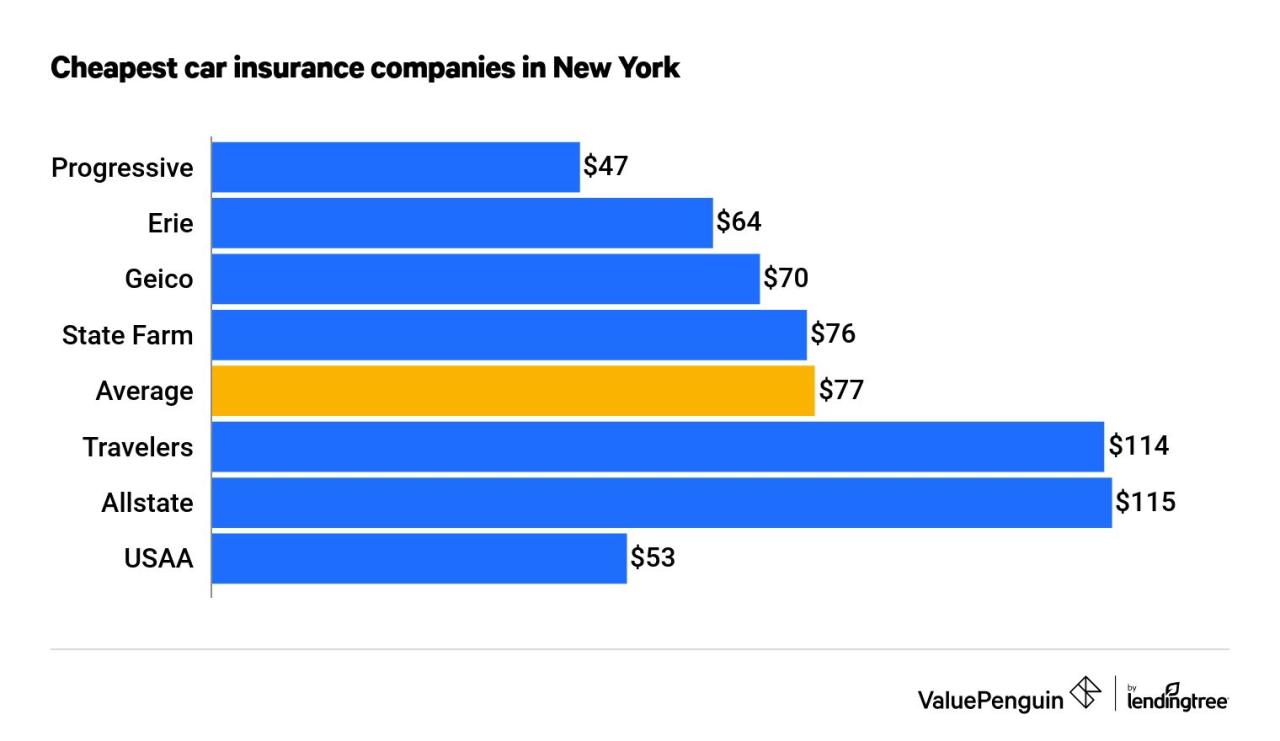

- Price: Auto insurance premiums vary widely across companies. Comparing quotes from multiple companies is essential to find the best price for the coverage you need. However, don’t prioritize price alone. Remember to balance cost with coverage options and customer service.

- Customer Service: Good customer service is crucial, especially in case of an accident or claim. Research the company’s reputation for handling claims efficiently and fairly. Look for companies that offer 24/7 customer support, online resources, and a clear claims process.

- Financial Stability: Choose a company with a strong financial standing. This ensures they can pay out claims in the event of an accident. You can check the company’s credit rating and financial reports for information about their stability.

- Discounts: Many insurance companies offer discounts for safe driving, good grades, multiple policies, and other factors. Explore the available discounts and see if you qualify for any.

- Technology and Online Services: Today, many companies offer online tools and mobile apps for managing your policy, paying premiums, and filing claims. Consider the convenience and user-friendliness of these features when making your decision.

Comparing Quotes from Multiple Companies

Getting quotes from multiple companies is a crucial step in finding the best auto insurance deal. You can use online comparison tools, contact companies directly, or work with an independent insurance agent to compare quotes.

Comparing quotes from at least three to five different companies allows you to see the full range of prices and coverage options available.

Benefits of Working with an Independent Insurance Agent

Working with an independent insurance agent can offer several advantages when choosing an auto insurance company. Independent agents represent multiple insurance companies, allowing them to compare quotes and coverage options from various providers.

- Expertise and Advice: Independent agents have a deep understanding of the insurance market and can provide personalized advice based on your individual needs and circumstances. They can help you navigate the complexities of insurance policies and ensure you get the right coverage at the best price.

- Unbiased Recommendations: Unlike captive agents who represent only one company, independent agents are not tied to a specific insurer. This allows them to provide unbiased recommendations based on your best interests.

- Personalized Service: Independent agents often build strong relationships with their clients, offering ongoing support and assistance throughout the insurance process. They can help you adjust your coverage as your needs change, answer questions, and handle claims efficiently.

Key Coverage Options and Features

In New York State, auto insurance is mandatory, and drivers must have specific coverages to comply with legal requirements. Understanding these coverages is essential for ensuring adequate protection in case of accidents or other incidents involving your vehicle. This section delves into the key coverage options and features available to drivers in New York, providing a comprehensive overview of their benefits and drawbacks.

Required Auto Insurance Coverages in New York

New York State law mandates that all drivers carry specific auto insurance coverages to protect themselves and others. These coverages are designed to address various potential scenarios arising from accidents or incidents involving your vehicle.

- Liability Coverage: This coverage protects you financially if you are at fault in an accident that causes injury or damage to another person or their property. It covers the other driver’s medical expenses, property damage, and legal costs. In New York, liability coverage is required in the following minimum amounts:

- Bodily Injury Liability: $25,000 per person / $50,000 per accident

- Property Damage Liability: $10,000 per accident

- Personal Injury Protection (PIP): This coverage, also known as “no-fault” insurance, covers your medical expenses and lost wages following an accident, regardless of who was at fault. New York requires a minimum PIP coverage of $50,000 per person. PIP benefits are not subject to deductibles or co-pays.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient insurance to cover your losses. UM/UIM coverage can cover your medical expenses, lost wages, and property damage.

Optional Auto Insurance Coverages in New York

While New York requires certain essential coverages, drivers can choose additional optional coverages to enhance their protection and peace of mind. These optional coverages can address specific needs and provide broader financial protection in various situations.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. This coverage is typically not required but can be valuable for newer vehicles or those with significant loan balances.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by non-accident events, such as theft, vandalism, fire, or natural disasters. This coverage is not required but can be beneficial for protecting your vehicle from unexpected events.

- Rental Reimbursement Coverage: This coverage provides financial assistance for rental car expenses if your vehicle is damaged or stolen and is being repaired or replaced. This coverage can help to minimize the inconvenience and costs associated with being without a vehicle.

- Roadside Assistance Coverage: This coverage provides assistance for unexpected situations on the road, such as flat tires, dead batteries, or lockouts. Roadside assistance coverage can help to alleviate stress and inconvenience in these situations.

- Gap Insurance: This coverage helps to cover the difference between the actual cash value of your vehicle and the amount you owe on your loan or lease if your vehicle is totaled. Gap insurance can be particularly helpful for newer vehicles that depreciate quickly.

Benefits and Drawbacks of Coverage Options

Each coverage option has its benefits and drawbacks, and it’s crucial to weigh these factors when choosing the right coverage for your needs and budget.

- Required Coverages: These coverages provide essential protection and are mandatory in New York. They help to ensure financial security in case of accidents or incidents involving your vehicle, protecting you from significant financial burdens.

- Optional Coverages: These coverages offer additional protection and can be valuable depending on your specific needs and financial situation. However, they can also increase your insurance premiums, so it’s important to weigh the benefits against the costs.

Factors Affecting Insurance Premiums

Your auto insurance premiums in New York are influenced by a variety of factors, ensuring a personalized rate based on your individual risk profile. Understanding these factors can help you make informed decisions to potentially lower your premiums.

Driving History

Your driving history is a significant factor determining your auto insurance premiums. A clean driving record with no accidents or violations will generally result in lower premiums. Conversely, a history of accidents, traffic violations, or DUI convictions will lead to higher premiums. Insurance companies consider these factors as indicators of your driving risk.

For example, a driver with a recent speeding ticket may see a 10-20% increase in their premiums compared to a driver with a clean record.

Vehicle Type

The type of vehicle you drive plays a crucial role in determining your insurance premiums. Certain vehicle types are considered higher risk due to factors like safety features, repair costs, and theft susceptibility.

For instance, a high-performance sports car may have higher premiums compared to a fuel-efficient sedan due to its higher repair costs and potential for higher speeds.

Location, New york state auto insurance companies

Your location, including the zip code where your vehicle is primarily parked, is a significant factor influencing your insurance premiums. Areas with higher crime rates, traffic congestion, and accident frequency generally have higher insurance premiums.

For example, a driver living in a densely populated urban area with high traffic volumes may pay more for insurance than a driver residing in a rural area with lower traffic density.

Table Illustrating Premium Impacts

Here’s a hypothetical table illustrating how different factors can affect your premiums:

| Factor | Scenario 1 | Scenario 2 | Scenario 3 |

|————————-|——————————————–|——————————————–|———————————————–|

| Driving History | Clean record, no accidents or violations | One speeding ticket in the past year | DUI conviction within the last five years |

| Vehicle Type | Fuel-efficient sedan | High-performance sports car | Pickup truck with a towing capacity of 5,000 lbs |

| Location | Rural area with low crime rate | Urban area with high crime rate | Suburban area with moderate crime rate |

| Estimated Premium | $1,000 per year | $1,200 per year | $1,500 per year |

Tips for Saving on Auto Insurance: New York State Auto Insurance Companies

Auto insurance in New York can be expensive, but there are ways to lower your premiums. By taking advantage of discounts, maintaining a good driving record, and making smart choices about your coverage, you can save money on your insurance.

Maintaining a Good Driving Record

A clean driving record is one of the most important factors in determining your auto insurance rates. Driving safely and avoiding traffic violations can significantly reduce your premiums. A good driving record demonstrates to insurance companies that you are a responsible driver, which translates into lower rates.

Taking Defensive Driving Courses

Completing a defensive driving course can also help you save on your insurance. These courses teach you safe driving techniques and help you avoid accidents. Insurance companies often offer discounts to drivers who complete these courses, recognizing their commitment to safe driving.

Bundling Insurance Policies

Bundling your auto insurance with other types of insurance, such as homeowners or renters insurance, can lead to significant savings. Insurance companies often offer discounts for bundling policies, as it makes it easier for them to manage your coverage.

Choosing the Right Deductible

Your deductible is the amount of money you pay out of pocket before your insurance coverage kicks in. A higher deductible generally means lower premiums. However, you need to choose a deductible that you can comfortably afford in case of an accident.

Comparing Quotes from Multiple Insurers

It is essential to shop around and compare quotes from multiple insurance companies before choosing a policy. You can use online comparison tools or contact insurance agents directly to get quotes. This will help you find the best rates for the coverage you need.

Taking Advantage of Discounts

Many insurance companies offer discounts for various factors, such as:

- Good student discounts

- Safe driver discounts

- Multi-car discounts

- Loyalty discounts

- Discounts for safety features in your car, such as anti-theft devices or airbags

Making Smart Choices About Coverage

You should review your coverage options and choose the coverage that is right for you. You may not need all the optional coverage, such as collision and comprehensive, if your car is older or has a lower value.

Negotiating Your Premium

Don’t be afraid to negotiate your premium with your insurance company. Explain your situation and see if they are willing to lower your rates. You may be able to get a lower premium by making a few small changes to your policy.

Understanding Insurance Claims and Disputes

Navigating the process of filing an auto insurance claim in New York can be overwhelming, especially if you’ve never had to deal with one before. Knowing your rights and understanding the steps involved can help you navigate this process smoothly.

Filing an Auto Insurance Claim

Filing an auto insurance claim in New York typically involves these steps:

- Report the accident: Contact your insurance company immediately after the accident. This is crucial to start the claims process and ensure timely assistance.

- Gather information: Collect as much information as possible about the accident, including details of the other driver, witnesses, police reports, and photographs of the damage.

- File a claim: Your insurance company will provide you with the necessary forms to file your claim. Be sure to complete all sections accurately and thoroughly.

- Provide documentation: Submit the required documents, such as police reports, medical bills, and repair estimates, to support your claim.

- Insurance company investigation: Your insurance company will investigate the accident and review your claim to determine coverage and liability.

- Negotiate settlement: If the insurance company determines you are covered, you will need to negotiate a settlement amount. This may involve discussing the cost of repairs, medical expenses, and other related costs.

The Insurance Company’s Role in Investigating and Resolving Claims

The insurance company plays a vital role in investigating and resolving claims. This includes:

- Reviewing the claim: The insurance company will review your claim to determine coverage and liability based on your policy terms and the circumstances of the accident.

- Investigating the accident: The company may conduct an investigation, which could involve interviewing witnesses, reviewing police reports, and inspecting the damaged vehicle.

- Determining liability: The insurance company will determine who is at fault for the accident and whether coverage applies to the claim.

- Negotiating a settlement: If liability is established, the insurance company will negotiate a settlement amount with you, which may involve paying for repairs, medical expenses, and other related costs.

Common Disputes Between Policyholders and Insurance Companies

Disputes between policyholders and insurance companies can arise for several reasons:

- Coverage disputes: Disputes may arise regarding the scope of coverage provided by the policy, such as whether certain damages are covered or whether the policyholder meets the requirements for coverage.

- Liability disputes: Disputes may arise regarding who is at fault for the accident and whether the insurance company is obligated to cover the claim.

- Settlement disputes: Disputes may arise regarding the amount of the settlement offered by the insurance company, with the policyholder feeling the amount is insufficient.

- Delay in processing claims: Policyholders may dispute delays in the processing of their claims, which can lead to financial hardship and inconvenience.

Outcome Summary

Choosing the right New York State auto insurance company involves careful consideration of your individual needs and driving habits. By comparing quotes, understanding coverage options, and implementing cost-saving strategies, you can find an insurance plan that provides adequate protection while fitting your budget.

FAQ Section

How often should I review my auto insurance policy?

It’s recommended to review your policy at least annually, or whenever there’s a significant change in your driving situation, such as a new car, change in address, or a change in your driving record.

What is the difference between liability and collision coverage?

Liability coverage protects you financially if you cause an accident, while collision coverage covers damage to your own vehicle, regardless of who is at fault.

What are some common discounts offered by New York auto insurance companies?

Common discounts include good driver discounts, safe driver courses, multi-car discounts, and bundling discounts for combining home and auto insurance.