Multi state auto insurance – Multi-state auto insurance provides coverage when you drive across state lines, ensuring you’re protected even if you’re unfamiliar with the local traffic laws and regulations. It offers peace of mind for frequent travelers, commuters, and those who move frequently.

This type of insurance is designed to cover accidents, injuries, and property damage that may occur in multiple states. It offers various coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage, to suit your specific needs and driving habits.

What is Multi-State Auto Insurance?

Multi-state auto insurance is a type of coverage that provides liability and other protection for drivers who operate vehicles in multiple states. This type of insurance can be beneficial for individuals who frequently travel between states for work, leisure, or other reasons.

Benefits of Multi-State Auto Insurance, Multi state auto insurance

Multi-state auto insurance offers several benefits for drivers who need coverage in more than one state.

- Simplified Coverage: Instead of managing separate insurance policies for each state, multi-state auto insurance provides a single policy that covers you in all the states you need. This simplifies the process of obtaining and managing your coverage.

- Convenience: Having a single policy for all your states eliminates the need to contact multiple insurance providers for claims or policy updates. It streamlines the process and reduces the risk of overlooking important information.

- Potential Cost Savings: Depending on your individual needs and the states you drive in, multi-state auto insurance can be more affordable than obtaining separate policies for each state. Insurance companies often offer discounts for bundling multiple vehicles or policies.

Drawbacks of Multi-State Auto Insurance

While multi-state auto insurance offers several benefits, it’s important to consider potential drawbacks as well.

- Limited Coverage Options: Some insurance companies may not offer coverage in all states or may have limited coverage options in certain states. This can be a drawback if you require specific coverage options that are not available in all states.

- Higher Premiums: In some cases, multi-state auto insurance premiums can be higher than obtaining separate policies for each state, especially if you drive in states with higher insurance rates.

- Complexity: While multi-state auto insurance simplifies coverage, it can also be more complex to understand and manage. You need to ensure that your policy meets the minimum requirements for each state you drive in and that you understand the specific coverage provisions for each state.

Eligibility and Requirements

Multi-state auto insurance is designed to cater to individuals who frequently travel between states or reside in multiple states. It provides comprehensive coverage regardless of the state where you’re driving.

To be eligible for multi-state auto insurance, you must meet specific requirements, and the necessary documentation will vary depending on the insurer.

Eligibility Criteria

To be eligible for multi-state auto insurance, you must generally meet the following criteria:

- Have a valid driver’s license in at least one state.

- Maintain a clean driving record with no significant violations.

- Own or lease a vehicle that is registered in at least one state.

- Have a permanent address in at least one state.

- Be at least 18 years old.

Required Documentation

The specific documentation required for applying for multi-state auto insurance will vary depending on the insurer, but generally includes:

- Proof of identity, such as a driver’s license or passport.

- Proof of residency, such as a utility bill or bank statement.

- Vehicle registration and proof of insurance.

- Driving history, including your driving record.

- Information about your vehicle, such as the year, make, model, and VIN.

Situations Where Multi-State Auto Insurance Is Necessary

Multi-state auto insurance is particularly beneficial in situations where you:

- Frequently travel between states for work or personal reasons.

- Live in one state but work in another.

- Own a second home or vacation property in another state.

- Are a student attending college in a different state.

- Are a member of the military and frequently relocate.

Coverage Options and Features

Multi-state auto insurance provides a range of coverage options to meet the diverse needs of drivers who frequently travel across state lines. Understanding the available coverage options and their features is crucial for making an informed decision about your insurance policy.

Coverage Options

The following are some common coverage options available for multi-state auto insurance:

- Liability Coverage: This coverage protects you financially if you cause an accident that results in injury or property damage to others. It covers the costs of medical bills, lost wages, and property repairs. The minimum liability coverage requirements vary by state, so it’s important to check the laws in each state you drive in.

- Collision Coverage: This coverage pays for repairs to your vehicle if it’s damaged in an accident, regardless of who is at fault. Collision coverage is typically optional, but it’s essential if you want to protect yourself from significant financial losses in the event of an accident.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, fire, or natural disasters. Comprehensive coverage is also typically optional, but it can be valuable if you want to protect your vehicle from unexpected damage.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who is uninsured or underinsured. It covers your medical expenses and property damage, even if the other driver is at fault.

- Personal Injury Protection (PIP): This coverage covers your medical expenses and lost wages if you’re injured in an accident, regardless of who is at fault. PIP is required in some states, but it’s often optional in others.

- Medical Payments Coverage (Med Pay): This coverage pays for your medical expenses, regardless of who is at fault, up to a certain limit. Med Pay is often optional, but it can be a valuable addition to your policy if you want additional protection for your medical expenses.

- Rental Reimbursement: This coverage helps pay for a rental car if your vehicle is damaged and needs repairs. Rental reimbursement is typically optional, but it can be a valuable addition to your policy if you rely on your vehicle for daily transportation.

- Roadside Assistance: This coverage provides assistance with services such as flat tire changes, jump starts, and towing. Roadside assistance is often optional, but it can be a valuable addition to your policy if you want peace of mind knowing that help is available if you encounter a roadside emergency.

Coverage Comparison

The following table provides a comparison of common coverage options, their premiums, and deductibles:

| Coverage Option | Premium | Deductible |

|---|---|---|

| Liability Coverage | Low | N/A |

| Collision Coverage | Moderate | Variable |

| Comprehensive Coverage | Moderate | Variable |

| Uninsured/Underinsured Motorist Coverage | Low | Variable |

| Personal Injury Protection (PIP) | Moderate | Variable |

| Medical Payments Coverage (Med Pay) | Low | Variable |

| Rental Reimbursement | Low | N/A |

| Roadside Assistance | Low | N/A |

Note: The premiums and deductibles for multi-state auto insurance vary based on factors such as your driving history, vehicle type, coverage limits, and the states you drive in.

Finding and Choosing a Multi-State Auto Insurance Provider

Finding a reliable multi-state auto insurance provider can seem daunting, but with a systematic approach, you can find the best option for your needs. You’ll need to consider your specific requirements, compare quotes, and evaluate different providers before making a decision.

Comparing Quotes and Choosing the Best Provider

Once you’ve identified potential providers, comparing quotes is crucial to find the best deal. Here are some helpful tips for getting the most competitive quotes:

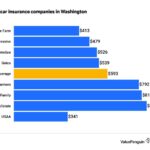

- Use online comparison websites: These platforms allow you to enter your details and receive quotes from multiple insurers simultaneously, saving you time and effort. Some popular comparison websites include Insurance.com, The Zebra, and Policygenius.

- Contact insurers directly: Don’t rely solely on comparison websites. Contact insurers directly to discuss your specific needs and get personalized quotes. This can help you uncover special discounts or coverage options not available through comparison websites.

- Be transparent about your driving history: Provide accurate information about your driving record, including any accidents or violations, to ensure you receive accurate quotes. Hiding information could lead to higher premiums later.

- Consider bundling policies: Many insurers offer discounts for bundling multiple policies, such as auto and homeowners insurance. This can significantly reduce your overall insurance costs.

- Shop around regularly: Don’t settle for the first quote you receive. Insurance rates fluctuate, so it’s wise to shop around periodically to ensure you’re getting the best possible price.

Factors to Consider When Evaluating Insurance Providers

When choosing a multi-state auto insurance provider, it’s essential to consider factors beyond just price. These factors will help you make a well-informed decision that aligns with your needs and preferences.

- Financial stability: Research the insurer’s financial strength to ensure they can cover claims in the future. You can check the insurer’s ratings from agencies like AM Best, Moody’s, and Standard & Poor’s.

- Customer service: Look for providers with a reputation for excellent customer service. Check online reviews, ratings, and testimonials to gauge their responsiveness and helpfulness.

- Claims handling process: Inquire about the insurer’s claims process. Ask about their average claim processing time, availability of 24/7 claims support, and their approach to handling disputes.

- Coverage options and features: Compare the coverage options and features offered by different providers. Ensure the policy includes the necessary coverage for your specific needs, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Discounts and rewards: Inquire about available discounts, such as safe driving discounts, good student discounts, and multi-car discounts. Some insurers also offer rewards programs for loyal customers.

Managing Your Multi-State Auto Insurance Policy

Once you’ve secured a multi-state auto insurance policy, it’s essential to understand how to manage it effectively. This involves knowing how to make changes, file claims, and avoid potential pitfalls.

Making Changes to Your Policy

Changes to your multi-state auto insurance policy, such as adding a driver, changing your vehicle, or updating your address, are typically straightforward.

You can usually make these changes through your insurance provider’s website, mobile app, or by contacting their customer service department.

It’s important to inform your insurer about any changes promptly to ensure your coverage remains accurate and up-to-date.

Filing a Claim

In the event of an accident or other covered incident, you’ll need to file a claim with your multi-state auto insurance provider.

The process for filing a claim may vary depending on your insurer, but it generally involves:

- Contacting your insurer as soon as possible after the incident.

- Providing details about the incident, including the date, time, location, and parties involved.

- Submitting any necessary documentation, such as a police report or medical records.

It’s important to follow your insurer’s instructions carefully and provide all required information to ensure your claim is processed efficiently.

Tips for Managing Your Policy Effectively

To manage your multi-state auto insurance policy effectively and avoid potential issues, consider the following tips:

- Review your policy regularly: It’s a good idea to review your policy at least annually to ensure it still meets your needs and that your coverage is adequate. You can also use this opportunity to look for potential savings on your premiums.

- Keep your contact information updated: Make sure your insurer has your current address, phone number, and email address. This will help ensure you receive important communications about your policy.

- Understand your coverage limits: Be aware of the limits on your coverage, such as the maximum amount your insurer will pay for a particular type of claim. This will help you make informed decisions about your coverage.

- Pay your premiums on time: Late payments can result in penalties or even cancellation of your policy. Set up automatic payments or reminders to ensure your premiums are paid on time.

- Shop around for the best rates: Don’t be afraid to compare quotes from different insurers to ensure you’re getting the best rates for your coverage.

Last Recap: Multi State Auto Insurance

Whether you’re a cross-country road tripper, a frequent business traveler, or simply someone who occasionally drives across state lines, understanding multi-state auto insurance is essential. By carefully considering your needs, comparing quotes, and choosing a reputable provider, you can ensure you have the right coverage to protect yourself and your vehicle wherever you go.

FAQ Section

How do I know if I need multi-state auto insurance?

If you frequently drive across state lines, you likely need multi-state auto insurance. This type of insurance is designed to cover you in multiple states, ensuring you have the right coverage wherever you drive.

What are the benefits of multi-state auto insurance?

Benefits include peace of mind, consistent coverage across states, and potentially lower premiums compared to multiple individual state policies.

How do I find a multi-state auto insurance provider?

You can find a provider online, through insurance brokers, or by contacting your current insurer to see if they offer multi-state coverage. It’s recommended to compare quotes from multiple providers to find the best rates and coverage options.