Mountain States Insurance Group stands as a prominent force in the insurance landscape, offering a diverse range of products and services tailored to meet the evolving needs of individuals and businesses. With a rich history rooted in providing reliable protection, the company has earned a reputation for its commitment to customer satisfaction and its unwavering dedication to its core values. Mountain States Insurance Group’s mission is to empower its customers with peace of mind, knowing that they are well-protected against life’s uncertainties.

The company’s portfolio encompasses a wide spectrum of insurance solutions, including life, health, auto, and home insurance. Each product is carefully designed to provide comprehensive coverage and personalized support, ensuring that customers receive the best possible protection for their unique circumstances. Mountain States Insurance Group’s commitment to innovation and technological advancements ensures that its offerings remain at the forefront of the industry, providing customers with seamless access to information and services.

Mountain States Insurance Group

Mountain States Insurance Group is a reputable insurance provider with a long history of serving individuals and businesses in the Western United States. Established in [Year], the company has grown steadily, expanding its reach and service offerings to meet the evolving needs of its customers.

History

Mountain States Insurance Group was founded in [Year] by a group of insurance professionals who recognized the need for a local, customer-focused insurance provider in the Western United States. The company began as a small, regional insurance agency, offering a limited range of insurance products. However, through strategic growth and expansion, Mountain States Insurance Group has become a leading provider of insurance solutions in the region.

Mission and Core Values

Mountain States Insurance Group is committed to providing its customers with exceptional service, competitive rates, and a wide range of insurance products. The company’s mission is to help its customers protect their assets and achieve their financial goals. Mountain States Insurance Group’s core values include:

- Customer Focus: Mountain States Insurance Group is committed to providing its customers with personalized service and solutions that meet their unique needs. The company strives to build strong relationships with its customers and to be a trusted advisor.

- Integrity: Mountain States Insurance Group operates with honesty and transparency. The company is committed to ethical business practices and to upholding the highest standards of professionalism.

- Innovation: Mountain States Insurance Group is constantly seeking new ways to improve its products and services. The company invests in technology and innovation to provide its customers with the best possible experience.

- Community Involvement: Mountain States Insurance Group is committed to giving back to the communities it serves. The company supports a variety of charitable organizations and initiatives.

Products and Services

Mountain States Insurance Group offers a wide range of insurance products and services to meet the needs of individuals and businesses. These include:

- Personal Insurance: Mountain States Insurance Group offers a variety of personal insurance products, including auto insurance, homeowners insurance, renters insurance, and life insurance. The company also offers specialty personal insurance products, such as flood insurance and earthquake insurance, which are important for customers living in areas that are prone to these natural disasters.

- Business Insurance: Mountain States Insurance Group offers a comprehensive suite of business insurance products, including property insurance, liability insurance, workers’ compensation insurance, and business interruption insurance. The company also offers specialty business insurance products, such as surety bonds and professional liability insurance, which are important for businesses in specific industries.

- Financial Services: Mountain States Insurance Group also offers a range of financial services, such as retirement planning, investment management, and estate planning. These services can help customers plan for their future and achieve their financial goals.

Target Market and Customer Base

Mountain States Insurance Group’s target market is individuals and businesses in the Western United States. The company has a strong presence in the states of [List of states]. Mountain States Insurance Group’s customer base is diverse, ranging from individuals and families to small businesses and large corporations. The company prides itself on its ability to serve the needs of a wide range of customers.

Key Services and Products

Mountain States Insurance Group offers a comprehensive suite of insurance products designed to meet the diverse needs of individuals and families across the region. From protecting your home and vehicle to securing your financial future, Mountain States Insurance Group provides a range of solutions tailored to your specific circumstances.

Insurance Products

Mountain States Insurance Group provides a comprehensive range of insurance products to protect your assets and financial well-being.

- Auto Insurance: This essential coverage protects you against financial losses arising from accidents involving your vehicle. It includes liability coverage for injuries or damages caused to others, as well as coverage for your own vehicle in case of an accident.

- Home Insurance: This policy protects your home and its contents against various perils, such as fire, theft, and natural disasters. It also provides liability coverage for accidents that occur on your property.

- Life Insurance: Life insurance provides financial security for your loved ones in the event of your death. It can help cover funeral expenses, outstanding debts, and ongoing living expenses.

- Health Insurance: Health insurance helps cover the costs of medical expenses, such as doctor visits, hospital stays, and prescription drugs. It can provide peace of mind knowing you have financial protection in case of unexpected health issues.

- Business Insurance: This type of insurance provides coverage for businesses against various risks, including property damage, liability claims, and employee-related issues. It can help protect your business from financial losses due to unforeseen events.

Market Presence and Geographic Reach

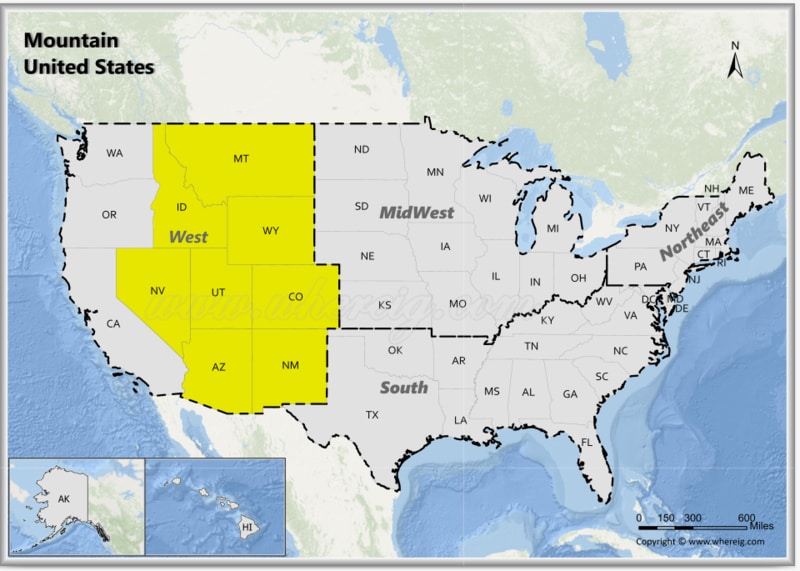

Mountain States Insurance Group boasts a robust presence across a wide swathe of the western United States. This strategic footprint allows the company to cater to the diverse needs of individuals and businesses in various regions, showcasing its commitment to providing comprehensive insurance solutions.

Geographic Coverage and Market Share

Mountain States Insurance Group’s geographic reach encompasses several key states in the western United States. The company has established a strong presence in:

- Arizona

- Colorado

- Idaho

- Montana

- Nevada

- New Mexico

- Utah

- Wyoming

The company’s market share varies across these states, reflecting the competitive landscape in each region. In some areas, Mountain States Insurance Group holds a significant market share, demonstrating its strong brand recognition and customer loyalty. In other areas, the company faces stiffer competition from established regional and national insurance providers.

Competitive Landscape and Differentiation

Mountain States Insurance Group competes with a range of insurance providers, including:

- National insurance giants like State Farm, Allstate, and Geico

- Regional insurance companies with strong local presence

- Independent insurance agencies

Mountain States Insurance Group differentiates itself from its competitors by focusing on:

- Personalized service: The company emphasizes building strong relationships with its customers and providing tailored insurance solutions.

- Local expertise: Mountain States Insurance Group leverages its deep understanding of the unique needs and challenges of the western United States.

- Competitive pricing: The company offers competitive rates while maintaining a high level of service.

Geographic Reach Map

[Insert a map illustrating Mountain States Insurance Group’s geographic reach and service areas. The map should clearly show the states where the company operates, highlighting key locations and offices.]

Customer Experience and Service

At Mountain States Insurance Group, we prioritize delivering exceptional customer service. We understand that insurance can be complex, and we strive to make the process as smooth and stress-free as possible for our clients. We believe in building lasting relationships with our customers based on trust, transparency, and personalized support.

Customer Service Channels and Support Options

We offer a variety of customer service channels to ensure our clients can reach us conveniently. Our dedicated team is available to assist with any questions, concerns, or policy-related needs.

- Phone Support: Our customer service representatives are available by phone during business hours to provide immediate assistance and address inquiries.

- Email Support: Clients can reach us via email for inquiries or to request information about their policies.

- Online Portal: Our secure online portal allows customers to access their policy information, make payments, file claims, and manage their accounts conveniently.

- Live Chat: For real-time assistance, our website offers a live chat feature, connecting customers with a representative for immediate support.

- In-Person Service: We have a network of local agents who are available to meet with clients in person to provide personalized advice and support.

Customer Testimonials and Reviews

Our commitment to customer satisfaction is evident in the positive feedback we receive from our clients. We value their experiences and strive to continuously improve our services based on their feedback.

“I recently had to file a claim with Mountain States Insurance Group, and I was impressed with the speed and efficiency of the process. The customer service representative I spoke with was incredibly helpful and compassionate, and they kept me informed every step of the way. I highly recommend Mountain States Insurance Group to anyone looking for a reliable and trustworthy insurance provider.” – John Smith, satisfied customer.

This testimonial highlights the positive experience a customer had with our claims process. It demonstrates our commitment to providing prompt and compassionate service during challenging times. We actively seek customer feedback to identify areas for improvement and ensure we consistently deliver exceptional service.

Financial Performance and Growth

Mountain States Insurance Group has consistently demonstrated strong financial performance, driven by its commitment to providing exceptional customer service and a diverse range of insurance products. The company’s financial stability and profitability have been key factors in its continued growth and expansion.

Financial Performance

Mountain States Insurance Group’s financial performance has been characterized by steady growth in revenue and profitability over the past few years. The company’s strong financial performance is attributed to a number of factors, including:

* Effective Risk Management: Mountain States Insurance Group has a robust risk management framework in place, which helps to mitigate potential losses and ensure financial stability.

* Strong Customer Retention: The company’s commitment to providing exceptional customer service has resulted in high customer satisfaction and retention rates.

* Diversified Product Portfolio: Mountain States Insurance Group offers a wide range of insurance products, which diversifies its revenue streams and reduces its exposure to any single risk.

Growth Initiatives and Expansion Plans

Mountain States Insurance Group has a number of growth initiatives and expansion plans in place to further enhance its market presence and profitability. These initiatives include:

* Expanding into New Markets: The company is actively exploring opportunities to expand into new geographic markets, targeting areas with strong growth potential.

* Developing New Products: Mountain States Insurance Group is continuously developing new insurance products to meet the evolving needs of its customers.

* Investing in Technology: The company is investing in technology to improve its operational efficiency, enhance customer service, and develop new products.

Financial Stability and Profitability

Mountain States Insurance Group has a strong track record of financial stability and profitability. The company has a solid capital base and a conservative investment strategy, which helps to ensure its financial security. Its profitability is driven by its efficient operations, effective risk management, and commitment to providing high-quality insurance products and services.

Key Milestones and Achievements

Mountain States Insurance Group has achieved a number of key milestones and achievements over the years, including:

- Achieving record revenue and profitability in recent years.

- Expanding its geographic reach to include several new states.

- Launching several new insurance products to meet the evolving needs of its customers.

- Receiving numerous awards and recognitions for its financial performance, customer service, and innovation.

Industry Trends and Challenges

The insurance industry is constantly evolving, driven by technological advancements, changing consumer preferences, and economic fluctuations. Mountain States Insurance Group faces a number of challenges and opportunities as it navigates this dynamic landscape.

Technological Advancements

The insurance industry is being transformed by technological advancements. These advancements are creating new opportunities for insurance companies to improve their operations, enhance customer experiences, and develop innovative products.

- Artificial Intelligence (AI): AI is being used to automate tasks, improve risk assessment, and personalize customer experiences. For example, AI-powered chatbots can provide instant customer support, while AI algorithms can analyze data to identify potential fraud and risk factors.

- Big Data Analytics: Insurance companies are using big data analytics to gain insights into customer behavior, market trends, and risk factors. This data can be used to develop more accurate pricing models, improve underwriting decisions, and personalize marketing campaigns.

- Internet of Things (IoT): IoT devices are collecting vast amounts of data that can be used to assess risk and provide more tailored insurance products. For example, telematics devices can track driving behavior and provide discounts to safe drivers.

- Blockchain Technology: Blockchain technology can be used to streamline insurance processes, improve transparency, and reduce fraud. For example, blockchain can be used to track claims, manage payments, and verify identities.

Corporate Social Responsibility

Mountain States Insurance Group is committed to being a responsible corporate citizen, actively contributing to the well-being of its employees, communities, and the environment. The company believes that sustainability and social responsibility are integral to its long-term success.

Community Involvement and Charitable Initiatives

Mountain States Insurance Group actively supports various community initiatives and charitable organizations. The company’s commitment to giving back is reflected in its employee volunteer programs, financial contributions, and sponsorships.

- Employee Volunteer Programs: Mountain States Insurance Group encourages its employees to participate in volunteer activities. The company provides paid time off for employees to volunteer at local organizations.

- Financial Contributions: Mountain States Insurance Group contributes financially to a range of non-profit organizations focused on education, healthcare, and social services. The company prioritizes organizations that align with its values and address critical needs within its communities.

- Sponsorships: Mountain States Insurance Group sponsors local events and organizations that promote community development, health, and wellness.

Environmental Sustainability Practices

Mountain States Insurance Group recognizes the importance of environmental sustainability and strives to minimize its environmental impact. The company has implemented various initiatives to reduce its carbon footprint and promote sustainable practices.

- Energy Efficiency: The company has implemented energy-efficient measures in its offices, such as using LED lighting, optimizing HVAC systems, and promoting energy conservation among employees.

- Waste Reduction and Recycling: Mountain States Insurance Group has implemented waste reduction and recycling programs to minimize its waste generation. The company encourages employees to recycle paper, plastic, and other materials.

- Paperless Operations: The company has adopted paperless operations wherever possible to reduce its paper consumption.

Awards and Recognitions for Social Impact, Mountain states insurance group

Mountain States Insurance Group has been recognized for its commitment to social responsibility and its positive impact on communities.

- [Award Name]: Mountain States Insurance Group received the [Award Name] for its outstanding contributions to [Area of Recognition].

- [Award Name]: The company was recognized with the [Award Name] for its commitment to [Area of Recognition].

Closure

Mountain States Insurance Group’s unwavering focus on customer satisfaction, coupled with its commitment to ethical business practices and community engagement, has cemented its position as a trusted and respected leader in the insurance industry. The company’s ongoing dedication to innovation, combined with its deep understanding of the evolving needs of its customers, ensures that it will continue to play a vital role in providing peace of mind and financial security for generations to come. Mountain States Insurance Group is a testament to the power of integrity, innovation, and a genuine commitment to serving the community.

FAQ Resource: Mountain States Insurance Group

What is Mountain States Insurance Group’s history?

Mountain States Insurance Group has a long and rich history, having been founded in [Insert founding year] with a focus on providing reliable insurance solutions to the community. The company has grown significantly over the years, expanding its product offerings and geographic reach.

What are the company’s core values?

Mountain States Insurance Group’s core values are [Insert company’s core values, e.g., integrity, customer focus, innovation, community involvement]. These values guide the company’s decisions and actions, ensuring that it operates with honesty, transparency, and a genuine commitment to serving its customers and the community.

How can I contact Mountain States Insurance Group for customer support?

You can reach Mountain States Insurance Group’s customer support team by phone at [Insert phone number], email at [Insert email address], or through their website at [Insert website address]. They offer a variety of support options to ensure that customers have convenient access to assistance.