Missouri State Minimum Car Insurance is a crucial aspect of driving in the Show-Me State. Understanding the requirements, coverage limits, and potential implications is essential for all drivers. Missouri’s fault-based insurance system means that the driver deemed at fault in an accident is typically responsible for covering damages. This can lead to significant financial burdens if you lack sufficient insurance coverage.

This guide will delve into the intricacies of Missouri’s minimum car insurance requirements, explore the factors influencing insurance costs, and provide insights into finding affordable coverage options. We’ll also examine the benefits and drawbacks of additional coverage options to help you make informed decisions about your insurance needs.

Missouri Minimum Car Insurance Requirements: Missouri State Minimum Car Insurance

Missouri law requires all drivers to have a minimum amount of liability insurance to protect themselves and others in case of an accident. This insurance covers the costs of damages or injuries to other people and their property.

Minimum Coverage Requirements

Missouri’s minimum car insurance requirements are Artikeld in the “Financial Responsibility Law.” These requirements ensure that drivers have adequate financial resources to cover the costs of damages or injuries they might cause to others.

- Bodily Injury Liability: This coverage protects you if you injure someone else in an accident. It covers their medical expenses, lost wages, and other related costs. The minimum limit for bodily injury liability is $25,000 per person and $50,000 per accident.

- Property Damage Liability: This coverage protects you if you damage someone else’s property in an accident. It covers the cost of repairs or replacement of the damaged property. The minimum limit for property damage liability is $10,000 per accident.

When Minimum Coverage Might Not Be Enough

While minimum coverage might meet the legal requirements, it might not be sufficient to cover all the expenses in some situations.

- Multiple Injuries: If an accident involves multiple injuries, the minimum bodily injury liability coverage might not be enough to cover the medical expenses of all injured parties.

- Severe Injuries: In cases of serious injuries, such as spinal cord injuries or permanent disabilities, the minimum coverage might not be sufficient to cover the long-term medical care and rehabilitation costs.

- Expensive Vehicles: If you are involved in an accident with a luxury vehicle or a vehicle with significant value, the minimum property damage liability coverage might not be enough to cover the cost of repairs or replacement.

- High-Value Property Damage: If you cause damage to a commercial property or other valuable assets, the minimum property damage liability coverage might not be enough to cover the full cost of repairs or replacement.

Understanding Missouri’s Fault-Based System

Missouri operates under a fault-based insurance system, meaning that the at-fault driver is typically responsible for covering the costs of the accident. This system is designed to hold drivers accountable for their actions on the road and ensure that victims receive compensation for their losses.

The Concept of Negligence in Car Accidents

In a fault-based system, the concept of “negligence” plays a crucial role in determining liability. Negligence refers to a driver’s failure to act as a reasonable and prudent person would in similar circumstances. This can include actions like speeding, driving under the influence of alcohol or drugs, distracted driving, or failing to obey traffic signals. If a driver’s negligence is proven to be the cause of an accident, they are typically held liable for the damages.

Fault-Based Systems vs. No-Fault Systems

Fault-based systems like Missouri’s differ from no-fault systems in how they handle accident claims. In a no-fault system, each driver’s insurance company covers their own medical expenses and lost wages, regardless of who caused the accident. However, fault is still considered when it comes to property damage claims.

- Fault-Based Systems: Drivers who are at fault for an accident are typically responsible for covering the costs of the other driver’s injuries, lost wages, and property damage.

- No-Fault Systems: Each driver’s insurance company covers their own medical expenses and lost wages, regardless of fault. However, fault is still considered when it comes to property damage claims.

Examples of Fault-Based Systems

Many states, including Missouri, operate under a fault-based insurance system. These systems are designed to encourage safe driving by holding drivers accountable for their actions.

“Missouri’s fault-based system is a key aspect of its legal framework for car accidents. Understanding how it works is crucial for navigating the claims process and ensuring fair compensation.”

Factors Influencing Car Insurance Costs in Missouri

In Missouri, your car insurance premiums aren’t a one-size-fits-all proposition. A variety of factors come into play, influencing the cost of your coverage. Understanding these factors can help you make informed decisions about your insurance needs and potentially save money.

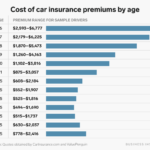

Age and Driving Experience

Insurance companies recognize that younger drivers, especially those with less experience behind the wheel, are statistically more likely to be involved in accidents. As a result, they often charge higher premiums for younger drivers. Conversely, as you gain more experience and age, your premiums tend to decrease. This is because a longer driving history with fewer accidents demonstrates a lower risk profile.

Driving History

Your driving record plays a significant role in determining your car insurance premiums. Accidents, traffic violations, and DUI convictions all increase your risk profile and, consequently, your insurance costs. Maintaining a clean driving record is crucial for keeping your premiums affordable.

Vehicle Type

The type of car you drive is another factor that influences your insurance costs. Factors like the vehicle’s value, safety features, and potential for theft all play a role. For example, a luxury sports car or a vehicle with a high theft rate will generally have higher insurance premiums compared to a basic, reliable sedan.

Location

Where you live in Missouri also impacts your car insurance premiums. Areas with higher crime rates or denser traffic tend to have higher insurance costs. Insurance companies factor in the likelihood of accidents and theft in different regions when setting their rates.

Credit Score

While it may seem surprising, your credit score can also influence your car insurance premiums in Missouri. Insurance companies often use credit scores as a proxy for assessing risk. Individuals with good credit scores are often considered more financially responsible, which can lead to lower insurance premiums.

Coverage Options

The type and amount of coverage you choose can significantly impact your insurance costs. Higher coverage limits, such as for liability or comprehensive coverage, will generally result in higher premiums. However, it’s essential to choose coverage levels that adequately protect you and your assets in case of an accident or other unforeseen events.

Table Comparing Average Insurance Premiums

| Driver Profile | Average Annual Premium |

|---|---|

| Young Driver (18-25) with Clean Record | $1,800 – $2,200 |

| Experienced Driver (30-45) with Clean Record | $1,200 – $1,600 |

| Senior Driver (65+) with Clean Record | $1,000 – $1,400 |

| Driver with Minor Accident or Violation | $1,500 – $2,000 |

| Driver with DUI Conviction | $2,500 – $3,500 |

Note: These are just estimates, and actual premiums can vary depending on specific factors and insurance providers.

Exploring Additional Coverage Options

Missouri’s minimum car insurance requirements provide basic protection, but you might want to consider additional coverage options to enhance your financial security in case of an accident. These optional coverages can help protect you from unexpected expenses and provide peace of mind.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. This coverage is especially important if you have a newer vehicle or a loan on your car.

- Benefit: Covers repairs or replacement costs for your vehicle in an accident, regardless of fault.

- Drawback: You’ll pay a deductible, which is the amount you pay out-of-pocket before the insurance company covers the rest.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, fire, hail, or natural disasters.

- Benefit: Covers damages to your vehicle caused by events other than collisions, like theft, vandalism, or natural disasters.

- Drawback: You’ll pay a deductible, which is the amount you pay out-of-pocket before the insurance company covers the rest.

Uninsured/Underinsured Motorist Coverage (UM/UIM)

UM/UIM coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your losses.

- Benefit: Provides coverage for your medical expenses, lost wages, and property damage if you’re hit by an uninsured or underinsured driver.

- Drawback: It’s an optional coverage, so you’ll need to purchase it separately.

Other Optional Coverages

Other optional coverages you might consider include:

- Rental Reimbursement: Covers the cost of a rental car while your vehicle is being repaired after an accident.

- Medical Payments Coverage (Med Pay): Covers medical expenses for you and your passengers, regardless of who is at fault, up to a certain limit.

- Roadside Assistance: Provides services like towing, flat tire changes, and jump starts.

Table of Additional Coverage Options

| Coverage | Benefit | Drawback | Cost |

|---|---|---|---|

| Collision | Covers repairs or replacement costs for your vehicle in an accident, regardless of fault. | You’ll pay a deductible, which is the amount you pay out-of-pocket before the insurance company covers the rest. | Varies depending on your vehicle, driving history, and other factors. |

| Comprehensive | Covers damages to your vehicle caused by events other than collisions, like theft, vandalism, or natural disasters. | You’ll pay a deductible, which is the amount you pay out-of-pocket before the insurance company covers the rest. | Varies depending on your vehicle, driving history, and other factors. |

| Uninsured/Underinsured Motorist (UM/UIM) | Provides coverage for your medical expenses, lost wages, and property damage if you’re hit by an uninsured or underinsured driver. | It’s an optional coverage, so you’ll need to purchase it separately. | Varies depending on your coverage limits and other factors. |

| Rental Reimbursement | Covers the cost of a rental car while your vehicle is being repaired after an accident. | May have a daily limit on the amount covered. | Varies depending on your coverage limits and other factors. |

| Medical Payments Coverage (Med Pay) | Covers medical expenses for you and your passengers, regardless of who is at fault, up to a certain limit. | May have a per-person limit on the amount covered. | Varies depending on your coverage limits and other factors. |

| Roadside Assistance | Provides services like towing, flat tire changes, and jump starts. | May have a limited number of services per year. | Varies depending on the services included and other factors. |

Finding Affordable Car Insurance in Missouri

Navigating the world of car insurance in Missouri can feel overwhelming, especially when you’re looking for the most affordable option. But don’t worry, there are several strategies you can implement to find a policy that fits your budget without compromising essential coverage.

Comparing Quotes From Multiple Insurers

Comparing quotes from different insurance companies is crucial for finding the best deal. This process allows you to see a wide range of prices and coverage options, giving you a clear picture of what’s available in the market.

- Online Comparison Tools: Many websites, such as those of insurance comparison platforms, allow you to enter your information once and receive quotes from multiple insurers simultaneously. This streamlines the process and saves you time.

- Directly Contacting Insurers: Don’t hesitate to contact insurance companies directly to request quotes. This approach gives you the opportunity to ask specific questions and discuss your individual needs.

- Using a Local Insurance Broker: A broker can act as your intermediary, comparing quotes from various insurers on your behalf. This service can be particularly helpful if you have complex insurance needs or want guidance in navigating the options.

Negotiating Lower Premiums, Missouri state minimum car insurance

Once you’ve gathered quotes, you can use your newfound knowledge to negotiate lower premiums with insurers.

- Highlight Your Driving Record: A clean driving record is a strong bargaining chip. If you have no accidents or traffic violations, insurers are more likely to offer you a lower rate.

- Bundle Your Policies: Many insurers offer discounts for bundling your car insurance with other policies, such as homeowners or renters insurance. This can significantly reduce your overall insurance costs.

- Consider Increasing Your Deductible: A higher deductible means you pay more out of pocket in case of an accident, but it can lead to lower premiums. Carefully weigh the potential cost savings against your financial preparedness for a larger deductible.

- Shop Around Regularly: Don’t assume your current insurer is always offering the best rates. It’s a good idea to shop around every year or two to ensure you’re getting the most competitive price.

Last Word

Navigating the complexities of car insurance in Missouri can be challenging. By understanding the state’s minimum requirements, the impact of a fault-based system, and the factors influencing premiums, you can make informed choices about your insurance coverage. Remember, having adequate insurance can provide peace of mind and financial protection in the event of an accident. Don’t hesitate to compare quotes from multiple insurers and explore additional coverage options to ensure you have the right level of protection for your needs.

FAQ Insights

What are the penalties for driving without car insurance in Missouri?

Driving without the required minimum car insurance in Missouri is illegal and can result in fines, license suspension, and even jail time. The specific penalties may vary depending on the circumstances of the offense.

Can I purchase car insurance online in Missouri?

Yes, many insurance companies in Missouri offer online quote and purchase options. You can compare rates and policies from multiple insurers online and find the best fit for your needs.

How often should I review my car insurance policy?

It’s recommended to review your car insurance policy at least annually, or whenever you experience a significant life change such as a change in driving habits, vehicle ownership, or marital status. This will ensure that your coverage remains adequate and your premiums are competitive.