Missouri State Minimum Auto Insurance sets the stage for understanding the legal requirements for driving in the Show-Me State. This article delves into the essential coverage types and minimum amounts mandated by Missouri law, ensuring you’re protected in case of an accident.

Beyond the legal requirements, we’ll explore additional insurance options that can provide greater peace of mind. Understanding the factors that influence your premiums and finding affordable coverage are key aspects we’ll discuss, helping you navigate the world of auto insurance in Missouri.

Missouri Minimum Auto Insurance Requirements

Missouri law mandates that all drivers carry a minimum amount of auto insurance to protect themselves and others in case of an accident. This requirement helps ensure financial responsibility for damages and injuries caused by car accidents.

Types of Required Coverage

The state of Missouri requires all drivers to carry the following types of auto insurance coverage:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages to the other party if you are at fault in an accident. The minimum required amount is $25,000 per person and $50,000 per accident.

- Property Damage Liability: This coverage pays for damage to the other party’s vehicle or property if you are at fault in an accident. The minimum required amount is $10,000 per accident.

Minimum Coverage Amounts

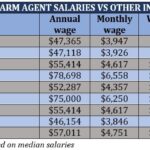

Here is a table summarizing the minimum required coverage amounts for each type of insurance:

| Coverage Type | Minimum Coverage Amount |

|---|---|

| Bodily Injury Liability | $25,000 per person / $50,000 per accident |

| Property Damage Liability | $10,000 per accident |

It is important to note that these are minimum requirements. You may want to consider purchasing higher coverage limits to ensure you are adequately protected in the event of a serious accident.

Understanding Missouri’s Financial Responsibility Law

Missouri’s Financial Responsibility Law is designed to ensure that drivers are financially responsible for any damages or injuries they may cause in an accident. It requires all drivers to maintain a minimum level of auto insurance coverage, which helps protect them and others on the road in the event of an accident.

Penalties for Driving Without Minimum Insurance, Missouri state minimum auto insurance

Driving without the required minimum auto insurance in Missouri is a serious offense that can lead to significant penalties. The consequences of driving without insurance can be severe, including:

- Fines: Drivers found to be operating a vehicle without the required minimum insurance coverage can face substantial fines. The exact amount of the fine may vary depending on the circumstances of the violation.

- License Suspension: The state of Missouri has the authority to suspend the driver’s license of individuals who are found to be driving without the required minimum insurance. This suspension can remain in effect until the driver provides proof of insurance or fulfills the necessary requirements.

- Vehicle Impoundment: In some cases, the vehicle of an uninsured driver may be impounded by law enforcement officials. This action is taken to ensure that the vehicle is not driven without insurance, and it can be a significant inconvenience for the driver.

- Court Costs: If a driver is found guilty of driving without insurance, they may be required to pay court costs in addition to any fines imposed. These costs can include fees for legal representation and other court-related expenses.

Consequences of an Accident Without Adequate Insurance

Being involved in an accident without adequate insurance coverage can have far-reaching consequences for the driver. In addition to the potential penalties for driving without insurance, the driver may face significant financial burdens:

- Liability for Damages: If a driver is found at fault for an accident, they may be held liable for all damages, including medical expenses, property damage, and lost wages. This liability can be substantial, and without insurance, the driver may be personally responsible for paying these costs.

- Legal Action: The injured party in an accident may pursue legal action against the at-fault driver to recover damages. This legal process can be lengthy and expensive, and it can result in significant financial losses for the uninsured driver.

- Credit Score Impact: Failing to pay damages or settle legal claims arising from an accident can have a negative impact on the driver’s credit score. This can make it difficult to obtain loans, credit cards, or other financial products in the future.

- Insurance Premiums: Even if a driver obtains insurance after an accident, their premiums may be significantly higher than those of drivers with a clean record. Insurance companies may view uninsured drivers as higher risks and charge accordingly.

Types of Auto Insurance Coverage Available in Missouri

While Missouri’s minimum auto insurance requirements are designed to protect you from financial ruin in case of an accident, they might not be enough to cover all your potential losses. Many drivers choose to purchase additional coverage for more comprehensive protection.

Types of Auto Insurance Coverage in Missouri

Here’s a look at some of the most common types of auto insurance coverage available in Missouri beyond the minimum requirements.

| Coverage Type | Description | Potential Benefits |

|---|---|---|

| Collision Coverage | Covers damage to your vehicle caused by a collision with another vehicle or object, regardless of who is at fault. | Repairs or replaces your vehicle after an accident, regardless of fault. |

| Comprehensive Coverage | Covers damage to your vehicle caused by events other than collisions, such as theft, vandalism, fire, or natural disasters. | Protects your vehicle from damage caused by non-collision events, ensuring you’re not financially burdened by these unexpected situations. |

| Uninsured/Underinsured Motorist Coverage | Protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage. | Provides financial compensation for injuries or property damage caused by a hit-and-run driver or an uninsured driver, ensuring you’re not left footing the bill. |

| Medical Payments Coverage (Med Pay) | Covers medical expenses for you and your passengers, regardless of who is at fault, up to a certain limit. | Provides immediate financial support for medical expenses following an accident, regardless of fault, ensuring you have access to necessary medical care. |

| Personal Injury Protection (PIP) | Covers medical expenses, lost wages, and other expenses related to injuries sustained in an accident, regardless of fault. | Offers comprehensive financial support for various expenses related to injuries, providing peace of mind knowing your recovery won’t be hampered by financial constraints. |

| Rental Reimbursement Coverage | Covers the cost of renting a vehicle while yours is being repaired after an accident. | Provides a temporary vehicle, ensuring you maintain mobility and convenience during the repair process. |

| Roadside Assistance Coverage | Provides assistance with services such as towing, flat tire changes, and jump starts. | Ensures you’re not stranded in case of a breakdown, offering quick and convenient assistance for common roadside emergencies. |

Factors Influencing Auto Insurance Premiums in Missouri

Your auto insurance premiums in Missouri are influenced by a variety of factors, and understanding these factors can help you make informed decisions to potentially lower your costs. Here’s a detailed look at some of the key considerations:

Driving History

Your driving history is a major factor in determining your auto insurance premiums. A clean driving record with no accidents or violations will generally lead to lower premiums. Conversely, a history of accidents, traffic violations, or even DUI convictions can significantly increase your rates.

- Accidents: Each accident, regardless of fault, is typically recorded on your driving history and can increase your premiums. The severity of the accident also plays a role, with more serious accidents leading to higher increases.

- Traffic Violations: Speeding tickets, reckless driving, and other traffic violations can also raise your premiums. The type of violation and the number of violations you have will affect the impact on your rates.

- DUI Convictions: A DUI conviction can have a significant impact on your insurance premiums, potentially leading to much higher rates or even cancellation of your policy.

Age

Age is another important factor, as younger drivers are statistically more likely to be involved in accidents.

- Teenage Drivers: Newly licensed drivers, particularly teenagers, often face higher premiums due to their lack of experience.

- Older Drivers: While senior drivers often have more experience, they may face higher premiums due to factors like health conditions or declining eyesight.

- Mature Drivers: Drivers in their mid-30s to mid-50s typically enjoy lower premiums, as they are considered to be in a period of lower risk.

Vehicle Type

The type of vehicle you drive plays a significant role in determining your premiums.

- Make and Model: Some car models are more expensive to repair or replace, leading to higher premiums. Sports cars and luxury vehicles are often associated with higher premiums.

- Safety Features: Vehicles with advanced safety features like anti-lock brakes, airbags, and electronic stability control can sometimes qualify for discounts, leading to lower premiums.

- Vehicle Value: The value of your vehicle is also considered. More expensive vehicles typically have higher premiums.

Location

Where you live can impact your premiums due to factors like traffic density, crime rates, and the prevalence of accidents.

- Urban Areas: Drivers in densely populated urban areas often face higher premiums due to increased traffic congestion and higher accident rates.

- Rural Areas: Drivers in rural areas may have lower premiums, as there is typically less traffic and lower accident rates.

Other Factors

- Credit Score: In some states, including Missouri, insurers may use your credit score as a factor in determining your premiums. A good credit score can often lead to lower premiums.

- Driving Habits: Your driving habits, such as the number of miles you drive annually, can also affect your premiums.

- Insurance History: Your insurance history with previous insurers can also be considered. A history of claims or lapses in coverage may lead to higher premiums.

- Discounts: Many insurers offer discounts for factors such as good driving records, safety features, multiple vehicles insured, and bundling insurance policies.

Finding Affordable Auto Insurance in Missouri

Finding the right auto insurance policy in Missouri can be challenging, especially when trying to balance coverage needs with budget constraints. Fortunately, several strategies can help you secure affordable auto insurance while ensuring adequate protection.

Comparing Insurance Providers and Their Coverage Offerings

Understanding the different insurance providers and their coverage offerings is crucial when searching for affordable auto insurance.

- Large National Insurance Companies: Companies like State Farm, Geico, and Progressive offer extensive coverage options and may provide competitive rates, especially for drivers with good driving records. However, their policies might not be as flexible or personalized as those offered by smaller, regional insurers.

- Regional and Local Insurance Companies: Smaller, regional insurance companies often cater to specific demographics and may offer more personalized policies and potentially lower rates for certain drivers. These companies might have a more localized understanding of risk factors and can offer more competitive rates for drivers in specific areas.

- Direct-to-Consumer Insurance Companies: These companies, such as Esurance and Lemonade, operate entirely online, often offering competitive rates due to lower overhead costs. However, their customer service and claims handling processes might differ from traditional insurance companies.

Benefits of Shopping Around and Obtaining Multiple Quotes

Shopping around and obtaining multiple quotes from different insurance providers is essential for finding the most affordable auto insurance.

- Competitive Pricing: Comparing quotes from multiple providers allows you to identify the best rates for your specific needs. Different companies use varying pricing algorithms, so one company might offer a better rate than another based on your individual risk profile.

- Customization Options: Obtaining multiple quotes can help you understand the different coverage options available and tailor a policy that meets your specific needs and budget. This can help you avoid paying for unnecessary coverage and potentially save money.

- Negotiation Power: Having multiple quotes in hand can give you leverage to negotiate with insurance providers. You can use these quotes to highlight the best rates you’ve found and potentially negotiate a lower rate with your preferred provider.

Final Conclusion: Missouri State Minimum Auto Insurance

By understanding the Missouri State Minimum Auto Insurance requirements and exploring available options, you can make informed decisions about your coverage. Remember, protecting yourself and others on the road is crucial, and having adequate insurance is a vital step towards responsible driving.

Detailed FAQs

What happens if I get into an accident without the required minimum insurance?

You could face serious consequences, including fines, license suspension, and even jail time. You’ll also be responsible for covering any damages or injuries you cause, potentially leading to significant financial burdens.

How often should I review my auto insurance policy?

It’s wise to review your policy annually, or even more frequently if you experience significant life changes, such as a new vehicle, a change in driving habits, or a move to a new location. These changes can impact your premiums and coverage needs.

What are some tips for finding affordable auto insurance in Missouri?

Shop around for quotes from multiple insurers, consider increasing your deductible, maintain a good driving record, and explore discounts offered by your insurer. Bundling your auto and home insurance can also lead to savings.