Minimum liability insurance by state is a crucial aspect of responsible driving. It serves as a financial safety net, protecting you and others from the potentially devastating consequences of accidents. Understanding your state’s minimum requirements is essential, as failing to comply can lead to significant financial penalties and legal ramifications.

The minimum liability insurance requirements vary significantly from state to state, reflecting factors such as population density, accident rates, and the cost of living. Understanding these differences can help you make informed decisions about your insurance coverage and ensure you have adequate protection on the road.

Understanding Minimum Liability Insurance Requirements

Minimum liability insurance is a legal requirement in all states, designed to protect you financially in case you cause an accident that results in injury or property damage to others. It helps cover the costs of medical expenses, lost wages, and property repairs for the other party involved.

Minimum Liability Insurance Coverage Types

Minimum liability insurance typically includes several types of coverage, each addressing different aspects of an accident. These coverages are essential to ensure you are financially protected and meet the legal requirements in your state.

State-Specific Minimum Liability Insurance Requirements

Understanding the specific minimum liability insurance requirements in your state is crucial. These requirements can vary significantly, so it’s essential to check with your state’s Department of Motor Vehicles (DMV) or an insurance agent for accurate information.

The table below provides a general overview of the minimum liability insurance requirements for each state. It includes the minimum coverage amounts for bodily injury liability, property damage liability, and uninsured/underinsured motorist coverage. However, it is important to note that these requirements may change, so it is always best to consult with your state’s DMV or an insurance agent for the most up-to-date information.

| State | Bodily Injury Liability per Person | Bodily Injury Liability per Accident | Property Damage Liability | Uninsured/Underinsured Motorist Coverage |

|---|---|---|---|---|

| Alabama | $25,000 | $50,000 | $25,000 | $25,000/$50,000 |

| Alaska | $50,000 | $100,000 | $25,000 | $50,000/$100,000 |

| Arizona | $25,000 | $50,000 | $15,000 | $25,000/$50,000 |

| Arkansas | $25,000 | $50,000 | $25,000 | $25,000/$50,000 |

| California | $15,000 | $30,000 | $5,000 | $15,000/$30,000 |

| Colorado | $25,000 | $50,000 | $15,000 | $25,000/$50,000 |

| Connecticut | $20,000 | $40,000 | $10,000 | $20,000/$40,000 |

| Delaware | $30,000 | $60,000 | $10,000 | $30,000/$60,000 |

| Florida | $10,000 | $20,000 | $10,000 | $10,000/$20,000 |

| Georgia | $25,000 | $50,000 | $25,000 | $25,000/$50,000 |

| Hawaii | $20,000 | $40,000 | $10,000 | $20,000/$40,000 |

| Idaho | $25,000 | $50,000 | $15,000 | $25,000/$50,000 |

| Illinois | $20,000 | $40,000 | $15,000 | $20,000/$40,000 |

| Indiana | $25,000 | $50,000 | $10,000 | $25,000/$50,000 |

| Iowa | $20,000 | $40,000 | $15,000 | $20,000/$40,000 |

| Kansas | $25,000 | $50,000 | $10,000 | $25,000/$50,000 |

| Kentucky | $25,000 | $50,000 | $10,000 | $25,000/$50,000 |

| Louisiana | $15,000 | $30,000 | $10,000 | $15,000/$30,000 |

| Maine | $50,000 | $100,000 | $25,000 | $50,000/$100,000 |

| Maryland | $30,000 | $60,000 | $15,000 | $30,000/$60,000 |

| Massachusetts | $20,000 | $40,000 | $5,000 | $20,000/$40,000 |

| Michigan | $20,000 | $40,000 | $10,000 | $20,000/$40,000 |

| Minnesota | $30,000 | $60,000 | $10,000 | $30,000/$60,000 |

| Mississippi | $25,000 | $50,000 | $25,000 | $25,000/$50,000 |

| Missouri | $25,000 | $50,000 | $10,000 | $25,000/$50,000 |

| Montana | $25,000 | $50,000 | $25,000 | $25,000/$50,000 |

| Nebraska | $25,000 | $50,000 | $25,000 | $25,000/$50,000 |

| Nevada | $25,000 | $50,000 | $25,000 | $25,000/$50,000 |

| New Hampshire | $25,000 | $50,000 | $25,000 | $25,000/$50,000 |

| New Jersey | $15,000 | $30,000 | $5,000 | $15,000/$30,000 |

| New Mexico | $25,000 | $50,000 | $10,000 | $25,000/$50,000 |

| New York | $25,000 | $50,000 | $10,000 | $25,000/$50,000 |

| North Carolina | $30,000 | $60,000 | $25,000 | $30,000/$60,000 |

| North Dakota | $25,000 | $50,000 | $25,000 | $25,000/$50,000 |

| Ohio | $25,000 | $50,000 | $25,000 | $25,000/$50,000 |

| Oklahoma | $25,000 | $50,000 | $10,000 | $25,000/$50,000 |

| Oregon | $25,000 | $50,000 | $20,000 | $25,000/$50,000 |

| Pennsylvania | $15,000 | $30,000 | $5,000 | $15,000/$30,000 |

| Rhode Island | $25,000 | $50,000 | $25,000 | $25,000/$50,000 |

| South Carolina | $25,000 | $50,000 | $25,000 | $25,000/$50,000 |

| South Dakota | $25,000 | $50,000 | $25,000 | $25,000/$50,000 |

| Tennessee | $25,000 | $50,000 | $25,000 | $25,000/$50,000 |

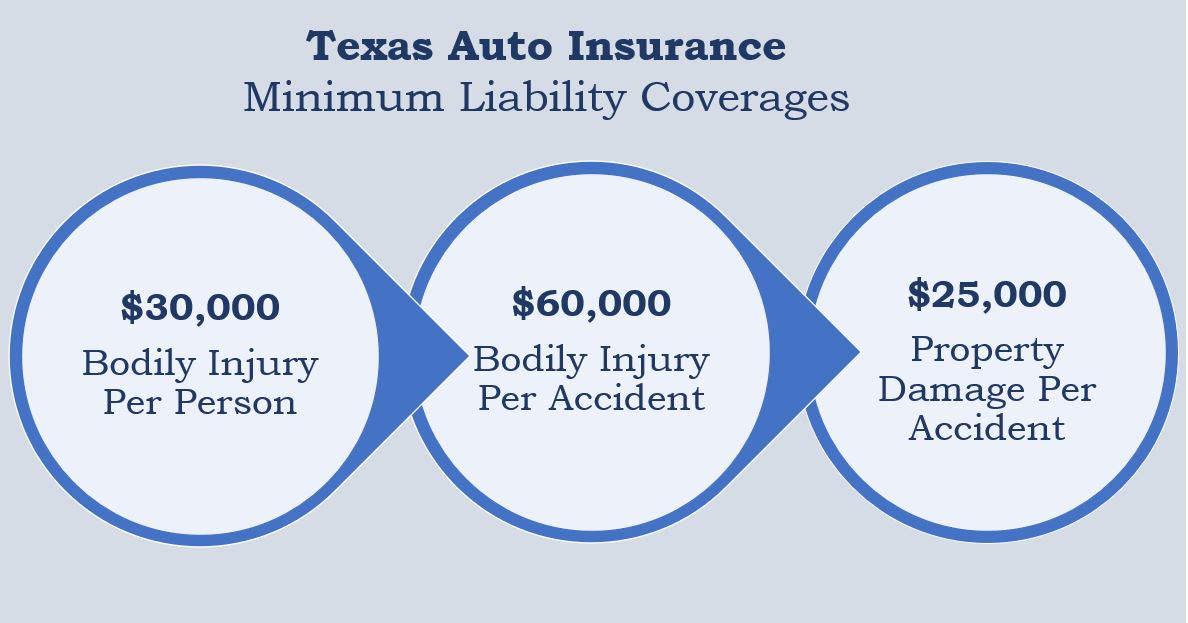

| Texas | $30,000 | $60,000 | $25,000 | $30,000/$60,000 |

| Utah | $25,000 | $65,000 | $15,000 | $25,000/$65,000 |

| Vermont | $25,000 | $50,000 | $10,000 | $25,000/$50,000 |

| Virginia | $25,000 | $50,000 | $20,000 | $25,000/$50,000 |

| Washington | $25,000 | $50,000 | $10,000 | $25,000/$50,000 |

| West Virginia | $25,000 | $50,000 | $10,000 | $25,000/$50,000 |

| Wisconsin | $25,000 | $50,000 | $10,000 | $25,000/$50,000 |

| Wyoming | $25,000 | $50,000 | $25,000 | $25,000/$50,000 |

Factors Influencing Minimum Liability Insurance

Minimum liability insurance requirements are not static. They are influenced by a variety of factors, including population density, accident rates, and the cost of living. These factors are interconnected and play a significant role in shaping the minimum coverage levels mandated by each state.

Population Density and Accident Rates

Population density and accident rates are directly correlated. Higher population density typically leads to more vehicles on the road, increasing the likelihood of accidents. Urban areas, with their denser populations and heavy traffic, generally experience higher accident rates compared to rural areas. This correlation is reflected in minimum liability insurance requirements, with urban states often requiring higher coverage levels to compensate for the increased risk of accidents.

Cost of Living and Insurance Premiums

The cost of living in a particular state influences the overall cost of insurance, including minimum liability coverage. States with a higher cost of living tend to have higher insurance premiums due to factors like higher medical costs and vehicle repair expenses. This higher cost of living, in turn, can influence minimum liability requirements. States with a higher cost of living may mandate higher minimum coverage to ensure adequate compensation for accident victims.

Urban vs. Rural Minimum Liability Requirements

The differences in minimum liability requirements between urban and rural areas can be attributed to the factors discussed above. Urban areas, with their higher population density and accident rates, typically have higher minimum liability requirements compared to rural areas. For instance, states with major metropolitan cities may have higher minimum liability limits for bodily injury and property damage than states with predominantly rural populations.

Consequences of Driving Without Minimum Liability Insurance

Driving without the required minimum liability insurance can have serious consequences, impacting your finances, driving privileges, and even your freedom. It is crucial to understand these consequences and ensure you are properly insured to avoid facing these challenges.

Financial Implications

Driving without insurance can result in significant financial repercussions. You could face fines, penalties, and potentially substantial legal costs.

- Fines and Penalties: Each state has its own set of fines and penalties for driving without insurance. These can range from hundreds to thousands of dollars, depending on the state and the number of offenses. For example, in California, a first offense can result in a fine of over $1,000 and a suspension of your driver’s license.

- Legal Costs: If you are involved in an accident without insurance, you could be held personally liable for all damages and injuries caused. This could lead to significant legal costs, including attorney fees, court fees, and potentially substantial settlements or judgments against you. Imagine being involved in a car accident where you are at fault. Without insurance, you could be responsible for medical bills, vehicle repairs, and even lost wages for the other driver, putting you in a financially devastating situation.

Impact on Driving Privileges, Minimum liability insurance by state

Driving without insurance can have a severe impact on your driving privileges. States have strict measures in place to discourage driving without insurance, including license suspension and even vehicle impoundment.

- License Suspension: Many states automatically suspend the driver’s license of individuals caught driving without insurance. This suspension can last for a specified period, and you may need to pay reinstatement fees and complete other requirements to regain your driving privileges. This can significantly disrupt your daily life, making it difficult to get to work, school, or handle other essential errands.

- Vehicle Impoundment: In some cases, your vehicle may be impounded until you provide proof of insurance. This means you will have to pay towing and storage fees, adding to your financial burden. Imagine your car being towed away and having to pay substantial fees to get it back, all because you were driving without insurance.

Choosing the Right Liability Coverage: Minimum Liability Insurance By State

While minimum liability insurance is legally required, it’s crucial to understand that it might not be enough to protect you financially in the event of a serious accident. Exceeding the minimum requirements can provide significantly more coverage and peace of mind.

Choosing the right liability coverage involves carefully considering your individual risk factors and financial situation. The amount of coverage you need will depend on various factors, including your driving habits, the value of your assets, and your potential exposure to lawsuits.

Assessing Personal Risk Factors

Understanding your individual risk factors is essential for determining the appropriate liability coverage level.

- Driving History: Drivers with a history of accidents or traffic violations may face a higher risk of future incidents, making higher liability coverage more crucial.

- Vehicle Type: Driving a larger or more expensive vehicle often increases the potential for greater damage in an accident, making higher liability coverage more beneficial.

- Driving Habits: Drivers who frequently drive in congested areas or during rush hour may encounter more potential accidents, emphasizing the importance of adequate liability coverage.

- Personal Assets: The value of your assets, including your home, savings, and investments, can be at risk in a lawsuit arising from an accident. Higher liability limits can protect your assets from being seized to cover damages.

Benefits of Higher Liability Limits

Choosing higher liability limits offers several benefits that can significantly enhance your financial security.

- Increased Financial Protection: Higher liability limits provide a greater financial cushion in the event of a serious accident, protecting your assets from potential lawsuits and judgments.

- Peace of Mind: Knowing you have adequate liability coverage can offer significant peace of mind, reducing the stress and worry associated with potential accidents.

- Reduced Risk of Financial Ruin: In a severe accident, insufficient liability coverage can lead to financial ruin. Higher limits help mitigate this risk, safeguarding your financial stability.

- Potential Savings in the Long Run: While higher liability limits may result in slightly higher premiums, they can save you significantly in the long run by protecting you from substantial financial losses in the event of a serious accident.

Resources and Additional Information

Navigating the world of minimum liability insurance can be complex. To ensure you have a comprehensive understanding of your state’s requirements and options, it’s crucial to access reliable resources. This section provides you with a curated list of valuable resources, including state insurance departments, insurance comparison websites, and consumer advocacy organizations.

State Insurance Departments

State insurance departments are the primary regulatory bodies responsible for overseeing insurance companies and ensuring consumer protection. These departments provide a wealth of information on minimum liability insurance requirements, including specific coverage limits, filing complaints, and understanding your rights.

| State | Department Name | Website | Contact Information |

|---|---|---|---|

| Alabama | Alabama Department of Insurance | https://www.doi.alabama.gov/ | (334) 242-5770 |

| Alaska | Alaska Department of Commerce, Community, and Economic Development | https://commerce.alaska.gov/web/portals/0/files/pdf/Insurance/Insurance-Brochure.pdf | (907) 465-2500 |

| Arizona | Arizona Department of Insurance | https://www.azinsurance.gov/ | (602) 255-5600 |

| Arkansas | Arkansas Department of Insurance | https://www.insurance.arkansas.gov/ | (501) 682-2000 |

| California | California Department of Insurance | https://www.insurance.ca.gov/ | (800) 927-4357 |

| Colorado | Colorado Division of Insurance | https://www.insurance.colorado.gov/ | (303) 894-7499 |

| Connecticut | Connecticut Insurance Department | https://portal.ct.gov/cid | (860) 297-3900 |

| Delaware | Delaware Department of Insurance | https://ddoi.delaware.gov/ | (302) 577-8383 |

| Florida | Florida Office of Insurance Regulation | https://www.floir.com/ | (877) 927-4357 |

| Georgia | Georgia Department of Insurance | https://www.oci.ga.gov/ | (404) 656-2070 |

| Hawaii | Hawaii Department of Commerce and Consumer Affairs | https://cca.hawaii.gov/insurance/ | (808) 586-2780 |

| Idaho | Idaho Department of Insurance | https://doi.idaho.gov/ | (208) 334-2200 |

| Illinois | Illinois Department of Insurance | https://www.insurance.illinois.gov/ | (217) 782-4515 |

| Indiana | Indiana Department of Insurance | https://www.idoi.in.gov/ | (317) 232-2395 |

| Iowa | Iowa Insurance Division | https://www.iid.iowa.gov/ | (515) 281-5705 |

| Kansas | Kansas Insurance Department | https://www.ksinsurance.org/ | (785) 296-3070 |

| Kentucky | Kentucky Department of Insurance | https://www.ky.gov/agencies/kdoi/Pages/default.aspx | (502) 564-3070 |

| Louisiana | Louisiana Department of Insurance | https://ldi.la.gov/ | (225) 326-5300 |

| Maine | Maine Bureau of Insurance | https://www.maine.gov/insurance/ | (207) 624-8477 |

| Maryland | Maryland Insurance Administration | https://insurance.maryland.gov/ | (410) 468-2480 |

| Massachusetts | Massachusetts Division of Insurance | https://www.mass.gov/orgs/division-of-insurance | (617) 521-7794 |

| Michigan | Michigan Department of Insurance and Financial Services | https://www.michigan.gov/difs | (877) 999-6442 |

| Minnesota | Minnesota Department of Commerce | https://mn.gov/commerce/ | (651) 539-1500 |

| Mississippi | Mississippi Department of Insurance | https://www.mid.ms.gov/ | (601) 359-1000 |

| Missouri | Missouri Department of Commerce and Insurance | https://www.insurance.mo.gov/ | (573) 751-4126 |

| Montana | Montana Department of Insurance | https://doi.mt.gov/ | (406) 444-2440 |

| Nebraska | Nebraska Department of Insurance | https://doi.nebraska.gov/ | (402) 471-2201 |

| Nevada | Nevada Division of Insurance | https://doi.nv.gov/ | (702) 486-4270 |

| New Hampshire | New Hampshire Insurance Department | https://www.nh.gov/insurance/ | (603) 271-2261 |

| New Jersey | New Jersey Department of Banking and Insurance | https://www.nj.gov/dobi/ | (609) 292-5500 |

| New Mexico | New Mexico Superintendent of Insurance | https://www.osi.state.nm.us/ | (505) 476-4885 |

| New York | New York State Department of Financial Services | https://dfs.ny.gov/ | (212) 480-6400 |

| North Carolina | North Carolina Department of Insurance | https://www.ncdoi.gov/ | (919) 807-6800 |

| North Dakota | North Dakota Department of Insurance | https://www.nd.gov/dmr/insurance | (701) 328-2400 |

| Ohio | Ohio Department of Insurance | https://insurance.ohio.gov/ | (614) 644-2000 |

| Oklahoma | Oklahoma Insurance Department | https://oid.ok.gov/ | (405) 521-2385 |

| Oregon | Oregon Department of Consumer and Business Services | https://www.oregon.gov/dcbs/Pages/index.aspx | (503) 945-8000 |

| Pennsylvania | Pennsylvania Department of Insurance | https://www.insurance.pa.gov/ | (800) 847-7825 |

| Rhode Island | Rhode Island Department of Business Regulation | https://dbr.ri.gov/ | (401) 222-2300 |

| South Carolina | South Carolina Department of Insurance | https://www.doi.sc.gov/ | (803) 737-6100 |

| South Dakota | South Dakota Department of Insurance | https://dos.sd.gov/insurance/ | (605) 773-3563 |

| Tennessee | Tennessee Department of Commerce and Insurance | https://www.tn.gov/commerce/insurance/ | (615) 741-2244 |

| Texas | Texas Department of Insurance | https://www.tdi.texas.gov/ | (800) 252-3439 |

| Utah | Utah Insurance Department | https://insurance.utah.gov/ | (801) 530-6600 |

| Vermont | Vermont Department of Financial Regulation | https://dfr.vermont.gov/ | (802) 828-3300 |

| Virginia | Virginia Bureau of Insurance | https://www.scc.virginia.gov/boi/ | (804) 371-9000 |

| Washington | Washington State Office of the Insurance Commissioner | https://www.insurance.wa.gov/ | (360) 684-4600 |

| West Virginia | West Virginia Department of Insurance | https://www.wvinsurance.gov/ | (304) 558-3280 |

| Wisconsin | Wisconsin Office of the Commissioner of Insurance | https://oci.wi.gov/ | (608) 266-3585 |

| Wyoming | Wyoming Department of Insurance | https://insurance.wyo.gov/ | (307) 777-7401 |

Additional Resources

Beyond state insurance departments, several other valuable resources can provide you with information and guidance on minimum liability insurance.

- Insurance Comparison Websites: Websites like Policygenius, The Zebra, and Insurify allow you to compare quotes from multiple insurance providers, helping you find the best coverage at the most competitive price. These platforms often provide comprehensive information on state-specific requirements and coverage options.

- Consumer Advocacy Organizations: Organizations like the National Association of Insurance Commissioners (NAIC) and the Consumer Federation of America (CFA) advocate for consumer protection in the insurance industry. They provide valuable resources, including educational materials, complaint filing procedures, and information on your rights as an insured individual.

- Insurance Agents and Brokers: Licensed insurance agents and brokers can provide personalized advice and guidance on choosing the right liability insurance coverage. They can help you understand your state’s requirements, evaluate your specific needs, and compare different insurance policies.

End of Discussion

Driving without minimum liability insurance can be a costly mistake, leaving you vulnerable to financial ruin and legal trouble. By understanding your state’s requirements and ensuring you have adequate coverage, you can protect yourself, your finances, and your driving privileges. Remember, it’s always better to be safe than sorry when it comes to insurance, so consider exceeding the minimum requirements for peace of mind and comprehensive protection.

Detailed FAQs

What happens if I get into an accident without minimum liability insurance?

You could face serious financial consequences, including fines, penalties, and legal costs. You may also be responsible for covering the costs of damages and injuries to other parties involved in the accident.

How can I find out the minimum liability insurance requirements in my state?

You can contact your state’s Department of Motor Vehicles or visit their website for information on insurance requirements. You can also consult with an insurance agent or use online insurance comparison websites.

What are the different types of coverage included in minimum liability insurance?

Minimum liability insurance typically includes bodily injury liability, property damage liability, and uninsured/underinsured motorist coverage. These coverages protect you from financial losses resulting from accidents you cause.

Can I be penalized for having insurance coverage below the minimum requirements?

Yes, you can be penalized for having insurance coverage below the minimum requirements in your state. It’s crucial to ensure that your insurance policy meets or exceeds the minimum limits.

What are the benefits of exceeding minimum liability insurance requirements?

Exceeding minimum liability insurance requirements can provide greater financial protection and peace of mind. It can help you avoid financial hardship and legal troubles in the event of a serious accident.