Maryland state car insurance plays a vital role in safeguarding drivers and their vehicles on the roads. Understanding the state’s regulations, coverage requirements, and available discounts is essential for obtaining the right insurance policy at an affordable price. This guide will provide you with a comprehensive overview of Maryland car insurance, helping you navigate the complexities of this crucial aspect of driving.

From the mandatory coverages to the various types of policies available, we will explore the key factors that influence your insurance costs and guide you through the process of choosing the right policy to meet your specific needs. We will also delve into the top insurance providers in Maryland, their strengths and weaknesses, and the benefits of working with local or national companies.

Maryland Car Insurance Overview

Maryland’s car insurance market is regulated by the Maryland Insurance Administration (MIA), which ensures fair and competitive pricing while safeguarding consumer interests. The state mandates specific coverage requirements, and understanding these regulations is crucial for all Maryland drivers.

Mandatory Coverage Requirements

Maryland law requires all drivers to carry certain types of car insurance coverage to protect themselves and others in the event of an accident. These mandatory coverages are:

- Liability Coverage: This coverage protects you financially if you cause an accident that results in injuries or damage to another person or their property. It is typically expressed as a limit, such as 20/40/15, which means you have $20,000 in coverage for bodily injury per person, $40,000 for total bodily injury per accident, and $15,000 for property damage per accident.

- Personal Injury Protection (PIP): This coverage, also known as “no-fault” insurance, pays for your medical expenses and lost wages, regardless of who is at fault in an accident. Maryland law requires a minimum of $2,500 in PIP coverage, but you can purchase higher limits.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient coverage. It pays for your medical expenses, lost wages, and property damage. Maryland law requires UM/UIM coverage equal to your liability limits, but you can purchase higher limits.

Average Car Insurance Costs and Influencing Factors

The average cost of car insurance in Maryland varies depending on several factors, including:

- Driving History: Drivers with a history of accidents, traffic violations, or DUIs will typically pay higher premiums. Maintaining a clean driving record is essential to keeping your insurance costs down.

- Age and Gender: Younger and inexperienced drivers generally face higher premiums due to their higher risk of accidents. However, premiums tend to decrease as drivers gain experience and age.

- Vehicle Type and Value: The type and value of your vehicle play a significant role in your insurance costs. Luxury cars, sports cars, and vehicles with high repair costs will typically have higher premiums.

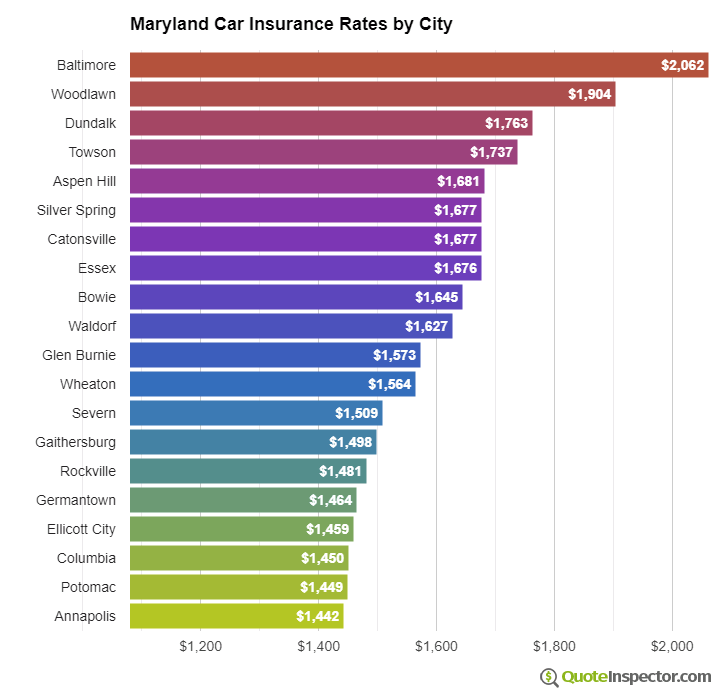

- Location: Car insurance rates can vary depending on the location of your residence. Areas with higher crime rates or traffic congestion may have higher premiums.

- Credit Score: In many states, including Maryland, insurance companies use credit scores to assess risk and determine premiums. Drivers with good credit scores generally receive lower rates.

- Coverage Limits: Choosing higher coverage limits will generally increase your premiums. However, higher limits provide greater financial protection in the event of an accident.

Choosing the Right Maryland Car Insurance

Choosing the right car insurance policy is crucial for protecting yourself financially in case of an accident. In Maryland, you have a variety of options to consider, each with its own benefits and drawbacks.

Types of Car Insurance Policies in Maryland

Maryland law requires all drivers to carry at least a minimum amount of liability insurance, which covers damages to other people and their property in an accident you cause. However, you can purchase additional coverage to protect yourself further. Here’s a comparison of different types of car insurance policies available in Maryland:

| Policy Type | Coverage | Description |

|---|---|---|

| Liability Insurance | Bodily Injury Liability (BIL) and Property Damage Liability (PDL) | Covers injuries and damages to others in an accident you cause. |

| Collision Coverage | Damage to your vehicle | Covers repairs or replacement of your vehicle in an accident, regardless of fault. |

| Comprehensive Coverage | Damage to your vehicle from non-accident events | Covers damage to your vehicle from theft, vandalism, fire, natural disasters, and other non-accident events. |

| Uninsured/Underinsured Motorist Coverage (UM/UIM) | Injuries and damages caused by a hit-and-run driver or a driver with insufficient insurance | Protects you and your passengers in case you’re involved in an accident with an uninsured or underinsured driver. |

| Medical Payments Coverage (Med Pay) | Medical expenses for you and your passengers | Covers medical expenses for you and your passengers, regardless of fault, up to a certain limit. |

| Personal Injury Protection (PIP) | Medical expenses and lost wages for you and your passengers | Provides coverage for medical expenses and lost wages for you and your passengers, regardless of fault. |

Choosing the Right Policy

Choosing the right car insurance policy involves considering your individual needs and circumstances. Here’s a step-by-step guide to help you make an informed decision:

- Assess Your Risk: Consider your driving history, the type of vehicle you drive, and your driving habits. If you have a history of accidents or violations, you may need higher coverage limits.

- Determine Your Budget: Set a realistic budget for your car insurance premiums. Consider factors like your income and expenses.

- Research Coverage Options: Research different types of car insurance policies and their coverage limits. Understand the different types of coverage available, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Compare Quotes: Get quotes from multiple insurance companies to compare prices and coverage options. Use online comparison tools or contact insurance agents directly.

- Review Your Policy: Once you’ve chosen a policy, carefully review the terms and conditions. Ensure you understand the coverage limits, deductibles, and exclusions.

Factors to Consider When Choosing a Policy

Several factors play a crucial role in determining the right car insurance policy for you. Here are some important considerations:

- Driving History: Your driving history significantly impacts your insurance premiums. Drivers with a clean record typically pay lower premiums than those with accidents or violations.

- Vehicle Type: The type of vehicle you drive also affects your insurance rates. High-performance or luxury vehicles generally have higher insurance premiums due to their higher repair costs and potential for higher claims.

- Coverage Limits: Coverage limits determine the maximum amount your insurance company will pay for specific types of claims. It’s crucial to choose limits that adequately protect you and your assets.

- Deductibles: Deductibles are the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles generally lead to lower premiums, while lower deductibles result in higher premiums.

- Discounts: Insurance companies offer various discounts to reduce premiums. These discounts can include safe driver discounts, good student discounts, and multi-policy discounts.

Top Car Insurance Providers in Maryland

Finding the right car insurance provider can be a daunting task, especially in a state like Maryland with a diverse range of options. This section will delve into some of the top car insurance providers in Maryland, highlighting their strengths and weaknesses, and providing insights into their pricing, features, and customer service.

Top Car Insurance Providers in Maryland

Maryland has a robust car insurance market, with both national and regional players vying for your business. Here’s a look at some of the top providers:

- GEICO: GEICO is known for its competitive pricing and comprehensive coverage options. They offer a wide range of discounts, including good driver, multi-car, and military discounts. GEICO also boasts a user-friendly online platform and a strong customer service reputation.

- State Farm: State Farm is another major player in the car insurance market, known for its strong financial stability and extensive network of agents. They offer a wide range of coverage options, including comprehensive and collision coverage, as well as discounts for good drivers, safe driving courses, and bundling with other insurance products.

- Progressive: Progressive is known for its innovative approach to car insurance, including its “Name Your Price” tool that allows customers to set their desired premium and then find coverage options that match. They also offer a variety of discounts, including good driver, multi-car, and safe driver discounts.

- Allstate: Allstate is a well-established car insurance provider known for its strong customer service and a variety of coverage options. They offer discounts for good drivers, multi-car policies, and bundling with other insurance products.

- USAA: USAA is a military-focused insurance provider known for its competitive rates and excellent customer service. They offer a wide range of coverage options and discounts, including good driver, multi-car, and military discounts. However, USAA membership is limited to military personnel and their families.

Local vs. National Insurance Companies

Choosing between a local and national insurance company often comes down to personal preference and priorities.

- Local insurance companies often provide more personalized service and a deeper understanding of the local market. They may also be more responsive to local needs and concerns. However, they may have limited coverage options or less financial stability than national companies.

- National insurance companies typically offer a wider range of coverage options, greater financial stability, and more extensive customer service networks. However, they may lack the personalized touch of local companies and may not be as responsive to local needs.

Understanding Maryland Car Insurance Discounts

Saving money on your Maryland car insurance is possible by taking advantage of the various discounts offered by insurance companies. These discounts can significantly reduce your premium, making car insurance more affordable.

Types of Maryland Car Insurance Discounts

Discounts are offered based on various factors, including your driving history, vehicle safety features, and policy choices. Here are some common discounts available in Maryland:

- Good Driver Discount: This discount is offered to drivers with a clean driving record, demonstrating responsible driving habits. Typically, you need to be accident-free for a specific period, often three to five years, to qualify.

- Safe Driver Discount: This discount is awarded to drivers who have completed defensive driving courses or have a good driving record, often with no accidents or traffic violations.

- Multi-Car Discount: Insuring multiple vehicles with the same insurance company can earn you a discount. The more vehicles you insure, the higher the discount.

- Multi-Policy Discount: Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can also result in significant savings.

- Good Student Discount: This discount is available to students who maintain a good academic record, typically a GPA of 3.0 or higher. This discount encourages safe driving among young drivers and recognizes their commitment to education.

- Anti-theft Device Discount: Installing anti-theft devices, such as alarms or GPS tracking systems, can make your car less appealing to thieves and reduce your insurance premium.

- Vehicle Safety Feature Discount: Cars equipped with safety features like anti-lock brakes, airbags, and electronic stability control can qualify for discounts.

- Loyalty Discount: Insurers often reward long-term customers with loyalty discounts for their continued business.

Maximizing Car Insurance Discounts

To maximize your car insurance discounts, consider the following:

- Maintain a Safe Driving Record: Avoid accidents and traffic violations, as a clean driving record is crucial for many discounts.

- Complete Defensive Driving Courses: These courses can help you improve your driving skills and qualify for discounts.

- Bundle Your Policies: Combining your car insurance with other policies like homeowners or renters insurance can significantly reduce your overall premium.

- Invest in Vehicle Safety Features: Installing anti-theft devices or purchasing a car with advanced safety features can lead to discounts.

- Shop Around: Compare quotes from different insurance companies to find the best rates and discounts.

Potential Savings with Discounts

The amount of savings you can achieve through discounts varies depending on your specific circumstances and the insurance company. However, discounts can significantly impact your overall premium. For example, a good driver discount can reduce your premium by 10-20%, while bundling your policies can save you 15-25%.

Filing a Car Insurance Claim in Maryland

Filing a car insurance claim in Maryland can be a stressful experience, but understanding the process and your rights can help make it smoother. This section will guide you through the steps involved in filing a claim, including the necessary documentation, timelines, and how to resolve any disputes.

The Process for Filing a Car Insurance Claim in Maryland, Maryland state car insurance

When you’re involved in an accident, the first step is to contact your insurance company as soon as possible. They will guide you through the claims process and provide you with a claim number. It’s important to gather all the necessary documentation, including:

- Police report

- Photos of the damage to your vehicle and the accident scene

- Contact information for all parties involved

- Your insurance policy information

- Medical records if you sustained injuries

Once you’ve gathered the necessary information, you can submit your claim to your insurance company. The timeline for processing a claim varies depending on the complexity of the case and the insurance company. However, you can expect to receive a response from your insurance company within a reasonable timeframe.

The Role of the Maryland Insurance Administration in Handling Claims Disputes

If you have a dispute with your insurance company regarding your claim, the Maryland Insurance Administration (MIA) can help. The MIA is a state agency that regulates the insurance industry in Maryland and provides consumer protection.

The MIA can help resolve disputes between policyholders and insurance companies through mediation, arbitration, or formal hearings.

To file a complaint with the MIA, you can contact them online or by phone. They will investigate your complaint and attempt to reach a resolution between you and your insurance company.

Navigating the Claims Process Effectively

To ensure a smooth resolution of your claim, it’s important to:

- Be prompt in contacting your insurance company and providing all necessary documentation.

- Be honest and accurate in your reporting of the accident.

- Keep detailed records of all communications with your insurance company.

- Seek legal advice if you feel your claim is not being handled fairly.

By following these steps, you can increase your chances of a successful outcome in your car insurance claim.

Maryland Car Insurance Resources

Navigating the world of car insurance can be overwhelming, especially when you’re trying to understand the specific requirements and options available in Maryland. Fortunately, there are several valuable resources available to help you make informed decisions and find the best coverage for your needs.

Maryland Insurance Administration

The Maryland Insurance Administration (MIA) is the state agency responsible for regulating the insurance industry and protecting consumers. The MIA provides a wealth of information on car insurance, including:

- Consumer guides and publications: The MIA offers comprehensive guides on various insurance topics, including car insurance, explaining your rights and responsibilities as a policyholder.

- Complaint resolution: If you have a dispute with your insurance company, the MIA can assist you in resolving the issue. You can file a complaint online or by phone.

- Market analysis and reports: The MIA conducts market research and publishes reports on insurance trends, pricing, and consumer satisfaction, which can help you understand the overall car insurance landscape in Maryland.

Other Consumer Protection Agencies

Besides the MIA, several other organizations can provide valuable support and information to Maryland car insurance consumers. These include:

- Maryland Office of the Attorney General: This office can assist with consumer complaints and provide legal advice on insurance matters.

- Maryland Department of Transportation: The MDOT offers resources on car safety, driver education, and vehicle registration, which can be relevant to your car insurance needs.

- National Association of Insurance Commissioners (NAIC): The NAIC is a national organization that works to standardize insurance regulations and consumer protection across the country. Their website provides valuable information and resources for consumers, including information on car insurance.

Consulting with an Insurance Agent

While online resources can be helpful, consulting with a qualified insurance agent is essential for obtaining personalized advice and finding the best coverage for your individual circumstances.

“An insurance agent can help you understand the different types of coverage available, assess your specific needs, and recommend the most suitable policy for your budget and risk profile.”

Insurance agents are well-versed in Maryland’s specific car insurance requirements and can help you navigate the complexities of the market. They can also provide valuable insights into discounts and other cost-saving options that you may not be aware of.

Last Word

Navigating the world of Maryland car insurance can be challenging, but with the right information and resources, you can secure the coverage you need at a price that suits your budget. By understanding the state’s regulations, comparing different insurance providers, and maximizing available discounts, you can ensure that you are adequately protected on the road. Remember to consult with a qualified insurance agent for personalized advice and guidance.

Clarifying Questions: Maryland State Car Insurance

What is the minimum car insurance coverage required in Maryland?

Maryland requires drivers to have a minimum of $30,000 in liability coverage per person, $60,000 per accident, and $15,000 for property damage.

How can I get a car insurance quote in Maryland?

You can get car insurance quotes online, by phone, or in person from various insurance providers. Be sure to provide accurate information about your vehicle, driving history, and coverage preferences.

What are some common car insurance discounts available in Maryland?

Common discounts include safe driver discounts, good student discounts, multi-car discounts, and bundling discounts for combining your car insurance with other types of insurance, such as homeowners or renters insurance.