Manufactured home insurance Washington state is crucial for protecting your investment. While similar to traditional homeowner’s insurance, it caters specifically to the unique needs of manufactured homes. This guide delves into the essential aspects of securing the right coverage, exploring factors influencing costs, and providing tips for managing risks.

From understanding coverage options and finding reputable providers to implementing preventative measures, this comprehensive resource empowers you to make informed decisions about your manufactured home insurance in Washington.

Understanding Manufactured Home Insurance in Washington State

Manufactured homes, also known as mobile homes, are unique dwellings that present specific insurance considerations. In Washington State, understanding the nuances of manufactured home insurance is crucial to ensure adequate protection for your investment. This guide will explore the key characteristics of manufactured homes in Washington and highlight the differences between manufactured home insurance and traditional homeowner’s insurance. It will also provide a comprehensive overview of the coverage options typically included in manufactured home insurance policies in Washington.

Manufactured Homes in Washington State

Manufactured homes in Washington State are subject to specific regulations and standards. The Washington State Department of Labor and Industries (L&I) oversees the construction and safety of manufactured homes. These regulations ensure that manufactured homes meet certain quality and safety standards, which can influence insurance considerations. For instance, the construction materials used in manufactured homes may differ from those used in traditional homes, impacting the risk assessment for insurance purposes.

Differences Between Manufactured Home Insurance and Traditional Homeowner’s Insurance

While both types of insurance protect your dwelling, manufactured home insurance differs from traditional homeowner’s insurance in several key ways.

- Coverage Scope: Traditional homeowner’s insurance typically covers a wider range of risks, including those related to the land on which the house sits. Manufactured home insurance, on the other hand, primarily focuses on the home itself, including its contents. The land, foundation, and any attached structures may require separate coverage.

- Valuation: Traditional homeowner’s insurance typically values the home based on its replacement cost, meaning it would cover the cost of rebuilding the home in the event of a total loss. Manufactured home insurance may use a different valuation method, such as actual cash value, which considers depreciation.

- Coverage Options: The coverage options available under manufactured home insurance policies can vary significantly from those offered in traditional homeowner’s insurance policies. For example, manufactured home insurance may offer specific coverage for damage caused by windstorms or hail, which are common risks in Washington State.

Coverage Options in Manufactured Home Insurance

Manufactured home insurance policies in Washington State typically include a range of coverage options, tailored to the specific risks associated with manufactured homes.

- Dwelling Coverage: This coverage protects the structure of your manufactured home against various perils, such as fire, windstorm, hail, vandalism, and theft.

- Personal Property Coverage: This coverage protects your personal belongings inside the manufactured home, including furniture, clothing, electronics, and other valuables.

- Liability Coverage: This coverage provides financial protection if you are found legally liable for injuries or property damage to others.

- Additional Living Expenses Coverage: This coverage helps cover the cost of temporary housing and other living expenses if your manufactured home becomes uninhabitable due to a covered event.

- Optional Coverages: In addition to the standard coverage options, you may be able to purchase optional coverages to provide additional protection. These can include coverage for:

- Flood damage: This coverage is essential if your manufactured home is located in a flood-prone area.

- Earthquake damage: Washington State is located in an earthquake-prone region, so this coverage may be necessary.

- Personal injury coverage: This coverage provides protection if you are injured on your property.

- Medical payments coverage: This coverage helps pay for medical expenses for guests who are injured on your property.

Factors Affecting Insurance Costs

Several factors can influence the cost of manufactured home insurance in Washington State, including:

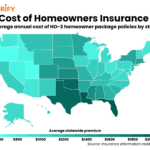

- Location: The risk of certain perils, such as windstorms, hail, and earthquakes, varies depending on the location of your manufactured home.

- Age and Condition of the Home: Older manufactured homes may be more prone to damage and therefore carry higher insurance costs.

- Credit Score: Your credit score can be a factor in determining your insurance premium.

- Deductible: A higher deductible will generally result in a lower premium.

- Coverage Options: The more coverage options you choose, the higher your premium will likely be.

Factors Influencing Manufactured Home Insurance Costs in Washington

The cost of manufactured home insurance in Washington is determined by a variety of factors, similar to traditional home insurance. These factors are carefully assessed by insurance companies to determine the level of risk associated with insuring a particular manufactured home. This evaluation process helps ensure that premiums accurately reflect the potential costs of covering claims for the insured home.

Location, Manufactured home insurance washington state

The location of a manufactured home significantly impacts its insurance cost. This is because different areas have varying risks of natural disasters, such as earthquakes, wildfires, and floods. For instance, homes located in areas prone to earthquakes will likely have higher insurance premiums than homes in areas with lower seismic activity. Additionally, the proximity of the manufactured home to fire hazards, like forests or dry brush, can also increase the cost of insurance.

Age and Condition of the Manufactured Home

The age and condition of a manufactured home are crucial factors in determining insurance costs. Older manufactured homes, especially those built before stricter building codes were implemented, tend to have higher premiums due to their potential for structural issues or outdated safety features. Furthermore, the condition of the home, including the state of its roof, plumbing, electrical systems, and overall maintenance, is considered. Homes with significant maintenance needs or structural defects will likely have higher insurance premiums.

Coverage Levels and Deductibles

The level of coverage and the deductible chosen by the homeowner directly impact insurance costs. Higher coverage limits, such as those encompassing more comprehensive protection against various risks, naturally result in higher premiums. Conversely, lower coverage limits lead to lower premiums. Similarly, the deductible, the amount the homeowner pays out of pocket before the insurance policy kicks in, influences the cost. Higher deductibles mean lower premiums, as the homeowner assumes a larger share of the financial burden in case of a claim.

Finding the Right Manufactured Home Insurance Provider in Washington

Securing the right manufactured home insurance in Washington requires careful consideration and a thorough understanding of the available options. With various insurance providers catering to this specific market, navigating the selection process can feel overwhelming. This guide will provide a step-by-step approach to help you find the ideal provider for your needs.

Steps to Finding the Right Manufactured Home Insurance Provider

Finding the right manufactured home insurance provider in Washington involves a systematic approach to ensure you secure the best coverage at a competitive price.

- Assess Your Needs: Start by evaluating your specific insurance requirements. Consider factors like the age and condition of your manufactured home, its location, and the desired level of coverage.

- Compare Quotes: Obtain quotes from multiple insurance providers specializing in manufactured homes. This allows you to compare coverage options, deductibles, and premiums.

- Review Policy Details: Carefully examine the policy details, including coverage limits, exclusions, and any additional riders or endorsements.

- Check Financial Stability: Assess the financial stability of the insurance provider by checking their ratings from organizations like A.M. Best or Standard & Poor’s.

- Evaluate Customer Service: Consider the provider’s customer service reputation. Look for positive reviews and testimonials from other manufactured homeowners.

- Consider Claims Handling Process: Understand the insurance provider’s claims handling process. Research their track record for prompt and fair claim settlements.

- Compare Discounts: Inquire about available discounts, such as those for security systems, fire alarms, or multiple policies.

- Read Reviews and Testimonials: Research online reviews and testimonials from other homeowners who have used the insurance provider’s services. This provides valuable insights into their customer satisfaction levels.

- Contact the Provider: Reach out to the insurance provider with any questions or concerns you have. A responsive and helpful customer service team is a good indicator of their commitment to their clients.

- Get a Written Quote: Request a written quote from the provider outlining the coverage details, premium, and any applicable discounts.

Reputable Manufactured Home Insurance Providers in Washington

Several reputable insurance providers specialize in manufactured homes in Washington. While it’s crucial to conduct your own research and compare quotes, here are a few providers known for their expertise in this market:

- State Farm: A well-known insurance provider with a strong reputation for manufactured home insurance in Washington.

- Farmers Insurance: Another major insurance company offering comprehensive coverage options for manufactured homes.

- American Family Insurance: Known for its competitive rates and personalized customer service.

- Nationwide: A national insurance provider with a wide range of coverage options for manufactured homes.

- Allstate: A leading insurance company offering various coverage choices and discounts.

- Liberty Mutual: Known for its innovative insurance products and strong financial stability.

- USAA: A reputable insurance provider specializing in serving military members and their families, offering coverage for manufactured homes.

Factors to Consider When Choosing an Insurance Provider

Choosing the right manufactured home insurance provider requires careful consideration of various factors to ensure you get the best value for your needs.

- Customer Service: Excellent customer service is essential, especially during stressful situations like claims filing. Look for providers known for their responsiveness, helpfulness, and clear communication.

- Claims Handling Process: A streamlined and efficient claims handling process is crucial. Research the provider’s track record for prompt and fair claim settlements, ensuring they handle claims with minimal hassle.

- Financial Stability: It’s vital to choose a financially stable insurance provider. Look for companies with strong ratings from independent agencies like A.M. Best or Standard & Poor’s. This indicates their ability to meet their financial obligations and pay claims in the long term.

- Coverage Options: Ensure the provider offers comprehensive coverage options that meet your specific needs. This includes coverage for damage caused by fire, wind, hail, theft, and other perils.

- Premiums and Deductibles: Compare premiums and deductibles from different providers. While lower premiums may seem appealing, consider the coverage limits and deductibles associated with them.

- Discounts: Inquire about available discounts, such as those for security systems, fire alarms, or multiple policies. This can help you save on your premiums.

Essential Considerations for Manufactured Home Insurance in Washington

While securing manufactured home insurance in Washington is crucial, it’s equally important to ensure you have adequate coverage for your specific needs. Understanding the intricacies of your policy and exploring available options can make a significant difference in protecting your investment.

Understanding Policy Exclusions and Limitations

It’s essential to carefully review your insurance policy and understand its exclusions and limitations. These provisions specify what your insurance won’t cover, so it’s crucial to be aware of them. Here are some common exclusions:

- Natural Disasters: While some policies cover earthquakes, floods, and landslides, others may exclude these events.

- Wear and Tear: Normal wear and tear on your manufactured home isn’t typically covered.

- Neglect or Maintenance Issues: Damage caused by negligence or lack of proper maintenance may be excluded.

- Specific Hazards: Some policies may exclude coverage for certain hazards, such as mold or pest infestations.

It’s important to note that these exclusions can vary significantly between insurance companies and policies. Therefore, carefully reviewing your policy and asking questions is essential.

The Importance of Flood Insurance

Flood insurance is a separate policy that protects your manufactured home from damage caused by flooding. While standard homeowner’s insurance doesn’t cover flood damage, flood insurance can provide financial assistance for repairs or replacement.

Consider the following factors when deciding whether flood insurance is necessary:

- Location: If your manufactured home is located in a flood zone, flood insurance is highly recommended.

- Flood History: If your area has a history of flooding, flood insurance can provide peace of mind.

- Personal Risk Tolerance: Even if your home isn’t in a flood zone, you may want to consider flood insurance if you’re concerned about potential flooding.

Flood insurance is available through the National Flood Insurance Program (NFIP) and private insurers. You can get a quote from your insurance agent or the NFIP website.

Other Specialized Coverage Options

Beyond standard manufactured home insurance and flood insurance, several specialized coverage options can enhance your protection. These options can provide additional coverage for specific risks or circumstances.

- Replacement Cost Coverage: This coverage pays the full cost to replace your manufactured home with a new one, regardless of its age or depreciation.

- Personal Property Coverage: This coverage protects your belongings inside your manufactured home from damage or theft.

- Liability Coverage: This coverage protects you from financial liability if someone is injured on your property.

- Personal Injury Coverage: This coverage protects you from financial liability if someone is injured on your property.

The availability and cost of these specialized coverage options can vary depending on your insurance provider and the specific policy you choose.

Protecting Your Manufactured Home: Manufactured Home Insurance Washington State

Owning a manufactured home in Washington State is a great way to enjoy affordable housing. However, like any home, manufactured homes are susceptible to various risks and hazards. To protect your investment, it’s crucial to understand these risks and implement preventative measures to minimize potential damage.

Common Risks and Hazards

Manufactured homes in Washington are susceptible to several risks and hazards due to their unique construction and location.

- Wind Damage: Washington is prone to strong winds, which can cause significant damage to manufactured homes, particularly those with weaker roofs or insufficient anchoring.

- Seismic Activity: The Pacific Northwest is known for its seismic activity. Earthquakes can cause significant damage to manufactured homes, including foundation cracks, structural damage, and even collapse.

- Flooding: Washington experiences heavy rainfall, which can lead to flooding. Manufactured homes, often situated in lower elevations or near bodies of water, are particularly vulnerable to flood damage.

- Fire: Fires are a common hazard for all homes, including manufactured homes. The unique construction of manufactured homes can make them more susceptible to fire spread due to the use of lightweight materials and open spaces.

- Mold Growth: Washington’s humid climate can lead to mold growth, especially in areas with poor ventilation or moisture problems. Mold can cause health issues and damage the structure of your home.

Preventative Measures

Taking preventative measures can significantly reduce the risk of damage to your manufactured home.

- Secure Your Home: Ensure your manufactured home is properly anchored to the ground, especially if you live in an area prone to high winds or seismic activity.

- Maintain Your Roof: Regularly inspect your roof for damage, leaks, or missing shingles. Replace any damaged sections promptly to prevent water damage and further deterioration.

- Check Your Foundation: Inspect your foundation for cracks, settling, or other signs of damage. Address any issues promptly to prevent structural problems.

- Install Smoke Detectors: Install smoke detectors on every level of your home and test them monthly. Replace batteries regularly.

- Ensure Proper Ventilation: Maintain good ventilation throughout your home, especially in areas prone to moisture build-up, such as bathrooms and kitchens.

- Clear Gutters and Downspouts: Regularly clean your gutters and downspouts to prevent water damage and ensure proper drainage.

- Trim Trees and Shrubs: Trim trees and shrubs near your home to prevent them from damaging your roof or siding during storms.

Regular Maintenance and Inspections

Regular maintenance and inspections are essential for keeping your manufactured home in good condition and minimizing potential problems.

- Annual Inspections: Have your home inspected annually by a qualified professional to identify potential issues and ensure your home is up to code.

- Regular Maintenance: Follow a regular maintenance schedule to address minor issues before they become major problems. This includes tasks like cleaning gutters, inspecting your roof, checking your foundation, and testing smoke detectors.

- Professional Services: Consult with professionals for specific tasks, such as roof repairs, plumbing, electrical work, and foundation repairs.

Concluding Remarks

By understanding the intricacies of manufactured home insurance in Washington, you can ensure your investment is protected against potential risks. From choosing the right coverage to implementing preventative measures, this guide equips you with the knowledge and tools to safeguard your manufactured home.

Question & Answer Hub

What is the difference between manufactured home insurance and traditional homeowner’s insurance?

Manufactured home insurance specifically covers homes built in factories, taking into account their unique construction and potential risks. Traditional homeowner’s insurance might not adequately cover manufactured homes.

What factors affect the cost of manufactured home insurance in Washington?

Factors like location, age, condition of the home, coverage levels, deductibles, and the insurer’s risk assessment influence the cost of insurance.

How do I find a reputable manufactured home insurance provider in Washington?

Seek recommendations, research online reviews, and compare quotes from multiple providers specializing in manufactured homes. Consider factors like customer service, claims handling, and financial stability.