Mandatory car insurance states ensure that drivers carry financial responsibility for potential accidents. These states, comprising a majority of the United States, require drivers to have a minimum level of insurance coverage, safeguarding both themselves and others on the road. This practice stems from the understanding that accidents can occur unexpectedly, and having insurance provides a financial safety net in case of unforeseen circumstances.

The purpose of mandatory car insurance is multifaceted. It protects drivers from significant financial burdens in the event of an accident, ensuring they can cover medical expenses, vehicle repairs, or even legal fees. Additionally, it provides compensation to victims of accidents, covering their medical bills and property damage. By fostering a culture of responsibility, mandatory car insurance laws contribute to road safety and reduce the financial strain on individuals and the overall healthcare system.

Types of Car Insurance Coverage Required

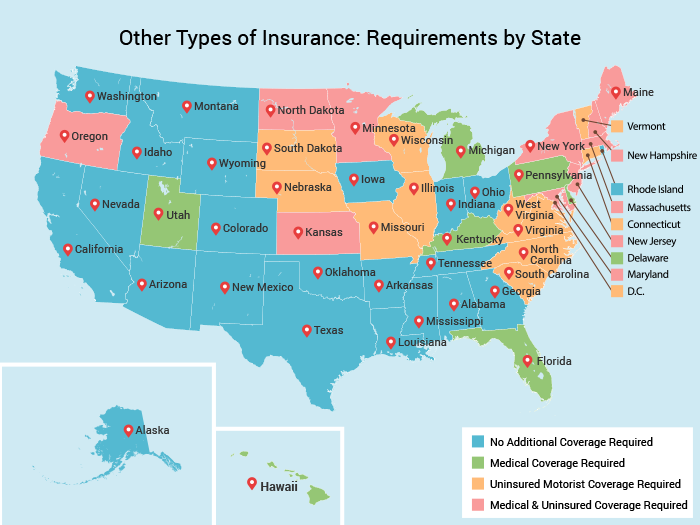

Each state in the United States has its own set of minimum car insurance requirements that drivers must meet. These requirements vary depending on the state, and understanding them is crucial for ensuring you have the necessary coverage in case of an accident.

The most common types of car insurance coverage required by states include liability coverage, which protects you financially if you cause an accident, and uninsured/underinsured motorist coverage, which protects you if you are involved in an accident with a driver who does not have adequate insurance. Some states may also require personal injury protection (PIP) coverage, which covers medical expenses and lost wages for you and your passengers in the event of an accident.

Minimum Coverage Requirements by State

Here’s a breakdown of minimum coverage requirements for liability insurance across different states:

-

Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages to the other party in an accident if you are at fault.

-

Minimum Limits:

- New York: $25,000 per person/$50,000 per accident

- California: $15,000 per person/$30,000 per accident

- Texas: $30,000 per person/$60,000 per accident

-

Minimum Limits:

-

Property Damage Liability: This coverage pays for damages to the other party’s vehicle or property if you are at fault in an accident.

-

Minimum Limits:

- New York: $10,000

- California: $5,000

- Texas: $25,000

-

Minimum Limits:

-

Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured.

-

Minimum Limits:

- New York: $25,000 per person/$50,000 per accident

- California: $15,000 per person/$30,000 per accident

- Texas: $30,000 per person/$60,000 per accident

-

Minimum Limits:

Variations in Coverage Requirements

Coverage requirements can vary based on factors such as the type of vehicle or the driver’s status:

- Vehicle Type: Certain states may have different coverage requirements for commercial vehicles, motorcycles, or other specialized vehicles. For instance, commercial vehicles may require higher liability limits to account for the potential for greater damages in an accident.

- Driver Status: Some states may have different coverage requirements for drivers who are younger than a certain age, have a history of driving violations, or are operating a vehicle for business purposes. For example, young drivers may be required to carry higher liability limits or may be subject to additional restrictions.

Benefits of Mandatory Car Insurance

Mandatory car insurance is a crucial aspect of any responsible driving culture. It ensures that drivers are financially prepared to handle the consequences of accidents, protecting both themselves and others on the road.

Protection for Drivers and Pedestrians

Mandatory car insurance plays a vital role in safeguarding both drivers and pedestrians in the event of an accident. It provides financial coverage for injuries, medical expenses, and property damage, ensuring that victims are not burdened with significant financial hardship.

“Mandatory car insurance ensures that drivers have the financial means to cover the costs associated with accidents, preventing victims from facing significant financial hardship.”

Financial Benefits of Car Insurance

Car insurance provides a safety net for drivers facing unexpected expenses due to accidents. It covers a range of costs, including:

- Medical expenses: Insurance covers medical treatment for injuries sustained in accidents, including hospital stays, surgeries, and rehabilitation.

- Property damage: Insurance covers repairs or replacement costs for damaged vehicles, including the driver’s own vehicle and any other vehicles involved in the accident.

- Liability coverage: Insurance protects drivers from financial liability in case they are found at fault for an accident, covering legal fees and settlements.

- Uninsured/underinsured motorist coverage: This coverage protects drivers in accidents involving uninsured or underinsured motorists, ensuring they receive compensation for their losses.

Promoting Road Safety

Mandatory car insurance plays a significant role in promoting road safety by:

- Encouraging responsible driving: Knowing that they are financially responsible for any accidents they cause, drivers are more likely to exercise caution and adhere to traffic rules.

- Reducing the risk of uninsured drivers: Mandatory car insurance ensures that all drivers are financially responsible, reducing the likelihood of accidents involving uninsured motorists, who are more likely to engage in risky driving behavior.

- Providing financial security for victims: Knowing that victims have access to financial compensation for their losses, drivers are less likely to engage in reckless driving, promoting a safer driving environment.

Consequences of Driving Without Insurance: Mandatory Car Insurance States

Driving without mandatory car insurance is not only illegal but can also lead to serious consequences, including financial hardship and legal repercussions. It is crucial to understand the potential risks associated with driving uninsured.

Penalties for Driving Without Insurance

Penalties for driving without mandatory car insurance vary from state to state but typically include:

- Fines: Uninsured drivers face hefty fines, which can range from hundreds to thousands of dollars depending on the state and the number of offenses.

- License Suspension: States may suspend the driver’s license of those caught driving without insurance, making it impossible to legally operate a vehicle.

- Vehicle Impoundment: In some cases, the vehicle itself may be impounded until the driver provides proof of insurance.

- Court Costs: If the driver is taken to court for driving without insurance, they may face additional court costs, further increasing their financial burden.

Legal Ramifications of an Accident Without Insurance

Being involved in an accident without insurance can have severe legal consequences:

- Liability: If an uninsured driver causes an accident, they are fully responsible for all damages, including injuries, property damage, and medical expenses incurred by the other party.

- Lawsuits: The injured party can sue the uninsured driver to recover their losses, which can result in a significant financial judgment against the driver.

- Criminal Charges: In some cases, driving without insurance may lead to criminal charges, especially if the accident results in serious injuries or death.

Financial Burden on Uninsured Drivers

Driving without insurance can lead to a substantial financial burden:

- Medical Expenses: In the event of an accident, the uninsured driver is responsible for all medical expenses, including hospital bills, surgeries, and rehabilitation.

- Property Damage: The uninsured driver is liable for any damage to their vehicle and the other party’s vehicle, including repairs or replacement costs.

- Legal Fees: If the uninsured driver is sued, they will have to cover legal fees, which can be substantial, especially if the case goes to trial.

- Wage Loss: If the uninsured driver is injured in an accident, they may lose wages while they recover, adding to their financial strain.

Obtaining Car Insurance

In mandatory car insurance states, obtaining insurance is a crucial step before hitting the road. The process is generally straightforward and involves several key steps.

The Process of Obtaining Car Insurance, Mandatory car insurance states

You will need to contact an insurance company or agent to begin the process of obtaining car insurance. You will need to provide information about yourself, your vehicle, and your driving history. This information will be used to determine your insurance premium. Once you have provided all of the necessary information, the insurance company will issue you a policy.

Finding Affordable Car Insurance Options

Finding affordable car insurance options is essential for most drivers. Here are some tips for finding the best rates:

- Compare quotes from multiple insurance companies. This is the best way to ensure you are getting the best possible rate. You can use an online comparison tool or contact insurance companies directly.

- Consider increasing your deductible. A higher deductible will result in a lower premium. However, you will be responsible for paying more out of pocket if you have an accident.

- Ask about discounts. Many insurance companies offer discounts for good drivers, safe cars, and other factors. Be sure to ask about any discounts that may apply to you.

- Shop around every year. Insurance rates can change, so it is a good idea to shop around for new quotes every year.

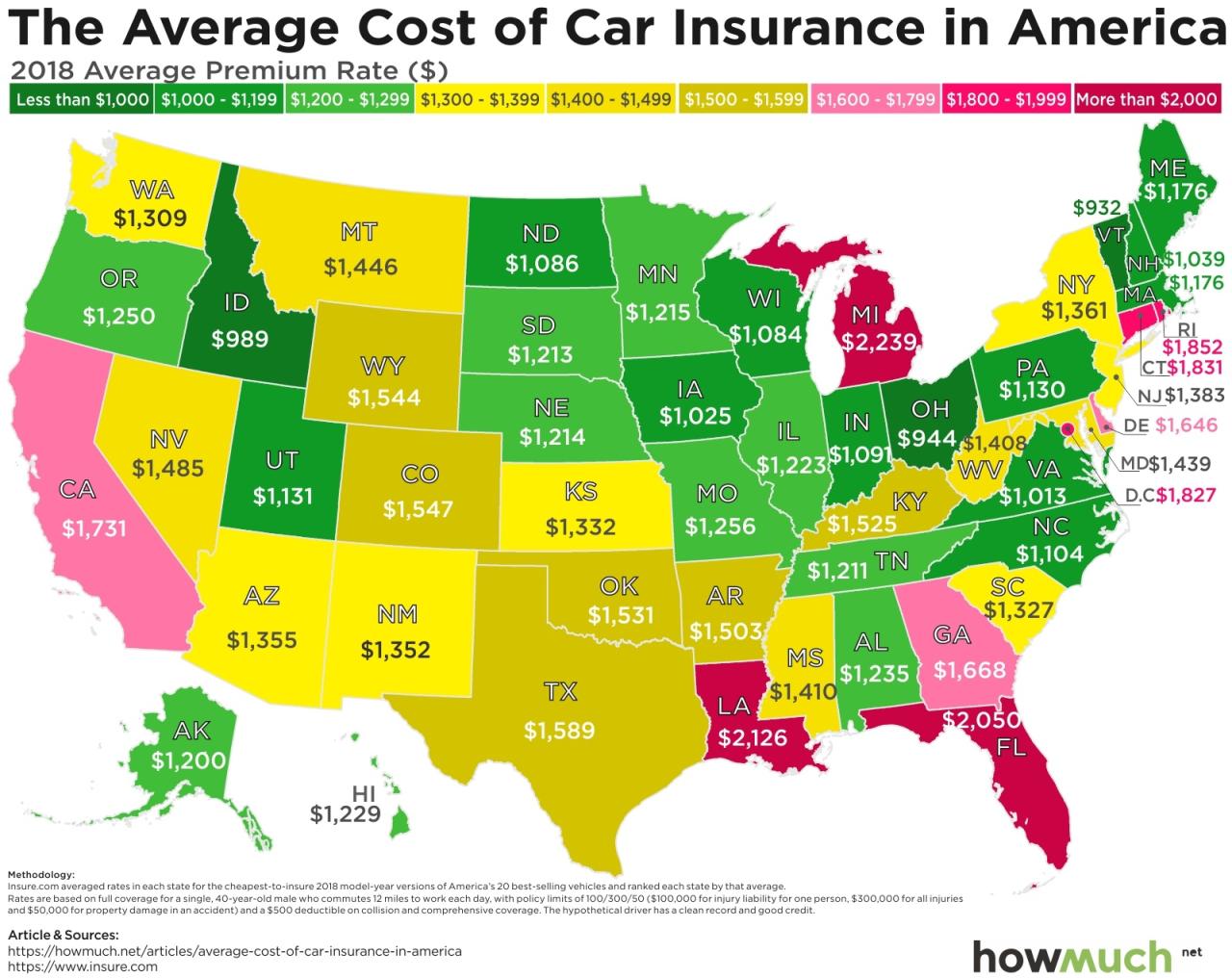

Factors that Influence Car Insurance Premiums

Several factors influence the cost of car insurance. Understanding these factors can help you make informed decisions about your coverage and potentially save money on your premiums.

- Driving History: Your driving record is a significant factor in determining your premium. A clean driving record with no accidents or violations will result in lower premiums. Conversely, a history of accidents or traffic violations will lead to higher premiums.

- Age and Gender: Younger drivers, especially males, tend to have higher premiums due to their higher risk of accidents. As drivers age and gain more experience, their premiums generally decrease.

- Vehicle Type and Value: The type and value of your vehicle significantly impact your premium. Luxury cars, sports cars, and vehicles with higher repair costs typically have higher insurance premiums.

- Location: Your location, including your state and zip code, can affect your premium. Areas with higher rates of accidents or theft may have higher premiums.

- Coverage Levels: The amount of coverage you choose, such as liability limits and comprehensive and collision coverage, will affect your premium. Higher coverage levels generally result in higher premiums.

- Credit Score: In some states, insurance companies use your credit score to determine your premium. Individuals with good credit scores often qualify for lower premiums.

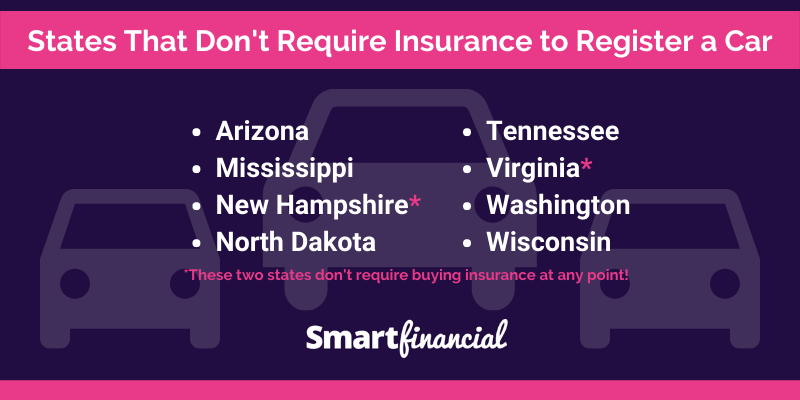

Exemptions from Mandatory Car Insurance

While most states mandate car insurance, there are some exemptions or exceptions to these rules. These exemptions are typically granted to individuals or vehicles that are considered low-risk or pose minimal liability to others.

These exemptions are usually granted to individuals or vehicles that are considered low-risk or pose minimal liability to others. This could be due to the nature of the vehicle, the limited use of the vehicle, or the individual’s circumstances.

Vehicles Exempt from Mandatory Insurance

Vehicles that are exempt from mandatory insurance vary by state. However, common exemptions include:

- Antique or Classic Vehicles: These vehicles are often exempt from mandatory insurance if they are not driven regularly on public roads and are primarily used for exhibitions or special events. The definition of an antique or classic vehicle varies by state, but it generally refers to vehicles that are at least 25 years old and are in original condition.

- Vehicles Used for Agricultural Purposes: Vehicles used solely for farming or agricultural activities may be exempt from mandatory insurance in some states. These exemptions often apply to vehicles used on private property and not on public roads.

- Vehicles Used for Military or Government Purposes: Vehicles owned and operated by the military or government may be exempt from mandatory insurance. These exemptions are typically granted because these vehicles are already insured under separate government policies.

Individuals Exempt from Mandatory Insurance

In some states, certain individuals may be exempt from mandatory car insurance. This could include:

- Individuals with Limited Driving Privileges: Some states may grant exemptions to individuals with limited driving privileges, such as those who are only allowed to drive to and from work or school. These exemptions often require individuals to demonstrate that they have a valid driver’s license and a clean driving record.

- Individuals with Financial Hardship: Some states may offer exemptions to individuals who can demonstrate financial hardship and are unable to afford car insurance. These exemptions may be temporary and subject to certain conditions.

Procedures for Obtaining an Exemption

The process for obtaining an exemption from mandatory car insurance varies by state. However, generally, individuals must:

- Submit an Application: Individuals seeking an exemption must typically submit an application to the state’s Department of Motor Vehicles (DMV) or other relevant agency.

- Provide Documentation: Applicants must provide supporting documentation to justify their exemption. This may include proof of vehicle ownership, driver’s license, and other relevant documents.

- Pay a Fee: Some states may charge a fee for processing exemption applications.

Future Trends in Mandatory Car Insurance

The landscape of car insurance is constantly evolving, driven by technological advancements, changing driving habits, and a growing focus on road safety. Mandatory car insurance laws are likely to adapt to these trends, potentially leading to significant changes in how insurance is regulated and provided.

Impact of Emerging Technologies

Emerging technologies are reshaping the automotive industry and, in turn, influencing car insurance regulations.

- Autonomous Vehicles: The rise of autonomous vehicles (AVs) poses new challenges for traditional insurance models. AVs are expected to significantly reduce accidents, potentially leading to lower insurance premiums. However, determining liability in case of an accident involving an AV will require new legal frameworks and insurance policies. For instance, some states might mandate specific coverage for autonomous vehicles, ensuring adequate protection for both passengers and pedestrians.

- Telematics and Usage-Based Insurance (UBI): Telematics devices and UBI programs track driving behavior, allowing insurers to offer personalized premiums based on actual driving habits. These programs can encourage safer driving practices and reward responsible drivers with lower premiums. As these technologies become more prevalent, insurance regulations might evolve to incorporate UBI programs as a standard component of mandatory insurance requirements.

- Connected Cars: Connected car technologies enable vehicles to communicate with each other and infrastructure, improving safety and efficiency. This data can be used by insurers to assess risk and adjust premiums accordingly. Regulations may emerge to ensure data privacy and security in connected cars, as well as to define how insurers can access and utilize this data.

Final Conclusion

Understanding the requirements and benefits of mandatory car insurance is crucial for all drivers. Whether you’re a seasoned driver or a new motorist, knowing the laws and regulations in your state is essential for responsible driving. By adhering to mandatory insurance requirements, you not only protect yourself financially but also contribute to a safer and more secure driving environment for everyone on the road.

Common Queries

What happens if I get into an accident without insurance?

You could face serious consequences, including hefty fines, license suspension, and even jail time. Additionally, you’ll be responsible for all accident-related costs, which can be substantial.

How can I find affordable car insurance?

Shop around and compare quotes from different insurance companies. Consider factors like your driving history, vehicle type, and coverage needs. You can also explore discounts for good driving records, safety features, and bundling multiple insurance policies.

What if I can’t afford car insurance?

Some states offer programs to help low-income individuals obtain affordable car insurance. You can contact your state’s insurance department or search for local organizations that provide assistance.