Lowest car insurance rates by state take center stage, offering a glimpse into the complex world of auto insurance pricing. Understanding how state-specific regulations, driving history, and vehicle characteristics impact premiums is crucial for finding the best deals. From comparing quotes to exploring coverage options, this guide provides insights and strategies to help you navigate the insurance landscape and secure affordable rates.

Each state has its own unique set of regulations and factors that influence car insurance costs. Understanding these nuances can help you make informed decisions about your insurance coverage. For instance, states with stricter safety regulations or higher traffic density often have higher average premiums. Additionally, individual factors such as your driving record, age, and credit score can also significantly impact your rates.

Factors Influencing Car Insurance Rates

Car insurance premiums are influenced by a complex interplay of factors, both state-specific and individual. Understanding these factors can help you make informed decisions to potentially lower your insurance costs.

State-Specific Regulations

State governments play a significant role in shaping car insurance rates by setting regulations and requirements for insurance companies. These regulations can influence the cost of insurance in various ways:

- Minimum Coverage Requirements: States mandate minimum liability coverage levels, which can impact premiums. States with higher minimum coverage requirements often have higher average insurance costs. For example, states like New Jersey and Pennsylvania have more stringent minimum coverage requirements compared to states like Wyoming and Idaho.

- No-Fault Laws: Some states have “no-fault” laws that require drivers to file claims with their own insurance company, regardless of fault in an accident. This can lead to lower average premiums but may also limit compensation for certain types of injuries.

- Insurance Rate Regulation: States have different approaches to regulating insurance rates. Some states allow insurers to set rates freely, while others have more stringent regulations that restrict rate increases. States with more rate regulation may have lower average insurance costs.

Factors Affecting Car Insurance Rates

Beyond state-specific regulations, several factors contribute to the determination of car insurance premiums:

- Driving History: Your driving record is a major factor in determining insurance rates. Accidents, speeding tickets, and other traffic violations can significantly increase premiums. A clean driving record, on the other hand, can lead to lower rates. Some insurance companies may even offer discounts for safe driving habits, such as using a telematics device to track your driving behavior.

- Demographics: Factors like age, gender, and marital status can also influence insurance premiums. Young drivers, particularly those under 25, generally pay higher premiums due to their higher risk of accidents. Similarly, men typically pay higher premiums than women, and unmarried individuals may face higher rates compared to married individuals.

- Vehicle Type and Value: The type and value of your vehicle are significant factors in determining insurance premiums. High-performance cars, luxury vehicles, and newer cars generally have higher insurance rates due to their higher repair costs and potential for theft. The vehicle’s safety features, such as anti-theft systems and advanced safety technologies, can also impact premiums.

- Location: Your location, including the city, county, and ZIP code, can affect your insurance rates. Areas with higher crime rates, traffic congestion, and accident rates generally have higher premiums. This is because insurers assess the likelihood of claims based on the risks associated with different locations.

- Credit Score: In some states, insurance companies may consider your credit score when setting your rates. This is based on the theory that individuals with good credit scores are more financially responsible and less likely to file claims. However, this practice is not universal and varies by state.

State-Specific Car Insurance Regulations: Lowest Car Insurance Rates By State

Each state in the United States has its own set of car insurance regulations that determine the minimum coverage requirements for drivers. These regulations can significantly impact the cost of car insurance in a particular state. Understanding these regulations can help you find the most affordable coverage options for your needs.

Comparison of Mandatory Coverage Requirements

The mandatory car insurance coverage requirements vary widely across different states. States have different levels of required coverage, which can significantly impact the overall cost of car insurance.

- Liability Coverage: This coverage protects you financially if you cause an accident that injures another person or damages their property. Most states require a minimum amount of liability coverage, typically expressed as a split limit, such as 25/50/25, which means $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $25,000 for property damage per accident.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. Some states require this coverage, while others allow you to opt out.

- Personal Injury Protection (PIP): This coverage pays for medical expenses and lost wages if you are injured in an accident, regardless of who is at fault. Some states require PIP coverage, while others offer it as an optional coverage.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. This coverage is typically optional, but it may be required if you have a car loan.

- Comprehensive Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged by something other than an accident, such as theft, vandalism, or natural disasters. This coverage is typically optional, but it may be required if you have a car loan.

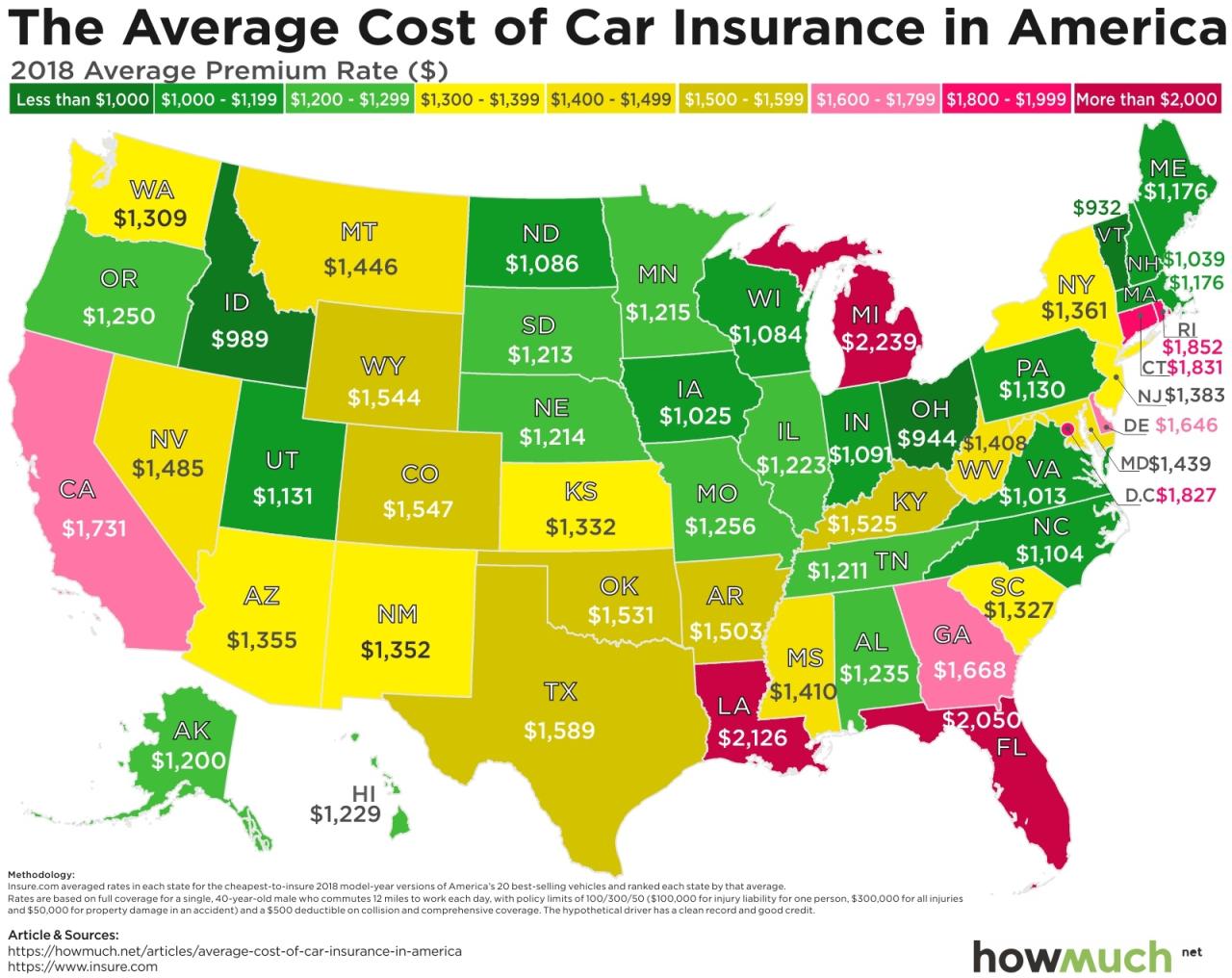

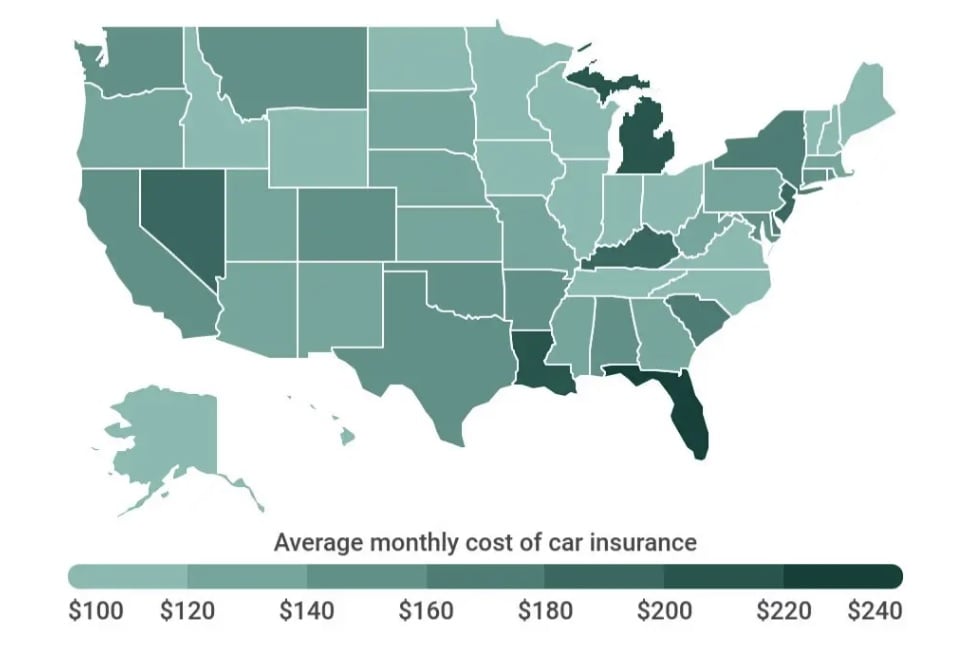

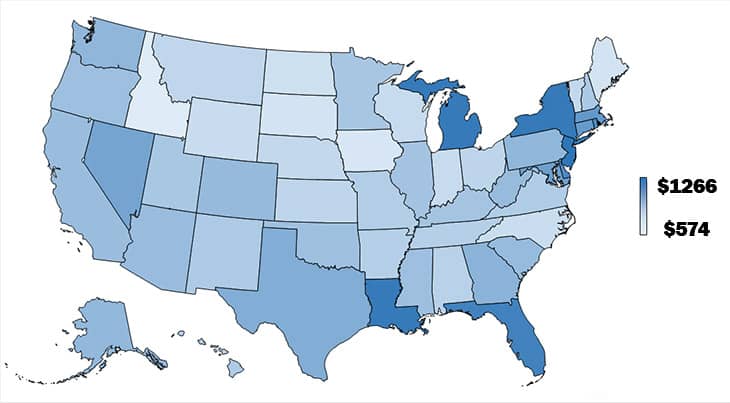

Categorization of States Based on Average Premiums

States can be categorized based on their average car insurance premiums.

- High-Premium States: These states typically have higher car insurance rates due to factors such as high population density, high traffic volume, and a high number of uninsured drivers. Examples include:

- Michigan

- Louisiana

- New Jersey

- Low-Premium States: These states typically have lower car insurance rates due to factors such as lower population density, lower traffic volume, and a lower number of uninsured drivers. Examples include:

- Idaho

- Maine

- Wyoming

Unique Regulations Impacting Insurance Costs

Some states have unique regulations that can significantly impact car insurance costs.

- No-Fault Laws: States with no-fault insurance laws require drivers to file claims with their own insurance company, regardless of who is at fault in an accident. These laws can lead to higher insurance premiums, but they can also simplify the claims process and reduce litigation costs.

- Mandatory Coverage Requirements: Some states require specific types of coverage that are not required in other states. For example, some states require drivers to carry uninsured motorist coverage, while others do not. These requirements can increase the cost of insurance in those states.

- State-Specific Discounts: Some states offer discounts on car insurance for certain groups of drivers, such as good students, senior citizens, or drivers who have completed a defensive driving course.

State-Specific Programs and Initiatives

Some states offer programs or initiatives that provide discounts or subsidies on car insurance.

- Low-Income Auto Insurance Programs: These programs provide subsidized insurance rates for low-income drivers who meet certain eligibility requirements.

- Driver Safety Programs: Some states offer discounts or subsidies on car insurance for drivers who complete driver safety courses.

- Insurance Rate Regulation: Some states have laws that regulate insurance rates to ensure they are fair and reasonable. These laws can help to keep car insurance costs down.

Finding the Lowest Rates in Each State

Finding the most affordable car insurance rates involves a proactive approach. By comparing quotes from various providers and understanding your coverage options, you can secure the best possible deal.

Comparing Quotes from Multiple Providers

Comparing quotes from multiple insurance providers is essential to finding the lowest rates. You can use online platforms, contact insurance agents directly, or work with an insurance broker. By gathering quotes from at least three to five different companies, you can get a comprehensive understanding of the market and identify the best deals.

Understanding Coverage Options and Deductibles, Lowest car insurance rates by state

Understanding your coverage options and deductibles is crucial when comparing quotes. Coverage options determine the types of incidents your insurance policy will cover, while deductibles represent the amount you pay out-of-pocket before your insurance kicks in. Higher deductibles generally result in lower premiums, but you’ll have to pay more in the event of a claim.

- Liability Coverage: This protects you financially if you cause an accident that injures another person or damages their property.

- Collision Coverage: Covers damage to your vehicle in an accident, regardless of who is at fault.

- Comprehensive Coverage: Covers damage to your vehicle from events like theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage.

Reputable Online Platforms and Tools

Several reputable online platforms and tools can help you compare car insurance quotes from multiple providers:

- Insurance Comparison Websites: Sites like Policygenius, The Zebra, and Insurify allow you to enter your information once and receive quotes from various insurance companies.

- Insurance Company Websites: Many insurance companies have online quote tools on their websites, allowing you to get a quick estimate of your potential rates.

Seeking Advice from an Insurance Broker or Agent

Working with an insurance broker or agent can provide valuable insights and guidance. Brokers can help you compare quotes from multiple insurers and ensure you have the right coverage for your needs. Agents typically represent a single insurance company but can still provide valuable advice on coverage options and rates.

Tips for Lowering Car Insurance Premiums

Car insurance is a necessity for most drivers, but it can also be a significant expense. Fortunately, there are several steps you can take to lower your premiums and save money. By understanding how insurance companies determine your rates and implementing some strategic changes, you can potentially reduce your annual car insurance costs.

Bundling Insurance Policies

Bundling your insurance policies can be a simple way to save money. Many insurance companies offer discounts for bundling multiple policies, such as car insurance, home insurance, renters insurance, or even life insurance. By combining these policies under one provider, you can often benefit from reduced premiums due to the company’s consolidated risk assessment and loyalty incentives. For example, if you bundle your car and home insurance with the same company, you might receive a discount of 10% or more on your overall premiums. This can significantly reduce your annual insurance costs.

Maintaining a Good Driving Record

Maintaining a clean driving record is one of the most effective ways to lower your car insurance premiums. Insurance companies consider your driving history a key factor in determining your risk profile. A history of accidents, traffic violations, or even speeding tickets can lead to higher premiums. Conversely, a clean driving record demonstrates responsible driving habits and reduces your perceived risk, resulting in lower insurance rates. This is why it is essential to drive safely, obey traffic laws, and avoid any incidents that could impact your driving record.

Improving Credit Scores

While it might seem surprising, your credit score can also play a role in determining your car insurance premiums. Many insurance companies use credit scores as a proxy for financial responsibility, assuming that individuals with good credit scores are more likely to be financially responsible drivers. This is not always the case, but it is a factor that some insurers consider. Improving your credit score can potentially lead to lower car insurance rates, especially if you are currently paying higher premiums due to a lower credit score. You can improve your credit score by paying your bills on time, keeping your credit utilization low, and avoiding unnecessary credit inquiries.

Understanding Insurance Coverage Options

Choosing the right car insurance coverage is crucial for protecting yourself financially in case of an accident. Understanding the different types of coverage available and their benefits can help you make informed decisions about your insurance policy.

Common Car Insurance Coverages

Car insurance policies typically include various coverages designed to protect you and your vehicle in different situations. Here is a table outlining some common car insurance coverages and their benefits:

| Coverage Type | Benefits |

|---|---|

| Liability Coverage | Covers damages and injuries you cause to other people or their property in an accident. This is usually required by law. |

| Collision Coverage | Covers damages to your vehicle in an accident, regardless of who is at fault. |

| Comprehensive Coverage | Covers damages to your vehicle from events other than accidents, such as theft, vandalism, or natural disasters. |

| Uninsured/Underinsured Motorist Coverage | Protects you if you are injured in an accident caused by a driver without insurance or with insufficient coverage. |

| Medical Payments Coverage (MedPay) | Covers medical expenses for you and your passengers, regardless of who is at fault. |

| Personal Injury Protection (PIP) | Covers medical expenses, lost wages, and other expenses related to injuries sustained in an accident. |

Importance of Liability Coverage

Liability coverage is arguably the most important type of car insurance. It protects you financially if you are at fault in an accident. If you are found liable, your liability coverage will pay for:

* Medical expenses: This includes medical bills for injuries to the other driver and passengers in the other vehicle.

* Property damage: This covers repairs or replacement costs for the other vehicle and any other property damaged in the accident, such as a fence or street sign.

* Legal fees: If the other driver sues you, your liability coverage will help pay for legal defense costs.

Liability coverage is typically required by law, and the minimum amounts vary by state.

Without liability coverage, you could be personally responsible for all the costs associated with an accident, which can be devastating financially.

Collision and Comprehensive Coverage

Collision and comprehensive coverage protect your vehicle against damage. They are optional coverages, but they can be essential depending on your financial situation and the value of your vehicle.

* Collision coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. If you are involved in an accident with a deer, for example, collision coverage would pay for the repairs.

* Comprehensive coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged by events other than accidents, such as theft, vandalism, or natural disasters. If your car is stolen, for example, comprehensive coverage would pay for the replacement cost.

Collision and comprehensive coverage are typically bundled together, but you can choose to have one without the other.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage (UM/UIM) is crucial for protecting yourself if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover your damages. UM/UIM coverage can help pay for:

* Medical expenses: Covers your medical bills if you are injured in an accident caused by an uninsured or underinsured driver.

* Lost wages: Covers your lost income if you are unable to work due to injuries sustained in an accident.

* Property damage: Covers damage to your vehicle if it is damaged in an accident caused by an uninsured or underinsured driver.

It’s important to note that UM/UIM coverage only applies if the other driver is at fault.

Case Studies

Understanding the factors that influence car insurance rates is crucial for making informed decisions about your coverage. Let’s explore real-world examples of states with both high and low insurance premiums, analyzing the contributing factors and highlighting the variations within each state.

States with the Highest Car Insurance Rates

The following states consistently rank among those with the highest average car insurance premiums. It’s important to remember that individual rates can vary significantly based on factors like driving history, vehicle type, and coverage options.

- Michigan: Michigan’s high rates are primarily attributed to its unique “no-fault” insurance system, which requires drivers to cover their own medical expenses regardless of who is at fault in an accident. This system can lead to higher premiums, especially for those with higher medical costs or who frequently file claims.

- Louisiana: Louisiana has a high rate of car accidents and a high number of uninsured drivers. These factors contribute to higher insurance premiums as insurers need to account for the increased risk. Louisiana’s no-fault insurance system also plays a role in higher premiums.

- Rhode Island: Rhode Island has a relatively high density of drivers and a high number of claims per insured vehicle. These factors, combined with its no-fault insurance system, result in higher premiums for drivers in the state.

States with the Lowest Car Insurance Rates

While some states have high premiums, others offer more affordable car insurance. Here are a few states known for their lower rates, and the reasons behind their affordability:

- Idaho: Idaho has a relatively low population density, resulting in fewer accidents and claims. Additionally, its no-fault insurance system is less expensive than those in other states, leading to lower premiums for drivers.

- Maine: Maine’s rural nature and lower population density contribute to lower accident rates and, consequently, lower insurance premiums. Maine’s no-fault insurance system is also relatively affordable.

- North Dakota: North Dakota has a low population density, resulting in fewer accidents and claims. The state’s no-fault insurance system is also relatively affordable.

Urban vs. Rural Car Insurance Rates in California

California provides a good example of how location can influence insurance rates.

- Urban Areas: Drivers in urban areas like Los Angeles and San Francisco typically face higher premiums due to increased traffic congestion, higher accident rates, and a greater likelihood of vehicle theft.

- Rural Areas: Drivers in rural areas of California often enjoy lower premiums. This is due to lower traffic density, fewer accidents, and a lower risk of vehicle theft.

Comparison of Insurance Provider Rates in Texas

Different insurance providers offer varying rates for the same coverage in Texas. Let’s consider two popular providers:

| Provider | Average Annual Premium | Factors Influencing Rates |

|---|---|---|

| Progressive | $1,200 | Progressive is known for its focus on personalized pricing, offering discounts for safe driving, good credit, and bundling multiple policies. |

| State Farm | $1,500 | State Farm is known for its broad coverage options and strong customer service. However, its rates can be higher than other providers, particularly for drivers with less-than-perfect driving records. |

Concluding Remarks

Finding the lowest car insurance rates by state requires a proactive approach. By comparing quotes from multiple providers, understanding coverage options, and implementing cost-saving strategies, you can secure a policy that meets your needs without breaking the bank. Remember, a little research and planning can go a long way in securing affordable car insurance that provides peace of mind.

FAQ Insights

How often should I compare car insurance quotes?

It’s generally recommended to compare quotes at least once a year, or even more frequently if you have a major life change, such as getting married, moving to a new state, or purchasing a new car.

What are some common car insurance discounts?

Common discounts include good driver discounts, safe driver discounts, multi-car discounts, and bundling discounts for combining home and auto insurance.

What is the difference between liability coverage and collision coverage?

Liability coverage protects you financially if you cause an accident, while collision coverage covers damage to your own vehicle in an accident, regardless of fault.