Low cost car insurance Washington state can be a challenge, but with careful planning and research, you can find affordable coverage that meets your needs. Understanding the state’s insurance requirements, factors influencing costs, and available discounts is key to finding the best deal.

This guide will explore strategies for finding affordable car insurance in Washington, including comparing providers, negotiating rates, and avoiding common mistakes. We’ll also discuss the importance of having adequate coverage to protect yourself and your vehicle in case of an accident.

Understanding Washington State Car Insurance Requirements: Low Cost Car Insurance Washington State

Driving a car in Washington State comes with the responsibility of having car insurance. This insurance protects you and others financially in case of accidents or other incidents involving your vehicle. To drive legally in Washington, you must meet specific insurance requirements set by the state.

Mandatory Coverage Requirements

Washington State requires all drivers to have a minimum amount of liability insurance coverage. This coverage protects others in case you cause an accident. It covers damages to other people’s property and medical expenses for injuries they sustain due to your negligence.

- Bodily Injury Liability: This covers medical expenses, lost wages, and other related costs for injuries caused to others in an accident. Washington’s minimum requirement is $25,000 per person and $50,000 per accident.

- Property Damage Liability: This covers damages to another person’s vehicle or property, such as a fence or building, if you are at fault in an accident. The minimum requirement in Washington is $10,000 per accident.

Additional Optional Coverage Options

While liability coverage is mandatory, you can choose to add optional coverage to your policy for more comprehensive protection. These additional options can provide financial security in various situations.

- Collision Coverage: This covers damages to your vehicle if you are involved in an accident, regardless of who is at fault. Collision coverage is helpful if you want to repair or replace your vehicle after an accident.

- Comprehensive Coverage: This covers damages to your vehicle from non-accident events, such as theft, vandalism, natural disasters, or falling objects. It helps protect you from unexpected expenses related to these events.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who has no insurance or insufficient insurance. It helps cover your medical expenses and property damage if the other driver is unable to pay for their share of the damages.

Factors Influencing Car Insurance Costs in Washington

In Washington State, the cost of car insurance is determined by a multitude of factors. Understanding these factors can help you make informed decisions to potentially lower your premiums.

Age

Your age plays a significant role in your car insurance rates. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents due to their lack of experience. Insurance companies recognize this higher risk and adjust their premiums accordingly. However, as you gain more driving experience and reach your mid-20s, your rates typically decrease.

Driving History

Your driving history is a critical factor in determining your insurance costs. A clean driving record with no accidents, violations, or DUI convictions will result in lower premiums. Conversely, having a history of accidents, traffic violations, or DUI convictions will significantly increase your rates. Insurance companies view these events as indicators of higher risk and adjust premiums to reflect this.

Vehicle Type

The type of vehicle you drive also impacts your insurance premiums. Sports cars, luxury vehicles, and high-performance cars are generally more expensive to insure due to their higher repair costs and potential for greater damage in accidents. Conversely, smaller, less expensive cars typically have lower insurance premiums.

Location

Your location in Washington State can influence your car insurance rates. Urban areas with higher population densities and traffic congestion often have higher rates due to the increased likelihood of accidents. Conversely, rural areas with lower population densities and less traffic typically have lower insurance rates.

Credit Score

In Washington State, insurance companies are allowed to consider your credit score when determining your insurance rates. This practice is based on the belief that individuals with good credit history are more financially responsible and less likely to file claims. However, it’s important to note that credit score is just one factor among many and does not solely determine your insurance rates.

Driving Habits

Your driving habits can significantly impact your car insurance premiums. Insurance companies may offer discounts for drivers who demonstrate safe driving practices, such as maintaining a clean driving record, avoiding risky behaviors like speeding or driving under the influence, and participating in defensive driving courses.

Strategies for Finding Affordable Car Insurance in Washington

Finding affordable car insurance in Washington doesn’t have to be a daunting task. By understanding the various strategies available, you can significantly reduce your premiums and save money.

Car Insurance Discounts in Washington

Many insurance companies offer discounts to lower your premiums. These discounts are often based on factors like your driving history, vehicle features, and other personal circumstances.

| Discount Type | Description |

|---|---|

| Safe Driver Discount | Rewarding drivers with a clean driving record. |

| Good Student Discount | Offered to students with good academic performance. |

| Multi-Car Discount | Insuring multiple vehicles with the same company. |

| Multi-Policy Discount | Bundling home, renters, or life insurance with your car insurance. |

| Anti-theft Device Discount | Having anti-theft devices installed in your vehicle. |

| Defensive Driving Course Discount | Completing a defensive driving course. |

| Loyalty Discount | Rewarding long-term customers. |

| Pay-in-Full Discount | Paying your premium in full upfront. |

| Paperless Billing Discount | Opting for electronic billing and communication. |

Negotiating with Insurance Companies

You can negotiate with insurance companies to potentially lower your premiums.

- Shop around for quotes: Compare quotes from multiple insurance providers to find the best rates.

- Bundle your insurance policies: Combine your car insurance with other policies like home or renters insurance to qualify for discounts.

- Ask about discounts: Inquire about all available discounts you may qualify for, such as safe driver, good student, or multi-car discounts.

- Consider increasing your deductible: A higher deductible means lower premiums, but you’ll pay more out of pocket if you have an accident.

- Review your coverage: Ensure you have adequate coverage but avoid unnecessary extras that drive up your premiums.

- Be prepared to switch providers: If you’re not satisfied with your current insurer’s rates, be ready to switch to a more affordable option.

Resources for Finding Free Car Insurance Quotes

Several resources can help you find free car insurance quotes from multiple providers.

- Online comparison websites: Websites like Insurance.com, Policygenius, and The Zebra allow you to compare quotes from various insurers in a single location.

- Insurance agents: Independent insurance agents can help you compare quotes from different companies and find the best options for your needs.

- Insurance company websites: You can also get quotes directly from insurance company websites, such as Geico, State Farm, and Progressive.

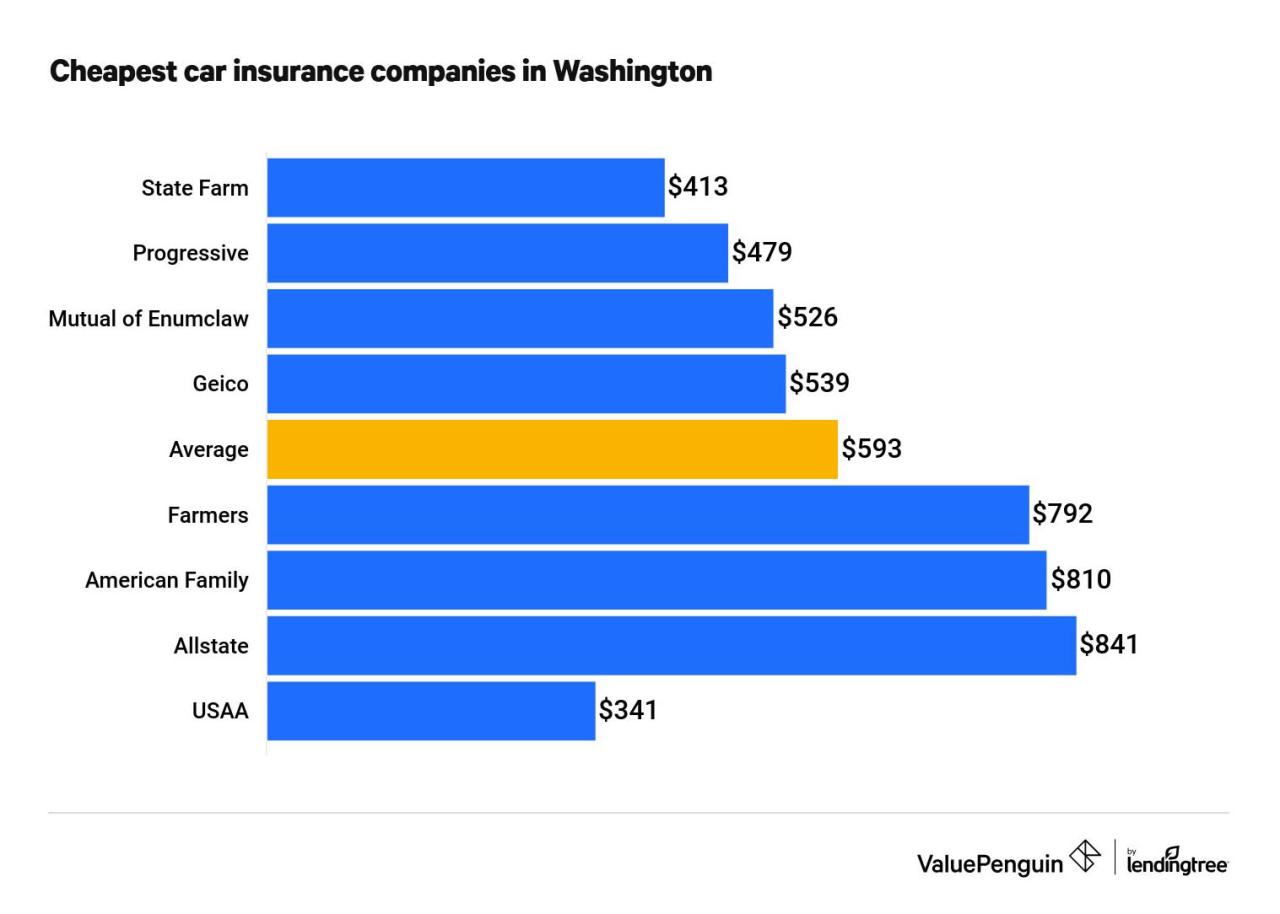

Low-Cost Car Insurance Providers in Washington

Finding affordable car insurance in Washington can be challenging, but there are several reputable companies known for offering competitive rates. This section will explore some of these providers, highlighting their strengths, weaknesses, and unique features.

Reputable Low-Cost Car Insurance Providers in Washington, Low cost car insurance washington state

- Geico: Geico is a well-known national insurer with a strong reputation for affordability. It offers a wide range of coverage options, including comprehensive and collision, and has a user-friendly website and mobile app. Geico also provides discounts for good drivers, multiple car policies, and safety features.

- Progressive: Progressive is another popular national insurer with a focus on personalized insurance plans. They offer a variety of discounts, including discounts for good drivers, safe driving courses, and bundling home and auto insurance. Progressive also has a unique “Name Your Price” tool that allows you to set your desired premium and find a policy that fits your budget.

- State Farm: State Farm is a well-established insurer with a strong local presence in Washington. They offer a range of insurance products, including car insurance, and are known for their customer service. State Farm provides discounts for good drivers, safe driving courses, and bundling home and auto insurance.

- USAA: USAA is a military-focused insurer that offers competitive rates to active-duty military personnel, veterans, and their families. They provide a wide range of coverage options, including comprehensive and collision, and offer discounts for good drivers, safe driving courses, and bundling home and auto insurance.

- Nationwide: Nationwide is a large national insurer that offers a variety of insurance products, including car insurance. They are known for their financial stability and customer service. Nationwide provides discounts for good drivers, safe driving courses, and bundling home and auto insurance.

Avoiding Common Car Insurance Mistakes

Navigating the world of car insurance can be confusing, and even a small mistake can lead to higher premiums. By understanding common pitfalls and taking proactive steps, you can ensure you’re getting the best possible coverage at an affordable price.

Choosing the Wrong Coverage

It’s essential to select the right coverage levels for your needs. Underinsuring your vehicle can leave you financially vulnerable in the event of an accident, while overinsuring can lead to unnecessary expenses.

- Liability Coverage: This is the most important type of coverage and protects you against financial losses if you cause an accident. Make sure your liability limits are high enough to cover potential damages and injuries.

- Collision Coverage: This covers damage to your car in an accident, regardless of fault. While optional, it’s usually recommended for newer or more expensive vehicles.

- Comprehensive Coverage: This protects against damage to your car from events other than collisions, such as theft, vandalism, or natural disasters. Consider this coverage if you have a valuable vehicle or live in an area prone to these risks.

Ignoring Discounts

Many insurers offer discounts that can significantly reduce your premiums.

- Good Driver Discounts: These are offered to drivers with clean driving records and no accidents or traffic violations.

- Safe Vehicle Discounts: Vehicles with advanced safety features like anti-lock brakes and airbags often qualify for lower rates.

- Multi-Policy Discounts: Bundling your car insurance with other policies, such as homeowners or renters insurance, can result in substantial savings.

Failing to Shop Around

Insurance rates can vary significantly between providers. It’s crucial to compare quotes from multiple insurers to find the best deal. Online comparison tools can make this process easier and more efficient.

Ignoring Your Policy

Once you have a policy, it’s essential to review it regularly. Changes in your driving habits, vehicle usage, or even your credit score can impact your premiums. Make sure your policy still meets your needs and that you’re taking advantage of all available discounts.

Not Understanding Your Deductible

Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your premium, but you’ll have to pay more in the event of a claim. Carefully consider your financial situation and risk tolerance when selecting your deductible.

Providing Inaccurate Information

When applying for insurance, it’s essential to provide accurate information about your driving history, vehicle usage, and other relevant details. Providing false information can lead to policy cancellation and potential legal consequences.

Failing to Review Your Policy After a Claim

After filing a claim, your insurance company may adjust your premium based on the claim details. It’s essential to review your policy after a claim to ensure that the premium changes are accurate and that your coverage hasn’t been reduced.

Neglecting to Maintain Your Vehicle

Proper vehicle maintenance can help prevent accidents and reduce the likelihood of claims. Regular servicing, including oil changes, tire rotations, and brake inspections, can help keep your car in good working order and potentially qualify you for discounts.

Last Point

Finding low cost car insurance in Washington State doesn’t have to be a daunting task. By understanding your insurance needs, comparing quotes, and taking advantage of available discounts, you can secure affordable coverage that provides peace of mind. Remember to regularly review your policy and make adjustments as needed to ensure you have the right protection for your vehicle and financial well-being.

Question & Answer Hub

What is the minimum liability coverage required in Washington State?

Washington State requires a minimum of $25,000 per person and $50,000 per accident for bodily injury liability, and $10,000 for property damage liability.

How can I get a free car insurance quote?

Many insurance companies offer free online quote tools. You can also contact insurance agents directly to request a quote.

What are some common mistakes to avoid when getting car insurance?

Common mistakes include failing to compare quotes, not taking advantage of discounts, and not having enough coverage.