Liability insurance new york state – Liability insurance in New York State is crucial for both individuals and businesses. It protects you from financial losses if you are found legally responsible for causing harm to others or their property. From general liability to professional liability, understanding the different types of coverage available is essential. This guide will explore the intricacies of liability insurance in New York, including requirements, premium factors, and the claims process.

New York State has specific regulations regarding liability insurance, particularly for certain industries and professions. Knowing these requirements and how they affect your business or personal life is vital. We’ll delve into the factors that influence your premium costs, such as your business size, industry, and risk profile. Finally, we’ll guide you through the process of filing a claim and finding the right policy for your needs.

Understanding Liability Insurance in New York State

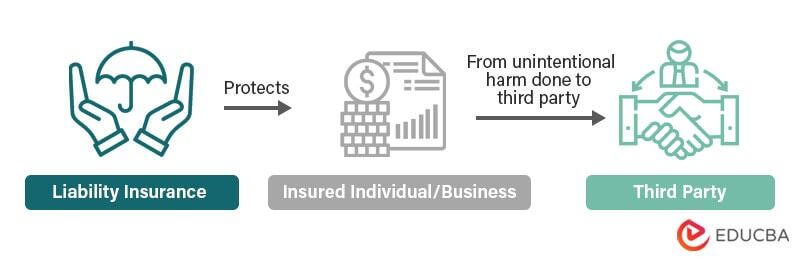

Liability insurance is a crucial component of financial protection for individuals and businesses in New York State. It safeguards you against financial losses arising from claims of negligence or wrongdoing that result in injury or damage to others. This insurance coverage is designed to cover legal fees, medical expenses, property damage, and other related costs that might arise from such incidents.

Types of Liability Insurance

Liability insurance in New York State is available in various forms, each tailored to specific needs and circumstances.

- General Liability Insurance: This is a broad form of coverage that protects individuals and businesses against claims of negligence or wrongdoing arising from their day-to-day operations. It covers a wide range of incidents, including bodily injury, property damage, and advertising injury.

- Professional Liability Insurance: Also known as Errors and Omissions (E&O) insurance, this type of coverage protects professionals, such as doctors, lawyers, accountants, and consultants, from claims of negligence or malpractice in the performance of their professional services.

- Product Liability Insurance: This coverage protects manufacturers and sellers of products against claims of harm caused by defects in their products. It covers expenses related to legal defense, settlements, and product recalls.

Key Components of a Liability Insurance Policy

Understanding the key components of a liability insurance policy is crucial for ensuring adequate protection. These components include:

- Coverage Limits: These limits define the maximum amount the insurance company will pay for covered claims. Coverage limits are typically expressed in dollar amounts, such as $1 million per occurrence or $2 million aggregate.

- Deductibles: This is the amount the policyholder is responsible for paying out-of-pocket before the insurance coverage kicks in. Deductibles can vary depending on the type of coverage and the policyholder’s risk profile.

- Exclusions: These are specific situations or types of claims that are not covered by the policy. Exclusions can include intentional acts, criminal activity, and certain types of professional negligence.

New York State Liability Insurance Requirements

New York State mandates specific liability insurance requirements for various industries and professions to ensure public safety and financial protection in case of accidents or negligence. These requirements are designed to safeguard individuals and businesses from potential financial losses arising from incidents related to their operations.

Liability Insurance Requirements for Specific Industries and Professions

New York State mandates specific liability insurance requirements for various industries and professions. These requirements are intended to ensure that businesses and individuals have adequate financial protection in case of accidents or negligence, safeguarding both public safety and the financial interests of those involved.

- Construction: Construction businesses are required to carry liability insurance, including workers’ compensation, to cover injuries or damages caused by their operations. This is particularly important due to the inherent risks associated with construction activities, such as falls, equipment malfunctions, and material handling.

- Healthcare: Healthcare providers, including hospitals, clinics, and doctors’ offices, are required to carry medical malpractice insurance to protect them from lawsuits arising from alleged negligence or errors in medical treatment. This coverage is crucial in ensuring that patients are financially protected if they experience adverse outcomes related to their medical care.

- Transportation: Businesses involved in transportation, such as trucking companies, taxi services, and bus lines, are required to carry liability insurance to cover accidents involving their vehicles. This insurance protects the public and businesses from potential financial losses due to injuries or property damage caused by these vehicles.

- Real Estate: Real estate agents and brokers are required to carry liability insurance to protect them from lawsuits arising from errors or omissions in their services. This coverage ensures that clients are financially protected if they experience losses due to negligence or misrepresentation in real estate transactions.

- Childcare: Daycare centers and other childcare facilities are required to carry liability insurance to cover injuries or accidents involving children in their care. This coverage is essential to protect both the children and the childcare providers from potential financial losses due to incidents that may occur during childcare activities.

Consequences of Operating Without Required Liability Insurance

Operating a business or engaging in a profession without the required liability insurance in New York State can lead to severe consequences, including:

- Financial Ruin: Without liability insurance, businesses and individuals are personally liable for any damages or injuries caused by their actions or negligence. This could lead to significant financial losses, including legal fees, medical expenses, and property damage costs. For example, a construction company without insurance could be held personally responsible for millions of dollars in damages if a worker is injured on a job site.

- License Suspension or Revocation: Failure to maintain required liability insurance can result in the suspension or revocation of business licenses or professional licenses. This can severely impact the ability of businesses to operate and individuals to practice their professions, leading to significant financial losses and reputational damage.

- Criminal Charges: In some cases, operating without required liability insurance can even lead to criminal charges, particularly if the lack of insurance contributes to serious injuries or deaths. These charges can result in fines, imprisonment, and a permanent criminal record, significantly impacting the individual’s future.

- Loss of Trust and Reputation: Operating without required liability insurance can damage a business’s or individual’s reputation, leading to a loss of trust from clients, customers, and the public. This can make it difficult to attract new business and retain existing clients, ultimately harming the long-term success of the business or professional.

Factors Affecting Liability Insurance Premiums in New York

The cost of liability insurance in New York can vary significantly depending on a range of factors. Understanding these factors can help individuals and businesses make informed decisions about their insurance coverage and potentially lower their premiums.

Business Size and Industry Type

The size and type of business are key determinants of liability insurance premiums. Larger businesses typically face higher premiums due to their increased potential for liability exposures. Similarly, businesses in high-risk industries, such as construction, manufacturing, and healthcare, generally pay higher premiums than those in lower-risk industries.

Risk Profile

An individual’s or business’s risk profile is a significant factor in determining liability insurance premiums. This profile considers factors such as:

- Prior Claims History: A history of claims, particularly significant or frequent ones, can significantly increase premiums. Insurance companies view this as an indicator of higher risk.

- Safety Practices: Businesses with strong safety protocols and a demonstrated commitment to risk mitigation often qualify for lower premiums. Conversely, those with inadequate safety measures or a history of safety violations may face higher rates.

- Nature of Operations: The type of work performed, the equipment used, and the potential hazards associated with a business’s operations all influence its risk profile and insurance premiums.

- Location: Geographic location can impact premiums, as some areas have higher rates of accidents, crime, or other risks.

Claims History

A history of claims, particularly significant or frequent ones, can significantly increase premiums. Insurance companies view this as an indicator of higher risk. Businesses with a clean claims history may qualify for lower premiums, while those with a history of claims may face higher rates.

Premium Rates for Different Types of Liability Insurance

Liability insurance premiums vary depending on the specific type of coverage. Here’s a comparison of premium rates for different types of liability insurance in New York:

| Type of Liability Insurance | Typical Premium Range | Factors Influencing Premium |

|---|---|---|

| General Liability Insurance | $500 – $5,000 per year | Business size, industry type, risk profile, claims history, coverage limits |

| Professional Liability Insurance (Errors and Omissions) | $1,000 – $10,000 per year | Professional experience, type of services offered, claims history, coverage limits |

| Product Liability Insurance | $1,000 – $10,000 per year | Type of products manufactured or sold, risk of product defects, claims history, coverage limits |

| Commercial Auto Liability Insurance | $1,000 – $5,000 per year | Number of vehicles, type of vehicles, driver experience, claims history, coverage limits |

Strategies to Lower Liability Insurance Premiums

Individuals and businesses can take several steps to potentially reduce their liability insurance premiums:

- Improve Safety Practices: Implementing robust safety protocols, providing employee training, and maintaining a safe work environment can demonstrate a commitment to risk mitigation and potentially lower premiums.

- Maintain a Clean Claims History: Avoiding claims or minimizing their frequency can significantly impact premiums. Implementing preventive measures and addressing potential risks proactively can help reduce the likelihood of claims.

- Increase Deductibles: Choosing higher deductibles can lower premiums, as you agree to pay more out-of-pocket in case of a claim. However, it’s important to ensure you can afford the deductible if a claim occurs.

- Shop Around for Quotes: Comparing quotes from multiple insurance companies can help secure the best rates and coverage options. This allows you to evaluate different pricing structures and find the most suitable insurance policy for your needs.

- Bundle Policies: Combining multiple insurance policies, such as liability insurance with property or auto insurance, can often result in discounts.

- Seek Professional Advice: Consulting with an insurance broker or agent can provide valuable insights into available coverage options and strategies to potentially lower premiums.

Liability Insurance Claims Process in New York: Liability Insurance New York State

Navigating the liability insurance claims process in New York can feel overwhelming, but understanding the steps involved can make the process smoother. This section will guide you through the process, explaining the roles of the insured, insurer, and claims adjuster, and discussing common types of claims.

Filing a Liability Insurance Claim in New York, Liability insurance new york state

When filing a liability insurance claim in New York, the process typically involves the following steps:

- Notify your insurer: As soon as possible after an incident, contact your insurance company to report the claim. This is crucial to initiate the claims process and ensure timely assistance. Provide all relevant details, such as the date, time, and location of the incident, as well as any injuries or damages sustained.

- Complete a claim form: Your insurer will provide you with a claim form to complete, which will require you to provide further information about the incident and your policy details. Be sure to fill out the form accurately and thoroughly to avoid any delays in processing your claim.

- Provide supporting documentation: To support your claim, gather and submit any relevant documentation, such as police reports, medical records, photographs of damages, and witness statements. This documentation will help validate your claim and expedite the claims process.

- Claims adjuster investigation: Once your claim is filed, an insurance claims adjuster will be assigned to investigate the incident. The adjuster will gather information, assess the damages, and determine the extent of coverage under your policy. They may request additional information or documentation from you, or conduct interviews with witnesses.

- Negotiation and settlement: After the investigation, the claims adjuster will negotiate a settlement with you. This involves determining the amount of compensation you will receive for your damages and injuries. If you disagree with the settlement offer, you have the right to negotiate or seek further assistance from an attorney.

- Payment of claim: Once a settlement is reached, your insurer will issue payment for your claim. The payment may be made directly to you, or to the party or parties involved in the incident, depending on the circumstances.

Roles in the Claims Process

- Insured: The insured is the individual or entity covered by the liability insurance policy. They are responsible for notifying their insurer of the incident, providing accurate information, and cooperating with the claims adjuster throughout the process.

- Insurer: The insurer is the insurance company that provides the liability insurance coverage. They are responsible for investigating the claim, assessing the damages, and negotiating a settlement with the insured.

- Claims Adjuster: The claims adjuster is an employee of the insurance company who is responsible for investigating and processing claims. They gather information, assess damages, and negotiate settlements with the insured.

Common Types of Liability Insurance Claims in New York

Liability insurance claims in New York can arise from various situations, including:

- Bodily injury: This type of claim involves injuries to a person, such as broken bones, cuts, burns, or other medical conditions. The insured may be liable for the injured person’s medical expenses, lost wages, and pain and suffering.

- Property damage: This type of claim involves damage to property, such as a car, home, or other belongings. The insured may be liable for the cost of repairs or replacement of the damaged property.

- Negligence: This type of claim involves a situation where someone fails to act with reasonable care, resulting in injury or damage to another person or property. For example, if a homeowner fails to maintain their sidewalk and a pedestrian slips and falls, the homeowner could be held liable for negligence.

Finding the Right Liability Insurance in New York

Finding the right liability insurance policy in New York can seem daunting, but with a strategic approach, you can secure the protection you need at a competitive price. This section provides a guide for individuals and businesses to navigate the process of selecting the most suitable liability insurance policy in New York.

Comparing Liability Insurance Providers in New York

Choosing the right liability insurance provider is crucial. It’s essential to compare various providers to find the best coverage and price for your needs. Here’s a table comparing different liability insurance providers in New York, including their coverage options, pricing, and customer service.

| Provider | Coverage Options | Pricing | Customer Service |

|---|---|---|---|

| [Provider 1 Name] | [List of coverage options] | [Price range or details] | [Rating or description of customer service] |

| [Provider 2 Name] | [List of coverage options] | [Price range or details] | [Rating or description of customer service] |

| [Provider 3 Name] | [List of coverage options] | [Price range or details] | [Rating or description of customer service] |

Importance of Consulting with an Insurance Broker or Agent

Consulting with an insurance broker or agent is highly recommended when selecting liability insurance. Brokers and agents can provide expert guidance based on your specific needs and circumstances. They can help you:

- Identify the types of liability insurance you require.

- Compare quotes from different providers.

- Negotiate better coverage and pricing.

- Understand the nuances of insurance policies.

- Ensure you have adequate coverage for your specific risks.

Closing Summary

Navigating the world of liability insurance in New York can seem daunting, but with the right information and guidance, you can make informed decisions to protect yourself and your assets. By understanding the types of coverage, legal requirements, and factors affecting premiums, you can find the right insurance policy to fit your specific needs and minimize your risk. Remember to consult with an experienced insurance broker or agent for personalized advice and support.

Helpful Answers

What are the minimum liability insurance requirements for businesses in New York?

The minimum liability insurance requirements vary depending on the industry and type of business. It’s crucial to check with the New York State Department of Insurance or a licensed insurance agent to determine the specific requirements for your business.

How often should I review my liability insurance policy?

It’s recommended to review your liability insurance policy at least annually, or more frequently if there are significant changes in your business operations, risk profile, or legal requirements.

What are some common exclusions in liability insurance policies?

Common exclusions in liability insurance policies include intentional acts, criminal activity, and certain types of professional negligence. Carefully review your policy to understand the specific exclusions that apply to your coverage.

Can I get a discount on my liability insurance premium?

Yes, there are several ways to potentially lower your liability insurance premium, including maintaining a good claims history, implementing safety measures, and bundling your insurance policies with the same provider.