Kentucky State Minimum Auto Insurance is a crucial aspect of driving in the Bluegrass State. It ensures drivers have the necessary financial protection in case of accidents. Understanding the minimum coverage requirements is essential for all Kentucky drivers, as failing to comply can lead to serious consequences.

This guide delves into the details of Kentucky’s minimum auto insurance requirements, covering the types of coverage mandated, the purpose behind them, and factors that influence insurance costs. We’ll also explore how to find affordable options and the implications of Kentucky’s Financial Responsibility Law.

Kentucky Minimum Auto Insurance Requirements

Driving a car in Kentucky requires you to have a minimum level of auto insurance coverage. This helps protect you and others in case of an accident.

Kentucky’s Minimum Auto Insurance Requirements

Kentucky mandates specific types of auto insurance coverage for all drivers. These include liability, uninsured/underinsured motorist, and personal injury protection (PIP).

Liability Coverage

Liability coverage protects you financially if you cause an accident that injures someone or damages their property. It covers the other driver’s medical bills, lost wages, and property damage.

Kentucky law requires a minimum of $25,000 per person for bodily injury liability, $50,000 per accident for bodily injury liability, and $25,000 for property damage liability.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you if you are involved in an accident with a driver who has no insurance or insufficient insurance to cover your losses.

Kentucky law requires a minimum of $25,000 per person for bodily injury liability, $50,000 per accident for bodily injury liability, and $25,000 for property damage liability.

Personal Injury Protection (PIP)

PIP coverage helps pay for your medical expenses and lost wages if you are injured in an accident, regardless of who is at fault.

Kentucky law requires a minimum of $10,000 in PIP coverage.

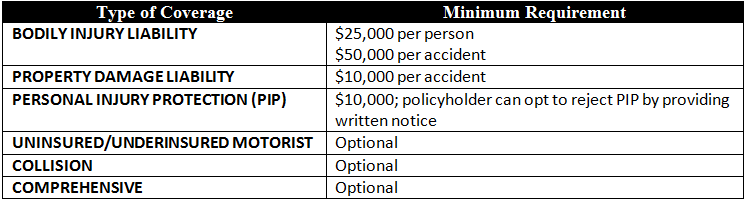

Minimum Coverage Limits

Here is a table summarizing the minimum coverage limits for each required insurance type:

| Coverage Type | Minimum Coverage Limit |

|—|—|

| Bodily Injury Liability per Person | $25,000 |

| Bodily Injury Liability per Accident | $50,000 |

| Property Damage Liability | $25,000 |

| Uninsured/Underinsured Motorist Coverage per Person | $25,000 |

| Uninsured/Underinsured Motorist Coverage per Accident | $50,000 |

| Personal Injury Protection (PIP) | $10,000 |

Understanding Kentucky’s Minimum Coverage

Kentucky law requires all drivers to carry a minimum amount of auto insurance to protect themselves and others on the road. These requirements ensure that drivers have financial resources to cover potential damages and injuries caused by accidents. Understanding the purpose and function of each coverage type is crucial for responsible driving in Kentucky.

Liability Coverage

Liability coverage is the most important part of your Kentucky auto insurance policy. It protects you financially if you cause an accident that results in injuries or property damage to others.

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages to people injured in an accident that you caused.

- Property Damage Liability: This coverage pays for repairs or replacement costs of damaged property, such as vehicles, buildings, or other structures, if you are at fault for an accident.

For instance, if you rear-end another vehicle, causing injuries to the driver and damage to their car, your bodily injury liability coverage would pay for the other driver’s medical bills, lost wages, and pain and suffering, while your property damage liability coverage would cover the cost of repairing or replacing the damaged vehicle.

Uninsured/Underinsured Motorist Coverage

This coverage protects you if you are involved in an accident with a driver who has no insurance or insufficient insurance to cover your losses.

- Uninsured Motorist Coverage: This coverage pays for your injuries and damages if you are hit by a driver without insurance.

- Underinsured Motorist Coverage: This coverage pays for the difference between your damages and the amount covered by the other driver’s insurance if they have insufficient coverage.

Imagine you are stopped at a red light and get hit by a driver who runs a red light. If the other driver doesn’t have insurance or has minimal coverage, your uninsured/underinsured motorist coverage will help you pay for your medical bills, lost wages, and property damage.

Personal Injury Protection (PIP), Ky state minimum auto insurance

PIP coverage, also known as no-fault insurance, covers your medical expenses and lost wages regardless of who is at fault in an accident. This coverage is optional in Kentucky, but it can be a valuable addition to your policy.

Kentucky law allows drivers to choose their PIP coverage level, ranging from $1,000 to $10,000.

For example, if you are involved in an accident and sustain injuries, your PIP coverage will help pay for your medical bills and lost wages, even if you are at fault for the accident.

Consequences of Driving Without Minimum Insurance

Driving without the minimum required insurance in Kentucky is illegal and can result in serious consequences.

- Fines and Penalties: You could face hefty fines, suspension of your driver’s license, and even jail time for driving without insurance.

- Financial Responsibility: If you are involved in an accident without insurance, you are personally liable for all damages and injuries, potentially leading to significant financial hardship.

- Difficulty Registering Your Vehicle: You may not be able to register your vehicle in Kentucky without proof of insurance.

Factors Influencing Insurance Costs in Kentucky

Your auto insurance premium in Kentucky is influenced by a variety of factors, including your driving history, the type of vehicle you drive, and where you live. Understanding these factors can help you make informed decisions about your insurance policy and potentially lower your premiums.

Driver Demographics

Your age, gender, and marital status can impact your insurance premiums. Younger and unmarried drivers are generally considered riskier, which can lead to higher premiums. This is because young drivers have less experience behind the wheel, and unmarried individuals may be more likely to take risks.

Vehicle Type

The type of vehicle you drive is a significant factor in determining your insurance costs. Sports cars, luxury vehicles, and high-performance vehicles are generally more expensive to insure than standard cars. This is because these vehicles are more likely to be involved in accidents and have higher repair costs.

Driving History

Your driving history plays a major role in your insurance premiums. Drivers with a clean driving record, including no accidents or traffic violations, will typically pay lower premiums. However, having a history of accidents, speeding tickets, or DUI convictions will significantly increase your insurance costs.

Location

The location where you live and drive can also affect your insurance premiums. Urban areas with higher population density and traffic congestion tend to have higher accident rates, leading to higher insurance premiums. Conversely, rural areas with lower population density and less traffic may have lower insurance premiums.

Insurance Company Pricing Strategies

Different insurance companies in Kentucky use varying pricing strategies. Some companies may focus on offering competitive rates to attract new customers, while others may prioritize profitability and charge higher premiums. It’s important to compare quotes from multiple insurers to find the best rates for your specific needs and circumstances.

Finding Affordable Auto Insurance in Kentucky

Finding affordable auto insurance in Kentucky is crucial, especially with the state’s minimum coverage requirements. Fortunately, there are several strategies you can employ to secure a policy that fits your budget without compromising on essential protection.

Comparing Quotes From Multiple Insurance Providers

It’s essential to compare quotes from multiple insurance providers before making a decision. This allows you to see a range of prices and coverage options, ensuring you get the best deal.

- Use online comparison tools: Many websites allow you to enter your information once and receive quotes from several insurance companies simultaneously, simplifying the comparison process.

- Contact insurance companies directly: Don’t hesitate to call or visit insurance companies directly to get personalized quotes and discuss your specific needs.

- Consider local insurance agents: Local insurance agents can often provide personalized recommendations and help you navigate the insurance market.

Exploring Discounts and Other Cost-Saving Options

Insurance companies offer various discounts to reduce premiums. It’s worth exploring these options to lower your overall cost.

- Good driving record: Maintaining a clean driving record with no accidents or traffic violations can significantly reduce your premiums.

- Safety features: Vehicles equipped with anti-theft devices, airbags, and other safety features may qualify for discounts.

- Bundling policies: Combining your auto insurance with other policies like homeowners or renters insurance can often lead to significant savings.

- Paying your premium in full: Some insurance companies offer discounts for paying your premium annually instead of monthly.

- Loyalty discounts: Staying with the same insurance company for an extended period can sometimes earn you a loyalty discount.

Understanding Kentucky’s Financial Responsibility Law

Kentucky’s Financial Responsibility Law is designed to protect you and other drivers on the road by ensuring that all drivers have the financial means to cover damages caused by accidents. This law Artikels the minimum insurance coverage required for all drivers and sets penalties for those who fail to comply.

Penalties for Driving Without Insurance

Driving without insurance in Kentucky is a serious offense. If you are caught driving without the required minimum insurance coverage, you can face a range of penalties, including:

- Fines: You can be fined up to $1,000 for the first offense and up to $2,000 for subsequent offenses.

- License Suspension: Your driver’s license can be suspended for up to six months for the first offense and up to one year for subsequent offenses.

- Vehicle Impoundment: Your vehicle may be impounded until you provide proof of insurance.

- Court Costs: You will also be responsible for court costs associated with the violation.

Obtaining a Certificate of Financial Responsibility

If you are involved in an accident and do not have the required minimum insurance coverage, you may be required to obtain a Certificate of Financial Responsibility. This certificate demonstrates your ability to pay for any damages caused by the accident.

- How to Obtain a Certificate: You can obtain a Certificate of Financial Responsibility by providing proof of insurance or by posting a bond with the Kentucky Department of Motor Vehicle Licensing.

- Duration: The certificate is typically valid for three years, but you may need to renew it depending on the specific circumstances.

Exploring Additional Auto Insurance Coverage Options

While Kentucky’s minimum auto insurance requirements provide basic protection, you might consider adding additional coverage for enhanced financial security. These optional coverages offer valuable protection beyond the state’s minimum requirements, but they also come with additional costs. Understanding the benefits and potential costs of these coverages can help you make informed decisions based on your individual needs and financial situation.

Collision Coverage

Collision coverage protects you against damage to your vehicle caused by a collision with another vehicle or an object, regardless of fault. If you’re involved in an accident, this coverage helps pay for repairs or replacement costs, minus your deductible. Collision coverage is particularly important if you have a newer or financed vehicle, as the cost of repairs or replacement could be significant.

Comprehensive Coverage

Comprehensive coverage provides financial protection against damage to your vehicle caused by events other than collisions, such as theft, vandalism, fire, hail, or natural disasters. This coverage can help you recover from unexpected losses and ensure your vehicle is repaired or replaced after a covered event.

Rental Reimbursement

Rental reimbursement coverage helps pay for a rental car if your vehicle is damaged and needs repairs or is stolen while covered by your insurance policy. This coverage can be particularly helpful if you rely on your vehicle for work or other essential activities, as it helps minimize disruptions to your daily life.

Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist (UM/UIM) coverage protects you and your passengers if you’re involved in an accident with a driver who is uninsured or underinsured. This coverage helps pay for medical expenses, lost wages, and other damages that you might incur. It’s essential to consider this coverage, as it can provide financial security in the event of an accident with a driver who lacks adequate insurance.

Closure: Ky State Minimum Auto Insurance

Navigating Kentucky’s auto insurance landscape can be complex, but by understanding the state’s minimum requirements and exploring available options, drivers can ensure they are adequately protected. Remember, driving without the proper insurance coverage can result in significant financial and legal penalties. Be informed, be prepared, and drive safely!

Detailed FAQs

How much does Kentucky minimum auto insurance cost?

The cost of Kentucky minimum auto insurance varies based on factors like your driving history, age, vehicle type, and location. It’s recommended to get quotes from multiple insurance companies to find the best rates.

What happens if I get into an accident and don’t have enough insurance?

If you cause an accident and your coverage is insufficient to cover the damages, you could be held personally liable for the remaining costs. This could lead to significant financial burdens and even legal action.

Is it worth getting more coverage than the minimum required?

While the minimum coverage is mandatory, it’s often wise to consider additional coverage like collision and comprehensive insurance. These options can provide greater protection and peace of mind in the event of an accident.