Is florida a no fault state for car insurance – Is Florida a no-fault state for car insurance sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Florida’s unique no-fault system for car insurance presents both advantages and disadvantages for drivers involved in accidents. This system, unlike many other states, mandates Personal Injury Protection (PIP) coverage, which covers medical expenses and lost wages regardless of fault. However, this comes with limitations, such as a “threshold” requirement for pursuing a lawsuit against the at-fault driver for pain and suffering. This exploration will delve into the intricacies of Florida’s no-fault system, highlighting its benefits, drawbacks, and the complexities of navigating claims and legal proceedings.

Florida’s no-fault system aims to simplify the process of handling car accidents by removing the need to determine fault in every case. This system is designed to expedite claim processing and reduce litigation, ultimately leading to quicker payouts for medical expenses and lost wages. However, the system also faces criticism for limiting compensation for serious injuries and creating opportunities for fraud. The “threshold” requirement, which necessitates a significant injury before pursuing a lawsuit against the at-fault driver, has sparked debate regarding its effectiveness in providing fair compensation to accident victims.

Florida’s No-Fault Insurance System

Florida operates under a no-fault insurance system, meaning that drivers involved in an accident are primarily responsible for covering their own medical expenses and lost wages, regardless of who caused the accident. This system is designed to streamline the claims process and reduce litigation.

Mandatory Personal Injury Protection (PIP) Coverage

Florida law mandates that all drivers carry Personal Injury Protection (PIP) coverage, which provides benefits for medical expenses and lost wages resulting from an accident, regardless of fault. PIP coverage is a crucial component of Florida’s no-fault system.

The “Threshold” Requirement for Pursuing a Lawsuit

Florida’s no-fault system has a “threshold” requirement that must be met before an injured party can file a lawsuit against the other driver for pain and suffering damages. This threshold is typically met when the injured person sustains “serious injury” as defined by Florida law.

“Serious injury” includes permanent injuries, significant scarring or disfigurement, or injuries that result in a permanent impairment of a bodily function.

Limitations on PIP Coverage

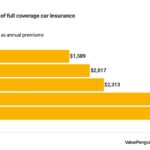

PIP coverage in Florida has certain limitations. The maximum benefit amount for PIP coverage is $10,000 per person per accident. This means that the total amount of medical expenses and lost wages that can be covered by PIP is capped at $10,000. Additionally, there is a deductible that must be paid by the insured before PIP benefits begin. The deductible amount can vary depending on the insurance policy.

Benefits and Drawbacks of Florida’s No-Fault System: Is Florida A No Fault State For Car Insurance

Florida’s no-fault insurance system has been in place since 1971, and its purpose is to simplify the process of handling car accidents and reduce the number of lawsuits. This system has both advantages and disadvantages, and it is important to understand both sides of the coin.

Advantages of Florida’s No-Fault System

The no-fault system in Florida aims to streamline the process of handling car accidents and reduce the number of lawsuits. It offers several advantages, including:

- Faster Claim Processing: Under the no-fault system, drivers are required to file claims with their own insurance companies, regardless of who caused the accident. This means that claims are processed faster, as there is no need to wait for the other driver’s insurance company to investigate the accident. This expedites the process of receiving compensation for medical expenses and other losses.

- Reduced Litigation: By requiring drivers to file claims with their own insurance companies, the no-fault system reduces the number of lawsuits. This is because drivers are less likely to sue each other for damages if they are already covered by their own insurance. This, in turn, reduces the burden on the court system and helps to keep insurance premiums lower.

Disadvantages of Florida’s No-Fault System

While the no-fault system has its benefits, it also has some drawbacks:

- Limited Coverage for Serious Injuries: Florida’s no-fault system limits the amount of coverage available for serious injuries. This means that drivers with severe injuries may not be able to recover all of their medical expenses and other losses. The system primarily focuses on covering economic losses, such as medical bills and lost wages, and limits the amount of compensation for pain and suffering. This can be particularly challenging for individuals who suffer permanent disabilities or long-term medical complications as a result of the accident.

- Potential for Fraud: Like any insurance system, Florida’s no-fault system is susceptible to fraud. Some individuals may attempt to file false claims or exaggerate their injuries to receive higher payouts. This can increase insurance premiums for all drivers, as insurance companies have to factor in the cost of fraudulent claims. It also puts a strain on the system, making it harder for legitimate claimants to receive the compensation they deserve.

Comparison to Other States’ Systems

Florida’s no-fault system differs significantly from the systems used in other states. Many states have a “tort” system, where drivers can sue each other for damages, regardless of who caused the accident. This allows for more flexibility in determining fault and potentially higher compensation for injuries, but it also increases the potential for litigation and higher insurance premiums. Some states have a “modified no-fault” system, which combines elements of both the no-fault and tort systems. This allows drivers to sue each other in certain circumstances, such as when the injuries are severe or the other driver was at fault.

Filing a Claim in Florida

Filing a claim in Florida’s no-fault system involves specific steps, including reporting the accident, seeking medical attention, and documenting the incident. Understanding these steps can help ensure a smoother claim process and maximize your chances of receiving compensation.

Filing a PIP Claim

After a car accident, you should file a Personal Injury Protection (PIP) claim with your insurance company. This claim covers your medical expenses, lost wages, and other related costs, regardless of who caused the accident.

- Report the Accident: Immediately after the accident, report it to your insurance company. You can usually do this by phone or online.

- Seek Medical Attention: It’s crucial to seek medical attention promptly after an accident, even if you don’t feel injured. This helps establish a record of your injuries and ensures you receive necessary treatment.

- Complete and Submit the PIP Claim Form: Your insurance company will provide you with a PIP claim form. Fill it out completely and accurately, providing all the necessary information, including your medical records, bills, and other relevant documents.

- Follow Up with Your Insurance Company: After submitting your claim, follow up with your insurance company to track its progress. Be prepared to provide any additional information they may require.

Reporting the Incident

Reporting the accident is crucial for starting the claim process.

- Contact Your Insurance Company: The first step is to contact your insurance company and report the accident. This should be done as soon as possible after the incident.

- Provide Necessary Information: When reporting the accident, be prepared to provide details such as the date, time, and location of the accident, the names and contact information of all parties involved, and a description of the accident.

- File a Police Report: If the accident involves injuries or property damage exceeding a certain threshold, you may be required to file a police report.

Seeking Medical Attention

Promptly seeking medical attention after an accident is essential for several reasons:

- Establish a Record of Your Injuries: Seeking medical attention establishes a record of your injuries, which is crucial for your PIP claim.

- Receive Necessary Treatment: Timely medical care can help prevent further injury and promote healing.

- Avoid Potential Complications: Ignoring injuries can lead to complications that could worsen your condition and impact your claim.

Obtaining Documentation and Evidence

Documentation and evidence play a crucial role in supporting your PIP claim.

- Medical Records: Gather all medical records related to your injuries, including doctor’s notes, test results, and bills.

- Lost Wage Documentation: If you miss work due to your injuries, keep track of your lost wages and provide documentation to your insurance company.

- Accident Scene Photographs: Take photographs of the accident scene, including any damage to your vehicle and the surrounding area.

- Witness Statements: If any witnesses were present, obtain their contact information and ask them to provide written statements about what they saw.

Seeking Legal Representation

In Florida’s no-fault system, you might wonder when it’s necessary to involve a lawyer. While you can handle your own claims initially, there are specific scenarios where seeking legal counsel becomes crucial.

When to Consult a Car Accident Attorney in Florida

Here are some situations where seeking legal representation after a car accident in Florida is strongly recommended:

- Significant Injuries: If your injuries are severe, leading to substantial medical bills, lost wages, and long-term disability, it’s vital to have an attorney advocate for your rights and ensure you receive fair compensation.

- Disputed Liability: When the other driver denies fault, or if the accident involves multiple vehicles, a lawyer can help establish liability and negotiate a settlement that reflects the true extent of your damages.

- Unfair Insurance Company Practices: If your insurance company delays, denies, or undervalues your claim, an attorney can challenge their actions and protect your interests.

- Permanent Injuries: If you’ve sustained permanent injuries, such as paralysis or disfigurement, you’ll need an attorney to ensure you receive appropriate compensation for future medical expenses, lost earning capacity, and pain and suffering.

- Death of a Loved One: In cases involving wrongful death, an attorney can guide you through the legal process and help you recover damages for loss of companionship, support, and future earnings.

Role of a Car Accident Attorney

A car accident attorney plays a vital role in navigating Florida’s no-fault system and pursuing legal action:

- Negotiate with Insurance Companies: Attorneys are skilled negotiators and can handle communication with insurance companies on your behalf, ensuring you receive a fair settlement.

- Investigate the Accident: Attorneys can gather evidence, such as police reports, witness statements, and medical records, to build a strong case in your favor.

- File Claims and Lawsuits: Attorneys are knowledgeable about legal procedures and can file necessary paperwork to pursue your claim or initiate a lawsuit if necessary.

- Represent You in Court: If your case goes to trial, an attorney will represent you in court and advocate for your rights.

- Maximize Your Compensation: Attorneys can help you understand your legal options and pursue all available avenues to maximize your compensation.

Finding a Qualified Car Accident Attorney

Here are some tips for finding a qualified car accident attorney in Florida:

- Seek Referrals: Ask friends, family, or colleagues for recommendations of attorneys they have worked with in the past.

- Check Online Reviews: Websites like Avvo and Martindale-Hubbell provide reviews and ratings of attorneys, allowing you to gauge their reputation.

- Contact the Florida Bar: The Florida Bar website provides a directory of attorneys licensed in the state, allowing you to search for specialists in car accident law.

- Schedule Consultations: Meet with several attorneys to discuss your case and get a feel for their experience, communication style, and fees.

Common Misconceptions about Florida’s No-Fault System

Florida’s no-fault insurance system, while designed to streamline accident claims, often leads to confusion and misunderstandings. This section will address some common misconceptions surrounding this system.

The Belief that All Accidents Are Covered by PIP, Is florida a no fault state for car insurance

One of the most common misconceptions is that all accidents are covered by Personal Injury Protection (PIP) coverage. While PIP coverage is a mandatory component of Florida auto insurance, it doesn’t cover every aspect of an accident. PIP coverage primarily focuses on your own injuries and medical expenses, regardless of fault. However, it does not cover all damages, such as property damage or pain and suffering.

Understanding the Differences Between PIP Coverage and Other Types of Car Insurance

It’s important to distinguish between PIP coverage and other types of car insurance, such as liability coverage. Liability coverage, unlike PIP, protects you against financial responsibility for damages you cause to others in an accident. It covers the other driver’s medical expenses, property damage, and even their lost wages. Therefore, while PIP covers your own injuries, liability coverage protects you from financial repercussions for causing harm to others.

Debunking Myths about the Threshold Requirement for Pursuing Lawsuits

Florida’s no-fault system has a threshold requirement, which means you can’t sue the other driver unless you meet certain criteria. A common misconception is that you can never sue the other driver after an accident. This is incorrect. You can sue the other driver if your injuries meet the threshold requirement, which is defined as:

“A permanent injury within a reasonable degree of medical probability, other than scarring or disfigurement.”

This threshold requirement does not mean you must have a permanent injury; it simply means that your injuries must be serious enough to be considered permanent. Furthermore, there are exceptions to this threshold requirement, such as if the other driver was intoxicated or driving recklessly.

Closing Summary

Understanding the intricacies of Florida’s no-fault system is crucial for drivers in the state. While the system aims to streamline the claims process and provide immediate benefits, it’s essential to be aware of its limitations and potential drawbacks. Drivers should familiarize themselves with their PIP coverage, the “threshold” requirement, and the process for filing claims. Seeking legal counsel from a qualified car accident attorney can be invaluable in navigating the complexities of the system and ensuring your rights are protected.

Helpful Answers

How much PIP coverage is required in Florida?

Florida law requires a minimum of $10,000 in PIP coverage.

What types of injuries meet the “threshold” requirement for a lawsuit?

The “threshold” requirement is met if you have suffered a significant injury, such as permanent injury, serious disfigurement, or death.

Can I choose to opt out of PIP coverage in Florida?

No, PIP coverage is mandatory in Florida. You cannot opt out of it.

What happens if my PIP benefits are exhausted?

If your PIP benefits are exhausted, you may need to pursue other options, such as health insurance or a lawsuit against the at-fault driver.

Is there a time limit for filing a PIP claim?

Yes, you have 14 days from the date of the accident to file a PIP claim.