Is florida a no fault car insurance state – Is Florida a no-fault car insurance state? The answer is yes, and it’s a system that has both advantages and disadvantages for drivers. Florida’s no-fault insurance system, known as Personal Injury Protection (PIP), aims to simplify the claims process and reduce litigation after accidents. But understanding the nuances of this system is crucial for anyone driving in the Sunshine State.

This system, implemented in 1971, requires all drivers to carry PIP coverage, which provides benefits for medical expenses and lost wages regardless of who is at fault. This means that after an accident, you can seek treatment and compensation from your own insurance company, regardless of whether you were the one who caused the accident. However, there are limitations to PIP coverage, and there are specific situations where a fault-based claim may be necessary.

Understanding Florida’s No-Fault System

Florida’s no-fault insurance system is a unique approach to handling car accident claims. Unlike traditional fault-based systems where drivers must prove negligence, Florida’s system focuses on ensuring prompt medical treatment and compensation for accident victims, regardless of who caused the accident.

Purpose and Rationale

The primary purpose of Florida’s no-fault system is to provide swift and efficient compensation for medical expenses and lost wages to accident victims. This system aims to reduce the number of lawsuits arising from car accidents, thus easing the burden on the court system and potentially lowering insurance premiums. Additionally, it is designed to encourage prompt medical treatment for accident victims, as they are not required to prove fault before seeking medical attention.

History of Implementation

Florida adopted its no-fault insurance system in 1971, following the lead of other states seeking to streamline the claims process and reduce the number of lawsuits. The implementation of no-fault was met with some resistance, with concerns raised about potential limitations on the rights of accident victims. However, the system has remained in place and has been modified over the years to address some of these concerns.

Key Components of Florida’s No-Fault Law: Is Florida A No Fault Car Insurance State

Florida’s no-fault system is a unique approach to car insurance, aiming to streamline the claims process and reduce litigation. It is governed by a set of regulations that define the rights and responsibilities of drivers involved in accidents.

Personal Injury Protection (PIP) Coverage

Florida’s no-fault law mandates that all drivers carry Personal Injury Protection (PIP) coverage. PIP provides coverage for medical expenses and lost wages incurred by the insured and their passengers in an accident, regardless of fault. It is designed to cover essential expenses while minimizing legal disputes.

Limitations of PIP Coverage

- Limited Coverage: PIP coverage in Florida is capped at $10,000 per person per accident. This means that if your medical expenses exceed this limit, you will be responsible for the remaining costs.

- 80% Rule: Florida law requires PIP coverage to pay 80% of your reasonable medical expenses, while the remaining 20% is your responsibility.

- Limited Lost Wage Coverage: PIP coverage also provides limited compensation for lost wages, usually capped at $2,000 per person per accident.

Benefits of PIP Coverage

- Quick Payments: PIP claims are typically processed and paid out faster than traditional liability claims. This can be a significant benefit for accident victims who need immediate financial assistance for medical bills or lost wages.

- No Fault Requirement: PIP coverage is available regardless of who caused the accident. This eliminates the need to prove fault, simplifying the claims process and reducing potential disputes.

- Mandatory Coverage: Since PIP is mandatory, all drivers in Florida have access to this essential coverage, ensuring that they are protected in the event of an accident.

Filing a PIP Claim

- Report the Accident: You must report the accident to your insurance company as soon as possible, typically within a specified timeframe (e.g., 30 days).

- Seek Medical Attention: Seek medical treatment for your injuries promptly. Your insurance company may require you to visit a healthcare provider within a certain time frame (e.g., 14 days) to qualify for benefits.

- Submit a Claim: Complete a PIP claim form and submit it to your insurance company along with supporting documentation, such as medical bills and lost wage statements.

- Review and Payment: Your insurance company will review your claim and make a determination regarding your benefits. If your claim is approved, you will receive payments for your covered expenses.

When to File a Fault-Based Claim

Florida’s no-fault system is designed to provide prompt medical benefits and compensation for lost wages after an accident. However, it’s not a complete shield against financial responsibility. There are instances where you can pursue a fault-based claim to recover additional damages beyond your Personal Injury Protection (PIP) benefits.

This section will delve into the situations where you can file a fault-based claim, the threshold for doing so, and the process involved.

Circumstances for Filing a Fault-Based Claim

In Florida, you can file a fault-based claim against the at-fault driver if your injuries meet certain criteria. This is because, under Florida’s no-fault system, you can only file a claim against the at-fault driver if you have suffered a “serious injury.” These injuries are defined as those that meet one or more of the following criteria:

- Permanent Injury: A permanent injury is defined as a significant impairment of bodily function that is permanent and not temporary. This includes injuries that have resulted in a permanent disability or loss of function.

- Significant and Permanent Disfigurement: This includes injuries that result in a permanent and significant disfigurement that is visible and noticeable.

- Significant Impairment of a Bodily Function: This includes injuries that have caused a significant impairment of a bodily function, such as loss of mobility, loss of sensation, or loss of use of a limb.

- Death: This is the most serious injury that can occur in a car accident and is always grounds for a fault-based claim.

It’s important to note that the threshold for a “serious injury” is high in Florida. For example, a broken bone or a soft tissue injury might not be considered a serious injury, unless it results in a significant impairment of a bodily function.

Filing a Fault-Based Claim

If you believe you have suffered a “serious injury” in a car accident, you should consult with an attorney to determine whether you have a valid claim. The attorney will review your medical records and other evidence to assess the severity of your injuries and whether they meet the legal definition of a “serious injury.”

Rights and Responsibilities of Drivers

Florida’s no-fault system dictates specific rights and responsibilities for drivers involved in accidents. Understanding these aspects is crucial for navigating the legal and financial implications of a crash.

Reporting Accidents to Authorities

It is legally mandatory to report any accident involving property damage or personal injury to the authorities. This ensures that the incident is documented, and necessary investigations can be conducted. Failure to report an accident can lead to legal consequences.

- Contacting Law Enforcement: In cases involving property damage, personal injury, or a fatality, you must contact law enforcement immediately. The police will create an accident report that documents the details of the incident, including the involved parties, their insurance information, and any witness statements. This report is essential for insurance claims and potential legal proceedings.

- Filing a Traffic Crash Report: If the accident involves only property damage and no injuries, you can file a traffic crash report online with the Florida Highway Patrol. This report should be completed within 10 days of the accident.

Seeking Medical Treatment After an Accident

After an accident, it is crucial to seek immediate medical attention, even if you feel only minor injuries. Delayed medical treatment can complicate your claim and potentially hinder your recovery.

- Prompt Medical Evaluation: Visit a doctor or emergency room as soon as possible after the accident. This will establish a record of your injuries and their severity, which is crucial for your insurance claim.

- Following Medical Advice: It is essential to follow your doctor’s instructions regarding treatment and rehabilitation. This includes attending all appointments, taking prescribed medications, and engaging in recommended therapies. This demonstrates your commitment to recovery and strengthens your claim.

The Role of Insurance Companies

In Florida’s no-fault system, insurance companies play a crucial role in processing claims and managing the financial aspects of car accidents. They are responsible for handling the initial claim process, determining coverage, and paying benefits to policyholders.

Processing Claims

Insurance companies are responsible for receiving and processing claims from policyholders involved in car accidents. They review the details of the accident, assess the extent of injuries and damages, and determine the amount of benefits payable under the policy. This process typically involves:

- Reviewing the accident report: Insurance companies analyze the accident report to understand the circumstances of the accident, identify any potential contributing factors, and determine if the accident falls under the scope of the policy.

- Evaluating medical bills and lost wages: Insurance companies review medical bills and lost wage statements to assess the financial impact of the accident and determine the appropriate level of compensation.

- Determining coverage: Insurance companies determine the coverage available under the policy, considering factors like the type of policy, the extent of coverage, and the policyholder’s deductible.

- Issuing payments: Once the claim is approved, insurance companies issue payments to the policyholder for medical expenses, lost wages, and other covered benefits.

Disputes Between Drivers and Insurance Companies

Disputes between drivers and insurance companies can arise for various reasons, including:

- Disagreements over coverage: Drivers may disagree with the insurance company’s assessment of coverage, particularly regarding the extent of benefits payable or the application of policy exclusions.

- Denial of claims: Insurance companies may deny claims based on various factors, such as the policyholder’s failure to meet policy requirements or the insurance company’s belief that the accident was not covered by the policy.

- Disputes over the amount of benefits: Drivers may challenge the insurance company’s calculation of benefits, arguing that the amount paid is insufficient to cover their medical expenses, lost wages, or other losses.

Resolving Insurance Claim Disputes

Several avenues are available for resolving insurance claim disputes in Florida, including:

- Negotiation: The first step in resolving a dispute is typically negotiation between the driver and the insurance company. The driver can attempt to negotiate a settlement that is satisfactory to both parties.

- Mediation: If negotiation fails, drivers can seek mediation, a process where a neutral third party helps the parties reach a mutually acceptable agreement. Mediation is often a less formal and less expensive alternative to litigation.

- Arbitration: If mediation fails, drivers can pursue arbitration, a process where a neutral third party reviews the evidence and makes a binding decision. Arbitration is often a more formal process than mediation but less formal than litigation.

- Litigation: As a last resort, drivers can file a lawsuit in court to resolve the dispute. This is typically the most expensive and time-consuming option, but it provides the opportunity for a judge or jury to make a final decision.

Impact of No-Fault on Accident Victims

Florida’s no-fault system, while aiming to streamline the claims process and reduce litigation, has a significant impact on accident victims. This system, known as Personal Injury Protection (PIP), provides coverage for medical expenses and lost wages regardless of fault, but it also imposes limitations on the ability to sue for pain and suffering.

Benefits of Florida’s No-Fault System, Is florida a no fault car insurance state

Florida’s no-fault system offers several benefits for accident victims:

- Faster Access to Medical Care: Victims can access medical treatment immediately without waiting for fault determination, as PIP coverage is triggered regardless of who caused the accident.

- Reduced Litigation: The no-fault system aims to reduce the number of lawsuits arising from accidents, potentially leading to quicker resolutions and lower insurance premiums.

- Guaranteed Coverage: All drivers in Florida are required to carry PIP coverage, ensuring that victims have access to essential medical and lost wage benefits, even if the at-fault driver is uninsured.

Drawbacks of Florida’s No-Fault System

While the no-fault system offers advantages, it also has its drawbacks:

- Limited Compensation: PIP coverage limits the amount of compensation available for medical expenses and lost wages, which may not be sufficient to cover all costs, especially for severe injuries.

- Restricted Right to Sue: Florida’s no-fault system restricts the ability of victims to sue for pain and suffering unless they meet specific thresholds, such as a “serious injury” or exceeding a certain amount of medical expenses.

- Potential for Disputes: Disputes can arise between victims and insurance companies over the extent of coverage and the interpretation of the no-fault law.

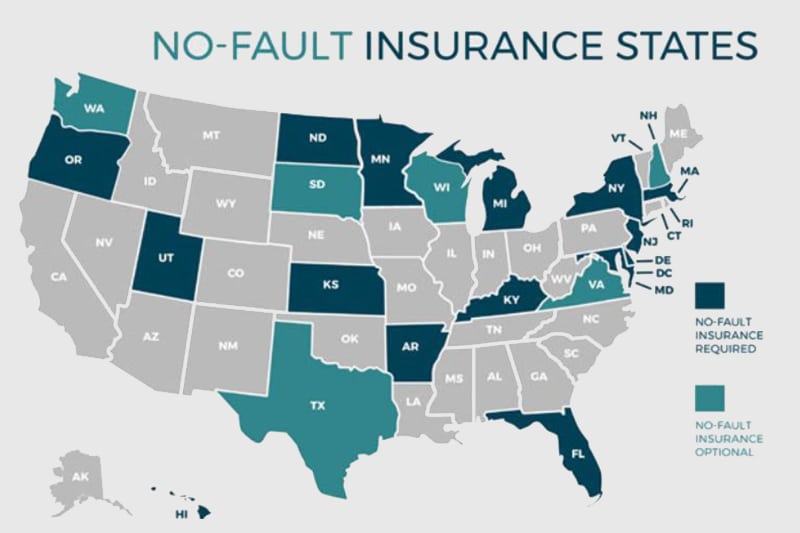

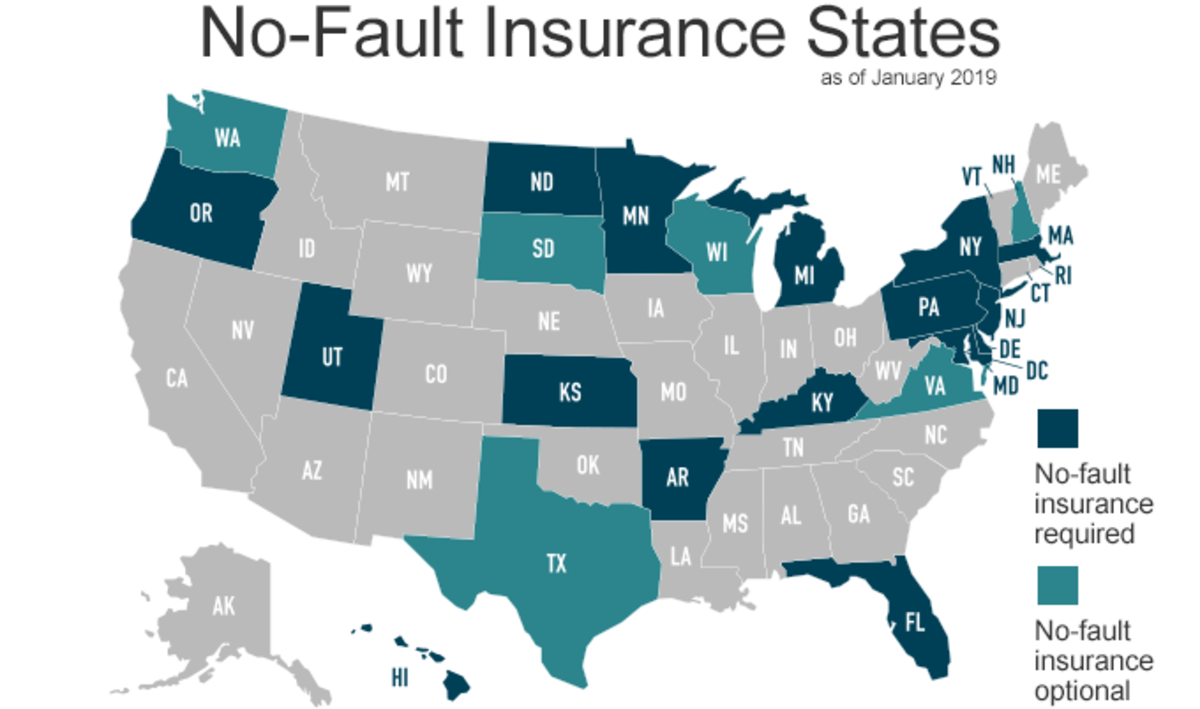

Comparison to Other No-Fault Systems

Florida’s no-fault system is considered a “modified” no-fault system, meaning that it allows victims to sue for pain and suffering under certain circumstances. Other states, such as Michigan, have a “pure” no-fault system, where victims are generally prohibited from suing for pain and suffering, regardless of the severity of their injuries.

- Pure No-Fault: In pure no-fault systems, victims are typically limited to recovering medical expenses and lost wages from their own insurance, regardless of fault. This system aims to minimize litigation and keep insurance premiums low.

- Modified No-Fault: Modified no-fault systems, like Florida’s, allow victims to sue for pain and suffering if they meet specific thresholds. This system aims to balance the benefits of no-fault with the need for compensation for severe injuries.

Concluding Remarks

Navigating Florida’s no-fault system can be complex, but understanding your rights and responsibilities is essential for protecting yourself after an accident. While PIP offers a streamlined approach to initial claims, there are situations where a fault-based claim is necessary. Being informed about the system’s intricacies can help you make the right decisions and ensure you receive the compensation you deserve.

Popular Questions

What is the minimum PIP coverage required in Florida?

Florida requires a minimum of $10,000 in PIP coverage per person.

Can I choose to have higher PIP coverage?

Yes, you can choose to have higher PIP coverage than the minimum requirement, which can provide greater financial protection.

How long do I have to file a PIP claim?

You generally have 14 days from the date of the accident to file a PIP claim.

Can I sue the other driver if I have PIP coverage?

In most cases, you can only sue the other driver if your injuries meet certain thresholds, such as “serious injury” or “permanent injury.”