Insurance quotes state farm – Insurance Quotes: State Farm Explained – Looking for reliable and affordable insurance? State Farm, a household name in the insurance industry, offers a wide range of insurance products to protect your assets and provide peace of mind. With a long history of financial stability and a commitment to customer satisfaction, State Farm has become a trusted choice for millions of individuals and families across the country. This guide will explore the ins and outs of getting insurance quotes from State Farm, providing valuable insights into their products, services, and customer experience.

Whether you’re seeking auto insurance, homeowners insurance, renters insurance, life insurance, or business insurance, State Farm has a solution tailored to your specific needs. From obtaining quotes to understanding coverage options and navigating the claims process, this comprehensive guide will equip you with the knowledge you need to make informed decisions about your insurance needs.

State Farm Insurance Overview

State Farm is a leading provider of insurance and financial services in the United States, renowned for its commitment to customer satisfaction and its strong financial stability. Founded in 1922, State Farm has grown to become one of the largest and most trusted insurance companies in the world.

History and Mission

State Farm was founded in 1922 by George J. Mecherle, a farmer in Bloomington, Illinois, who wanted to provide affordable automobile insurance to his fellow farmers. The company’s mission has remained consistent over the years: to provide financial protection and peace of mind to its customers. This commitment to customer service and financial security has been a cornerstone of State Farm’s success.

Market Position and Strengths

State Farm is the largest property and casualty insurer in the United States, with a market share of over 18%. The company’s strong financial position, its extensive distribution network, and its focus on customer service have contributed to its dominance in the insurance market.

- Strong Financial Position: State Farm has a strong financial position, with an A+ rating from A.M. Best, one of the highest ratings in the industry. This rating reflects the company’s ability to meet its financial obligations to its policyholders.

- Extensive Distribution Network: State Farm has a vast network of agents throughout the United States, providing convenient access to insurance products and services.

- Customer Service Focus: State Farm is known for its commitment to customer service, with a focus on providing personalized attention and support to its policyholders.

Weaknesses

While State Farm has a strong market position and numerous strengths, it also faces some challenges.

- Limited Product Offerings: Compared to some of its competitors, State Farm offers a relatively limited range of insurance products.

- Digital Transformation: State Farm has been slower to embrace digital technologies than some of its competitors, which could be a challenge in a rapidly evolving insurance landscape.

Target Customer Demographic

State Farm’s target customer demographic is broad, encompassing a wide range of individuals and families. However, the company has a strong presence in rural and suburban areas, particularly in the Midwest and Southeast.

- Homeowners: State Farm is a leading provider of homeowners insurance, catering to a wide range of housing needs.

- Auto Insurance: State Farm is also a major provider of auto insurance, serving a diverse customer base, including drivers of all ages and experience levels.

- Families: State Farm offers a range of insurance products and financial services that are designed to meet the needs of families, including life insurance, disability insurance, and retirement planning.

Customer Needs

State Farm’s target customers are looking for reliable insurance coverage, competitive pricing, and excellent customer service. They also value convenience and ease of access to insurance products and services.

- Reliable Coverage: Customers want to be confident that their insurance will provide adequate financial protection in the event of an accident or other unforeseen event.

- Competitive Pricing: Customers are looking for insurance policies that offer a good value for the price.

- Excellent Customer Service: Customers value prompt and courteous service, as well as clear and concise communication from their insurance provider.

- Convenience and Accessibility: Customers appreciate having multiple ways to access insurance products and services, such as online, by phone, or through a local agent.

Insurance Products Offered by State Farm

State Farm offers a comprehensive range of insurance products designed to meet the diverse needs of its customers. From protecting your car and home to securing your financial future and safeguarding your business, State Farm provides a wide array of insurance options to ensure peace of mind.

Types of Insurance Offered

State Farm offers a variety of insurance products to meet your needs. These include:

| Type of Insurance | Coverage Options | Benefits |

|---|---|---|

| Auto Insurance |

|

|

| Home Insurance |

|

|

| Renters Insurance |

|

|

| Life Insurance |

|

|

| Business Insurance |

|

|

Obtaining Insurance Quotes from State Farm

Getting a quote for State Farm insurance is a straightforward process. You can obtain a quote through their website, over the phone, or by visiting a local agent.

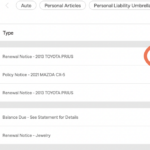

Methods for Obtaining Insurance Quotes, Insurance quotes state farm

- Online: State Farm’s website offers a user-friendly platform for obtaining quotes. You can input your information and receive an instant quote without needing to speak to an agent.

- Phone: You can call State Farm’s customer service line and speak with an agent to receive a quote. This option allows you to ask questions and receive personalized advice.

- In-Person: Visiting a local State Farm agent’s office allows for a more in-depth consultation. You can discuss your specific needs and receive personalized recommendations.

Information Required for a Quote

State Farm requires certain information to generate an accurate quote. This includes:

- Personal Details: Your name, address, date of birth, and contact information are essential for identifying you and creating your policy.

- Vehicle Information: For auto insurance, you’ll need to provide details about your vehicle, such as make, model, year, and VIN (Vehicle Identification Number). You’ll also need to specify the vehicle’s usage (e.g., daily commute, occasional use).

- Property Details: For homeowners or renters insurance, you’ll need to provide information about your property, including its address, square footage, and any safety features (e.g., smoke detectors, alarm systems).

- Driving History: For auto insurance, State Farm will request your driving history, including any accidents, violations, or DUI convictions. This information helps determine your risk profile.

- Credit Score: In some states, State Farm may use your credit score as a factor in determining your insurance premium. This is because studies have shown a correlation between credit score and driving behavior.

Factors Influencing Insurance Premiums

Several factors can influence your insurance premiums, including:

- Driving History: A clean driving record with no accidents or violations will generally result in lower premiums. Conversely, a history of accidents or traffic violations can lead to higher premiums.

- Credit Score: As mentioned earlier, credit score can be a factor in determining your premium in some states. A good credit score can potentially lead to lower premiums.

- Location: Your location can influence your insurance premiums due to factors such as crime rates, traffic congestion, and weather conditions. Areas with higher crime rates or more frequent accidents may have higher premiums.

- Age and Gender: Generally, younger drivers and male drivers tend to pay higher premiums than older drivers and female drivers. This is due to statistical data showing that younger and male drivers are more likely to be involved in accidents.

- Vehicle Type: The type of vehicle you drive can affect your premium. Sports cars or luxury vehicles often have higher premiums due to their higher repair costs and greater risk of theft.

State Farm’s Customer Service and Claims Process

State Farm prides itself on its commitment to providing exceptional customer service and a streamlined claims process. The company offers various channels for customers to reach out for assistance and support, ensuring a smooth and efficient experience.

Customer Service Channels

State Farm offers multiple avenues for customers to connect with their representatives. These channels are designed to cater to diverse preferences and provide convenient access to assistance.

- Phone Support: State Farm maintains a dedicated phone line for customer inquiries and assistance. Customers can reach out to a representative 24/7, ensuring immediate support whenever needed.

- Online Chat: State Farm provides an online chat feature on its website, allowing customers to connect with a representative in real-time. This option is particularly convenient for quick inquiries or immediate assistance.

- Mobile App: State Farm’s mobile app offers a user-friendly platform for managing policies, paying premiums, and accessing various services. The app also includes a messaging feature for direct communication with customer support.

Filing a Claim with State Farm

State Farm’s claims process is designed to be straightforward and efficient. The company offers various methods for reporting a claim, including online, over the phone, or through the mobile app.

- Required Documentation: To ensure a smooth claims process, it is essential to have the necessary documentation readily available. This typically includes the policy number, details of the incident, and any relevant supporting documents, such as photographs or police reports.

- Timeline: State Farm aims to process claims promptly. The time it takes to resolve a claim depends on the complexity of the situation and the availability of necessary information. In most cases, State Farm strives to provide an initial assessment within 24 hours of receiving a claim.

Examples of Customer Experiences

“I was involved in a minor car accident and was impressed with the ease of filing a claim through the State Farm app. The process was straightforward, and I received a prompt response from a representative who guided me through the steps. The entire process was completed within a few days, and I was very satisfied with the outcome.”

“Unfortunately, I had a negative experience with State Farm’s claims process. My claim took several weeks to be processed, and I had to follow up multiple times to receive updates. Communication was inconsistent, and I felt like my concerns were not adequately addressed.”

Comparing State Farm Quotes with Competitors

Getting the best insurance deal often involves comparing quotes from multiple providers. This section will delve into how State Farm’s offerings stack up against other major insurance companies, exploring key differences in coverage, pricing, and customer service.

Coverage Comparison

Understanding the specific coverage provided by each insurance company is crucial when comparing quotes. State Farm, like other major insurance providers, offers a wide range of insurance products, including auto, home, life, and health insurance. However, the specific details of coverage can vary significantly between companies.

For instance, State Farm’s auto insurance policies might offer different levels of comprehensive and collision coverage compared to competitors like Geico or Progressive. Similarly, their home insurance policies might have different deductibles, coverage limits, or exclusions for specific perils.

It’s essential to carefully review the policy documents and compare coverage details to ensure you are getting the protection you need at a price that fits your budget.

Pricing Comparison

Insurance premiums are a significant factor in choosing a provider. State Farm’s pricing can vary depending on several factors, including your location, driving record, credit score, and the type and value of your insured property.

To compare pricing, you can use online quote comparison tools or contact insurance agents directly. These tools allow you to input your personal information and compare quotes from multiple providers side-by-side. However, it’s crucial to remember that the lowest price doesn’t always equate to the best deal.

You should also consider the coverage offered by each provider to ensure you are getting adequate protection at a fair price.

Customer Service and Claims Process

Customer service and the claims process are crucial aspects of any insurance provider. State Farm is known for its strong customer service reputation and claims handling processes. However, other companies like USAA or Liberty Mutual are also highly regarded for their customer service.

To compare customer service, you can read online reviews, check customer satisfaction ratings, and speak with insurance agents or current policyholders.

The claims process can be a stressful experience, and it’s important to choose a provider with a streamlined and efficient claims process. State Farm offers a 24/7 claims reporting system and a dedicated team of claims adjusters.

However, other providers like Allstate or Nationwide also have similar processes, so it’s crucial to research and compare the claims experience offered by each company.

Comparison Table

The following table provides a simplified comparison of State Farm with some of its major competitors across key aspects:

| Feature | State Farm | Geico | Progressive | USAA | Allstate |

|————–|————|——-|————-|——|———-|

| Coverage | Good | Good | Good | Excellent | Good |

| Pricing | Competitive | Good | Competitive | Good | Competitive |

| Customer Service | Excellent | Good | Good | Excellent | Good |

| Claims Process | Good | Good | Good | Excellent | Good |

Note: This table is a simplified representation and does not capture all the nuances of each company’s offerings. It’s essential to conduct thorough research and compare quotes from multiple providers before making a decision.

Advantages and Disadvantages of Choosing State Farm

Choosing an insurance provider is a significant decision that requires careful consideration. State Farm, a well-established and reputable insurance company, offers a wide range of insurance products and services. Before making a decision, it’s essential to weigh the advantages and disadvantages of choosing State Farm.

Advantages of Choosing State Farm

State Farm has built a strong reputation for its financial stability, customer service, and wide range of insurance products.

- Financial Stability: State Farm is a financially sound company with a long history of paying claims and meeting its financial obligations. Its strong financial position provides customers with peace of mind, knowing that their insurance claims will be honored.

- Customer Service: State Farm is known for its excellent customer service. The company has a large network of agents who are available to provide personalized advice and assistance. State Farm also has a user-friendly website and mobile app, making it easy for customers to manage their policies and file claims.

- Wide Range of Products: State Farm offers a comprehensive range of insurance products, including auto, home, life, health, and business insurance. This allows customers to consolidate their insurance needs with one provider, simplifying their insurance management.

- Discounts and Bundling Options: State Farm offers a variety of discounts, such as safe driving discounts, multi-policy discounts, and good student discounts. Customers can also bundle their insurance policies, which can lead to significant cost savings.

- Strong Community Presence: State Farm is deeply involved in local communities through sponsorships, charitable contributions, and volunteerism. This commitment to community involvement is often appreciated by customers.

Disadvantages of Choosing State Farm

While State Farm offers many advantages, it’s essential to consider potential disadvantages before making a decision.

- Pricing: State Farm’s insurance premiums may be higher than those of some competitors, especially for certain types of coverage or in specific geographic areas. It’s crucial to compare quotes from multiple insurers before making a decision.

- Limited Coverage Options: While State Farm offers a wide range of insurance products, it may not offer all coverage options available in the market. For example, some specialized coverage options may be limited or unavailable through State Farm.

- Agent Dependence: State Farm relies heavily on its network of agents for sales and customer service. This can be an advantage, but it can also be a disadvantage if a customer is not satisfied with their assigned agent or if they prefer to manage their insurance online.

End of Discussion

When it comes to insurance, choosing the right provider is crucial. State Farm, with its strong reputation, diverse product offerings, and customer-centric approach, presents a compelling option for individuals and families seeking comprehensive insurance protection. By understanding the factors that influence insurance quotes, exploring coverage options, and familiarizing yourself with State Farm’s claims process, you can confidently navigate the world of insurance and make informed choices that safeguard your future.

Common Queries: Insurance Quotes State Farm

How do I get an insurance quote from State Farm?

You can get a quote online, over the phone, or by visiting a local State Farm agent. You’ll need to provide some basic information about yourself, your vehicle(s) or property, and your driving history.

What factors affect my insurance premium?

Factors that can influence your insurance premium include your age, driving history, credit score, location, and the type and value of your vehicle or property.

What if I need to file a claim?

You can file a claim online, over the phone, or through the State Farm mobile app. You’ll need to provide details about the incident, including the date, time, and location. You may also need to provide supporting documentation, such as a police report or medical records.

What are the advantages of choosing State Farm?

State Farm offers a wide range of insurance products, competitive pricing, excellent customer service, and a strong financial reputation. They also have a large network of agents across the country, making it easy to find someone local to help you.

What are the disadvantages of choosing State Farm?

While State Farm is generally well-regarded, some customers have reported that their premiums are higher than those offered by competitors. They may also have limitations in coverage options, depending on your specific needs.