Insurance quote State Farm, a household name in the insurance industry, has become synonymous with reliable coverage and dependable service. State Farm, founded in 1922, is one of the largest insurance companies in the United States, offering a wide range of insurance products, including auto, home, life, and business insurance. The company prides itself on its commitment to customer satisfaction and financial stability, making it a popular choice for individuals and families across the country.

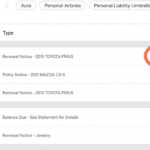

Obtaining a State Farm insurance quote is a straightforward process, with options for online, phone, and in-person interactions. Factors like age, driving history, location, and vehicle type can influence your insurance rates. State Farm’s reputation for customer service is widely acknowledged, with a strong online presence and user-friendly digital tools.

State Farm Overview

State Farm is a renowned insurance company with a rich history and a strong reputation for providing reliable insurance coverage to millions of customers across the United States. Founded in 1922, State Farm has grown into one of the largest and most trusted insurance providers in the country, offering a wide range of insurance products and services.

Key Facts and Figures

State Farm’s success can be attributed to its commitment to customer satisfaction, financial stability, and community involvement. The company boasts a significant market share in the insurance industry, serving over 83 million policies across various lines of insurance. As of 2022, State Farm held assets exceeding $300 billion, solidifying its position as a financially sound and reputable organization.

Types of Insurance Products

State Farm offers a comprehensive suite of insurance products designed to meet the diverse needs of its customers. These products include:

- Auto Insurance: State Farm provides comprehensive auto insurance coverage, including liability, collision, comprehensive, and uninsured motorist coverage, to protect drivers and their vehicles from financial losses due to accidents or other unforeseen events.

- Home Insurance: State Farm offers various home insurance plans, including dwelling coverage, personal property coverage, liability coverage, and additional living expenses coverage, to safeguard homeowners against financial losses caused by fire, theft, vandalism, and other perils.

- Life Insurance: State Farm provides a range of life insurance options, such as term life, whole life, and universal life insurance, to help individuals protect their families financially in the event of their death.

- Business Insurance: State Farm offers a variety of business insurance products, including property insurance, liability insurance, workers’ compensation insurance, and business interruption insurance, to protect businesses from financial risks associated with property damage, lawsuits, employee injuries, and business disruptions.

Obtaining a State Farm Insurance Quote

Getting a quote for insurance from State Farm is a straightforward process, with multiple options to suit your preferences. Whether you prefer the convenience of online tools, the personalized touch of a phone call, or the face-to-face interaction of an in-person visit, State Farm provides various avenues to explore your insurance needs.

Factors Influencing State Farm Insurance Rates

Several factors influence the final cost of your State Farm insurance policy. These factors are designed to provide a personalized rate based on your individual circumstances and risk profile.

- Age: Younger drivers often have less experience on the road, making them statistically more prone to accidents. As drivers gain experience and a proven track record, their insurance rates typically decrease.

- Driving History: A clean driving record with no accidents or violations usually translates to lower insurance premiums. Conversely, a history of accidents or traffic violations may result in higher rates.

- Location: The geographic location where you live significantly impacts your insurance rates. Areas with higher crime rates, traffic congestion, or a greater number of accidents generally have higher insurance costs.

- Vehicle Type: The type of vehicle you drive plays a crucial role in determining your insurance premiums. High-performance vehicles, luxury cars, and vehicles with expensive parts tend to have higher insurance rates due to their higher repair costs and potential for more significant damage.

Comparison to Other Insurance Companies

State Farm’s quote process is generally similar to that of other major insurance companies. Most companies offer online quote tools, phone consultations, and in-person appointments with agents. The specific features and options available may vary depending on the company and its policies. However, the core elements of providing personal information, vehicle details, and driving history remain consistent across most insurers.

State Farm’s Customer Experience: Insurance Quote State Farm

State Farm is renowned for its commitment to customer service and satisfaction, consistently ranking among the top insurance providers in this regard. The company’s focus on building strong customer relationships and providing a positive experience is evident in its various initiatives and strategies.

Customer Service Reputation and Satisfaction, Insurance quote state farm

State Farm’s reputation for exceptional customer service is well-established, supported by numerous accolades and customer testimonials. The company consistently ranks high in customer satisfaction surveys conducted by independent organizations such as J.D. Power and the American Customer Satisfaction Index (ACSI). For example, in the J.D. Power 2023 U.S. Auto Insurance Satisfaction Study, State Farm ranked second overall and received top marks in several categories, including customer interaction, price, and policy offerings.

Examples of Customer Experiences

- Positive Experience: A customer named Sarah recently had a positive experience with State Farm when she filed a claim after a car accident. She praised the company’s prompt and efficient claims processing, as well as the helpful and empathetic support she received from her agent. Sarah was impressed by the ease of communication and the transparency throughout the process.

- Negative Experience: Another customer, John, reported a less favorable experience with State Farm. He had difficulty getting through to a customer service representative and felt frustrated by the lengthy wait times. John also found the online tools and resources to be confusing and not user-friendly.

State Farm’s Online Presence and Digital Tools

State Farm has invested heavily in its online presence and digital tools to enhance the customer experience. The company offers a comprehensive website and mobile app that provide customers with access to a wide range of services, including policy management, claims reporting, and payment options. The website features a user-friendly interface, detailed information about products and services, and helpful resources such as FAQs and online calculators. The mobile app allows customers to manage their policies, submit claims, contact customer support, and access other features on the go.

State Farm’s Financial Strength and Stability

State Farm is renowned for its strong financial position, a testament to its long history and prudent management practices. This financial strength is a key factor for policyholders, offering them confidence and assurance that their claims will be met even during challenging economic times.

Financial Ratings and History

State Farm consistently receives high financial strength ratings from reputable organizations like A.M. Best, Moody’s, and Standard & Poor’s. These ratings reflect the company’s robust capital reserves, strong earnings, and conservative investment strategies.

- A.M. Best, a leading insurance rating agency, assigns State Farm an “A++” (Superior) rating, signifying its exceptional financial strength and ability to meet its policy obligations.

- Moody’s, another renowned rating agency, awards State Farm an “Aaa” rating, indicating its exceptional creditworthiness and low risk of default.

- Standard & Poor’s, a global credit rating agency, also gives State Farm an “AA+” rating, reflecting its strong financial position and ability to withstand economic downturns.

Implications for Policyholders

State Farm’s financial strength has significant implications for policyholders:

- Claim Payment Security: Policyholders can rest assured that State Farm will have the financial resources to pay claims promptly and fairly, even in the event of catastrophic events or economic instability.

- Financial Stability: State Farm’s strong financial position translates into greater stability for policyholders. The company is less likely to face financial difficulties, reducing the risk of policy cancellations or premium increases due to financial constraints.

- Long-Term Reliability: State Farm’s financial strength provides a sense of long-term reliability and stability. Policyholders can have confidence that the company will be there for them throughout the life of their insurance policy.

Comparison to Other Insurance Companies

While many insurance companies strive for financial strength, State Farm consistently ranks among the top performers. The company’s financial stability and ratings are comparable to, or even exceed, those of its major competitors.

- For example, A.M. Best assigns an “A++” rating to other major insurance companies like Allstate and Liberty Mutual, indicating that they also have strong financial positions. However, State Farm’s financial strength is consistently recognized as being among the best in the industry.

State Farm’s Claims Process

State Farm’s claims process is designed to be straightforward and efficient, aiming to provide a smooth experience for policyholders. The process involves reporting the claim, an investigation by State Farm, and ultimately, payment for covered damages.

Reporting a Claim

State Farm offers multiple channels for reporting a claim, including:

- Online: Policyholders can report claims online through State Farm’s website, providing detailed information about the incident. This option offers convenience and accessibility, allowing for claim reporting anytime, anywhere.

- Phone: State Farm has a dedicated claims hotline, accessible 24/7, where policyholders can speak with a representative to report their claim. This method allows for immediate assistance and personalized guidance.

- Mobile App: The State Farm mobile app enables policyholders to report claims directly from their smartphones. This option offers a user-friendly interface and convenient access to claim information.

- Agent: Policyholders can also report claims through their local State Farm agent, who can provide personalized assistance and guidance throughout the claims process.

Investigation

Once a claim is reported, State Farm initiates an investigation to determine the validity of the claim and the extent of the damages. This investigation may involve:

- Reviewing the policy: State Farm will examine the policy to determine the coverage for the reported incident. This includes verifying the policyholder’s coverage limits and deductibles.

- Gathering information: State Farm will gather information about the incident, including details about the cause, the date, and the location. This may involve reviewing police reports, witness statements, and medical records.

- Inspection: Depending on the nature of the claim, State Farm may conduct an inspection of the damaged property. This allows for an accurate assessment of the damages and ensures the claim is handled appropriately.

Payment

After the investigation is complete and the claim is approved, State Farm will process the payment for the covered damages. This may involve:

- Direct payment: In some cases, State Farm may pay the repair or replacement costs directly to the vendor or service provider. This streamlines the process and eliminates the need for the policyholder to manage the payments.

- Reimbursement: In other cases, State Farm may reimburse the policyholder for the expenses incurred due to the covered incident. This allows for flexibility and gives the policyholder control over the repair or replacement process.

State Farm’s Reputation for Handling Claims Fairly and Efficiently

State Farm has consistently earned a positive reputation for its claims handling process.

“State Farm has a long history of being a reliable and trustworthy insurance provider. Their claims process is known for being fair, efficient, and customer-focused. The company has consistently received high ratings from independent organizations for its claims handling practices.”

State Farm’s commitment to customer satisfaction is reflected in its claims handling practices. The company has invested in technology and training to ensure its claims representatives are equipped to handle claims promptly and efficiently. Additionally, State Farm has established a robust appeals process to address any disputes or concerns that may arise.

Comparison to Other Insurance Companies

While State Farm’s claims process is generally considered to be efficient and fair, it’s important to compare it to other insurance companies. When evaluating claims processes, it’s essential to consider factors such as:

- Claim reporting options: Some insurance companies offer more convenient or accessible claim reporting options than others. This can include online reporting, mobile app reporting, or 24/7 phone support.

- Investigation process: The investigation process can vary significantly among insurance companies. Some companies may have a more streamlined process than others, while others may require more documentation or inspections.

- Payment process: The payment process can also vary, with some companies offering faster payment options than others. Some companies may also offer different payment methods, such as direct payment to vendors or reimbursement to policyholders.

- Customer service: The level of customer service provided during the claims process can vary significantly among insurance companies. Some companies may have more responsive or helpful customer service representatives than others.

State Farm’s Discounts and Benefits

State Farm offers a wide range of discounts and benefits to its policyholders, designed to help them save money and make their insurance experience more rewarding. These discounts and benefits can significantly reduce your insurance premiums and provide valuable protection and peace of mind.

Discounts Offered by State Farm

State Farm provides numerous discounts to its policyholders, helping them save money on their insurance premiums. Here are some of the most common discounts:

- Good Driver Discount: This discount is awarded to drivers with a clean driving record, demonstrating safe driving habits. State Farm may consider factors such as the number of years without accidents or traffic violations.

- Safe Driver Discount: This discount is similar to the good driver discount and rewards drivers who have demonstrated safe driving practices. State Farm may consider factors such as completion of defensive driving courses or maintaining a good driving record.

- Multi-Policy Discount: State Farm offers a discount for bundling multiple insurance policies, such as auto, home, and life insurance. This discount encourages customers to consolidate their insurance needs with State Farm.

- Homeowner Discount: This discount is available to homeowners who insure their homes with State Farm. It recognizes the value of protecting your property and rewards homeowners for their investment.

- Anti-theft Device Discount: If you have installed anti-theft devices in your vehicle, State Farm may offer a discount on your auto insurance. These devices help reduce the risk of theft and make your vehicle less appealing to criminals.

- Student Discount: Students who maintain good grades and are enrolled in college or university may be eligible for a discount on their auto insurance. State Farm recognizes the responsibility and maturity associated with higher education.

- Defensive Driving Course Discount: Completing a defensive driving course can demonstrate your commitment to safe driving practices and may qualify you for a discount on your auto insurance. State Farm encourages drivers to improve their driving skills and knowledge.

- Loyalty Discount: Long-term State Farm policyholders may be eligible for a loyalty discount, recognizing their continued commitment to the company.

Benefits Offered by State Farm

In addition to discounts, State Farm provides various benefits to its policyholders, enhancing their insurance experience and providing additional protection.

- 24/7 Customer Support: State Farm offers round-the-clock customer support through multiple channels, including phone, email, and online chat. This ensures that policyholders have access to assistance whenever they need it.

- Mobile App: State Farm’s mobile app provides a convenient way for policyholders to manage their insurance policies, file claims, access roadside assistance, and find nearby agents. The app streamlines the insurance process and provides quick access to essential services.

- Roadside Assistance: State Farm offers roadside assistance to its policyholders, providing help with situations such as flat tires, dead batteries, and lockouts. This service ensures that policyholders are not stranded in case of unexpected car troubles.

- Claims Process: State Farm’s claims process is designed to be efficient and customer-friendly. Policyholders can file claims online, through the mobile app, or by phone. State Farm aims to provide prompt and fair settlements for covered claims.

- Financial Strength and Stability: State Farm is a financially sound and stable company, known for its strong financial performance and long-term commitment to its policyholders. This financial stability provides peace of mind and assurance that State Farm will be there to support its policyholders in times of need.

Comparison of State Farm’s Discounts and Benefits with Other Insurance Companies

State Farm’s discounts and benefits are competitive compared to other insurance companies. While specific discounts and benefits may vary depending on the insurer and policy, State Farm generally offers a comprehensive package of options designed to meet the needs of its policyholders.

| Discount/Benefit | State Farm | Other Companies |

|---|---|---|

| Good Driver Discount | Yes | Yes |

| Multi-Policy Discount | Yes | Yes |

| Homeowner Discount | Yes | Yes |

| Student Discount | Yes | Yes |

| 24/7 Customer Support | Yes | Yes |

| Mobile App | Yes | Yes |

| Roadside Assistance | Yes | Yes |

It’s important to compare quotes from multiple insurance companies to find the best coverage and value for your specific needs. State Farm’s discounts and benefits are designed to be competitive and provide value to its policyholders, but it’s essential to shop around and ensure you are getting the best deal.

State Farm’s Agents and Network

State Farm agents play a vital role in the insurance process, serving as the primary point of contact for policyholders. They provide personalized advice, answer questions, and assist with claims. State Farm’s vast agent network is a key aspect of its success, ensuring widespread accessibility and local expertise.

The Role of State Farm Agents

State Farm agents are more than just salespeople; they are insurance advisors who work to understand their clients’ individual needs and provide tailored solutions. They offer guidance on coverage options, explain policy terms, and help customers choose the right insurance products. Agents also assist with claims, acting as liaisons between policyholders and State Farm.

The Size and Reach of State Farm’s Agent Network

State Farm boasts a massive agent network, with over 18,000 agents across the United States. This extensive network allows State Farm to reach customers in nearly every community, ensuring local presence and accessibility. Agents are often deeply embedded in their communities, building relationships with local businesses and residents. This local knowledge and connection are invaluable for understanding the specific needs of each region.

Benefits of Working with a State Farm Agent

- Personalized advice and tailored solutions

- Local expertise and community knowledge

- Convenient access to insurance products and services

- Assistance with claims and policy management

- Building relationships with a trusted advisor

Drawbacks of Working with a State Farm Agent

- Potential for variations in service quality based on individual agents

- Limited availability outside of regular business hours

- Possible pressure to purchase additional products or services

State Farm’s Social Responsibility

State Farm is not just an insurance company; it’s a company deeply committed to giving back to the communities it serves. Beyond providing financial security, State Farm actively participates in various social responsibility initiatives and philanthropic efforts, demonstrating its dedication to making a positive impact on society.

State Farm’s Commitment to Social Responsibility

State Farm’s social responsibility initiatives are guided by its core values, which include integrity, respect, and customer focus. These values are reflected in the company’s commitment to supporting education, promoting safety, and empowering communities.

Examples of State Farm’s Philanthropic Efforts

State Farm’s commitment to social responsibility is evident in its extensive philanthropic efforts. Here are some notable examples:

- State Farm Neighborhood Assist Program: This program provides grants to non-profit organizations across the country, focusing on areas like education, community development, and disaster relief.

- State Farm Youth Advisory Councils: These councils, composed of young people from across the country, provide valuable input on issues affecting their communities and advocate for positive change.

- State Farm’s Support for Education: State Farm supports educational initiatives at all levels, from early childhood education to higher education, through grants, scholarships, and partnerships with educational institutions.

- State Farm’s Commitment to Disaster Relief: State Farm is known for its quick and effective response to natural disasters. The company provides financial assistance to affected individuals and communities, as well as support for disaster relief efforts.

Impact of State Farm’s Social Responsibility Programs

State Farm’s social responsibility programs have a significant impact on communities across the country. Here are some of the key benefits:

- Community Empowerment: State Farm’s initiatives empower communities by providing resources and support to address local needs and challenges.

- Improved Quality of Life: State Farm’s focus on education, safety, and community development contributes to a better quality of life for individuals and families.

- Strengthened Relationships: State Farm’s commitment to social responsibility fosters strong relationships with communities and builds trust among stakeholders.

- Positive Brand Image: State Farm’s social responsibility efforts enhance its brand image and reputation as a socially responsible and ethical company.

Final Wrap-Up

Whether you’re seeking auto insurance, home insurance, or any other type of coverage, State Farm offers a comprehensive range of options. The company’s commitment to financial stability and customer satisfaction, combined with its competitive pricing and diverse discounts, makes it a compelling choice for those looking for reliable insurance solutions.

Essential FAQs

How do I get a State Farm insurance quote?

You can get a quote online, over the phone, or by visiting a local State Farm agent.

What factors affect my State Farm insurance rates?

Your age, driving history, location, vehicle type, and coverage options can all influence your insurance rates.

What are some of the discounts offered by State Farm?

State Farm offers discounts for safe driving, good student, multiple policies, and more.

How can I file a claim with State Farm?

You can file a claim online, over the phone, or by visiting a local State Farm agent.