Insurance Car State Farm, a household name in the world of insurance, has a rich history and a strong reputation for providing comprehensive coverage to drivers across the nation. This guide delves into the ins and outs of State Farm car insurance, exploring its coverage options, pricing, customer service, and its impact on the automotive industry.

From the basic tenets of liability and collision coverage to the nuanced details of discounts and claim processes, we aim to provide you with a clear understanding of what State Farm offers and how it compares to other major insurance providers.

State Farm Car Insurance Overview

State Farm is a leading provider of car insurance in the United States, renowned for its comprehensive coverage options, competitive pricing, and exceptional customer service. The company has a rich history, dating back to 1922, when it was founded by George J. Mecherle, a farmer in Bloomington, Illinois. Mecherle’s initial vision was to provide affordable insurance for farmers, and over the years, State Farm has expanded its offerings to serve a wide range of customers, including individuals, families, and businesses.

State Farm Car Insurance Offerings

State Farm offers a comprehensive suite of car insurance products designed to meet the diverse needs of its customers. The company’s offerings include:

- Liability Coverage: This coverage protects you financially if you are responsible for an accident that causes injury or damage to another person or property. State Farm offers different levels of liability coverage, allowing you to choose the level of protection that best suits your needs and budget.

- Collision Coverage: This coverage helps pay for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. Collision coverage is typically optional, but it is often recommended if you have a loan or lease on your vehicle.

- Comprehensive Coverage: This coverage protects your vehicle against damage from events other than accidents, such as theft, vandalism, fire, or hail. Comprehensive coverage is also typically optional, but it is a good idea to consider it if you have a newer or more expensive vehicle.

- Uninsured/Underinsured Motorist Coverage: This coverage provides financial protection if you are involved in an accident with a driver who does not have insurance or has insufficient coverage. This type of coverage can help pay for your medical expenses, lost wages, and property damage.

- Personal Injury Protection (PIP): This coverage helps pay for your medical expenses, lost wages, and other expenses related to injuries you sustain in an accident, regardless of who is at fault. PIP coverage is required in some states.

- Rental Car Coverage: This coverage helps pay for a rental car if your vehicle is damaged or stolen and you need transportation while it is being repaired or replaced.

- Roadside Assistance: This coverage provides assistance with flat tires, jump starts, towing, and other roadside emergencies.

Key Features and Benefits of State Farm Car Insurance Policies

State Farm car insurance policies offer a range of features and benefits designed to provide customers with peace of mind and financial protection. Some of the key features and benefits include:

- Competitive Pricing: State Farm is known for its competitive pricing, offering a wide range of discounts to help customers save money on their premiums. These discounts may include safe driving discounts, multi-policy discounts, and good student discounts.

- Excellent Customer Service: State Farm has a reputation for providing excellent customer service. The company has a large network of agents and claims adjusters who are available to assist customers with their insurance needs.

- Financial Strength: State Farm is a financially strong company with a long history of paying claims promptly and fairly. This financial strength provides customers with confidence that they will be able to rely on State Farm in the event of an accident or other claim.

- Digital Convenience: State Farm offers a variety of digital tools and resources to make it easy for customers to manage their insurance policies online. These tools include online account management, mobile app access, and online claims reporting.

- Personalized Service: State Farm agents are trained to understand the unique needs of their customers and to provide personalized insurance solutions. This personalized service helps ensure that customers have the right coverage for their specific needs and circumstances.

Coverage Options and Features

State Farm offers a comprehensive range of car insurance coverage options to cater to diverse needs and preferences. Understanding the various coverage options and their features is crucial for making informed decisions about your insurance policy.

Types of Car Insurance Coverage

State Farm provides a variety of car insurance coverage options, each designed to protect you and your vehicle in specific situations. These coverages include:

- Liability Coverage: This is the most basic type of car insurance and is required by law in most states. Liability coverage protects you financially if you cause an accident that results in injuries or damage to another person or their property. It covers the costs of:

- Medical expenses for the injured party

- Property damage to the other vehicle or property

- Legal defense fees

- Collision Coverage: This coverage protects you if your vehicle is damaged in an accident, regardless of who is at fault. Collision coverage pays for repairs or replacement of your vehicle, minus your deductible.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, fire, or natural disasters. Comprehensive coverage also pays for repairs or replacement of your vehicle, minus your deductible.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are injured in an accident caused by a driver who does not have insurance or has insufficient insurance. It covers your medical expenses and lost wages, up to the limits of your policy.

- Personal Injury Protection (PIP): This coverage, available in some states, pays for your medical expenses and lost wages, regardless of who is at fault in an accident.

- Medical Payments Coverage: This coverage pays for your medical expenses, regardless of who is at fault in an accident. It is often included as part of your liability coverage.

State Farm Coverage Features

State Farm offers a variety of features that can enhance your car insurance coverage. These features include:

- Accident Forgiveness: This feature allows you to avoid a rate increase after your first at-fault accident. It is available in most states and can be a valuable benefit for drivers with a clean driving record.

- Drive Safe & Save: This program rewards safe driving habits with discounts on your car insurance premiums. It uses telematics technology to track your driving behavior and provides feedback on your driving habits.

- Ride Share Coverage: This coverage provides protection for rideshare drivers while they are transporting passengers. It covers the driver’s liability and medical expenses, as well as the passenger’s medical expenses.

- Customizable Coverage: State Farm allows you to customize your coverage to meet your specific needs and budget. You can choose the coverage limits and deductibles that best fit your situation.

State Farm vs. Other Insurers, Insurance car state farm

State Farm is one of the largest and most reputable car insurance providers in the United States. It is known for its competitive pricing, excellent customer service, and a wide range of coverage options. However, it is important to compare State Farm’s coverage options and prices with other major insurers before making a decision. Some of the key factors to consider when comparing insurers include:

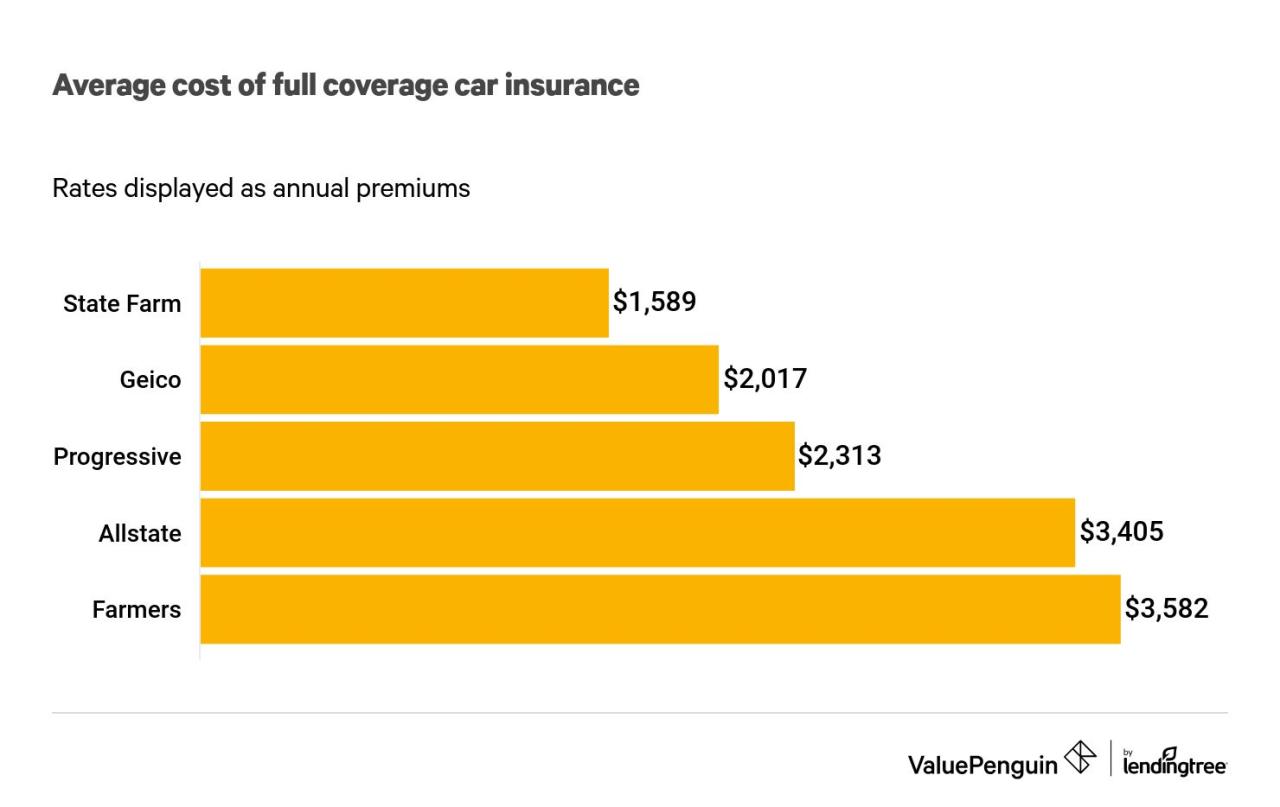

- Price: State Farm’s prices can vary depending on your location, driving record, and the type of coverage you choose. It is important to get quotes from multiple insurers to compare prices.

- Coverage: Each insurer offers different coverage options and features. It is important to compare the coverage offered by different insurers to find the best fit for your needs.

- Customer Service: Customer service is an important factor to consider when choosing an insurer. It is important to choose an insurer with a good reputation for customer service.

- Financial Strength: It is important to choose an insurer with a strong financial rating. This ensures that the insurer will be able to pay claims if you need to file one.

Pricing and Discounts

State Farm’s car insurance pricing is based on a comprehensive assessment of various factors, aiming to offer competitive rates while reflecting the individual risk associated with each policyholder. Understanding the factors influencing your premium and exploring the available discounts can help you optimize your car insurance costs.

Factors Influencing Car Insurance Premiums

Several factors contribute to the determination of your car insurance premium. These factors are grouped into categories to provide a clear understanding of their impact on your rate:

- Vehicle-Related Factors:

- Make and Model: Certain car models are statistically associated with higher repair costs or theft rates, influencing premium calculations.

- Year of Manufacture: Newer vehicles often come with advanced safety features and higher repair costs, potentially affecting your premium.

- Vehicle Usage: The purpose and frequency of your vehicle usage, such as commuting or occasional driving, influence the risk assessment.

- Driver-Related Factors:

- Driving History: Your past driving record, including accidents, traffic violations, and claims history, significantly impacts your premium.

- Age and Gender: Younger and less experienced drivers generally face higher premiums due to higher risk profiles.

- Credit Score: In some states, credit score is considered a factor, as it can be an indicator of financial responsibility.

- Location-Related Factors:

- Zip Code: The area where you reside impacts your premium due to factors like traffic density, crime rates, and weather conditions.

- Driving Distance: The distance you drive daily or annually contributes to the overall risk assessment.

- Coverage Options:

- Coverage Levels: Choosing higher coverage limits, such as liability or comprehensive coverage, can increase your premium.

- Deductibles: Selecting a lower deductible, meaning you pay less out of pocket in case of an accident, typically leads to a higher premium.

Discounts Available

State Farm offers a wide range of discounts to help policyholders save on their car insurance premiums. These discounts can be categorized as follows:

- Driving Record Discounts:

- Safe Driver Discount: This discount is awarded to drivers with a clean driving record, demonstrating responsible driving habits.

- Defensive Driving Course Discount: Completing an approved defensive driving course can qualify you for a discount, as it demonstrates your commitment to safe driving practices.

- Vehicle-Related Discounts:

- Anti-theft Device Discount: Having anti-theft devices installed in your vehicle, such as alarms or tracking systems, can lower your premium due to reduced theft risk.

- New Car Discount: Purchasing a new car may qualify you for a discount, reflecting the lower risk associated with newer vehicles.

- Multi-Car Discount: Insuring multiple vehicles with State Farm can often lead to a discount, as it indicates a higher level of loyalty and commitment.

- Other Discounts:

- Good Student Discount: Students maintaining a good academic record may be eligible for a discount, reflecting their responsible nature and lower risk profile.

- Bundling Discount: Combining your car insurance with other State Farm insurance policies, such as home or renters insurance, can result in a significant discount.

- Loyalty Discount: Long-standing State Farm policyholders may be eligible for a discount, rewarding their loyalty and commitment to the company.

Customer Experience and Service

State Farm is known for its strong commitment to customer satisfaction, offering a comprehensive range of services and resources designed to provide a positive and seamless experience for policyholders. The company prioritizes building long-term relationships with its customers, striving to meet their individual needs and exceeding their expectations.

Customer Service Reviews and Testimonials

Customer feedback plays a vital role in shaping State Farm’s service offerings. The company actively seeks and responds to customer reviews and testimonials, utilizing them to identify areas for improvement and enhance the overall customer experience.

- Positive Reviews: Many State Farm customers praise the company’s friendly and knowledgeable agents, efficient claims processing, and responsive customer support. They often highlight the personalized attention they receive, with agents taking the time to understand their individual needs and providing tailored solutions.

- Negative Reviews: While State Farm enjoys a generally positive reputation, some customers have reported challenges with specific agents or delays in claim processing. These instances often involve communication issues or misunderstandings, emphasizing the importance of clear and consistent communication between the company and its customers.

Digital Tools and Resources

State Farm recognizes the importance of providing convenient and accessible digital tools and resources to its policyholders. The company has invested heavily in developing a robust online platform and mobile app, enabling customers to manage their policies, access important documents, and connect with customer support from the comfort of their homes.

- State Farm Website: The company’s website offers a user-friendly interface, allowing customers to obtain quotes, manage their policies, make payments, and access various resources, such as articles and FAQs.

- State Farm Mobile App: The State Farm mobile app provides a convenient way for customers to manage their policies on the go. They can access their policy information, make payments, file claims, and contact customer support directly through the app.

- Online Claim Filing: State Farm offers a streamlined online claim filing process, allowing customers to report accidents and submit supporting documentation electronically. This simplifies the claims process, making it faster and more efficient for policyholders.

Claims Process and Support

State Farm offers a straightforward claims process designed to make it easy for policyholders to report and manage their claims. The company provides various resources and support to assist policyholders throughout the process.

Claims Reporting Options

State Farm offers multiple convenient options for reporting a claim, including:

- Online: Policyholders can file a claim directly through State Farm’s website, providing a quick and efficient method.

- Mobile App: The State Farm mobile app allows for convenient claim reporting, photo uploads, and tracking updates.

- Phone: Policyholders can call State Farm’s 24/7 claims line to speak with a representative.

Claims Process

The claims process typically involves the following steps:

- Report the Claim: Policyholders report the claim using one of the available methods mentioned above.

- Initial Assessment: State Farm reviews the claim details and determines the coverage and potential liability.

- Damage Inspection: An adjuster may be assigned to inspect the damaged vehicle and assess the extent of the damage.

- Estimate and Payment: State Farm provides an estimate for the repairs or replacement costs. The payment is then processed according to the policy coverage and deductibles.

- Claim Resolution: The claim is finalized once all necessary steps are completed, including the repair or replacement of the vehicle.

Support and Resources

State Farm provides various resources and support to assist policyholders during the claims process:

- Dedicated Claims Representatives: Policyholders can reach out to a claims representative for personalized assistance and guidance throughout the process.

- Online Resources: State Farm’s website and mobile app provide detailed information on the claims process, FAQs, and helpful tips.

- 24/7 Claims Line: Policyholders can call the 24/7 claims line for immediate assistance and support.

- Repair Network: State Farm has a network of preferred repair shops that meet specific quality standards, ensuring reliable and efficient repairs.

Claims Handling Efficiency and Responsiveness

State Farm has a reputation for efficient and responsive claims handling. The company aims to process claims quickly and fairly, ensuring a smooth and positive experience for policyholders.

“State Farm consistently ranks high in customer satisfaction surveys for its claims handling process, with customers praising its responsiveness and professionalism.”

State Farm’s Competitive Landscape

State Farm is a dominant player in the car insurance industry, known for its extensive network, customer service, and wide range of coverage options. However, the market is competitive, with numerous other insurance companies vying for customers. Understanding State Farm’s competitive landscape is crucial to assess its strengths, weaknesses, and overall market position.

State Farm’s Market Share and Position

State Farm holds a significant market share in the car insurance industry, consistently ranking among the top providers in the United States. As of 2023, State Farm is the largest auto insurer in the country, holding approximately 18% of the market share. This dominant position reflects State Farm’s long-standing reputation, strong brand recognition, and extensive agent network.

Comparison with Other Major Insurers

State Farm faces competition from several major insurance companies, including Geico, Progressive, Allstate, and Liberty Mutual. Each competitor has its own strengths and weaknesses, making the market dynamic and competitive.

- Geico is known for its competitive pricing and direct-to-consumer model, often offering lower premiums than State Farm.

- Progressive is a leader in innovative features, offering telematics programs and personalized pricing based on driving behavior. They also have a strong online presence and a user-friendly website.

- Allstate is known for its comprehensive coverage options and customer service, offering a wide range of discounts and bundled insurance products.

- Liberty Mutual focuses on personalized customer service and a range of coverage options, including specialized policies for high-value vehicles.

State Farm’s Strengths and Weaknesses

State Farm has several strengths that contribute to its market position, but it also faces some weaknesses in the competitive landscape.

- Strengths:

- Extensive Agent Network: State Farm has a vast network of agents across the country, providing personalized customer service and local expertise.

- Strong Brand Recognition: State Farm has a strong brand reputation for reliability and customer satisfaction, built over decades of operation.

- Wide Range of Coverage Options: State Farm offers a comprehensive suite of coverage options, catering to diverse customer needs.

- Competitive Pricing: While not always the cheapest, State Farm generally offers competitive pricing, especially when considering discounts and bundled insurance options.

- Weaknesses:

- Limited Online Presence: While State Farm has an online presence, it is not as robust as some competitors, particularly in terms of digital tools and customer service.

- Potential for Higher Premiums: State Farm’s premiums can be higher than some competitors, especially for certain demographics or risk profiles.

- Complex Claims Process: State Farm’s claims process can be more complex than some competitors, requiring more paperwork and potentially longer processing times.

State Farm’s Impact on the Automotive Industry

State Farm, as one of the largest insurance providers in the United States, has a significant impact on the automotive industry. Beyond providing financial protection to drivers, State Farm actively promotes safe driving practices and road safety initiatives. These efforts contribute to a safer driving environment, ultimately influencing the automotive industry’s trends and developments.

State Farm’s Role in Promoting Safe Driving Practices

State Farm’s commitment to road safety is evident in its various initiatives designed to educate drivers and encourage responsible behavior. These initiatives aim to reduce accidents, injuries, and fatalities on the road.

- Driver Education Programs: State Farm offers driver education programs for both teens and adults, covering topics such as defensive driving, traffic laws, and risk management. These programs aim to equip drivers with the knowledge and skills necessary to navigate the roads safely.

- Community Outreach and Partnerships: State Farm collaborates with various organizations and communities to promote safe driving practices. This includes sponsoring events, providing educational materials, and participating in awareness campaigns.

- Technology Integration: State Farm has embraced technology to enhance driver safety. Its Drive Safe & Save program uses telematics to track driving behavior and reward safe drivers with discounts. This incentivizes drivers to adopt safer driving habits.

Last Point

Choosing the right car insurance is a crucial decision, and State Farm has consistently proven itself to be a reliable and comprehensive option. With its wide array of coverage choices, competitive pricing, and commitment to customer satisfaction, State Farm stands as a strong contender in the insurance market. By understanding the nuances of State Farm’s offerings, you can make an informed decision that best meets your individual needs and driving requirements.

FAQ Insights: Insurance Car State Farm

What types of discounts does State Farm offer?

State Farm offers a wide range of discounts, including safe driver discounts, good student discounts, multi-policy discounts, and more. It’s best to contact State Farm directly to see which discounts you qualify for.

How do I file a claim with State Farm?

You can file a claim online, over the phone, or through the State Farm mobile app. The claims process is typically straightforward and efficient, with dedicated support available to guide you through each step.

What are the factors that influence my car insurance premium?

Factors that influence your premium include your driving history, age, location, vehicle type, and coverage level. State Farm provides personalized quotes based on your individual circumstances.