Indiana State Minimum Auto Insurance is a crucial aspect of driving in the Hoosier State. It’s not just a legal requirement, but also a safety net that can protect you financially in the event of an accident. This guide delves into the specifics of Indiana’s minimum insurance requirements, helping you understand what’s necessary and how to make informed decisions about your coverage.

The state of Indiana mandates specific types of auto insurance coverage for all drivers, designed to ensure financial responsibility and protect those involved in accidents. This includes liability coverage, which protects others in case of an accident you cause, and personal injury protection (PIP), which covers your own medical expenses and lost wages. Understanding these requirements is essential for all drivers in Indiana, as failure to comply can lead to significant penalties.

Indiana’s Minimum Auto Insurance Requirements

Driving a car in Indiana requires you to have a minimum amount of auto insurance coverage. This ensures that you are financially protected in case of an accident and helps to cover the costs of damages or injuries to others. The Indiana Department of Insurance specifies these minimum requirements to protect drivers and pedestrians.

Liability Coverage

Liability coverage protects you financially if you are at fault in an accident that causes injury or damage to another person or their property. It is crucial to have this coverage to avoid significant financial burdens in the event of an accident.

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages for injuries to others caused by an accident for which you are at fault. Indiana requires a minimum of $25,000 per person and $50,000 per accident. For example, if you cause an accident that injures three people, this coverage would pay up to $25,000 for each injured person, with a total limit of $50,000.

- Property Damage Liability: This coverage pays for damages to another person’s property caused by an accident for which you are at fault. Indiana requires a minimum of $25,000. For instance, if you hit another car and cause $10,000 worth of damage, this coverage would pay for the repairs.

Uninsured/Underinsured Motorist Coverage

This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. It helps compensate you for your injuries or damages, even if the other driver does not have sufficient insurance to cover your losses.

- Uninsured Motorist Coverage: This coverage pays for your medical expenses, lost wages, and other damages if you are injured in an accident caused by an uninsured driver. Indiana requires a minimum of $25,000 per person and $50,000 per accident.

- Underinsured Motorist Coverage: This coverage pays for your damages if you are injured in an accident caused by a driver with insurance but not enough to cover your losses. Indiana requires a minimum of $25,000 per person and $50,000 per accident. For example, if you are injured in an accident caused by a driver with $25,000 in liability coverage, but your medical expenses are $40,000, this coverage would pay the remaining $15,000.

Personal Injury Protection (PIP)

PIP coverage, also known as no-fault insurance, pays for your medical expenses, lost wages, and other damages, regardless of who is at fault in an accident. Indiana requires a minimum of $50,000 per person. This coverage is essential for covering your own medical bills and lost wages, even if you are at fault in an accident.

Understanding Indiana’s Financial Responsibility Law

Indiana’s Financial Responsibility Law is designed to ensure that drivers are financially responsible for any accidents they cause. It requires all drivers to have the minimum amount of auto insurance, and failing to comply can result in significant penalties.

Penalties for Driving Without Insurance

Driving without the minimum required auto insurance in Indiana can result in a range of penalties, including fines, license suspension, and even vehicle impoundment. The severity of these penalties can vary depending on the nature of the violation.

- Fines: The first offense for driving without insurance in Indiana can result in a fine of $250 to $500. Subsequent offenses can lead to even higher fines, potentially reaching $1,000 or more.

- License Suspension: If you are caught driving without insurance, your driver’s license can be suspended for up to 90 days. This suspension can be extended if you fail to provide proof of insurance within the specified time frame.

- Vehicle Impoundment: In some cases, your vehicle may be impounded if you are caught driving without insurance. This means that your vehicle will be towed and stored at a designated facility until you provide proof of insurance and pay any associated fees.

Penalties for Different Insurance Violations, Indiana state minimum auto insurance

Here is a table summarizing the penalties for different violations related to insurance requirements in Indiana:

| Violation | Penalty |

|---|---|

| Driving without insurance | Fine of $250 to $500, license suspension for up to 90 days, vehicle impoundment |

| Driving with suspended license due to lack of insurance | Fine of $100 to $500, license suspension for up to one year, vehicle impoundment |

| Failing to provide proof of insurance to law enforcement | Fine of $25 to $100, license suspension for up to 30 days |

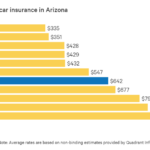

Factors Influencing Indiana Auto Insurance Costs

Your auto insurance premiums in Indiana are determined by a variety of factors, and understanding these factors can help you make informed decisions about your coverage and potentially save money. Let’s delve into the key factors that influence your insurance costs in Indiana.

Driving History

Your driving history plays a crucial role in determining your insurance premiums. Insurance companies consider your past driving record, including accidents, violations, and even the number of years you’ve been driving. A clean driving record translates to lower premiums, while a history of accidents or violations can significantly increase your costs.

For instance, a driver with multiple speeding tickets or a DUI conviction will likely face much higher premiums compared to a driver with a spotless record.

Age

Age is another factor that insurance companies consider when calculating your premiums. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. Therefore, they typically face higher premiums than older drivers. However, as drivers age and gain more experience, their premiums generally decrease.

For example, a 20-year-old driver may pay significantly more for insurance than a 40-year-old driver with a similar driving record.

Vehicle Type

The type of vehicle you drive also influences your insurance premiums. Some vehicles are considered riskier to insure than others due to factors like safety ratings, repair costs, and the likelihood of theft.

For example, a high-performance sports car will likely have higher premiums than a standard sedan due to its higher speed potential and potentially higher repair costs.

Location

Your location can significantly impact your auto insurance premiums. Insurance companies consider factors like the density of traffic, crime rates, and the prevalence of accidents in your area. Areas with higher traffic congestion or higher crime rates may have higher insurance premiums.

For example, a driver living in a densely populated urban area may pay more for insurance than a driver living in a rural area with less traffic and crime.

Table of Factors Affecting Premiums

| Factor | Impact on Premiums | Example |

|—|—|—|

| Driving History | Clean record = lower premiums, Accidents/violations = higher premiums | A driver with no accidents or violations may pay significantly less than a driver with a DUI conviction. |

| Age | Younger drivers = higher premiums, Older drivers = lower premiums | A 20-year-old driver may pay significantly more than a 40-year-old driver with a similar driving record. |

| Vehicle Type | Higher-performance vehicles = higher premiums, Standard vehicles = lower premiums | A sports car may have higher premiums than a standard sedan due to its higher speed potential and potentially higher repair costs. |

| Location | High-traffic/crime areas = higher premiums, Low-traffic/crime areas = lower premiums | A driver living in a densely populated urban area may pay more for insurance than a driver living in a rural area with less traffic and crime. |

Exploring Additional Coverage Options

While Indiana’s minimum auto insurance requirements provide essential coverage, they might not be sufficient to protect you fully in every situation. Exploring additional coverage options can offer greater peace of mind and financial security in case of an accident.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. This coverage is particularly valuable if you have a newer or more expensive vehicle.

Collision coverage can help you avoid significant out-of-pocket expenses if your car is totaled or requires extensive repairs after an accident. It’s also crucial if you have a loan or lease on your vehicle, as lenders often require collision coverage.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damage caused by events other than collisions, such as theft, vandalism, fire, hail, or natural disasters. This coverage is essential if your vehicle is financed or leased.

Comprehensive coverage helps you recover from unexpected losses caused by events beyond your control. It can cover the cost of repairs or replacement for damage caused by things like a fallen tree branch, a hailstorm, or a fire.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you and your passengers if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage.

UM/UIM coverage is crucial because it provides financial protection if you are injured by a hit-and-run driver or a driver with minimal liability insurance. This coverage can cover medical expenses, lost wages, and pain and suffering.

Rental Car Reimbursement

Rental car reimbursement coverage pays for a rental car while your vehicle is being repaired after an accident. This coverage can be especially helpful if you rely on your vehicle for work or daily commutes.

Rental car reimbursement coverage helps you maintain your mobility and avoid the inconvenience of being without a vehicle while yours is being repaired. This coverage can also save you money on rental car expenses, which can be significant, especially if you need to rent a car for an extended period.

Tips for Obtaining Affordable Auto Insurance in Indiana: Indiana State Minimum Auto Insurance

Securing affordable auto insurance in Indiana requires a strategic approach. By implementing the following tips, you can significantly reduce your premiums and ensure you have adequate coverage.

Comparing Quotes from Multiple Insurers

It is crucial to compare quotes from multiple insurers before settling on a policy. Different insurers use varying formulas to calculate premiums, leading to substantial price differences. Online comparison websites, such as Insurify and Policygenius, allow you to easily compare quotes from various insurers in minutes. These websites gather your information once and then send it to multiple insurers, eliminating the need for repetitive data entry.

Exploring Discounts

Insurers offer a wide range of discounts to incentivize safe driving and responsible behavior. By taking advantage of these discounts, you can significantly reduce your premiums. Here are some common discounts offered by Indiana insurers:

- Good Driver Discount: This discount is awarded to drivers with a clean driving record, free of accidents and traffic violations. It reflects your safe driving habits and reduces your premium accordingly.

- Safe Driver Discount: Similar to the good driver discount, this discount rewards drivers who have completed defensive driving courses or have a proven track record of safe driving practices.

- Multi-Car Discount: Insurers often provide discounts for multiple vehicles insured under the same policy. This discount recognizes your loyalty and encourages you to bundle your insurance needs.

- Multi-Policy Discount: Bundling your auto insurance with other insurance products, such as homeowners or renters insurance, can result in significant savings. This discount acknowledges your comprehensive insurance needs and incentivizes you to consolidate your policies.

- Pay-in-Full Discount: Some insurers offer discounts for paying your premium in full upfront. This eliminates the need for installment payments and simplifies the payment process, leading to a lower premium.

- Loyalty Discount: Long-term customers often qualify for loyalty discounts. This discount rewards your continued patronage and encourages you to maintain your policy with the same insurer.

- Anti-theft Device Discount: Installing anti-theft devices, such as alarms or GPS trackers, can reduce your premium. This discount recognizes your efforts to enhance your vehicle’s security and reduce the risk of theft.

- Good Student Discount: Students with good academic records often qualify for discounts. This discount encourages academic excellence and recognizes your commitment to education.

- Military Discount: Active military personnel and veterans may qualify for discounts. This discount recognizes their service and contributions to the country.

Maintaining a Clean Driving Record

A clean driving record is essential for obtaining affordable auto insurance. Accidents and traffic violations can significantly increase your premium. Avoiding these incidents can help you maintain a good driving record and benefit from lower insurance rates.

“A clean driving record is a key factor in determining your auto insurance premium. Avoiding accidents and traffic violations can significantly reduce your costs.”

Using Online Tools and Resources

Online tools and resources can greatly assist in finding affordable auto insurance. Comparison websites allow you to compare quotes from multiple insurers simultaneously. Insurance companies often provide online tools for calculating premiums and exploring discounts. Utilizing these resources can save you time and effort while ensuring you find the most competitive rates.

Conclusive Thoughts

Navigating Indiana’s auto insurance landscape can feel complex, but understanding the minimum requirements and available options empowers you to make informed choices. By carefully considering your needs and comparing quotes from different insurers, you can find affordable coverage that provides the protection you need. Remember, driving without the proper insurance can lead to serious consequences, so ensure you meet the state’s minimum requirements and explore additional coverage options to enhance your peace of mind.

FAQ Guide

What happens if I get into an accident without the minimum required auto insurance?

You could face serious penalties, including fines, license suspension, and even vehicle impoundment. You’ll also be responsible for covering all accident-related costs yourself, which can be significant.

Can I get discounts on my Indiana auto insurance?

Yes, many insurers offer discounts for safe driving records, good grades for young drivers, and bundling insurance policies. Be sure to ask about available discounts when you’re comparing quotes.

How often should I review my auto insurance policy?

It’s a good idea to review your policy at least once a year, especially if your driving situation changes (e.g., you get a new car, your family grows, or you move to a different location). You might find that your current coverage is no longer adequate or that you can find a better deal with another insurer.