Il state insurance – Illinois State Insurance plays a vital role in protecting individuals and businesses against unforeseen events. From health and auto insurance to property and liability coverage, Illinois residents have access to a wide range of insurance options. Understanding the state’s insurance landscape, regulations, and consumer options is crucial for making informed decisions and securing the right protection.

This guide explores the key characteristics of the Illinois insurance market, including the major insurance carriers, prevalent coverage types, and regulatory environment. We delve into the specifics of insurance regulations, licensing requirements, and claim filing processes. Additionally, we provide insights into consumer insurance options, including comparisons of different insurance plans and factors to consider when choosing a policy. The guide also addresses key insurance issues in Illinois, such as the impact of natural disasters, affordability concerns, and the role of technology in shaping the industry.

Illinois State Insurance Landscape

Illinois boasts a dynamic and multifaceted insurance market, characterized by a robust regulatory environment and a diverse range of insurance carriers catering to the needs of its residents. The state’s insurance landscape is shaped by its large population, diverse industries, and the presence of major insurance hubs.

Major Insurance Carriers Operating in Illinois

The Illinois insurance market is home to a wide array of insurance carriers, both national and regional, competing for market share.

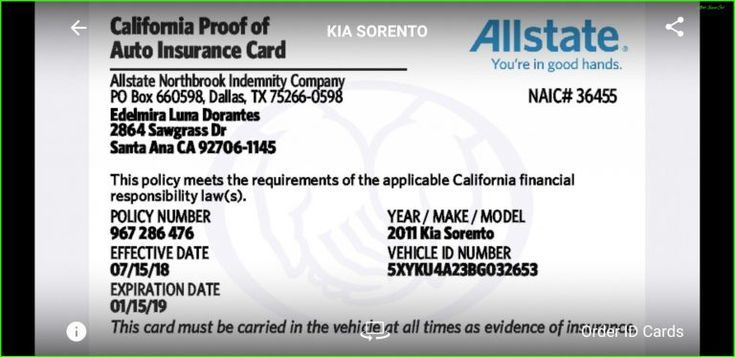

- National Carriers: These companies operate nationwide and often have a significant presence in Illinois. Examples include State Farm, Allstate, and Nationwide, which are known for their wide range of insurance products and extensive distribution networks.

- Regional Carriers: These carriers focus on specific regions of the country, including Illinois. They may offer specialized products or services tailored to the needs of local communities. Examples include Country Financial, Horace Mann, and Kemper, which have strong roots in Illinois and serve specific customer segments.

- Local Carriers: These are smaller insurance companies that operate primarily within Illinois. They may offer niche products or services or cater to specific communities. Examples include Illinois Mutual, Horace Mann, and Kemper, which have strong roots in Illinois and serve specific customer segments.

Most Prevalent Types of Insurance Coverage in Illinois

Illinois residents seek a variety of insurance coverage to protect themselves and their assets. The most prevalent types of insurance coverage in the state include:

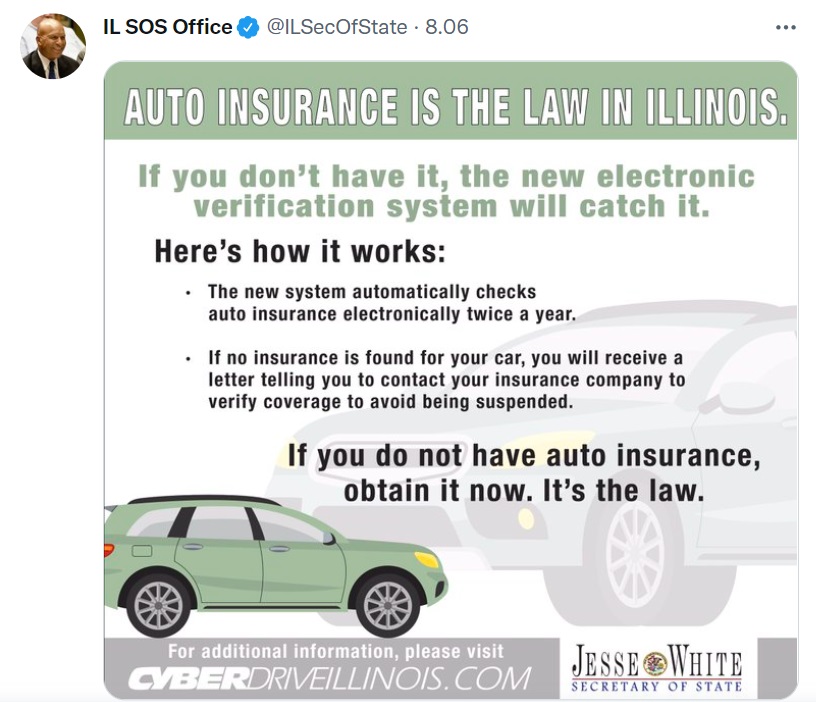

- Auto Insurance: Illinois has a mandatory auto insurance law, requiring all drivers to have liability coverage. This makes auto insurance one of the most common types of coverage sought by residents.

- Homeowners Insurance: Homeowners insurance is essential for protecting homes from various risks, including fire, theft, and natural disasters. Illinois has a high concentration of urban areas, making homeowners insurance a significant need.

- Health Insurance: The Affordable Care Act (ACA) has expanded access to health insurance, making it a priority for many Illinois residents. The state also has a robust network of hospitals and healthcare providers.

- Business Insurance: Illinois is home to a diverse range of businesses, each requiring specific insurance coverage to protect against risks. This includes general liability, workers’ compensation, and property insurance.

Comparison of Illinois Insurance Regulatory Environment

The Illinois Department of Insurance (DOI) plays a crucial role in regulating the insurance industry in the state.

- Regulation of Rates: The DOI has the authority to review and approve insurance rates to ensure they are fair and reasonable. This helps protect consumers from excessive premiums.

- Consumer Protection: The DOI enforces laws and regulations designed to protect consumers from unfair or deceptive insurance practices. This includes addressing complaints and investigating fraudulent activities.

- Licensing and Oversight: The DOI licenses and oversees insurance companies, agents, and brokers operating in the state. This ensures that only qualified individuals and companies are authorized to sell insurance.

Illinois Insurance Regulations

The Illinois Department of Insurance (DOI) plays a crucial role in overseeing and regulating the insurance industry within the state. It ensures fair practices, protects consumers, and maintains the financial stability of insurance companies.

Licensing Requirements for Insurance Agents and Brokers

Illinois mandates specific licensing requirements for individuals who wish to operate as insurance agents or brokers within the state. These requirements ensure that individuals possess the necessary knowledge and skills to provide competent insurance services.

- Eligibility: Applicants must meet specific age and residency requirements and pass a background check.

- Education: Applicants must complete a pre-licensing education course approved by the DOI, covering insurance principles, laws, and regulations.

- Examination: Applicants must successfully pass a licensing exam administered by the DOI, demonstrating their understanding of insurance concepts and regulations.

- Appointment: Once licensed, agents must be appointed by an insurance company to represent and sell their products.

- Continuing Education: Licensed agents and brokers must complete ongoing education requirements to maintain their licenses, ensuring they stay updated on industry changes and best practices.

Insurance Claim Filing Process

The DOI Artikels a specific process for filing insurance claims in Illinois, ensuring a fair and transparent resolution of claims.

- Prompt Notification: Policyholders must promptly notify their insurance company of any covered loss or incident, following the guidelines Artikeld in their policy.

- Claim Filing: Policyholders must file a claim with their insurance company, providing all necessary documentation and information, such as a police report or medical records.

- Investigation: The insurance company will investigate the claim, verifying the details and assessing the extent of the loss.

- Claim Settlement: The insurance company will review the claim and make a decision on the settlement amount, based on the policy coverage and the investigation findings.

- Appeals Process: If a policyholder disagrees with the insurance company’s decision, they can appeal the decision through the DOI’s dispute resolution process.

Impact of Recent Legislative Changes, Il state insurance

Illinois has witnessed several legislative changes in recent years, impacting the insurance industry in various ways. These changes aim to address evolving consumer needs and industry challenges.

- Increased Transparency: New laws require insurance companies to provide clearer and more transparent information about their policies and pricing, empowering consumers to make informed decisions.

- Consumer Protection: Legislation has strengthened consumer protection measures, addressing issues like unfair claim denials, excessive premiums, and deceptive marketing practices.

- Digital Innovation: Regulatory changes have embraced technological advancements in the insurance industry, allowing for greater use of digital platforms and data analytics.

- Climate Change: Illinois has implemented measures to address the impact of climate change on the insurance industry, such as requiring insurance companies to consider climate-related risks in their underwriting practices.

Consumer Insurance Options in Illinois

Illinois residents have access to a wide range of insurance options to protect themselves and their assets against various risks. Understanding these options and choosing the right insurance plan is crucial for financial security.

Types of Insurance Available in Illinois

Illinois residents have access to a wide range of insurance options to protect themselves and their assets against various risks. Understanding these options and choosing the right insurance plan is crucial for financial security. Here are some common types of insurance available in Illinois:

- Health Insurance: This covers medical expenses, including doctor visits, hospital stays, and prescription drugs. Illinois offers various health insurance plans through the Affordable Care Act (ACA) marketplace, as well as private insurance options.

- Auto Insurance: Required by law in Illinois, auto insurance protects against financial losses due to accidents, theft, or damage to your vehicle. Coverage options include liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Homeowners Insurance: This protects your home and belongings against damage caused by fire, theft, natural disasters, and other covered perils. Homeowners insurance also provides liability coverage for accidents that occur on your property.

- Renters Insurance: This protects your personal belongings and provides liability coverage for accidents that occur in your rental unit. It’s essential for renters, as it offers financial protection against unforeseen events.

- Life Insurance: This provides financial protection to your loved ones in the event of your death. It can help cover funeral expenses, mortgage payments, and other financial obligations.

- Disability Insurance: This provides income replacement if you become disabled and unable to work. It can help cover living expenses and other financial obligations while you recover.

- Long-Term Care Insurance: This covers the costs of long-term care services, such as assisted living, nursing home care, and home health care. It can help protect your assets and ensure you have access to quality care when needed.

Comparing Insurance Companies and Coverage

Insurance companies in Illinois offer a variety of coverage options and pricing structures for different insurance products. When comparing insurance companies, consider factors like:

- Coverage Options: Different companies may offer varying levels of coverage and deductibles.

- Premiums: Premiums are the monthly payments you make for your insurance. Compare prices from multiple companies to find the best value.

- Customer Service: Consider the company’s reputation for customer service and claims handling.

- Financial Stability: Choose a financially stable company with a strong track record of paying claims.

Factors to Consider When Choosing an Insurance Policy

When selecting an insurance policy in Illinois, consider the following factors:

- Your Individual Needs: Determine your specific insurance needs based on your age, health, lifestyle, and financial situation.

- Your Budget: Choose a policy that fits your budget and provides the necessary coverage without putting a strain on your finances.

- Coverage Limits and Deductibles: Understand the limits and deductibles associated with each policy and ensure they meet your requirements.

- Exclusions and Limitations: Be aware of any exclusions or limitations in the policy, such as specific perils not covered or maximum payout amounts.

- Policy Renewals: Understand how the policy is renewed and whether premiums are subject to changes.

Key Features of Different Insurance Plans in Illinois

Here’s a table comparing key features of different insurance plans offered in Illinois:

| Insurance Type | Key Features | Coverage Options | Deductibles | Premiums |

|---|---|---|---|---|

| Health Insurance | Covers medical expenses, including doctor visits, hospital stays, and prescription drugs. | Various plans available through the ACA marketplace and private insurers. | Varies depending on the plan. | Varies depending on the plan and your individual circumstances. |

| Auto Insurance | Required by law in Illinois. Protects against financial losses due to accidents, theft, or damage to your vehicle. | Liability, collision, comprehensive, and uninsured/underinsured motorist coverage. | Varies depending on the coverage and plan. | Varies depending on factors like driving history, vehicle type, and location. |

| Homeowners Insurance | Protects your home and belongings against damage caused by fire, theft, natural disasters, and other covered perils. | Coverage for dwelling, personal property, liability, and additional living expenses. | Varies depending on the coverage and plan. | Varies depending on factors like home value, location, and coverage levels. |

| Renters Insurance | Protects your personal belongings and provides liability coverage for accidents that occur in your rental unit. | Coverage for personal property, liability, and additional living expenses. | Varies depending on the coverage and plan. | Varies depending on factors like rental value, location, and coverage levels. |

| Life Insurance | Provides financial protection to your loved ones in the event of your death. | Term life, whole life, universal life, and variable life insurance. | No deductible. | Varies depending on factors like age, health, and coverage amount. |

| Disability Insurance | Provides income replacement if you become disabled and unable to work. | Short-term and long-term disability insurance. | No deductible. | Varies depending on factors like age, occupation, and income level. |

| Long-Term Care Insurance | Covers the costs of long-term care services, such as assisted living, nursing home care, and home health care. | Various coverage options and benefit periods. | Varies depending on the plan. | Varies depending on factors like age, health, and coverage level. |

Key Insurance Issues in Illinois: Il State Insurance

Illinois, like many other states, faces a range of insurance-related challenges impacting both residents and businesses. These challenges are influenced by factors like natural disasters, economic conditions, and technological advancements. Understanding these issues is crucial for navigating the Illinois insurance landscape effectively.

Natural Disasters and Climate Change

The impact of natural disasters and climate change on insurance in Illinois is significant. The state is prone to severe weather events, including tornadoes, floods, and heat waves. These events can lead to substantial property damage, business disruptions, and increased insurance premiums.

- In 2022, Illinois experienced a record-breaking number of tornadoes, causing widespread damage to homes and businesses.

- Rising temperatures and increased precipitation are also contributing to more frequent and severe flooding events, particularly in urban areas with aging infrastructure.

- The changing climate necessitates proactive measures, such as stricter building codes, improved flood mitigation strategies, and the development of innovative insurance products that address climate-related risks.

Affordability of Insurance Coverage

The affordability of insurance coverage is a growing concern for many Illinois residents. Factors such as rising healthcare costs, inflation, and limited access to affordable insurance options contribute to this challenge.

- Low-income families often struggle to afford health insurance, particularly those who are ineligible for government-sponsored programs like Medicaid.

- Rising premiums for auto, home, and health insurance can place a significant burden on individuals and families, especially those with limited financial resources.

- Insurance companies are facing pressure to balance affordability with the need to maintain financial stability, leading to complex trade-offs in pricing and coverage.

Technology and the Transformation of Insurance

Technology is rapidly transforming the insurance industry in Illinois, creating new opportunities and challenges. The use of data analytics, artificial intelligence (AI), and digital platforms is changing how insurance is underwritten, priced, and delivered.

- Insurers are leveraging data analytics to better understand customer needs, predict risk, and personalize insurance products.

- AI-powered chatbots and virtual assistants are being used to automate customer service interactions and streamline claims processing.

- The rise of digital insurance platforms is offering consumers greater convenience and flexibility in accessing and managing their insurance policies.

Resources for Illinois Insurance Consumers

Navigating the world of insurance can be overwhelming, especially when it comes to understanding your rights and options. Luckily, Illinois offers a variety of resources to help consumers make informed decisions about their insurance needs.

Illinois Department of Insurance

The Illinois Department of Insurance (DOI) serves as the primary regulatory body for the insurance industry in the state. They play a crucial role in protecting consumers by ensuring that insurance companies operate fairly and responsibly. The DOI provides a range of services and resources to help Illinois residents understand their insurance rights and navigate the insurance landscape.

- Consumer Hotline: The DOI operates a consumer hotline at (800) 444-4576. This hotline is available to answer questions, address concerns, and provide guidance on insurance matters. You can reach out to them with inquiries regarding insurance policies, claims, or any other insurance-related issues.

- Website: The DOI’s website, www.insurance.illinois.gov, offers a wealth of information on various insurance topics. You can find information on insurance regulations, consumer rights, insurance companies, and filing complaints. The website also features helpful resources, such as brochures, fact sheets, and FAQs, to help you understand your insurance coverage and make informed decisions.

- Complaint Filing: If you have an issue with an insurance company, you can file a complaint with the DOI. The DOI will investigate your complaint and attempt to resolve the matter between you and the insurance company. If the issue cannot be resolved through mediation, the DOI may take further action, such as imposing fines or penalties on the insurance company.

Consumer Advocacy Groups

In addition to the DOI, several consumer advocacy groups offer support and resources to Illinois residents regarding insurance issues. These groups often specialize in specific areas of insurance, such as health insurance, auto insurance, or life insurance.

- Illinois PIRG: The Illinois Public Interest Research Group (PIRG) is a non-profit organization that advocates for consumer protection and public interest issues. They provide information and resources on a variety of topics, including insurance. Their website, www.illinoispirg.org, features articles, reports, and tools to help consumers understand their insurance rights and make informed decisions.

- AARP: The American Association of Retired Persons (AARP) offers a range of resources and services to people aged 50 and over, including information on insurance. Their website, www.aarp.org, provides guidance on Medicare, health insurance, and other insurance products. They also offer a free insurance counseling service to help seniors understand their insurance options and make informed decisions.

Resolving Insurance Disputes

If you are unable to resolve an insurance dispute with your insurance company directly, you have several options available in Illinois.

- Mediation: Mediation is a process where a neutral third party helps you and your insurance company reach a mutually agreeable solution. The DOI offers a free mediation service to help resolve insurance disputes. You can contact the DOI’s consumer hotline or visit their website for more information about their mediation program.

- Arbitration: Arbitration is a more formal process where a neutral third party hears evidence from both sides and makes a binding decision. Arbitration is often used for more complex insurance disputes, such as those involving significant financial amounts or complex legal issues.

- Litigation: If all other options fail, you can file a lawsuit against your insurance company. However, litigation can be expensive and time-consuming. It is important to consult with an attorney before pursuing this option.

Understanding Insurance Terms and Concepts

Insurance policies often contain complex terms and concepts that can be difficult to understand.

- Deductible: The deductible is the amount you must pay out of pocket before your insurance coverage kicks in. For example, if you have a $1,000 deductible on your auto insurance policy and you get into an accident that causes $5,000 in damages, you will be responsible for paying the first $1,000, and your insurance company will cover the remaining $4,000.

- Premium: The premium is the amount you pay to your insurance company for coverage. Premiums are typically paid monthly or annually. The amount of your premium will depend on several factors, including your age, driving history, and the type of coverage you choose.

- Coinsurance: Coinsurance is the percentage of covered medical expenses that you are responsible for paying after you have met your deductible. For example, if you have 80/20 coinsurance on your health insurance policy, you will pay 20% of your medical expenses after you have met your deductible. Your insurance company will cover the remaining 80%.

- Exclusions: Exclusions are specific events or circumstances that are not covered by your insurance policy. For example, your auto insurance policy may exclude coverage for damages caused by wear and tear or acts of war.

- Limits: Limits are the maximum amounts that your insurance company will pay for covered events. For example, your auto insurance policy may have a $100,000 limit for bodily injury liability coverage. This means that your insurance company will pay no more than $100,000 for injuries caused to other people in an accident.

Closing Notes

Navigating the world of insurance in Illinois can be complex, but with the right information and resources, you can make informed decisions to secure the coverage you need. By understanding the state’s insurance landscape, regulations, and consumer options, you can find the right policies to protect your assets, health, and financial well-being. Remember to consult with a qualified insurance agent or broker to discuss your specific needs and obtain personalized advice.

Commonly Asked Questions

What is the role of the Illinois Department of Insurance?

The Illinois Department of Insurance regulates the insurance industry in the state, ensuring fair practices and protecting consumers.

How can I file a complaint against an insurance company?

You can file a complaint with the Illinois Department of Insurance through their website or by phone.

What are the penalties for insurance fraud in Illinois?

Insurance fraud is a serious crime in Illinois, and penalties can include fines, imprisonment, and license revocation.