How to change car insurance from one state to another – Moving to a new state? You’ll need to update your car insurance to comply with the new state’s regulations. Changing car insurance from one state to another can seem daunting, but it’s a straightforward process if you follow the right steps. This guide will walk you through everything you need to know, from understanding state-specific requirements to choosing the best policy for your needs.

First, you’ll need to contact your current insurer and inform them of your move. They’ll help you update your policy and may even offer a seamless transition to a new policy in your new state. Once you’ve notified your current insurer, it’s time to explore new insurance providers in your new state. Compare quotes from different companies, considering factors like coverage options, discounts, and customer service ratings.

Understanding State-Specific Insurance Requirements

Each state in the U.S. has its own unique set of car insurance regulations, so understanding these differences is crucial when you move to a new state. These regulations dictate the minimum coverage requirements, the types of coverage you must have, and the financial responsibility you must bear in case of an accident.

Minimum Liability Coverage Requirements

It’s important to understand that each state mandates a minimum amount of liability insurance you must carry to legally operate a vehicle. This coverage protects you financially if you cause an accident and injure someone or damage their property. Here’s a comparison of minimum liability coverage requirements across different states:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages resulting from injuries you cause to another person in an accident. States like Florida have a minimum requirement of $10,000 per person and $20,000 per accident, while Pennsylvania mandates $15,000 per person and $30,000 per accident.

- Property Damage Liability: This coverage pays for repairs or replacement costs of the other person’s vehicle or property you damage in an accident. The minimum requirement for this coverage varies significantly across states. For example, New York requires $25,000, while Texas mandates only $25,000 per accident.

Other State-Specific Insurance Requirements

Beyond minimum liability coverage, states may also mandate additional coverage, such as:

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who has no insurance or insufficient insurance to cover your damages. This coverage is mandatory in some states, while others offer it as an optional add-on.

- Personal Injury Protection (PIP): This coverage covers medical expenses, lost wages, and other related costs for you and your passengers, regardless of who caused the accident. States like Florida and Michigan require PIP coverage, while others may offer it as an optional add-on.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of fault. This coverage is generally optional but may be required if you have a loan or lease on your vehicle.

- Comprehensive Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged due to events other than an accident, such as theft, vandalism, or natural disasters. This coverage is generally optional but may be required if you have a loan or lease on your vehicle.

Contacting Your Current Insurer

Once you’ve determined your new state’s insurance requirements, the next step is to contact your current insurer. They’ll guide you through the process of transferring your policy and ensuring you have the right coverage in your new location.

Notifying Your Insurer, How to change car insurance from one state to another

It’s essential to inform your current insurer about your move as soon as possible. This will allow them to update your policy and address any changes in coverage or premiums. Here’s a step-by-step guide:

- Contact Your Insurer: Reach out to your insurer through their website, phone, or email. Most insurers have a dedicated customer service line for policy changes.

- Provide Your New Address: Share your new address with your insurer. This will be crucial for updating your policy and ensuring you receive any necessary documents.

- State Your Move Date: Inform them about your move date. This will help them determine the effective date for any policy changes.

- Discuss Coverage Needs: Take this opportunity to review your current coverage with your insurer and ensure it meets your needs in your new state. You might need to adjust your policy to comply with new state requirements or to reflect changes in your driving habits or vehicle usage.

Impact of Changing Insurance Mid-Policy

Changing your insurance mid-policy can have some implications. It’s important to understand these potential impacts before making any decisions:

- Premium Adjustments: Your insurance premiums might change when you move to a new state. This is because insurance rates vary depending on factors such as the cost of living, accident rates, and traffic density in different locations. Your insurer will calculate your new premium based on your new address and other relevant factors.

- Coverage Changes: Depending on the specific requirements in your new state, you might need to add or remove certain coverage from your policy. For instance, some states require specific types of coverage, such as personal injury protection (PIP) or uninsured motorist coverage (UMC), that may not be mandatory in your previous state. Your insurer will guide you through any necessary adjustments.

- Policy Cancellation: In some cases, your insurer might cancel your current policy if it doesn’t offer coverage in your new state. This is less common, but it’s important to be aware of the possibility. If this happens, your insurer should help you find a suitable replacement policy.

Obtaining Quotes from New Insurers

Once you’ve gathered information about your new state’s insurance requirements and contacted your current insurer, the next step is to get quotes from new insurance providers. This process will help you compare different coverage options and find the best policy for your needs and budget.

Factors to Consider When Choosing a New Insurer

When selecting a new insurance provider, consider these key factors:

- Coverage Options: Ensure the insurer offers the specific coverage you need, such as liability, collision, comprehensive, and uninsured motorist coverage. Consider the minimum requirements in your new state and any additional coverage you might need, like roadside assistance or rental car reimbursement.

- Discounts: Many insurers offer discounts for various factors, such as safe driving records, good credit scores, multiple vehicle insurance, and bundling insurance policies. Research the available discounts and see which ones you qualify for.

- Customer Service Ratings: Customer service is crucial when dealing with insurance claims. Look for insurers with high customer satisfaction ratings and positive reviews. Consider factors like response times, claim processing speed, and overall customer experience.

- Financial Stability: Choose an insurer with a strong financial rating. This indicates the company’s ability to pay claims in the event of a major disaster or economic downturn. You can find financial ratings from organizations like AM Best, Standard & Poor’s, and Moody’s.

- Price: While price is an important factor, it shouldn’t be the only one. Remember that the cheapest option might not always offer the best coverage or customer service. Compare quotes from multiple insurers to find the best balance between price and value.

Comparison Table of Key Factors

| Factor | Description | Example |

|—|—|—|

| Coverage Options | The types of insurance coverage offered by the insurer | Liability, collision, comprehensive, uninsured motorist, roadside assistance, rental car reimbursement |

| Discounts | Discounts offered for various factors | Safe driving record, good credit score, multiple vehicle insurance, bundling policies |

| Customer Service Ratings | Customer satisfaction ratings and reviews | J.D. Power, Consumer Reports |

| Financial Stability | Insurer’s financial rating | AM Best, Standard & Poor’s, Moody’s |

| Price | The cost of the insurance policy | Annual premium, monthly payments |

Reputable Insurance Companies

Here are some reputable insurance companies that operate in various states:

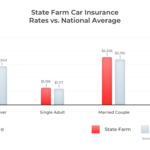

- State Farm

- Geico

- Progressive

- Allstate

- USAA

- Farmers

- Liberty Mutual

- Nationwide

Understanding Coverage Options

When you change your car insurance to a new state, it’s crucial to understand the coverage options available and how they differ from your previous state. Each state has its own minimum insurance requirements, and the coverage options you choose will determine the level of protection you have in case of an accident.

Common Coverage Options

Here are some common coverage options available in most states:

- Liability Coverage: This is the most basic type of car insurance and is required by law in all states. It covers damages to other people’s property and injuries caused by you in an accident. It is divided into two parts:

- Bodily Injury Liability: Covers medical expenses, lost wages, and pain and suffering for injuries to others.

- Property Damage Liability: Covers damage to another person’s vehicle or property.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. You’ll need to pay your deductible first, and the insurance company will cover the remaining costs up to your coverage limit.

- Comprehensive Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged by something other than an accident, such as theft, vandalism, fire, or hail. You’ll need to pay your deductible first, and the insurance company will cover the remaining costs up to your coverage limit.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages. It can cover your medical expenses, lost wages, and pain and suffering.

- Uninsured Motorist Coverage: Covers damages caused by a driver without insurance.

- Underinsured Motorist Coverage: Covers damages caused by a driver with insufficient insurance.

- Personal Injury Protection (PIP): This coverage pays for your medical expenses and lost wages, regardless of who is at fault in an accident. It’s often required in states with “no-fault” insurance systems.

- Medical Payments Coverage (Med Pay): This coverage pays for your medical expenses, regardless of who is at fault in an accident. It’s typically a lower coverage limit than PIP.

Understanding Coverage Limits and Deductibles

Coverage limits and deductibles are important factors to consider when choosing your insurance coverage. Coverage limits determine the maximum amount your insurance company will pay for a claim. Deductibles are the amount you pay out-of-pocket before your insurance kicks in.

For example, if you have a $10,000 coverage limit for collision coverage and a $500 deductible, your insurance company will pay up to $9,500 for repairs after you pay your $500 deductible.

Higher coverage limits and lower deductibles generally result in higher insurance premiums. You’ll need to weigh the benefits and costs of different coverage options and choose the combination that best suits your needs and budget.

Comparing and Contrasting Coverage Options

Each coverage option has its own benefits and limitations. Here’s a brief comparison:

| Coverage | Benefits | Limitations |

|---|---|---|

| Collision Coverage | Covers repairs or replacement of your vehicle after an accident, regardless of who is at fault. | You need to pay your deductible first. |

| Comprehensive Coverage | Covers repairs or replacement of your vehicle for damages other than accidents, such as theft, vandalism, or natural disasters. | You need to pay your deductible first. |

| Uninsured/Underinsured Motorist Coverage | Protects you from financial losses if you’re involved in an accident with an uninsured or underinsured driver. | The coverage limit may not be enough to cover all your damages. |

| Personal Injury Protection (PIP) | Covers your medical expenses and lost wages, regardless of who is at fault. | The coverage limit may not be enough to cover all your expenses. |

| Medical Payments Coverage (Med Pay) | Covers your medical expenses, regardless of who is at fault. | It typically has a lower coverage limit than PIP. |

Choosing the Right Policy: How To Change Car Insurance From One State To Another

Now that you understand the coverage options available, it’s time to choose the policy that best suits your needs and budget. This involves carefully evaluating your individual circumstances and making informed decisions about the level of coverage you require.

Factors to Consider

When selecting a car insurance policy, several factors play a crucial role. These factors influence the premium you pay and the level of protection you receive.

- Your Vehicle: The make, model, year, and value of your vehicle significantly impact your insurance premium. Luxury or high-performance vehicles often command higher premiums due to their greater repair costs and higher risk of theft. Older vehicles, on the other hand, may have lower premiums but may offer less comprehensive coverage.

- Your Driving History: Your driving record, including accidents, traffic violations, and DUI convictions, directly affects your insurance rates. A clean driving history typically leads to lower premiums, while a history of accidents or violations can result in higher premiums. Insurance companies often use a points system to assess your driving history, with more points indicating a higher risk and higher premiums.

- Your Location: The state you live in and the specific area within that state can impact your insurance rates. Areas with higher crime rates or more traffic congestion tend to have higher premiums due to the increased risk of accidents and theft. Insurance companies use a variety of factors to assess the risk associated with different locations, including crime statistics, traffic density, and weather conditions.

- Your Age and Gender: Younger drivers, particularly those under 25, generally face higher premiums due to their higher risk of accidents. This is because younger drivers have less experience on the road and are more likely to engage in risky behaviors. Gender can also play a role in insurance rates, with men typically paying higher premiums than women. This is because men are statistically more likely to be involved in accidents.

- Your Coverage Needs: Consider the level of coverage you require based on your individual circumstances. For example, if you have a newer car with a high value, you may want to opt for comprehensive coverage to protect yourself against theft and damage from events like hailstorms or floods. If you have an older car with a lower value, you may be able to save money by choosing a less comprehensive policy. It’s also important to consider the potential financial impact of an accident. If you can’t afford to pay for repairs or medical bills out of pocket, you’ll need higher liability coverage to protect yourself financially.

Calculating Your Insurance Needs

To determine the right amount of coverage, consider the following:

- Vehicle Value: If your car is worth $20,000, consider getting comprehensive and collision coverage with a deductible that you can comfortably afford. This will ensure that you’re fully covered in the event of an accident or theft.

- Liability Coverage: Liability coverage protects you financially if you’re at fault in an accident that causes injuries or property damage to others. The minimum liability coverage required by your state may not be sufficient in all cases. If you have significant assets or a high net worth, you may want to consider purchasing higher liability limits to protect yourself from potential lawsuits.

- Medical Payments Coverage: This coverage pays for your medical expenses, regardless of who’s at fault in an accident. It’s essential to have adequate medical payments coverage to cover the costs of medical treatment, including ambulance fees, hospital stays, and rehabilitation.

Negotiating with Insurance Companies

Once you’ve identified the coverage you need, it’s time to negotiate with insurance companies to secure the best rates. Here are some tips:

- Shop Around: Get quotes from multiple insurance companies to compare rates and coverage options. Online comparison tools can help you quickly and easily compare quotes from different insurers.

- Bundle Policies: Many insurance companies offer discounts if you bundle multiple policies, such as car insurance and homeowners or renters insurance. Bundling your policies can save you a significant amount of money.

- Ask About Discounts: Inquire about any discounts that you may be eligible for, such as safe driver discounts, good student discounts, and multi-car discounts.

- Be Prepared to Negotiate: Don’t be afraid to negotiate with insurance companies to try to get a lower premium. Be polite but firm, and be prepared to walk away if you’re not satisfied with the offer.

Switching to a New Policy

Once you’ve chosen the right policy, it’s time to make the switch. This process involves canceling your old policy and activating your new one, ensuring a seamless transition.

Canceling Your Old Policy

It’s crucial to notify your current insurer of your decision to switch policies. Here’s a step-by-step guide to ensure a smooth cancellation:

- Contact Your Insurer: Reach out to your current insurer, either by phone, email, or mail, and inform them of your intention to cancel your policy. Provide them with your policy details and the effective date of cancellation.

- Request Cancellation Confirmation: Always request written confirmation of your policy cancellation, including the effective date. This documentation will serve as proof in case of any disputes.

- Return Policy Documents: If required, return any policy documents or materials to your insurer as per their instructions.

- Obtain a Refund (If Applicable): If you’re canceling your policy mid-term, you may be entitled to a prorated refund. Ensure you understand your insurer’s refund policy and how it applies to your situation.

Activating Your New Policy

Once your old policy is canceled, you can activate your new policy with your chosen insurer. This usually involves:

- Providing Required Information: You’ll need to provide your new insurer with the necessary information, such as your driving history, vehicle details, and coverage preferences.

- Paying the Premium: You’ll need to pay your first premium to activate your new policy. This could be done online, by phone, or through mail.

- Receiving Policy Documents: Your new insurer will provide you with your policy documents, including the policy details, coverage information, and payment schedule.

Ensuring Seamless Coverage Transfer

It’s essential to ensure a smooth transition between your old and new policies to avoid any gaps in coverage. This involves:

- Timing is Key: Cancel your old policy only after your new policy is activated. This ensures continuous coverage and avoids any potential issues.

- Verification: Double-check the effective dates of both policies to ensure they align. This helps avoid any overlapping coverage or gaps in coverage.

- Contact Your Insurer: If you encounter any issues or have questions about the transition, contact both your old and new insurers for clarification.

Maintaining Continuous Coverage

It’s crucial to ensure that you don’t have any gaps in your car insurance coverage when moving to a new state. This is because driving without insurance is illegal in all states, and you could face serious consequences if you’re caught.

A lapse in coverage can lead to hefty fines, legal issues, and even the suspension of your driver’s license. Furthermore, if you’re involved in an accident without insurance, you could be held personally liable for all damages and injuries, potentially putting your finances at risk.

Maintaining Uninterrupted Coverage

To prevent any interruptions in your insurance coverage, it’s essential to have a plan in place. Here’s a checklist to help you ensure a smooth transition:

- Contact your current insurer well in advance of your move. Inform them about your upcoming relocation and the new state you’ll be residing in. They can guide you on the process of transferring your policy or provide you with the necessary information to obtain a new policy in your new state.

- Obtain quotes from multiple insurers in your new state. Compare prices, coverage options, and customer reviews to find the best policy that suits your needs and budget. Don’t hesitate to ask questions and seek clarification on any aspect of the policy that you don’t understand.

- Ensure that your new policy starts on the same day or before your current policy expires. This will ensure that you have continuous coverage without any gaps. You can typically request a policy effective date that aligns with your move date.

- Keep all documentation related to your insurance policies in a safe place. This includes your policy documents, renewal notices, and proof of insurance cards. This will help you manage your insurance effectively and provide necessary information when needed.

Additional Considerations

When changing your car insurance to a new state, it’s crucial to understand how factors like your driving history and credit score can influence your premiums. Additionally, exploring discounts and savings opportunities can help you save money on your new policy.

Driving History and Credit Score

Your driving history and credit score are significant factors that insurance companies use to assess your risk and determine your premiums.

- Driving History: Insurance companies consider your past driving record, including accidents, traffic violations, and claims. A clean driving record typically translates to lower premiums, while a history of accidents or violations can lead to higher rates.

- Credit Score: While it might seem surprising, insurance companies in many states use your credit score as a proxy for risk assessment. A good credit score generally indicates responsible financial behavior, which can be correlated with responsible driving habits. However, this practice is not universal and is subject to state regulations.

Final Wrap-Up

Switching car insurance when moving states is a crucial step to ensure you have the right coverage and avoid any legal issues. By understanding state-specific requirements, comparing quotes, and choosing a policy that meets your needs, you can navigate this process smoothly. Remember to maintain continuous coverage to avoid any gaps in protection and explore available discounts to minimize your premiums.

FAQ Corner

What happens if I don’t update my car insurance after moving?

Driving without proper insurance in a new state can lead to fines, penalties, and even license suspension. It’s essential to update your policy as soon as you move.

Can I keep my current insurance policy after moving?

In some cases, your current insurer may offer coverage in your new state. However, it’s often more beneficial to explore new insurance providers in your new location to find better rates and coverage options.

What documents do I need to provide when changing my car insurance?

You’ll typically need your driver’s license, proof of residency, and vehicle registration details. Your insurer will provide specific instructions.

How long does it take to switch car insurance policies?

The process usually takes a few days to a week. It’s best to start the process early to ensure a smooth transition.

Can I get a discount on my car insurance after moving?

Yes, you may be eligible for discounts based on your new location, driving history, or safety features in your vehicle. Be sure to ask your insurer about available discounts.