How much do State Farm insurance agents make? This is a question many aspiring insurance professionals ask themselves. State Farm, a leading insurance provider, offers a unique compensation structure for its agents, combining a base salary with a commission-based system. This structure allows agents to earn substantial income based on their performance and sales abilities.

State Farm agents can expect to earn a base salary, which serves as a foundation for their income. However, the majority of their earnings come from commissions earned on the insurance policies they sell. The commission structure is designed to incentivize agents to sell more policies and provide exceptional customer service. Additionally, State Farm offers bonuses and incentives to recognize outstanding performance and encourage agents to reach specific sales targets.

State Farm Agent Compensation Structure

State Farm agents are independent contractors who earn income through a combination of base salary, commissions, and bonuses. This structure allows agents to directly impact their earnings based on their performance and sales efforts.

Base Salary

State Farm agents receive a base salary, which provides a stable income foundation. The base salary is typically modest and serves as a starting point for their earnings.

Commission Structure

The primary source of income for State Farm agents is commissions earned on insurance policies sold. Commissions are calculated as a percentage of the premium paid by policyholders.

The commission rate varies based on the type of insurance policy sold, the policyholder’s risk profile, and the agent’s experience.

- For example, an agent might earn a higher commission rate for selling a comprehensive auto insurance policy compared to a basic liability policy.

- Experienced agents with a strong track record of sales and customer satisfaction often receive higher commission rates.

Bonuses and Incentives

State Farm offers a range of bonuses and incentives to motivate agents and reward their performance. These bonuses can be based on various factors, including:

- Sales volume: Agents who exceed their sales targets may receive bonuses based on the total premium generated from their sales.

- Customer retention: Agents who successfully retain existing customers can earn bonuses for their efforts in building strong customer relationships.

- New product adoption: Agents who promote and sell new insurance products may receive incentives for their efforts in expanding the company’s product portfolio.

Factors Influencing Commission Rates

Several factors influence the commission rates that State Farm agents receive. These factors include:

- Policy type: Different types of insurance policies, such as auto, home, life, and business insurance, have varying commission rates.

- Policyholder risk profile: Policyholders with higher risk profiles, such as those with a history of accidents or claims, may have higher premiums, resulting in higher commissions for agents.

- Agent experience: Experienced agents with a proven track record of sales and customer satisfaction often receive higher commission rates.

- Market conditions: Factors such as competition, economic conditions, and regulatory changes can influence commission rates.

Average Earnings of State Farm Agents

State Farm agents’ income can vary significantly depending on various factors, including experience, location, and the number of clients they serve. While exact figures are not publicly disclosed by State Farm, analyzing industry data and agent testimonials can shed light on the typical earnings range.

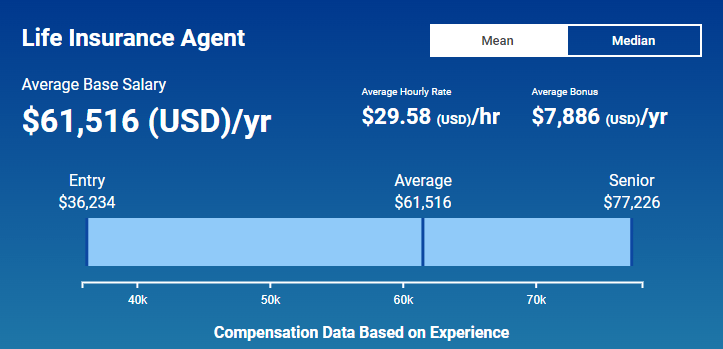

Average Annual Income

The average annual income for State Farm agents is estimated to be between $60,000 and $100,000. This range reflects the commission-based nature of the role, where agents earn a percentage of the premiums they generate.

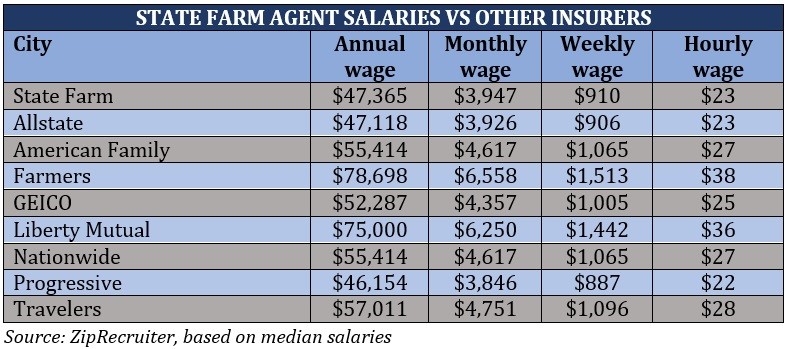

Comparison to Other Insurance Agent Positions

State Farm agents’ average earnings generally align with or exceed those of other insurance agents in the industry. According to the U.S. Bureau of Labor Statistics, the median annual salary for insurance sales agents in 2022 was $55,270. However, top-performing State Farm agents can earn significantly more than this median.

Factors Contributing to Income Variation

Several factors influence the income of State Farm agents, including:

- Experience: More experienced agents tend to have a larger client base and higher income potential due to their established reputation and expertise.

- Location: Agents in high-population areas or regions with a strong demand for insurance services may earn more than those in less populated or competitive markets.

- Sales Skills and Client Base: Agents with strong sales skills and a large, loyal client base can generate higher premiums and earn more income.

- Product Specialization: Agents who specialize in specific insurance products, such as auto or life insurance, may have higher earning potential in their niche areas.

- Business Management: Effective business management practices, including marketing, customer service, and financial planning, can significantly impact an agent’s profitability.

Examples of High-Earning and Low-Earning Agents

While the average income for State Farm agents falls within a specific range, individual earnings can vary greatly. Some agents, particularly those with extensive experience, a large client base, and strong sales skills, may earn well over $100,000 annually. Conversely, newer agents or those in less competitive markets may earn closer to the lower end of the range.

Factors Influencing Agent Earnings

The income of a State Farm insurance agent is not fixed but is influenced by several factors. These factors determine the agent’s success in generating revenue and building a profitable business.

Experience and Tenure

Experience and tenure play a significant role in determining an agent’s earnings. Agents with more experience tend to have a wider network of clients, stronger relationships with existing customers, and a deeper understanding of the insurance industry. This translates into higher sales volume and increased commission income. A longer tenure also indicates a successful track record, leading to greater trust and confidence from clients.

Sales Skills and Customer Service

Effective sales skills and exceptional customer service are essential for success as a State Farm agent. Agents who excel in these areas are more likely to attract new clients, retain existing ones, and generate higher sales volume. Strong sales skills involve building rapport with potential clients, understanding their needs, and effectively presenting insurance solutions. Excellent customer service involves providing prompt and helpful assistance, resolving issues quickly, and building long-lasting relationships with clients.

Location and Market Size

The location and market size of an agent’s territory can significantly impact earnings. Agents operating in densely populated areas with a high concentration of potential clients often have a larger customer base and higher sales volume. Similarly, markets with a high demand for insurance products, such as areas with a large number of car owners or homeowners, can present more opportunities for agents.

Specialization in Specific Insurance Products

Agents can specialize in specific insurance products, such as auto, home, life, or business insurance. This allows them to develop expertise in a particular area and attract clients seeking specialized insurance solutions. Specialization can lead to higher sales volume and income as agents become recognized as experts in their chosen field.

Career Path and Advancement Opportunities

State Farm agents have the potential to build successful careers with opportunities for growth and advancement within the company. The agency management structure provides a clear path for agents to progress, taking on greater responsibilities and earning higher compensation along the way.

Agency Management Structure

State Farm’s agency management structure is designed to provide agents with a clear path for career advancement. Agents can progress through a series of levels, each with its own set of responsibilities and requirements.

The main levels of agency management include:

- Agent: This is the entry-level position for new State Farm agents. Agents are responsible for selling insurance products, providing customer service, and managing their own book of business.

- Senior Agent: Senior agents have a proven track record of success and are responsible for mentoring new agents, overseeing a larger book of business, and participating in community activities.

- Agency Manager: Agency managers are responsible for the overall performance of their agency, including sales, customer service, and financial management. They also supervise and mentor a team of agents.

- Regional Manager: Regional managers oversee a group of agencies within a specific geographic area. They are responsible for the overall performance of their region, including sales, customer service, and agent development.

Requirements and Responsibilities

Each level of agency management has specific requirements and responsibilities. For example, to become a Senior Agent, an agent must meet certain sales and customer service performance targets. To become an Agency Manager, an agent must have a proven track record of success as a Senior Agent and must demonstrate leadership skills.

Potential for Salary Increases and Bonuses

Agents who advance through the management structure can expect to see significant salary increases and bonuses. The specific compensation package for each level is based on factors such as performance, experience, and location.

Examples of Successful Career Trajectories

Many State Farm agents have successfully advanced through the management structure, building successful careers within the company. For example, some agents have started as new agents and have progressed to become Agency Managers or Regional Managers. Others have started as Senior Agents and have progressed to become Agency Managers. The company provides opportunities for agents to develop their skills and advance their careers.

Costs and Expenses Associated with Being a State Farm Agent

While the potential for high earnings is attractive, becoming a State Farm agent involves significant upfront and ongoing expenses. Understanding these costs is crucial for making informed decisions about this career path.

Office Space Costs, How much do state farm insurance agents make

The cost of office space is a major expense for State Farm agents. This can include rent or mortgage payments, utilities, insurance, and maintenance. Agents have options for their office setup:

- Traditional Office: Renting or owning a physical office space provides a professional setting and can be beneficial for building relationships with clients. However, this comes with the highest costs.

- Home Office: Operating from a home office can significantly reduce rent and utility expenses. This option is more common for newer agents or those who prefer a more flexible work environment.

- Shared Office Space: Sharing office space with other professionals can be a cost-effective alternative, offering shared amenities and reduced overhead. This option is popular among agents looking to minimize costs while maintaining a professional image.

Marketing Expenses

Attracting new clients is essential for any agent’s success, and marketing plays a crucial role. Marketing expenses can include:

- Advertising: Traditional media like print, radio, and television, as well as online platforms like social media, search engine optimization (), and pay-per-click (PPC) advertising, can be used to reach potential customers.

- Community Involvement: Participating in local events, sponsoring community initiatives, and networking with local organizations can build brand recognition and trust.

- Referral Programs: Rewarding existing clients for referrals can be a cost-effective way to acquire new business.

Technology Costs

Technology plays a vital role in the day-to-day operations of a State Farm agent. Essential technology expenses include:

- Computer Hardware and Software: High-speed internet, computers, and specialized software are essential for managing client data, processing policies, and communicating effectively.

- Mobile Devices: Smartphones and tablets allow agents to stay connected with clients and access critical information on the go.

- Cloud Storage: Securely storing and accessing client data from multiple devices is essential for efficient operations.

Strategies for Managing Expenses

To maximize profitability, agents can implement strategies to manage expenses:

- Negotiate Rates: Negotiating favorable rates with suppliers for office space, utilities, and technology can significantly reduce costs.

- Optimize Marketing Campaigns: Tracking the effectiveness of marketing campaigns and adjusting strategies to focus on high-performing channels can improve return on investment.

- Leverage Technology: Automating tasks and using online tools can reduce administrative costs and increase efficiency.

- Outsource Non-Core Functions: Outsourcing tasks like bookkeeping, marketing, or administrative support can free up time and resources for agents to focus on client relationships and sales.

Impact of Overhead Costs on Agent Earnings

Overhead costs can significantly impact agent earnings. A higher percentage of earnings dedicated to overhead expenses will leave less available for personal income and profit.

For example, an agent earning $100,000 annually with $25,000 in overhead expenses will have $75,000 remaining for personal income and profit. An agent earning the same amount but with $40,000 in overhead expenses will only have $60,000 remaining.

Agents need to carefully manage their expenses to maximize their earnings potential.

Last Word

Becoming a State Farm insurance agent can be a rewarding career choice, offering the potential for significant income and professional growth. By understanding the factors that influence earnings, including experience, sales skills, location, and specialization, aspiring agents can develop a strategic plan to maximize their earning potential. While there are costs associated with operating an agency, the potential for high earnings and career advancement makes State Farm a competitive and attractive option for individuals seeking a fulfilling career in the insurance industry.

Commonly Asked Questions: How Much Do State Farm Insurance Agents Make

What is the typical commission rate for State Farm agents?

Commission rates for State Farm agents vary depending on the type of insurance policy sold and the agent’s experience. Generally, agents earn a percentage of the premium paid by policyholders.

How do I become a State Farm insurance agent?

To become a State Farm insurance agent, you typically need to meet certain qualifications, including a valid driver’s license, a clean background check, and a high school diploma or equivalent. You will also need to complete training and obtain the necessary licenses and certifications.

Are there any benefits offered to State Farm insurance agents?

State Farm offers a comprehensive benefits package to its agents, including health insurance, dental insurance, vision insurance, disability insurance, and life insurance. Agents may also be eligible for retirement plans and other benefits.