How much do insurance agents make state farm – How much do insurance agents make at State Farm? This is a question many aspiring insurance professionals and curious individuals ponder. State Farm, a renowned insurance giant, offers a unique compensation structure for its agents, combining a base salary with a commission-based system, bonuses, and potential for growth. The amount an agent earns depends on various factors, including experience, location, client base, and specialization.

This article will delve into the intricacies of State Farm’s agent compensation structure, exploring the key elements that influence earnings. We’ll compare State Farm’s compensation model to other insurance companies, highlighting potential benefits and drawbacks. Additionally, we’ll provide valuable resources for researching State Farm agent compensation, helping you gain a comprehensive understanding of this career path.

State Farm Agent Compensation Structure: How Much Do Insurance Agents Make State Farm

State Farm agents earn income through a combination of base salary, commission, and bonuses. This unique compensation structure allows agents to control their earning potential based on their performance and dedication.

Base Salary

State Farm agents receive a base salary, providing a consistent income stream. This base salary is typically modest, designed to cover essential expenses and provide a foundation for income generation.

Commission-Based Compensation

The primary source of income for State Farm agents is commission. Commissions are calculated as a percentage of the premiums collected on insurance policies sold. The commission rate varies depending on the type of insurance policy sold. For example, auto insurance policies may have a different commission rate than life insurance policies.

Bonuses and Incentives

State Farm offers various bonuses and incentives to motivate agents and reward their achievements. These bonuses can be based on factors such as:

- Number of new policies sold

- Increased premium volume

- Customer satisfaction ratings

- Meeting specific sales goals

Growth and Advancement

State Farm provides opportunities for agents to grow and advance within the company. Agents can progress through different levels of experience and responsibility, potentially earning higher commissions and bonuses. State Farm also offers training and development programs to help agents enhance their skills and knowledge.

Factors Influencing State Farm Agent Earnings

State Farm agent compensation is a complex system that takes into account a multitude of factors. While the base compensation structure is relatively straightforward, several variables significantly impact an agent’s overall earnings potential. These factors influence the level of income that State Farm agents can achieve, ranging from modest to substantial.

Experience

Experience plays a crucial role in determining a State Farm agent’s earnings. As agents gain more experience, they tend to build a larger client base and develop a deeper understanding of the insurance industry. This translates to higher commissions and increased income.

The more experience an agent has, the more likely they are to be successful in selling insurance products.

A new agent starting their career may initially earn a lower income than an experienced agent with a well-established clientele. However, with time and dedication, they can build their practice and increase their earnings potential.

Location

The location of a State Farm agency can significantly impact an agent’s income. Agents in high-population areas with a strong demand for insurance products generally earn higher commissions than those in less populated areas.

The cost of living and the demand for insurance products vary significantly across different regions.

For example, an agent in a major metropolitan city like New York City may earn a higher income than an agent in a rural area due to the higher density of potential clients and the higher value of insurance policies in urban areas.

Number of Clients

The number of clients an agent has directly affects their income. The more clients an agent has, the more premiums they collect, resulting in higher commissions.

The number of clients is a key factor in determining an agent’s income.

Agents who actively build their client base and provide excellent customer service are more likely to retain clients and attract new ones. This leads to a larger client portfolio and increased income.

Specialization

Specialization within the insurance industry can also impact an agent’s earnings. Agents who focus on specific types of insurance, such as life insurance or commercial insurance, may be able to command higher commissions due to their specialized knowledge and expertise.

Specialization can lead to higher commissions and increased income.

For example, an agent specializing in life insurance may be able to earn a higher income than an agent who sells a broader range of insurance products. This is because life insurance policies often have higher premiums, and specialized agents may have a better understanding of complex life insurance products.

State Farm Agent Compensation Compared to Other Insurance Companies

Comparing State Farm agent compensation to other insurance companies is crucial for understanding the potential earnings and career trajectory within the industry. Analyzing the compensation structure, benefits, and overall job satisfaction can help individuals make informed decisions about their career path.

Compensation Structures and Incentives

The compensation structure for State Farm agents typically involves a commission-based system, where earnings are directly tied to the volume of insurance policies sold. This structure can be highly lucrative for successful agents, but it also carries the risk of lower earnings during slow periods.

While commission-based compensation is common across the insurance industry, State Farm offers several unique incentives that can boost earnings:

- Performance Bonuses: State Farm offers performance bonuses based on achieving sales targets and exceeding customer satisfaction metrics. These bonuses can significantly increase overall earnings for top-performing agents.

- Leadership Opportunities: State Farm has a strong emphasis on leadership development, providing opportunities for agents to advance their careers through management positions and regional leadership roles. These positions often come with higher salaries and benefits.

- Training and Development Programs: State Farm invests heavily in training and development programs for its agents, providing access to industry-leading knowledge and skills. These programs can help agents enhance their sales skills and increase their earning potential.

Benefits and Drawbacks, How much do insurance agents make state farm

Working as a State Farm agent offers several potential benefits:

- High Earning Potential: The commission-based compensation structure, combined with performance bonuses and leadership opportunities, can lead to significant earning potential for top performers.

- Strong Brand Recognition: State Farm is a well-established and reputable insurance company, which can provide agents with a strong brand name to leverage when building their client base.

- Comprehensive Training and Support: State Farm offers extensive training and support programs to help agents succeed in their roles. This includes sales training, marketing support, and ongoing mentorship.

However, there are also some potential drawbacks to consider:

- Sales-Driven Environment: The commission-based compensation structure can create a highly sales-driven environment, which may not be suitable for all individuals. Some agents may find the pressure to meet sales targets stressful.

- Limited Salary Stability: Earnings can fluctuate depending on sales volume, which can lead to periods of lower income during slow periods or economic downturns.

- High Initial Investment: Starting a State Farm agency often requires a significant initial investment, which can be a barrier for some individuals.

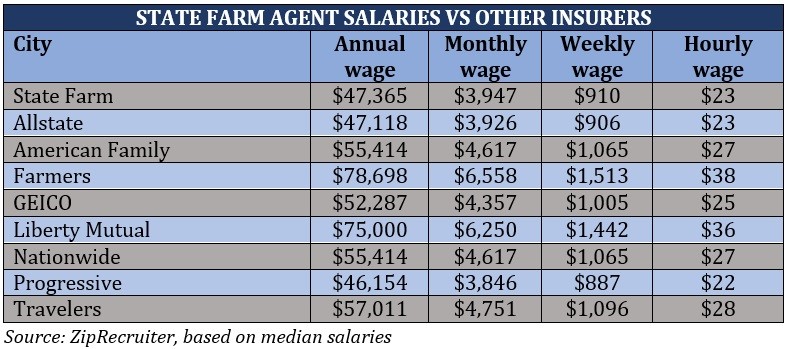

Comparison to Other Insurance Companies

While State Farm is known for its strong compensation structure and incentives, it’s important to compare it to other insurance companies to understand the overall landscape.

- Commission-Based Compensation: Many insurance companies, including Allstate, Farmers, and Nationwide, offer commission-based compensation structures for their agents. However, the specific commission rates and bonus structures can vary significantly.

- Base Salary: Some insurance companies, particularly larger firms with a more structured sales environment, may offer a base salary in addition to commissions. This can provide a more stable income stream for agents.

- Benefits and Perks: The benefits package offered by insurance companies can vary widely, including health insurance, retirement plans, and paid time off. State Farm is generally known for its competitive benefits package.

It’s important to research and compare the compensation structures, benefits, and overall culture of different insurance companies before making a decision. Factors such as your individual goals, risk tolerance, and work preferences should be considered.

Resources for Researching State Farm Agent Compensation

Finding accurate information about State Farm agent compensation can be challenging as the company doesn’t publicly disclose detailed salary data. However, various resources can provide valuable insights into potential earnings.

Online Resources

Several online platforms offer data and insights on State Farm agent compensation. These resources can provide a starting point for your research.

| Resource | Description |

|---|---|

| Glassdoor | This popular job site allows employees to anonymously share salary information, providing insights into average State Farm agent earnings based on location, experience, and other factors. |

| Salary.com | This website offers salary data and comparisons for various professions, including insurance agents. You can search for State Farm agent salaries based on location and experience. |

| Indeed | Another job site that allows users to search for open positions and view salary ranges for various roles. You can use Indeed to research State Farm agent salaries in your area. |

Industry Publications

Reputable industry publications often provide insights into insurance agent salaries and compensation trends.

- Insurance Journal: This publication covers news and analysis related to the insurance industry, including articles on agent compensation and trends.

- National Underwriter: This publication focuses on insurance industry news, analysis, and trends, including insights into agent compensation and industry practices.

- Insurance Business: This publication covers insurance industry news, analysis, and trends, including articles on agent compensation and industry practices.

Professional Organizations

Professional organizations and associations dedicated to insurance agents can offer valuable resources and data on compensation trends.

- National Association of Insurance Agents (NAIA): This organization provides resources and support to insurance agents, including data on compensation trends and industry insights.

- Independent Insurance Agents & Brokers of America (IIABA): This organization represents independent insurance agents and brokers, providing resources and data on compensation trends and industry insights.

Outcome Summary

In conclusion, understanding the factors influencing State Farm agent compensation is crucial for anyone considering this career path. While the base salary provides a foundation, commission-based earnings, bonuses, and growth opportunities play a significant role in determining overall income. Researching resources and comparing State Farm’s compensation model to other insurance companies can help you make an informed decision about your career aspirations. Whether you’re seeking a stable income or a lucrative commission-driven path, understanding the complexities of State Farm agent compensation is essential for achieving your financial goals.

Quick FAQs

What are the typical benefits offered to State Farm agents?

State Farm agents often receive benefits such as health insurance, retirement plans, paid time off, and professional development opportunities.

Is it necessary to have prior insurance experience to become a State Farm agent?

While prior experience is beneficial, State Farm provides comprehensive training programs for new agents.

What are the typical responsibilities of a State Farm agent?

State Farm agents are responsible for selling insurance products, providing customer service, managing client relationships, and adhering to company policies.

Are there any specific educational requirements to become a State Farm agent?

Typically, a high school diploma or equivalent is required, but a college degree can be advantageous.