How much do insurance agents make at State Farm? It’s a question many aspiring insurance professionals ask, and the answer is not as straightforward as you might think. State Farm agents earn a combination of base salary, commissions, bonuses, and incentives, with the final amount varying based on a number of factors.

This guide will delve into the intricacies of State Farm agent compensation, exploring the different components of their income and the factors that influence their earnings. We’ll also discuss typical income ranges, career progression, and the importance of building a strong client base for long-term financial success.

State Farm Agent Compensation Structure

State Farm agents, like many insurance professionals, are compensated through a combination of base salary and commission-based earnings. This structure incentivizes agents to actively sell policies and build a strong client base.

Base Salary

State Farm agents typically receive a modest base salary, which serves as a foundation for their income. This base salary is often designed to cover basic living expenses and provide a stable financial footing. The exact amount can vary based on experience, location, and performance.

Commission-Based Compensation

The primary source of income for State Farm agents is commission-based compensation. This means that agents earn a percentage of the premiums paid by their clients for various insurance products. The commission rate varies depending on the type of insurance policy sold.

- Life Insurance: Agents typically earn a higher commission on life insurance policies, as these policies usually involve larger premiums.

- Auto and Home Insurance: Commissions on auto and home insurance policies are generally lower, but these policies tend to be more frequently renewed, providing a consistent stream of income.

Bonuses and Incentives

In addition to base salary and commissions, State Farm agents may be eligible for various bonuses and incentives. These rewards are often tied to achieving specific sales goals, exceeding performance targets, or demonstrating exceptional customer service.

- Sales Bonuses: Agents may receive bonuses for meeting or exceeding monthly or quarterly sales quotas.

- Performance Incentives: State Farm may offer incentives for agents who consistently rank high in customer satisfaction, retention rates, or new client acquisition.

- Referral Bonuses: Agents may receive bonuses for referring new clients to State Farm.

“State Farm agents are encouraged to build long-term relationships with their clients, which can lead to ongoing income streams through policy renewals and additional sales.”

Factors Influencing State Farm Agent Earnings: How Much Do Insurance Agents Make At State Farm

State Farm agents’ earnings are influenced by a combination of factors, including their experience, location, and sales performance. While a base salary is provided, the majority of an agent’s income comes from commissions earned on the insurance products they sell. This commission structure incentivizes agents to build a strong customer base and maintain high levels of customer satisfaction.

Experience

Experience plays a significant role in determining an agent’s income. As agents gain more experience, they typically develop a larger customer base and become more proficient at selling insurance products. This translates into higher commission earnings. For instance, a seasoned agent with a decade of experience might earn significantly more than a newly licensed agent.

Location

The geographic location of an agency can also influence an agent’s earnings. Areas with higher population density and a greater demand for insurance products tend to offer higher earning potential. Agents operating in rural areas might face lower sales volume and, consequently, lower earnings.

Sales Performance, How much do insurance agents make at state farm

An agent’s sales performance is a primary driver of their income. State Farm incentivizes strong sales performance through its commission structure, which rewards agents for exceeding their sales targets. Agents who consistently meet or exceed their sales goals are likely to earn higher commissions.

Customer Base Size and Retention

The size and retention rate of an agent’s customer base are crucial factors in determining their income. Building a large and loyal customer base allows agents to generate consistent revenue streams through renewals and additional sales. Agents who effectively retain their customers can expect to earn more over the long term.

Specialized Training and Certifications

Pursuing specialized training and certifications can enhance an agent’s income potential. By obtaining specialized knowledge in areas like commercial insurance or life insurance, agents can position themselves to serve a niche market and earn higher commissions. These certifications also demonstrate expertise and credibility to potential clients.

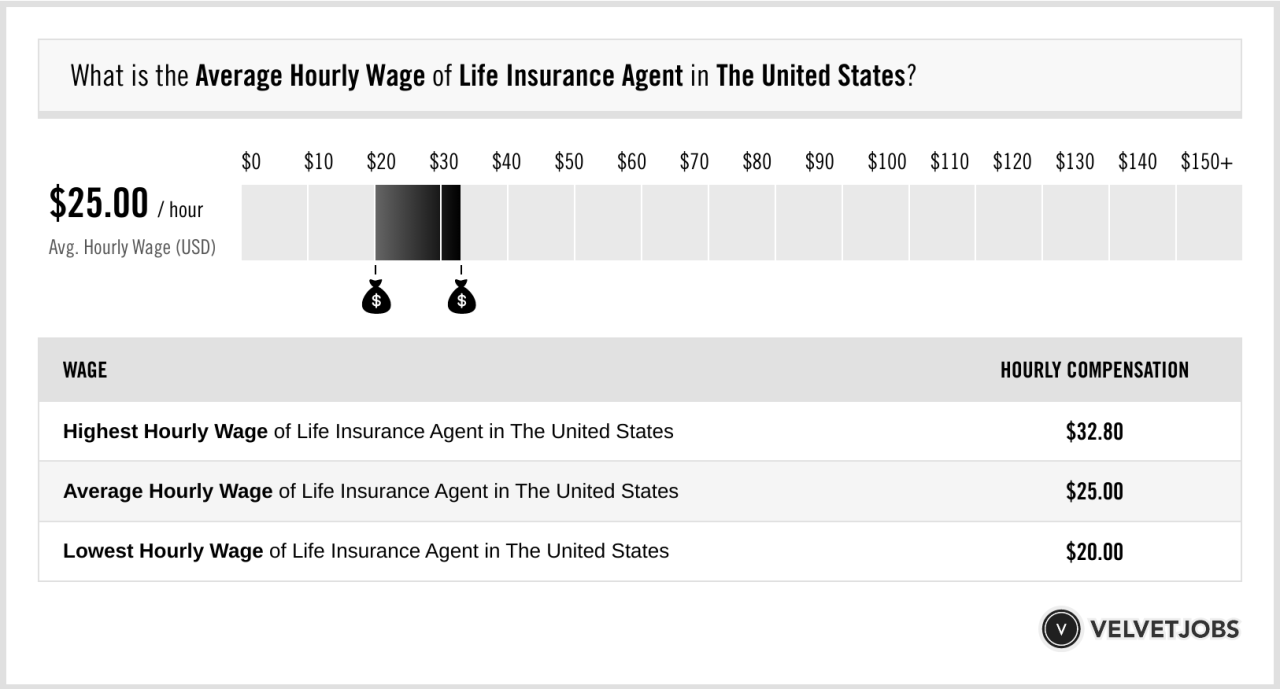

Typical State Farm Agent Income Ranges

State Farm agents’ income varies greatly depending on factors such as experience, location, and specialization. While it’s challenging to pinpoint an exact figure for every agent, exploring typical income ranges provides valuable insights into the potential earnings associated with this career path.

Income Ranges Based on Experience Level

The experience level significantly influences a State Farm agent’s income. Here’s a breakdown of estimated annual earnings for agents at different experience levels:

- New Agents (0-2 years): New agents typically earn a base salary, which can range from $40,000 to $60,000 per year, supplemented by commissions on policies sold.

- Mid-Level Agents (3-5 years): As agents gain experience, their commission rates often increase, and they may start building a larger client base. Their annual income could fall within the range of $70,000 to $100,000.

- Experienced Agents (6+ years): Experienced agents generally have established client networks and strong relationships within their communities. Their annual income can range from $100,000 to $200,000 or more, depending on their success and sales volume.

Income Ranges Based on Geographic Location

The geographic location of an agent’s territory also plays a significant role in their earnings. Agents operating in densely populated areas with a high demand for insurance services often have the potential to earn higher incomes compared to those in rural or less populated areas.

- Major Metropolitan Areas: Agents in major metropolitan areas like New York City, Los Angeles, or Chicago, often have access to a larger pool of potential clients and higher insurance premiums, leading to potentially higher earnings.

- Smaller Cities and Suburbs: While agents in smaller cities and suburbs may face lower premiums, they can still achieve significant income levels by building strong relationships within their communities and specializing in specific insurance lines.

- Rural Areas: Agents in rural areas often have lower client density and potentially lower premiums. Their income may be lower than those in more populated areas, but they can still achieve a comfortable living by focusing on providing exceptional service and building strong relationships with local clients.

Income Ranges Based on Specialization

State Farm agents can specialize in different insurance lines, which can influence their income potential.

- Property and Casualty Insurance: Agents specializing in property and casualty insurance, which includes homeowners, renters, and auto insurance, often have a larger client base and can generate higher income.

- Life Insurance: Agents specializing in life insurance often work with clients who have more complex financial needs and can earn higher commissions on larger policies.

- Commercial Insurance: Agents specializing in commercial insurance typically work with businesses and can earn higher commissions due to the complexity and value of commercial policies.

Career Progression and Earnings Potential

A State Farm agent’s career path is designed for growth, offering opportunities for increased earnings and professional development. The structure encourages continuous learning, leadership development, and building a successful and profitable agency.

Salary Increases and Career Progression

State Farm agents’ compensation is directly tied to their performance, making it a highly rewarding career path. The primary source of income for an agent is commission earned from selling insurance policies. As agents gain experience, build their client base, and develop their skills, their income potential increases. The commission structure typically involves a higher percentage of commission for higher-value policies, encouraging agents to focus on providing comprehensive financial solutions to their clients.

Advancement Opportunities within State Farm

State Farm offers a structured career path for agents who aspire to leadership roles. Here are some of the advancement opportunities available:

- District Manager: This position involves overseeing a group of agents within a specific geographic area, providing guidance, mentorship, and support. District managers typically earn a higher base salary and commission on the performance of the agents under their supervision.

- Regional Manager: This role oversees a larger group of agents and district managers, playing a strategic role in developing and implementing regional growth plans. Regional managers are responsible for driving performance and profitability across their region and enjoy a substantial salary and benefits package.

- State Manager: This position is the highest level of management within State Farm’s agency system, responsible for overseeing all agents and district managers within a state. State managers have significant responsibilities and enjoy a high level of autonomy and compensation.

Long-Term Income Growth and Financial Stability

The potential for long-term income growth and financial stability as a State Farm agent is substantial. As agents build their client base and expand their business, their income potential grows significantly. The commission structure is designed to reward agents for their efforts and success, creating a strong incentive for continued growth and development. Additionally, State Farm provides agents with comprehensive training, support, and resources to help them achieve their financial goals.

“The average State Farm agent makes around $100,000 annually, but top performers can earn significantly more. The potential for long-term income growth is directly tied to the agent’s ability to build a strong client base and expand their business.” – State Farm Agent Compensation Guide

The Value of Building a Strong Client Base

A strong client base is the foundation of a successful State Farm agent’s career. It provides a steady stream of income, ensures long-term financial security, and fosters a reputation for expertise and reliability.

Attracting and Retaining Clients

Building a strong client base requires a proactive approach to attracting new clients and nurturing existing ones. Effective marketing and communication strategies are crucial for achieving these goals.

- Targeted Marketing: Identify your ideal customer demographic and tailor your marketing efforts accordingly. Utilize various channels, such as social media, local events, and community involvement, to reach potential clients. For instance, you might sponsor a local sports team if your target audience includes families with young children.

- Networking: Attend industry events, join professional organizations, and connect with other business owners to build relationships and generate referrals. Participate in community events to increase visibility and establish trust within your local area.

- Exceptional Customer Service: Provide personalized service, answer questions promptly, and go the extra mile to meet your clients’ needs. This includes being available for them, actively listening to their concerns, and providing clear explanations of insurance policies and coverage options.

- Proactive Communication: Keep clients informed about their policy updates, industry changes, and potential savings opportunities. Regular communication builds trust and demonstrates your commitment to their well-being.

The Impact of Client Satisfaction and Referrals

Satisfied clients are the best ambassadors for your business. When clients are happy with your services, they are more likely to recommend you to their friends and family. Referrals are a valuable source of new business, as they come from trusted sources and often convert into loyal clients.

“Happy clients are the lifeblood of any business. They are not only repeat customers but also the best source of referrals.”

Final Conclusion

Becoming a State Farm agent can be a rewarding career path, offering the potential for substantial income and financial stability. By understanding the compensation structure, identifying key factors that influence earnings, and focusing on building a strong client base, agents can maximize their earning potential and achieve their financial goals.

Essential FAQs

What is the average salary for a State Farm agent?

The average salary for a State Farm agent can vary significantly depending on experience, location, and sales performance. However, experienced agents in high-volume markets can earn upwards of $100,000 per year.

How do State Farm agents get paid?

State Farm agents are compensated through a combination of base salary, commissions, bonuses, and incentives. The base salary is relatively low, but commissions and bonuses can significantly increase earnings based on sales performance and client retention.

What are the benefits of being a State Farm agent?

State Farm agents enjoy a variety of benefits, including health insurance, retirement plans, and paid time off. They also have access to extensive training and support from the company.

Is it difficult to become a State Farm agent?

Becoming a State Farm agent requires meeting certain qualifications, including passing a licensing exam and completing training. The process can be competitive, but with dedication and hard work, it is achievable.