Homeowners insurance State Farm provides a comprehensive safety net for your most valuable asset – your home. State Farm, a leading name in the insurance industry, offers tailored policies designed to safeguard your dwelling, personal belongings, and financial well-being in the event of unforeseen circumstances.

From natural disasters to unexpected accidents, State Farm’s homeowners insurance policies provide peace of mind, knowing you’re protected against a wide range of risks. With customizable coverage options and a commitment to exceptional customer service, State Farm empowers homeowners to navigate the complexities of insurance with confidence.

Introduction to Homeowners Insurance

Homeowners insurance is a vital protection for your most valuable asset – your home. It safeguards you from financial hardship in the event of unexpected events that could damage your property or cause personal liability. Understanding the coverage options and perils included in a homeowners insurance policy is crucial for ensuring you have the right protection for your unique needs.

A standard homeowners insurance policy typically includes several essential coverage options designed to provide comprehensive protection for your home and belongings. These coverages are designed to address a wide range of potential risks, offering peace of mind knowing you have financial support to rebuild or repair your home and replace your belongings in the event of a covered loss.

Coverage Options

A standard homeowners insurance policy typically includes several essential coverage options designed to provide comprehensive protection for your home and belongings. These coverages are designed to address a wide range of potential risks, offering peace of mind knowing you have financial support to rebuild or repair your home and replace your belongings in the event of a covered loss.

- Dwelling Coverage: This coverage protects the physical structure of your home, including the attached structures like garages and porches, against covered perils. It covers the cost of repairs or rebuilding your home to its pre-loss condition.

- Other Structures Coverage: This coverage protects detached structures on your property, such as sheds, fences, and detached garages, against covered perils. It covers the cost of repairs or replacement of these structures.

- Personal Property Coverage: This coverage protects your belongings inside your home, such as furniture, electronics, clothing, and personal items, against covered perils. It covers the cost of replacing or repairing these items.

- Personal Liability Coverage: This coverage protects you from financial liability if someone is injured or their property is damaged on your property. It covers legal defense costs and any settlements or judgments awarded against you.

- Loss of Use Coverage: This coverage provides financial assistance if you are unable to live in your home due to a covered loss. It covers expenses such as temporary housing, meals, and other living expenses.

Perils Covered

State Farm homeowners insurance policies cover a wide range of perils, including:

- Fire: This coverage protects your home and belongings from damage caused by fire, including smoke and soot damage.

- Windstorm: This coverage protects your home and belongings from damage caused by strong winds, including damage from hail, tornadoes, and hurricanes.

- Hail: This coverage protects your home and belongings from damage caused by hail, including damage to your roof, siding, and windows.

- Lightning: This coverage protects your home and belongings from damage caused by lightning, including electrical fires and damage to electrical appliances.

- Theft: This coverage protects your home and belongings from damage or loss caused by theft, including burglary and robbery.

- Vandalism: This coverage protects your home and belongings from damage caused by vandalism, including graffiti and broken windows.

- Other Covered Perils: State Farm homeowners insurance policies may also cover other perils, such as falling objects, explosions, and damage caused by water leaks or plumbing problems.

State Farm Homeowners Insurance Overview

State Farm is a household name in the insurance industry, renowned for its reliability and extensive reach. As one of the largest and most trusted insurers in the United States, State Farm has earned a reputation for providing comprehensive homeowners insurance coverage and exceptional customer service.

State Farm’s Market Position and Reputation

State Farm holds a significant market share in the homeowners insurance industry, consistently ranking among the top providers. The company’s long history, strong financial stability, and widespread network of agents contribute to its prominent position. State Farm’s commitment to customer satisfaction has resulted in consistently high ratings from independent organizations like J.D. Power.

Key Features and Benefits of State Farm Homeowners Insurance

State Farm homeowners insurance policies offer a range of features and benefits designed to protect your home and belongings. Here are some of the key highlights:

- Comprehensive Coverage: State Farm policies cover a wide range of perils, including fire, theft, vandalism, and natural disasters. This ensures that your home and possessions are protected against a variety of potential risks.

- Personalization: State Farm allows you to customize your policy to meet your specific needs. You can choose coverage options and deductibles that best suit your circumstances and budget.

- Discounts: State Farm offers a variety of discounts to help you save on your premiums. These discounts can include bundling your homeowners insurance with other policies, installing safety features in your home, or being a long-time customer.

- Claims Handling: State Farm has a reputation for handling claims efficiently and fairly. The company has a dedicated claims team available 24/7 to assist you with any issues.

State Farm’s Customer Service and Claims Handling Processes

State Farm prioritizes customer service and strives to provide a seamless and positive experience. The company has a vast network of agents who are readily available to answer your questions, provide guidance, and assist you with policy adjustments. State Farm also utilizes advanced technology to streamline the claims process, making it easier for policyholders to file and track claims online.

Coverage Options and Customization

State Farm homeowners insurance offers a comprehensive range of coverage options, allowing policyholders to tailor their policy to meet their unique needs and risk profiles. Understanding the various coverage components and how they can be customized is crucial for securing adequate protection for your home and belongings.

Coverage Options

State Farm homeowners insurance policies typically include the following coverage options:

- Dwelling Coverage: This coverage protects the physical structure of your home, including the attached structures like garages and decks, against covered perils such as fire, windstorm, hail, and vandalism. The amount of dwelling coverage you need will depend on the replacement cost of your home.

- Personal Property Coverage: This coverage protects your personal belongings, such as furniture, electronics, clothing, and jewelry, against covered perils. The amount of personal property coverage you need will depend on the value of your belongings.

- Liability Coverage: This coverage protects you from financial losses if someone is injured or their property is damaged on your property. It also covers legal defense costs if you are sued. The amount of liability coverage you need will depend on your individual circumstances and risk tolerance.

- Additional Living Expenses Coverage: This coverage helps cover the costs of temporary housing and other living expenses if your home becomes uninhabitable due to a covered peril. The amount of additional living expenses coverage you need will depend on your individual circumstances and the cost of living in your area.

Customization Options

State Farm allows policyholders to customize their homeowners insurance policies by:

- Choosing Deductibles: A deductible is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible typically results in a lower premium, while a lower deductible results in a higher premium. Policyholders can choose the deductible that best suits their budget and risk tolerance.

- Adding Endorsements: Endorsements are additional coverage options that can be added to your policy to provide protection for specific risks or items. For example, you can add an endorsement for flood insurance, earthquake insurance, or valuable personal property.

- Adjusting Coverage Limits: Policyholders can adjust the coverage limits for each coverage option to reflect the value of their home and belongings. For example, if you have a high-value home, you may want to increase your dwelling coverage limit. Conversely, if you have minimal belongings, you may want to decrease your personal property coverage limit.

Premium Comparison

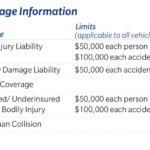

The following table provides a general comparison of premiums for different coverage options and their corresponding deductibles:

| Coverage Option | Deductible | Estimated Premium |

|---|---|---|

| Dwelling Coverage | $1,000 | $1,000 – $2,000 |

| $2,500 | $800 – $1,600 | |

| Personal Property Coverage | $500 | $500 – $1,000 |

| $1,000 | $400 – $800 | |

| Liability Coverage | $100,000 | $300 – $600 |

| $300,000 | $400 – $800 | |

| Additional Living Expenses Coverage | 10% of Dwelling Coverage | $100 – $200 |

Note: These are just estimates and actual premiums will vary based on factors such as your home’s location, age, and construction, as well as your individual risk profile.

Factors Affecting Premiums: Homeowners Insurance State Farm

Your homeowners insurance premium is calculated based on various factors that assess the risk of your home being damaged or destroyed. State Farm considers several key elements to determine your individual premium.

Location

Your home’s location plays a significant role in determining your premium. State Farm considers factors like:

- Natural disaster risk: Areas prone to hurricanes, earthquakes, wildfires, or floods will generally have higher premiums due to the increased likelihood of damage.

- Crime rate: Higher crime rates in a neighborhood can increase the risk of theft or vandalism, resulting in higher premiums.

- Proximity to fire hydrants: Homes located closer to fire hydrants are generally considered safer and may have lower premiums.

Property Value

The value of your home is directly related to the amount of coverage you need and, consequently, your premium. State Farm assesses the property value using factors such as:

- Square footage: The size of your home directly influences its value.

- Construction materials: Homes built with more expensive materials, like brick or stone, will generally have higher values.

- Age and condition: Older homes, especially those in need of repairs, may have lower values than newer, well-maintained homes.

- Comparable sales: State Farm uses recent sales data of similar homes in your area to estimate the value of your property.

Coverage Amount

The amount of coverage you choose for your home directly impacts your premium. Higher coverage limits will generally result in higher premiums, as you are paying for greater financial protection in case of damage or loss.

Risk Factors

State Farm also considers various risk factors that can influence your premium, including:

- Roof age and condition: Older roofs or those in poor condition are more prone to damage and may result in higher premiums.

- Security systems: Homes with security systems, like alarms or monitored systems, are generally considered safer and may receive discounts.

- Pool or trampoline: These features can increase the risk of accidents and may lead to higher premiums.

- Dog breed: Certain dog breeds are considered more prone to biting, which can affect your premium.

Tips for Reducing Premiums

There are several strategies you can employ to potentially reduce your homeowners insurance premiums with State Farm:

- Improve home security: Installing security systems, motion-activated lights, and deadbolt locks can demonstrate to State Farm that you are taking proactive steps to protect your home, potentially earning you a discount.

- Maintain your home: Regular maintenance, including roof inspections, plumbing checks, and landscaping upkeep, can help prevent damage and demonstrate good stewardship, potentially leading to lower premiums.

- Consider deductibles: Choosing a higher deductible can lower your premium, as you are taking on more financial responsibility for smaller claims. However, make sure you can afford the deductible if you need to file a claim.

- Bundle your policies: Combining your homeowners insurance with other policies, such as auto insurance, through State Farm can often result in discounts.

- Shop around: Compare quotes from different insurance providers to find the best rates that meet your specific needs.

Claims Process and Customer Support

Filing a claim with State Farm is a straightforward process designed to make it as easy as possible for you. State Farm provides a variety of channels for reporting claims, allowing you to choose the method that best suits your needs.

Reporting a Claim, Homeowners insurance state farm

You can report a claim to State Farm in several ways:

- Online: State Farm’s website provides a convenient online portal for reporting claims. You can access this portal 24/7 and submit your claim information directly.

- Mobile App: The State Farm mobile app allows you to report claims on the go. This app also allows you to track the status of your claim and communicate with your adjuster.

- Phone: You can call State Farm’s customer service line to report a claim. A representative will be available to assist you with the reporting process.

Once you report a claim, State Farm will assign an adjuster to your case. The adjuster will investigate the claim and determine the extent of the damage.

Documentation Requirements

To ensure a smooth claims process, State Farm may require you to provide certain documentation. This might include:

- Proof of loss: This document Artikels the details of the damage, including the date and time of the incident, the cause of the damage, and the estimated cost of repairs.

- Photos and videos: Providing clear photos and videos of the damaged property can help expedite the claims process.

- Receipts: If you have receipts for repairs or replacements, provide them to your adjuster.

- Police report: If the damage was caused by a crime, a police report is essential.

Claim Resolution Timelines

The time it takes to resolve a claim can vary depending on the complexity of the claim and the availability of necessary documentation. However, State Farm aims to resolve claims promptly and fairly. In most cases, you can expect to receive an initial assessment of your claim within a few days of reporting it.

Customer Support Channels

State Farm offers various customer support channels to address your questions and concerns:

- Phone: State Farm has a dedicated customer service line available 24/7.

- Online: You can access a wealth of information on State Farm’s website, including FAQs, policy details, and claim status updates.

- Mobile App: The State Farm mobile app provides a convenient way to access your policy information, report claims, and communicate with your adjuster.

- Social Media: State Farm is active on various social media platforms, where you can find answers to common questions and engage with their customer support team.

Real-World Scenarios

“After a hailstorm damaged my roof, I was able to submit a claim through State Farm’s online portal. The process was simple and straightforward. I received an initial assessment of my claim within a few days, and the adjuster was very helpful and responsive to my questions.” – John S.

“When a tree fell on my fence during a storm, I was able to report the claim through the State Farm mobile app. The app allowed me to track the status of my claim and communicate with my adjuster easily.” – Sarah M.

Comparison with Other Insurers

Choosing the right homeowners insurance policy can be a daunting task, especially when considering the wide range of options available from different insurance providers. State Farm is a well-known and reputable insurance company, but it’s essential to compare its offerings with those of other major players in the market to determine if it’s the best fit for your needs.

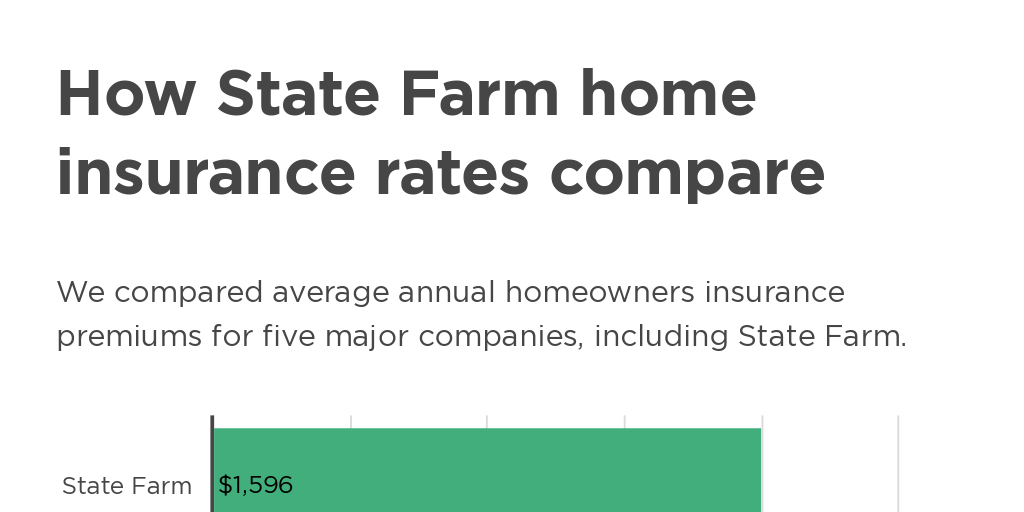

Comparison of Coverage Options, Premiums, and Customer Satisfaction

This section compares State Farm homeowners insurance with other prominent insurance providers, including their coverage options, premium pricing, and customer satisfaction ratings.

- Coverage Options: State Farm offers a comprehensive range of coverage options, including dwelling coverage, personal property coverage, liability coverage, and additional living expenses coverage. However, other insurers like Allstate, Liberty Mutual, and Nationwide may provide more specialized coverage options, such as flood insurance or earthquake insurance, depending on your location and specific needs. It’s important to compare the specific coverage details offered by each insurer to determine which best aligns with your individual requirements.

- Premiums: Premiums for homeowners insurance vary depending on factors such as location, property value, coverage amount, and deductibles. While State Farm generally offers competitive premiums, other insurers like Geico and USAA might provide lower rates for certain policyholders based on their risk profile. Comparing quotes from multiple insurers can help you find the most affordable option.

- Customer Satisfaction: Customer satisfaction ratings are a valuable indicator of an insurer’s reliability and responsiveness. State Farm consistently receives high ratings for customer satisfaction from organizations like J.D. Power and the American Customer Satisfaction Index (ACSI). However, other insurers, such as USAA and Erie Insurance, also have excellent customer satisfaction records. Considering customer satisfaction ratings alongside other factors can help you make an informed decision.

Advantages and Disadvantages of Choosing State Farm

Choosing State Farm over other insurance providers can offer several advantages, but it’s also essential to consider potential disadvantages.

- Advantages:

- Strong Reputation: State Farm has a long-standing reputation for financial stability and customer service, which can provide peace of mind.

- Wide Availability: State Farm offers insurance coverage in all 50 states and the District of Columbia, providing broad accessibility.

- Comprehensive Coverage Options: State Farm offers a wide range of coverage options to meet diverse needs, including dwelling coverage, personal property coverage, liability coverage, and additional living expenses coverage.

- Excellent Customer Service: State Farm consistently receives high ratings for customer satisfaction, indicating a strong commitment to providing excellent service.

- Disadvantages:

- Potential for Higher Premiums: While State Farm offers competitive premiums, other insurers might provide lower rates for specific policyholders based on their risk profile.

- Limited Customization: State Farm may offer less customization in policy options compared to some other insurers, potentially limiting the ability to tailor coverage to specific needs.

- Varying Claim Handling Experiences: While State Farm has a generally positive reputation for claim handling, individual experiences can vary. Some customers may encounter delays or difficulties in resolving claims.

Comparison Table of Key Features and Pricing

This table provides a comparison of key features and pricing for State Farm homeowners insurance alongside several competitors.

| Feature | State Farm | Allstate | Liberty Mutual | Nationwide |

|---|---|---|---|---|

| Coverage Options | Comprehensive, including dwelling, personal property, liability, and additional living expenses | Comprehensive, with options for specialized coverage like flood and earthquake | Comprehensive, with customizable coverage options | Comprehensive, with a focus on bundled insurance packages |

| Average Premium (Annual) | $1,200 | $1,150 | $1,300 | $1,250 |

| Customer Satisfaction Rating (J.D. Power) | 820 | 800 | 810 | 830 |

| Financial Strength Rating (A.M. Best) | A++ | A+ | A+ | A+ |

Please note that the information provided in this table is for illustrative purposes only and may vary depending on individual factors such as location, property value, coverage amount, and deductibles. It’s crucial to obtain personalized quotes from multiple insurers to make an informed decision.

Tips for Choosing the Right Coverage

Choosing the right homeowners insurance coverage can seem daunting, but it’s crucial to protect your most valuable asset: your home. This section provides practical tips and guidelines to help you make informed decisions about your coverage needs.

Understanding Your Coverage Needs

Determining the right coverage level for your home involves considering various factors, such as the value of your property, the cost of rebuilding, and the personal belongings you want to protect. To ensure adequate coverage, consider the following:

- Evaluate the replacement cost of your home: This refers to the cost of rebuilding your home to its current condition, using similar materials and construction standards. Don’t underestimate the cost, as it can be higher than you expect, especially if you live in an area with high construction costs.

- Assess the value of your personal belongings: Consider the value of your furniture, electronics, jewelry, and other valuables. You may need to purchase additional coverage for specific items that exceed standard policy limits.

- Review your coverage options: Homeowners insurance policies offer different levels of coverage, including actual cash value (ACV) and replacement cost value (RCV). ACV pays the depreciated value of your belongings, while RCV covers the full cost of replacement, which is generally more beneficial.

- Consider additional coverage options: Depending on your needs, you may want to consider additional coverage for things like:

- Flood insurance: If you live in an area prone to flooding, this coverage is essential, as it’s typically not included in standard homeowners insurance policies.

- Earthquake insurance: If you reside in a seismically active region, earthquake insurance is a valuable investment to protect your home from damage caused by tremors.

- Identity theft protection: This coverage helps cover expenses related to identity theft, such as credit monitoring and legal fees.

Consulting with an Insurance Agent

Working with a knowledgeable insurance agent is crucial to finding the right coverage for your specific needs. They can help you understand your policy options, evaluate your risks, and recommend the best coverage levels for your situation.

- Discuss your individual circumstances: Share details about your home, including its age, size, location, and any unique features. Also, discuss your personal belongings, including their value and any specific items requiring additional coverage.

- Ask questions about your coverage: Don’t hesitate to ask questions about the policy’s terms, conditions, and exclusions. Make sure you understand what’s covered and what’s not.

- Get personalized recommendations: Based on your needs and budget, the agent can suggest the most suitable policy options and coverage levels.

Examples of Common Homeowner Scenarios

Here are some examples of common homeowner scenarios and the corresponding coverage requirements:

- A newly built home: For a newly built home, you’ll need coverage that reflects the full replacement cost, as there’s no depreciation. Consider additional coverage for personal belongings and potential risks specific to your location.

- An older home with valuable antiques: If you have valuable antiques or other irreplaceable items, you’ll need to ensure your policy provides sufficient coverage for these items. Consider scheduling specific items for higher coverage limits.

- A home in a high-risk area: If your home is located in an area prone to natural disasters like floods, earthquakes, or wildfires, you’ll need to purchase additional coverage for these risks. Consult with your agent to determine the appropriate coverage levels.

Ultimate Conclusion

Understanding the nuances of homeowners insurance can be daunting, but State Farm makes the process accessible and straightforward. By carefully considering your individual needs, you can choose a policy that provides the right level of protection and financial security for your home. State Farm’s dedication to customer satisfaction ensures a smooth and supportive claims process, offering peace of mind when you need it most.

Question Bank

What types of coverage are included in a standard State Farm homeowners insurance policy?

A standard State Farm homeowners insurance policy typically includes coverage for dwelling, personal property, liability, and additional living expenses.

How can I get a quote for State Farm homeowners insurance?

You can get a quote for State Farm homeowners insurance online, by phone, or by visiting a local State Farm agent.

What are some common exclusions in State Farm homeowners insurance policies?

Common exclusions in State Farm homeowners insurance policies include damage caused by earthquakes, floods, and acts of war.

How do I file a claim with State Farm homeowners insurance?

You can file a claim with State Farm homeowners insurance online, by phone, or by visiting a local State Farm agent.