Homeowners insurance state is a critical aspect of homeownership, offering financial protection against unforeseen events that could damage your property. Understanding the nuances of state-specific regulations, coverage options, and claim processes is essential for securing the right policy and ensuring peace of mind.

From the basics of coverage to the intricacies of state-mandated requirements, this guide delves into the complexities of homeowners insurance state. We’ll explore key considerations, provide actionable tips, and equip you with the knowledge to make informed decisions about protecting your biggest investment.

Understanding Homeowners Insurance: Homeowners Insurance State

Homeowners insurance is a crucial aspect of protecting your most valuable asset: your home. It provides financial protection against unexpected events that could damage your property or lead to liability claims. Understanding the coverage options and factors influencing premiums is essential for making informed decisions about your insurance policy.

Types of Coverage

A standard homeowners insurance policy typically includes several types of coverage, each designed to protect you from specific risks.

- Dwelling Coverage: This coverage protects the physical structure of your home, including the attached structures like garages and porches, against damage caused by covered perils such as fire, windstorm, hail, and vandalism. It covers the cost of repairs or rebuilding your home up to the policy limit.

- Other Structures Coverage: This coverage extends protection to detached structures on your property, such as sheds, fences, and swimming pools. It covers damage to these structures due to covered perils, but typically has a lower limit than dwelling coverage.

- Personal Property Coverage: This coverage protects your belongings inside your home, such as furniture, electronics, clothing, and jewelry. It covers loss or damage to these items due to covered perils, with a limit on the amount of coverage.

- Liability Coverage: This coverage protects you from financial liability if someone is injured on your property or if you are found legally responsible for damage to someone else’s property. It covers legal defense costs and settlements up to the policy limit.

- Additional Living Expenses Coverage: This coverage helps cover the cost of temporary housing and other expenses if you are unable to live in your home due to a covered event. It provides financial assistance for expenses such as hotel stays, meals, and transportation.

Factors Influencing Premiums

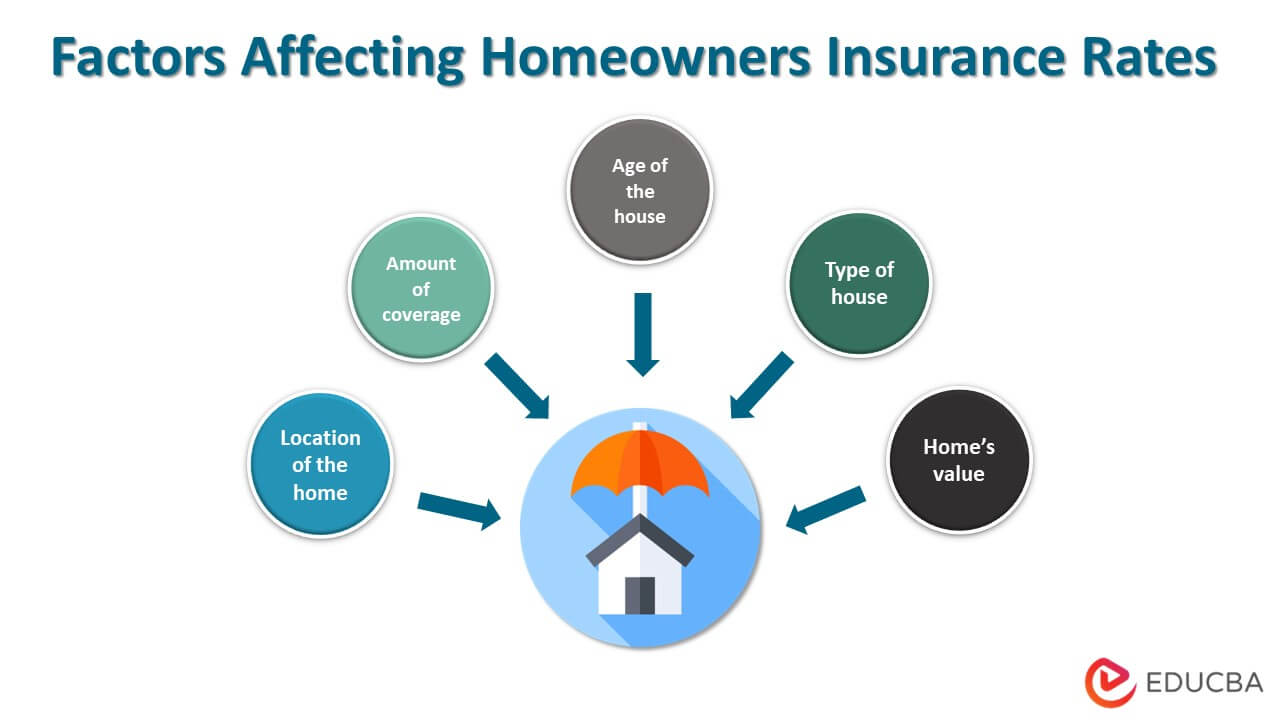

Several factors influence the cost of homeowners insurance premiums.

- Location: The risk of natural disasters, crime rates, and the cost of construction materials in your area can affect your premium. Areas prone to earthquakes, hurricanes, or wildfires typically have higher premiums.

- Home Value: The value of your home is a significant factor in determining your premium. Homes with higher replacement costs will generally have higher premiums.

- Construction Materials: Homes built with fire-resistant materials, such as brick or concrete, may qualify for lower premiums than homes built with wood.

- Roof Age and Condition: The age and condition of your roof can impact your premium. Older roofs or roofs in poor condition may pose a higher risk of damage, leading to higher premiums.

- Safety Features: Installing safety features, such as smoke detectors, burglar alarms, and fire sprinklers, can reduce your premium. These features demonstrate a lower risk of claims and can qualify you for discounts.

- Credit Score: Your credit score can also affect your premium. Individuals with good credit scores generally qualify for lower premiums.

- Claims History: Your past claims history can significantly influence your premium. Frequent claims or large claims can lead to higher premiums.

State-Specific Considerations

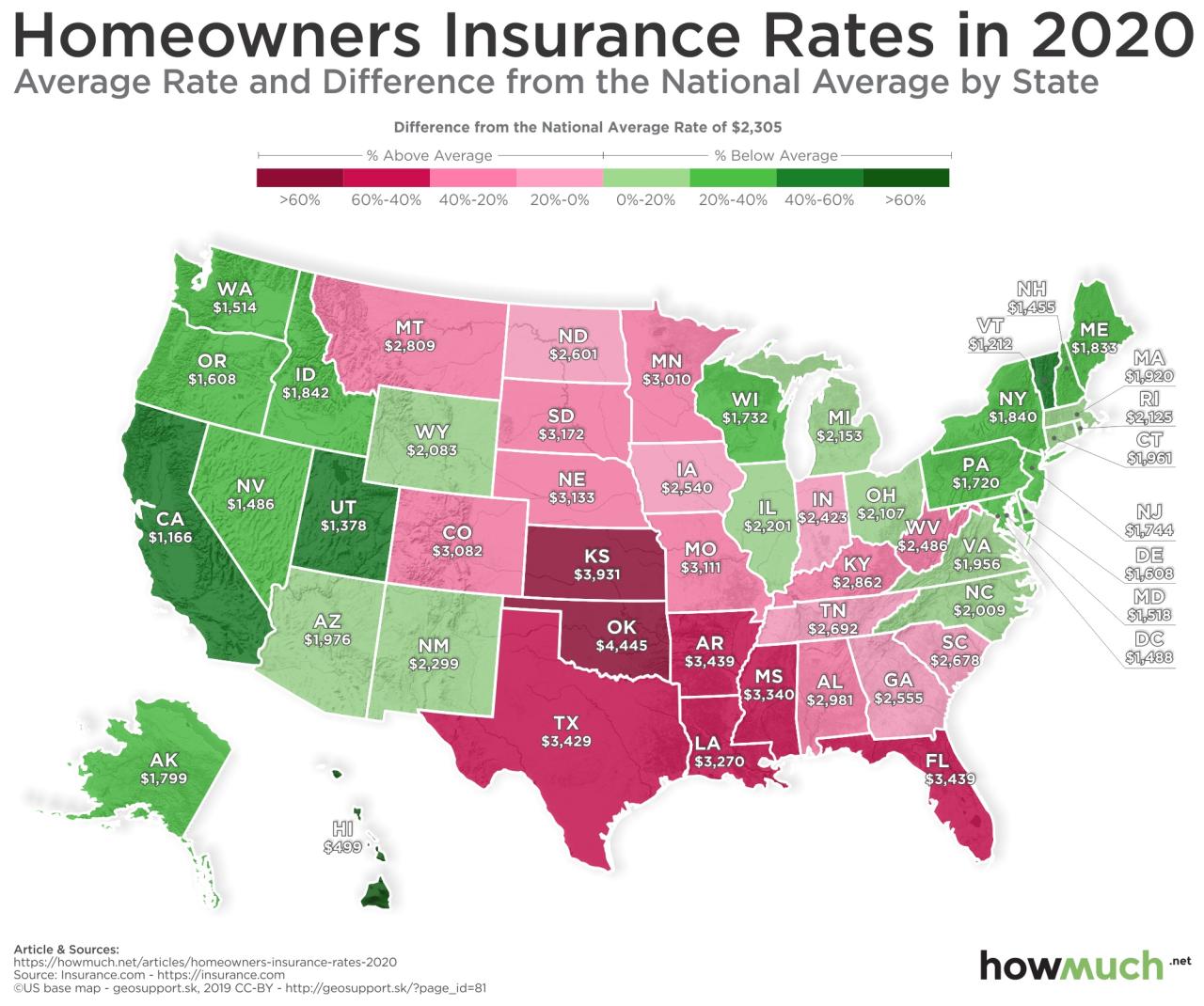

Homeowners insurance policies are not one-size-fits-all. The specific coverage, costs, and regulations can vary significantly from state to state. Understanding these state-specific considerations is crucial for finding the right policy for your needs and ensuring you have adequate protection.

State-Specific Natural Disaster Risks

Different states face different natural disaster risks. These risks can significantly impact the cost and availability of homeowners insurance. For example, states prone to hurricanes, earthquakes, or wildfires may have higher premiums or more stringent coverage requirements.

- Coastal states are more likely to experience hurricanes, leading to higher premiums and potential restrictions on coverage for wind damage.

- States in earthquake-prone regions may require earthquake coverage as a separate policy, adding to the overall cost of insurance.

- States with high wildfire risks may have specific coverage limitations for fire damage, especially in areas with high fire risk.

Finding the Right Coverage

Finding the right homeowners insurance policy is crucial for protecting your financial well-being in the event of unexpected events. It involves carefully considering your individual needs, the value of your property, and the potential risks you face.

Factors to Consider

Understanding the factors that influence your homeowners insurance policy is essential for making informed decisions. The table below Artikels key considerations:

| Factor | Importance | Considerations |

|---|---|---|

| Coverage Amounts | Ensures sufficient protection for your property and belongings. | Determine the replacement cost of your home, personal belongings, and other structures. Consider potential risks like natural disasters, theft, and liability. |

| Deductibles | Affects your out-of-pocket expenses in the event of a claim. | Higher deductibles typically result in lower premiums. Choose a deductible you can afford while ensuring adequate coverage. |

| Policy Exclusions | Identifies events or situations not covered by your policy. | Review the policy carefully to understand what is and is not covered. Consider additional coverage for specific risks like floods or earthquakes. |

| Discounts | Reduce your overall premium cost. | Inquire about discounts for security systems, fire alarms, or bundling multiple policies. |

| Insurance Company Reputation | Ensures reliable and efficient claim processing. | Research the financial stability and customer service ratings of different insurance companies. |

Comparing Insurance Quotes

Once you have a clear understanding of your needs and preferences, comparing insurance quotes from different companies is essential for finding the best value. Follow these steps for an effective comparison:

- Gather Information: Collect details about your home, including its square footage, construction type, and any upgrades. Note any potential risks, such as location near a flood zone or high crime area.

- Contact Multiple Insurers: Reach out to at least three to five different insurance companies. Provide them with your information and request personalized quotes.

- Review Policy Details: Carefully compare the coverage amounts, deductibles, exclusions, and discounts offered by each insurer. Pay attention to the policy language and any fine print.

- Consider Customer Service: Evaluate the insurer’s reputation for customer service and claim handling. Look for online reviews and ratings.

- Negotiate: If you find a quote that’s close to your desired coverage and price, don’t hesitate to negotiate with the insurer. They may be willing to adjust their premium or offer additional discounts.

Common Homeowner Insurance Claims

Homeowner insurance policies are designed to protect you from financial losses due to various unforeseen events that can damage your property or belongings. Understanding common homeowner insurance claims can help you better assess your coverage needs and prepare for potential future events.

Types of Homeowner Insurance Claims

- Fire and Smoke Damage: Fire, whether accidental or caused by faulty wiring, is a leading cause of homeowner insurance claims. Smoke damage resulting from a fire can also be covered.

- Wind and Hail Damage: Strong winds and hailstorms can cause significant damage to roofs, siding, windows, and other exterior structures. This type of damage is often covered by homeowner insurance.

- Water Damage: Water damage can result from various sources, including burst pipes, flooding, and leaking roofs. Coverage for water damage often depends on the specific cause and the policy’s exclusions.

- Theft and Vandalism: Homeowner insurance policies generally cover losses due to theft or vandalism, including damage to property and stolen belongings.

- Other Common Claims: Other common claims include damage from tree falls, lightning strikes, and accidents involving personal liability.

The Claim Process

- Reporting the Claim: The first step is to contact your insurance company immediately after an incident occurs. This is typically done by phone or online through their website.

- Claim Investigation: An insurance adjuster will be assigned to investigate the claim. This involves assessing the damage, gathering documentation, and verifying the cause of the loss.

- Negotiating a Settlement: Once the investigation is complete, the insurance company will provide a settlement offer. This offer may cover the cost of repairs or replacement, as well as other expenses like temporary housing or lost wages.

- Claim Resolution: You have the right to negotiate the settlement offer if you feel it’s inadequate. Once you agree to the terms, the insurance company will process the payment.

Factors Influencing Claim Payouts, Homeowners insurance state

- Policy Coverage: The specific coverage limits and exclusions in your policy will determine the amount you receive for a claim. Make sure you understand the details of your policy before an incident occurs.

- Deductible: Your deductible is the amount you are responsible for paying out of pocket before your insurance coverage kicks in. A higher deductible typically means lower premiums, but you’ll pay more in the event of a claim.

- Actual Cash Value (ACV) vs. Replacement Cost Value (RCV): ACV considers depreciation when calculating the payout, while RCV covers the full cost of replacement without depreciation. RCV generally results in higher payouts but may come with a higher premium.

- Negligence: If you are found to be negligent in causing the damage, your claim may be reduced or denied.

Claim Denials

- Exclusions: Insurance policies have specific exclusions, such as damage caused by acts of war or earthquakes. Claims related to these excluded events will likely be denied.

- Fraudulent Claims: Filing a false or exaggerated claim is considered fraud and will result in a denial and potential legal consequences.

- Policy Lapse: If your policy has lapsed, you will not be covered for any claims that occur during the lapse period.

Homeowner Insurance Tips

Being proactive about home maintenance and safety can significantly reduce your risk of insurance claims and potentially lower your premiums. By taking preventive measures, you can protect your investment and ensure peace of mind.

Regular Home Maintenance

Regular home maintenance is crucial for preventing costly repairs and potential insurance claims. By addressing issues before they escalate, you can save money and avoid disruptions to your life.

- Roof Inspections: Have your roof inspected annually, especially after severe weather events. A damaged roof can lead to water damage, mold growth, and other costly issues.

- Gutter Cleaning: Clean your gutters regularly to prevent clogs and water damage. Clogged gutters can cause water to back up and damage your roof, foundation, and landscaping.

- Plumbing Check-ups: Schedule regular plumbing inspections to identify and address any leaks or potential problems. Plumbing issues can lead to water damage, mold growth, and costly repairs.

- Electrical System Maintenance: Have your electrical system inspected periodically to ensure it is safe and functioning properly. Faulty wiring can cause fires and other hazards.

- Smoke Detectors and Carbon Monoxide Detectors: Test your smoke detectors and carbon monoxide detectors monthly and replace batteries as needed. These devices can save lives in the event of a fire or carbon monoxide leak.

Maintaining Accurate Records

Keeping detailed records of your home and its contents can be crucial for insurance claims. It helps you to prove the value of your belongings and ensure you receive adequate compensation in the event of a loss.

- Home Inventory: Create a detailed inventory of your belongings, including descriptions, purchase dates, and receipts. Take photos or videos of your possessions, especially valuable items. Consider using a home inventory app to make the process easier.

- Insurance Policy Documentation: Keep all your insurance policy documents organized and easily accessible. This includes your policy details, coverage limits, and any endorsements or changes.

- Home Improvement Records: Maintain records of all home improvements, repairs, and renovations. This documentation can be helpful in supporting claims for increased coverage or depreciation.

Safety Measures

Taking simple safety measures can significantly reduce the risk of accidents and potential insurance claims.

- Fire Safety: Install and maintain smoke detectors and carbon monoxide detectors. Create a fire escape plan and practice it with your family. Avoid using flammable materials near open flames.

- Water Safety: Turn off the water supply to your home when you are away for extended periods. Inspect your plumbing regularly for leaks. Install water sensors in areas prone to flooding.

- Security Measures: Install a home security system and consider using motion-activated lights. Keep your doors and windows locked when you are away. Be cautious about sharing personal information online.

Last Recap

Navigating the world of homeowners insurance state can feel overwhelming, but with the right information and a proactive approach, you can secure comprehensive coverage that aligns with your specific needs. By understanding the key factors, comparing quotes effectively, and implementing preventative measures, you can ensure that your home is adequately protected against potential risks.

Questions Often Asked

What are some common exclusions in homeowners insurance policies?

Common exclusions include damage caused by acts of war, nuclear events, and intentional acts by the policyholder. It’s crucial to review your policy carefully to understand the specific exclusions that apply.

How can I reduce my homeowners insurance premiums?

You can lower your premiums by installing security systems, making home improvements, and maintaining good credit. Some insurers offer discounts for bundling multiple insurance policies.

What are the consequences of failing to disclose important information when applying for homeowners insurance?

Failing to disclose critical information, such as previous claims or property modifications, can result in policy cancellation or denial of claims. Honesty and transparency are essential when applying for homeowners insurance.