Homeowners insurance estimate state farm is a crucial aspect of protecting your most valuable asset – your home. Whether you’re a new homeowner or looking to review your current coverage, understanding the process of obtaining an accurate estimate from State Farm is essential. This guide will delve into the key factors influencing your insurance premiums, tips for saving money, and provide insights into State Farm’s offerings and reputation in the insurance industry.

Navigating the world of homeowners insurance can feel overwhelming, but this guide aims to simplify the process and empower you to make informed decisions about your coverage. We’ll explore the different types of coverage, discuss deductibles, and explain how factors like location, property features, and your credit history can impact your insurance rates. By understanding these elements, you can effectively compare quotes, negotiate favorable terms, and ensure you have the right level of protection for your home and belongings.

Understanding Homeowners Insurance

Homeowners insurance is a vital part of protecting your most valuable asset: your home. This type of insurance provides financial protection against various risks that could damage your property or cause personal liability. It’s essential to understand the key components of a homeowners insurance policy to make informed decisions about your coverage.

Components of a Homeowners Insurance Policy

Homeowners insurance policies typically consist of several essential components that work together to provide comprehensive protection. These components are designed to cover various aspects of your home and personal belongings.

- Dwelling Coverage: This coverage protects the physical structure of your home, including the walls, roof, foundation, and attached structures like garages or porches. It covers damages caused by perils like fire, windstorms, hail, and vandalism.

- Other Structures Coverage: This component extends coverage to detached structures on your property, such as sheds, fences, and detached garages. It provides protection against the same perils as dwelling coverage.

- Personal Property Coverage: This component covers your personal belongings, such as furniture, electronics, clothing, and jewelry, against various perils. It typically includes coverage for theft, fire, and water damage.

- Liability Coverage: This coverage protects you from financial responsibility if someone is injured on your property or if you cause damage to someone else’s property. It can help cover legal expenses, medical bills, and property damage claims.

- Additional Living Expenses (ALE): This coverage provides financial assistance if you’re unable to live in your home due to a covered peril. It can help pay for temporary housing, meals, and other essential living expenses.

Types of Coverage

Homeowners insurance policies offer different types of coverage to suit various needs and risk profiles.

- HO-3 (Special Form): This is the most comprehensive homeowners insurance policy. It covers all perils except those specifically excluded in the policy, providing broad protection for your home and belongings.

- HO-5 (Comprehensive Form): This policy offers similar coverage to the HO-3 but provides broader protection for personal property, covering all perils except those specifically excluded in the policy.

- HO-4 (Contents Broad Form): This policy is designed for renters and covers personal belongings against various perils. It does not cover the dwelling itself.

- HO-6 (Condominium Unit Owners Form): This policy is designed for condo owners and covers their personal belongings and their unit’s interior. It does not cover the building itself or common areas.

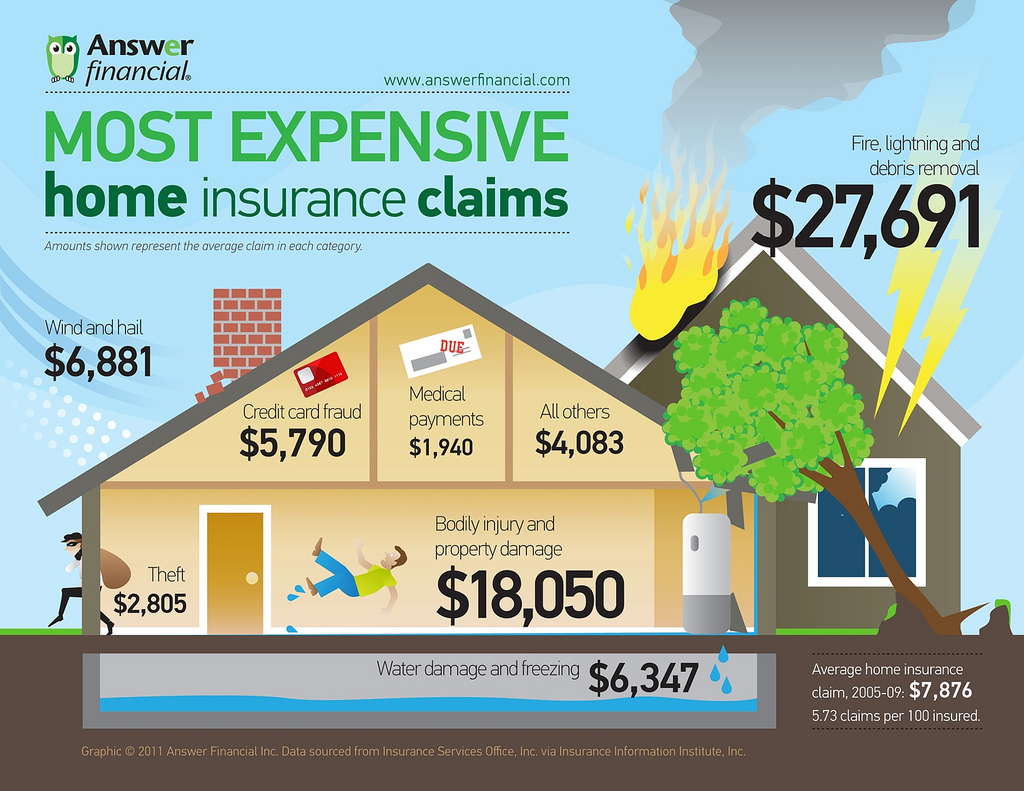

Common Perils Covered

Homeowners insurance policies typically cover a wide range of perils that could damage your home or property.

- Fire: This includes coverage for damage caused by fires, smoke, and soot.

- Windstorm: This covers damage caused by strong winds, such as those associated with hurricanes or tornadoes.

- Hail: This covers damage caused by hailstones, which can dent roofs and damage siding.

- Vandalism: This covers damage caused by malicious acts, such as graffiti or broken windows.

- Theft: This covers losses from theft, including burglary and robbery.

- Water Damage: This covers damage caused by water leaks, floods, and sewer backups.

Deductibles

Deductibles are the amount of money you pay out-of-pocket before your insurance coverage kicks in. The higher your deductible, the lower your insurance premium will be.

Deductibles act as a cost-sharing mechanism between you and your insurer.

- Impact on Insurance Costs: Higher deductibles mean lower premiums, and lower deductibles mean higher premiums. Choosing a deductible that balances your risk tolerance and affordability is crucial.

- Example: If your deductible is $1,000, you will pay the first $1,000 of any covered claim yourself. Your insurance company will then cover the remaining costs up to your policy limits.

State Farm as an Insurance Provider

State Farm is a well-established and highly recognized name in the homeowners insurance industry. With a long history and a vast customer base, the company has earned a reputation for its reliable service, competitive pricing, and strong financial stability.

State Farm’s Market Position

State Farm is one of the largest and most successful insurance companies in the United States. Its widespread presence and strong brand recognition give it a significant market share in the homeowners insurance sector. The company’s extensive network of agents and its commitment to customer satisfaction have contributed to its enduring success.

Comparison with Other Insurers

State Farm’s homeowners insurance policies are generally considered competitive in terms of coverage, pricing, and customer service. Compared to other major insurance companies, State Farm offers a wide range of coverage options, including comprehensive protection for various perils, such as fire, theft, and natural disasters. The company’s pricing is generally competitive, and it often offers discounts for various factors, such as home security systems, multiple policy bundling, and good driving records.

Customer Service and Claims Handling

State Farm is known for its responsive and helpful customer service. The company has a large network of agents across the country, providing easy access to local representatives for policy inquiries, claims reporting, and other assistance. State Farm’s claims handling process is generally efficient and transparent, with a focus on resolving claims promptly and fairly.

Discounts and Special Programs

State Farm offers a variety of discounts and special programs designed to save homeowners money on their insurance premiums. Some common discounts include:

- Good driving record discount: For policyholders with a clean driving record, State Farm may offer a discount on their homeowners insurance premiums.

- Multiple policy discount: State Farm often provides a discount to customers who bundle their homeowners insurance with other policies, such as auto insurance or life insurance.

- Home security discount: Installing a home security system can qualify homeowners for a discount on their insurance premiums, as it helps to reduce the risk of theft and other property damage.

- Energy-efficient home discount: Homeowners who have made energy-efficient upgrades to their homes may be eligible for a discount on their insurance premiums.

In addition to discounts, State Farm also offers various special programs, such as:

- State Farm Bank: This program allows homeowners to access financial products and services, such as mortgages, home equity loans, and savings accounts, directly through State Farm.

- State Farm Neighborhood of Good: This program encourages community involvement and supports local initiatives that promote safety, education, and well-being.

Obtaining a Homeowners Insurance Estimate from State Farm

Getting a homeowners insurance estimate from State Farm is a straightforward process. You can obtain an estimate online, over the phone, or by visiting a local State Farm agent.

Steps Involved in Getting a Homeowners Insurance Estimate

To obtain an accurate estimate, State Farm will need certain information about your property. This information helps them assess the risk associated with insuring your home.

- Contact State Farm: You can initiate the process by visiting State Farm’s website, calling their customer service line, or contacting a local agent.

- Provide Property Details: State Farm will ask for information about your home, such as the address, year built, square footage, number of bedrooms and bathrooms, and the type of construction materials used.

- Describe Coverage Needs: State Farm will inquire about the level of coverage you require, including dwelling coverage, personal property coverage, liability coverage, and additional living expenses coverage.

- Provide Personal Information: You will need to provide your personal information, including your name, address, phone number, and email address.

- Receive a Quote: After providing the necessary information, State Farm will generate a customized homeowners insurance quote.

Information State Farm Typically Requires

State Farm needs specific information to accurately assess the risk associated with your home and provide a fair quote.

- Property Details: This includes the address, year built, square footage, number of bedrooms and bathrooms, the type of construction materials used, and any renovations or upgrades made to the property.

- Location: Your home’s location is a significant factor in determining insurance premiums. Factors like the proximity to fire hydrants, the crime rate in your neighborhood, and the risk of natural disasters like earthquakes or floods can influence your rates.

- Coverage Needs: State Farm will ask about the level of coverage you need, including dwelling coverage, personal property coverage, liability coverage, and additional living expenses coverage. This information helps them determine the amount of financial protection you require.

- Security Features: State Farm may inquire about security features in your home, such as alarm systems, fire extinguishers, and smoke detectors. These features can lower your premiums as they reduce the risk of loss.

- Claims History: State Farm may ask about your past claims history, including any claims filed on previous homeowners insurance policies. Your claims history can impact your premiums, as a history of frequent claims may indicate a higher risk.

- Credit Score: In some states, State Farm may consider your credit score when calculating your premiums. A good credit score generally indicates responsible financial behavior, which can lead to lower insurance rates.

Tips for Maximizing Your Chances of Receiving a Competitive Quote

To increase your chances of getting a competitive quote from State Farm, consider the following tips:

- Shop Around: Compare quotes from multiple insurance companies to ensure you are getting the best rate.

- Improve Your Credit Score: A good credit score can help you qualify for lower insurance rates.

- Install Security Features: Installing security features like alarm systems, fire extinguishers, and smoke detectors can lower your premiums.

- Bundle Your Policies: Consider bundling your homeowners insurance with other policies, such as auto insurance, to potentially receive a discount.

- Negotiate: Don’t be afraid to negotiate with State Farm to see if they are willing to offer a lower rate.

Factors that Influence Homeowners Insurance Premiums

Here’s a table comparing the factors that influence homeowners insurance premiums:

| Factor | Impact on Premiums |

|---|---|

| Location | Higher premiums in areas with higher risk of natural disasters, crime, or other hazards. |

| Home Value | Higher premiums for homes with higher replacement costs. |

| Coverage Amount | Higher premiums for higher coverage limits. |

| Deductible | Lower premiums for higher deductibles. |

| Security Features | Lower premiums for homes with security features like alarm systems and smoke detectors. |

| Claims History | Higher premiums for policyholders with a history of frequent claims. |

| Credit Score | Higher premiums for policyholders with lower credit scores. |

Factors Affecting Homeowners Insurance Estimates

Your homeowners insurance premium is determined by several factors, including your property’s characteristics, your location, and your personal risk profile. Understanding these factors can help you make informed decisions about your insurance coverage and potentially save money on your premiums.

Property Features

The features of your home significantly influence your insurance premiums. Here’s a table illustrating the impact of different property features:

| Property Feature | Impact on Premium | Explanation |

|—|—|—|

| Construction Materials | Brick or stone homes generally have lower premiums than wood-framed homes. | Fire-resistant materials like brick and stone are less susceptible to damage, resulting in lower insurance costs. |

| Roof Type | Homes with newer, fire-resistant roofs (e.g., tile or metal) may have lower premiums than those with older, more vulnerable roofs (e.g., asphalt shingles). | A sturdy roof is crucial for protecting your home from weather damage, which can impact your insurance premiums. |

| Home Size | Larger homes typically have higher premiums than smaller homes. | Larger homes generally require more coverage, leading to higher premiums. |

| Number of Stories | Single-story homes usually have lower premiums than multi-story homes. | Multi-story homes are more challenging to access and may have higher potential for damage, potentially increasing insurance costs. |

| Security Systems | Homes with security systems, including alarms and fire sprinklers, often have lower premiums. | Security features can deter theft and mitigate fire damage, resulting in lower risk for insurance companies. |

Location and Risk Factors

Your home’s location plays a significant role in determining your insurance premiums. Here’s a breakdown of how location and risk factors influence rates:

* Natural Disaster Risk: Homes located in areas prone to hurricanes, earthquakes, floods, or wildfires generally have higher premiums. Insurance companies assess the risk of damage in these areas, which can impact premiums. For example, a home in a coastal region with a high risk of hurricane damage will likely have a higher premium than a home in a less-exposed area.

* Crime Rate: Homes in areas with high crime rates may have higher premiums. Insurance companies consider the risk of theft and vandalism, which can influence premiums.

* Distance to Fire Station: Homes located further from fire stations may have slightly higher premiums. This is because response times can be longer, potentially increasing the risk of fire damage.

* Proximity to Water Bodies: Homes located near bodies of water, such as rivers or lakes, may have higher premiums due to increased flood risk.

Credit History and Claims History

Your credit history and claims history also impact your insurance premiums. Here’s how:

* Credit History: Some insurance companies consider your credit history as a measure of your financial responsibility. A good credit history may result in lower premiums, while a poor credit history could lead to higher premiums.

* Claims History: If you have filed numerous claims in the past, your insurance premiums may be higher. This is because you are considered a higher risk to insurance companies.

Coverage Levels and Deductibles

The level of coverage and your deductible also affect your homeowners insurance premiums.

* Coverage Levels: Higher coverage levels typically result in higher premiums. This is because you are paying for more protection in case of damage or loss.

* Deductibles: A higher deductible means you pay more out of pocket in case of a claim. This can lead to lower premiums, as you are sharing more of the risk with the insurance company.

For example, if you have a $500 deductible and your home suffers $10,000 in damage, you would pay $500 and your insurance company would pay $9,500.

Tips for Saving on Homeowners Insurance: Homeowners Insurance Estimate State Farm

You can significantly reduce your homeowners insurance premiums by implementing a few strategic steps. By making your home safer and more secure, you not only protect your property but also lower your insurance costs. Furthermore, bundling your insurance policies with State Farm can offer substantial savings.

Improving Home Security for Lower Premiums

Investing in home security measures can significantly reduce your homeowners insurance premiums. State Farm recognizes and rewards homeowners who take proactive steps to protect their property.

- Install a Security System: A professionally installed and monitored security system can deter burglars and lower your insurance costs. State Farm may offer discounts for having an alarm system.

- Reinforce Doors and Windows: Solid core doors and double-pane windows provide added security and can qualify you for discounts.

- Install Exterior Lighting: Well-lit areas deter criminals and improve visibility. Consider motion-activated lights for added security.

- Maintain Your Roof: A well-maintained roof is crucial for preventing water damage and can lead to discounts.

Bundling Insurance Policies for Savings, Homeowners insurance estimate state farm

Bundling your homeowners, auto, and other insurance policies with State Farm can result in significant cost savings. State Farm offers multi-policy discounts for bundling different insurance products.

- Bundling Benefits: By bundling your policies, you simplify your insurance management, streamline your payments, and potentially receive a discount.

- Discount Calculation: The discount amount varies depending on the policies you bundle and your individual circumstances.

State Farm Discounts

State Farm offers various discounts to help you save on your homeowners insurance premiums.

| Discount | Description |

|---|---|

| Good Student Discount | For students with high GPAs. |

| Safe Driver Discount | For drivers with a clean driving record. |

| Homeowner Safety Discount | For homeowners who install safety features like smoke detectors, burglar alarms, and fire extinguishers. |

| Loyalty Discount | For long-term State Farm customers. |

Epilogue

Obtaining a homeowners insurance estimate from State Farm is a straightforward process, but understanding the key factors that influence your premiums can help you secure the best possible coverage at a competitive price. By leveraging the tips and insights provided in this guide, you can make informed decisions, save money, and gain peace of mind knowing your home is adequately protected. Remember to regularly review your coverage and explore discounts to ensure you’re getting the most out of your homeowners insurance policy.

FAQ Corner

What factors influence my homeowners insurance estimate?

Your insurance estimate is influenced by various factors, including your home’s location, age, construction materials, coverage levels, deductibles, and your personal credit history. State Farm considers these factors to assess the risk associated with insuring your property.

How can I lower my homeowners insurance premiums?

There are several ways to reduce your premiums. Consider making home improvements that enhance security, installing smoke detectors and fire alarms, bundling your insurance policies with State Farm, and exploring available discounts.

What are some common discounts offered by State Farm?

State Farm offers a range of discounts, including those for safety features, multiple policies, and good driving records. Contact your local State Farm agent to learn about the discounts you qualify for.