Homeowners insurance coverage state farm – Homeowners insurance coverage from State Farm is a vital component of protecting your most valuable asset – your home. This comprehensive guide delves into the intricacies of State Farm’s homeowners insurance policies, providing insights into coverage options, cost factors, and the claim process. Whether you’re a first-time homeowner or seeking to optimize your existing coverage, this information will empower you to make informed decisions about your insurance needs.

Understanding the nuances of homeowners insurance can seem daunting, but it’s essential for safeguarding your financial well-being. State Farm, a leading insurance provider, offers a range of customizable policies designed to meet the diverse needs of homeowners. This guide explores the key features and benefits of State Farm’s homeowners insurance, highlighting the advantages and disadvantages of choosing them as your insurer.

Understanding Homeowners Insurance

Homeowners insurance is a vital financial safety net that protects your most valuable asset – your home. It provides financial coverage against unexpected events that can cause damage to your property or lead to personal liability. This insurance policy acts as a shield, helping you rebuild your life and recover from devastating situations.

Types of Coverage

Homeowners insurance policies typically include a range of coverage options designed to protect your property and financial interests. Understanding the different types of coverage is crucial for ensuring you have adequate protection.

- Dwelling Coverage: This is the most significant part of your homeowners insurance. It covers damage to the physical structure of your home, including the walls, roof, foundation, and attached structures. This coverage protects you against perils like fire, windstorms, hail, and vandalism.

- Other Structures Coverage: This portion of the policy covers detached structures on your property, such as a garage, shed, or fence. It protects against similar perils as dwelling coverage.

- Personal Property Coverage: This coverage protects your belongings inside your home, including furniture, appliances, clothing, electronics, and other personal items. It provides financial assistance to replace or repair damaged or stolen items.

- Loss of Use Coverage: If your home becomes uninhabitable due to a covered event, this coverage provides temporary living expenses, such as hotel stays or rental payments, while your home is being repaired or rebuilt.

- Personal Liability Coverage: This coverage protects you from financial losses if someone is injured on your property or if you are held liable for damage to someone else’s property. It also covers legal defense costs if you are sued.

- Medical Payments Coverage: This coverage provides medical payments for injuries sustained by guests on your property, regardless of fault.

Common Perils Covered

Homeowners insurance policies typically cover a wide range of perils, including:

- Fire: This covers damage caused by fire, smoke, and soot.

- Windstorm: This covers damage caused by high winds, including hurricanes, tornadoes, and straight-line winds.

- Hail: This covers damage caused by falling hailstones.

- Vandalism: This covers damage caused by malicious acts, such as graffiti or broken windows.

- Theft: This covers loss of personal property due to theft or burglary.

- Lightning: This covers damage caused by lightning strikes.

- Explosions: This covers damage caused by explosions, such as gas leaks or fireworks.

- Falling Objects: This covers damage caused by falling objects, such as trees or branches.

- Weight of Snow or Ice: This covers damage caused by the weight of snow or ice accumulating on your roof.

- Water Damage: This covers damage caused by water leaks, floods, and sewer backups. Note that flood coverage is often purchased separately.

Importance of Adequate Coverage

Having adequate homeowners insurance coverage is crucial for protecting your financial interests. Here are some key reasons why:

- Financial Protection: Homeowners insurance provides a financial safety net in case of a covered event, helping you pay for repairs or replacement of damaged property.

- Peace of Mind: Knowing you have insurance coverage can provide peace of mind, knowing you are protected against unexpected events.

- Legal Protection: Homeowners insurance includes liability coverage, which protects you from lawsuits and financial losses if someone is injured on your property.

- Mortgage Requirements: Most mortgage lenders require homeowners insurance as a condition of lending. This ensures that the lender’s investment in your home is protected.

State Farm Homeowners Insurance

State Farm is one of the largest and most well-known insurance providers in the United States. They offer a comprehensive range of homeowners insurance policies designed to protect your home and belongings from various risks.

Key Features and Benefits of State Farm Homeowners Insurance

State Farm homeowners insurance policies offer several key features and benefits, including:

- Comprehensive Coverage: State Farm’s policies cover a wide range of perils, such as fire, theft, vandalism, and natural disasters like hurricanes, tornadoes, and earthquakes (depending on your location).

- Personal Liability Coverage: This coverage protects you financially if someone is injured on your property or you accidentally damage someone else’s property.

- Additional Living Expenses: If your home becomes uninhabitable due to a covered event, State Farm can help cover the costs of temporary housing and other essential expenses.

- Replacement Cost Coverage: This coverage helps you rebuild or repair your home to its pre-loss condition, regardless of the age or depreciation of the materials.

- Discounts: State Farm offers various discounts for homeowners who meet certain criteria, such as having a security system, smoke detectors, or being a loyal customer.

- Excellent Customer Service: State Farm is known for its strong customer service reputation. They have a network of agents across the country who can provide personalized advice and support.

Comparison with Other Insurance Providers

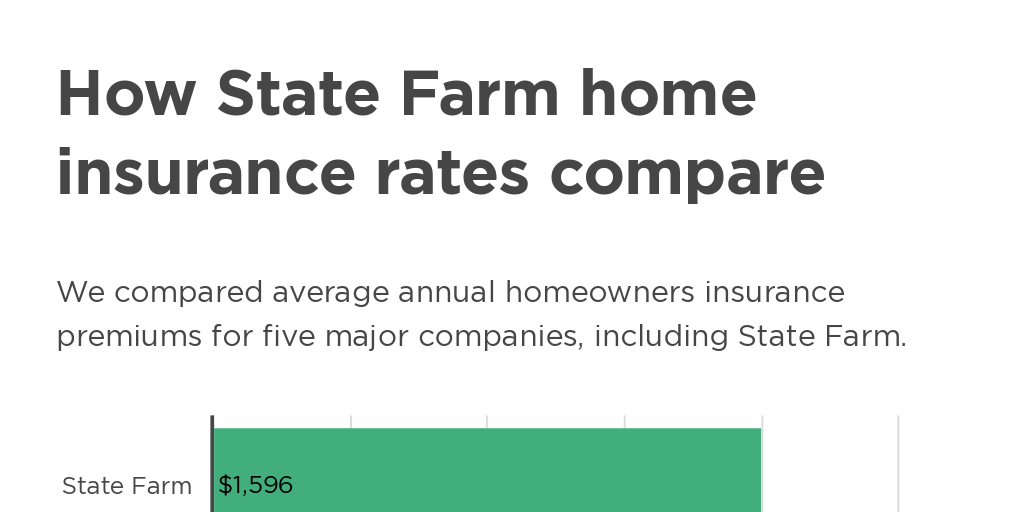

State Farm’s homeowners insurance policies are competitive with those offered by other major insurance providers like Allstate, Liberty Mutual, and Nationwide.

- Coverage Options: State Farm offers a variety of coverage options, including standard, comprehensive, and specialized policies tailored to different needs.

- Pricing: State Farm’s premiums are generally in line with industry averages, but they can vary depending on factors like your location, the value of your home, and your coverage choices.

- Customer Satisfaction: State Farm consistently ranks high in customer satisfaction surveys, reflecting its commitment to providing excellent service.

Advantages and Disadvantages of Choosing State Farm

Choosing State Farm for your homeowners insurance has both advantages and disadvantages.

- Advantages:

- Strong Financial Stability: State Farm is a financially sound company with a long history of paying claims.

- Wide Coverage Options: They offer a variety of coverage options to suit different needs and budgets.

- Excellent Customer Service: State Farm is known for its strong customer service reputation.

- Discounts: They offer various discounts to help lower premiums.

- Disadvantages:

- Premiums Can Vary: Like other insurers, State Farm’s premiums can vary significantly depending on factors like your location, home value, and coverage choices.

- Claims Process Can Be Complex: While State Farm is known for its customer service, the claims process can sometimes be complex and time-consuming.

Factors Influencing the Cost of State Farm Homeowners Insurance

Several factors influence the cost of State Farm homeowners insurance, including:

- Location: The cost of homeowners insurance is significantly impacted by your location. Areas prone to natural disasters, such as hurricanes, earthquakes, or wildfires, generally have higher premiums.

- Home Value: The value of your home is a major factor in determining your premium. Higher-value homes typically require higher premiums.

- Coverage Options: The type and amount of coverage you choose will affect your premium. More comprehensive coverage options usually come with higher premiums.

- Deductible: Your deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. A higher deductible typically leads to lower premiums.

- Risk Factors: Your home’s features, such as security systems, smoke detectors, and building materials, can impact your premium. Homes with safety features typically receive lower premiums.

- Claims History: Your past claims history can also influence your premium. Individuals with a history of frequent claims may face higher premiums.

Key Coverage Components: Homeowners Insurance Coverage State Farm

State Farm homeowners insurance offers a comprehensive package of coverage designed to protect your home and belongings from various perils. Understanding the key components of this insurance is crucial for ensuring you have adequate protection.

Dwelling Coverage

Dwelling coverage is the cornerstone of your homeowners insurance policy. It provides financial protection for your home’s structure, including the walls, roof, foundation, and attached structures like garages or porches. This coverage protects you against damages caused by covered perils, such as fire, windstorms, hail, and vandalism.

- The coverage amount is typically based on the replacement cost of your home, meaning it would cover the cost to rebuild your home to its current condition, minus your deductible.

- It’s important to ensure your dwelling coverage is sufficient to cover the full cost of rebuilding your home, as underinsurance could leave you financially responsible for a significant portion of the repair or rebuilding costs.

Personal Property Coverage

Personal property coverage protects your belongings inside your home, such as furniture, electronics, clothing, and jewelry. This coverage extends to your personal property while it’s being transported, stored, or temporarily located outside your home.

- The coverage amount is typically a percentage of your dwelling coverage, often ranging from 50% to 70%.

- It’s crucial to review your personal property coverage limits to ensure they adequately cover the value of your belongings. You may need to consider additional coverage for high-value items, such as jewelry or artwork, through a separate endorsement or rider.

Liability Coverage

Liability coverage provides financial protection if you are held legally responsible for injuries or property damage to others. This coverage applies to accidents that occur on your property or as a result of your actions.

- It covers legal defense costs, medical expenses, and property damage up to your policy’s coverage limits.

- Liability coverage is essential to protect you from potentially devastating financial losses, as lawsuits arising from accidents can be very costly.

Additional Living Expenses Coverage

Additional living expenses coverage, also known as loss of use coverage, helps cover the costs of living away from your home if it becomes uninhabitable due to a covered peril. This coverage can help pay for temporary housing, meals, and other essential expenses.

- The coverage amount is typically a percentage of your dwelling coverage, often ranging from 20% to 30%.

- It’s important to consider the potential costs of living elsewhere, such as rent, utilities, and food, when determining your coverage needs.

Coverage Limits and Deductibles

| Coverage Component | Coverage Limits | Deductibles |

|---|---|---|

| Dwelling Coverage | Varies based on the replacement cost of your home | Varies, typically ranging from $500 to $2,500 |

| Personal Property Coverage | Typically a percentage of dwelling coverage (50% to 70%) | Same as dwelling coverage deductible |

| Liability Coverage | Varies, typically ranging from $100,000 to $500,000 per occurrence | None, as this is a separate coverage component |

| Additional Living Expenses Coverage | Typically a percentage of dwelling coverage (20% to 30%) | Same as dwelling coverage deductible |

Real-Life Scenarios

Dwelling Coverage

- A fire damages your kitchen, requiring extensive repairs. Dwelling coverage would help pay for the cost of rebuilding or repairing the damaged area.

- A strong windstorm blows off part of your roof, causing significant water damage to the interior. Dwelling coverage would help cover the cost of roof repairs and interior restoration.

Personal Property Coverage

- A thief breaks into your home and steals your laptop, television, and jewelry. Personal property coverage would help replace these stolen items.

- A burst pipe causes water damage to your furniture and electronics. Personal property coverage would help cover the cost of replacing or repairing these damaged items.

Liability Coverage

- A guest slips and falls on your icy porch, sustaining injuries. Liability coverage would help cover the guest’s medical expenses and legal defense costs if they sue you.

- Your dog bites a neighbor’s child. Liability coverage would help cover the child’s medical expenses and legal defense costs if the neighbor sues you.

Additional Living Expenses Coverage

- A major plumbing issue forces you to evacuate your home for several weeks while repairs are completed. Additional living expenses coverage would help pay for temporary housing, meals, and other essential expenses during this time.

- A fire renders your home uninhabitable for several months. Additional living expenses coverage would help pay for the cost of temporary housing, utilities, and other expenses while your home is being rebuilt.

Coverage Customization and Add-ons

State Farm Homeowners Insurance provides various customization options to tailor your coverage to your specific needs. You can adjust your policy’s limits and deductibles to match your budget and risk tolerance. Additionally, State Farm offers several optional add-ons that can enhance your coverage and protect you against unforeseen events. These add-ons can be purchased separately or as part of a package.

Flood Insurance

Flood insurance is crucial for homeowners in areas prone to flooding, as standard homeowners insurance typically doesn’t cover flood damage. State Farm offers flood insurance through the National Flood Insurance Program (NFIP). This coverage protects your home and belongings against damage caused by flooding from overflowing rivers, lakes, or heavy rainfall.

Flood insurance has a 30-day waiting period before it takes effect.

It’s important to note that flood insurance has a 30-day waiting period before it takes effect. This means that if you purchase flood insurance and experience flooding within the first 30 days, your claim will not be covered.

Earthquake Insurance

Earthquake insurance is essential for homeowners living in earthquake-prone regions. Standard homeowners insurance doesn’t typically cover damage caused by earthquakes. State Farm offers earthquake insurance as an optional add-on, providing financial protection against damage to your home and belongings resulting from seismic activity.

Earthquake insurance often has a separate deductible from your standard homeowners insurance.

Earthquake insurance typically has a separate deductible from your standard homeowners insurance. This means that you will need to pay a certain amount out of pocket before your insurance coverage kicks in.

Identity Theft Protection

Identity theft protection is a valuable add-on for homeowners who want to safeguard their personal information and financial security. State Farm offers identity theft protection services that provide various features, including:

- Credit monitoring

- Identity theft restoration services

- Fraud alerts

- Lost wallet protection

These services can help you detect and resolve identity theft issues, minimizing potential financial losses and restoring your credit.

Other Add-ons

State Farm also offers other optional add-ons that can enhance your homeowners insurance coverage, such as:

- Personal property replacement cost coverage: This add-on covers the full replacement cost of your belongings, regardless of their age or depreciation.

- Scheduled personal property coverage: This coverage provides additional protection for specific valuable items, such as jewelry, artwork, or collectibles.

- Loss of use coverage: This add-on covers your living expenses if you are unable to live in your home due to a covered event.

- Personal liability coverage: This coverage protects you from financial liability if someone is injured on your property or if you are held liable for damage to someone else’s property.

Claim Process and Customer Support

When you need to file a claim, State Farm aims to make the process as straightforward and hassle-free as possible. Here’s a detailed look at the claim process and the support options available to you.

Filing a Claim, Homeowners insurance coverage state farm

You can file a claim with State Farm in several ways:

- Online: State Farm’s website offers a user-friendly online claim filing system, allowing you to report your claim 24/7.

- Mobile App: The State Farm mobile app allows you to file a claim quickly and conveniently from your smartphone or tablet.

- Phone: You can contact State Farm’s customer service hotline to report your claim and speak with a representative.

- Agent: If you prefer, you can contact your local State Farm agent directly to report your claim.

Cost Factors and Pricing

The cost of your State Farm homeowners insurance is determined by a variety of factors, each playing a role in shaping your premium. Understanding these factors can help you make informed decisions about your coverage and potentially lower your insurance costs.

Factors Influencing Homeowners Insurance Costs

- Location: Your home’s location is a significant factor in determining your insurance premium. Areas prone to natural disasters, such as earthquakes, hurricanes, or floods, generally have higher insurance rates due to the increased risk of damage. Similarly, areas with higher crime rates may also have higher premiums due to the risk of theft or vandalism.

- Property Value: The value of your home is directly proportional to your insurance premium. A higher-valued home will typically have a higher premium because the potential cost of rebuilding or repairing the property in case of damage is greater.

- Coverage Limits: The amount of coverage you choose for your home and belongings will also influence your premium. Higher coverage limits mean higher premiums, as you are paying for more protection in case of a loss.

- Deductibles: Your deductible is the amount you agree to pay out-of-pocket before your insurance coverage kicks in. A higher deductible generally translates to a lower premium, as you are taking on more financial responsibility for smaller losses. Conversely, a lower deductible will result in a higher premium.

- Home Features: Certain home features, such as security systems, fire alarms, or impact-resistant windows, can lower your premium. These features demonstrate a reduced risk of damage or loss, making your home more attractive to insurers.

- Credit Score: In some states, your credit score can impact your homeowners insurance premium. A good credit score may indicate a lower risk of making claims, leading to lower premiums. However, this practice is not universally adopted by all insurance companies.

- Claims History: Your past claims history plays a significant role in determining your premium. Frequent claims can increase your premium, as insurers perceive you as a higher risk. Conversely, a clean claims history can potentially earn you discounts.

Location’s Impact on Premiums

Location plays a crucial role in determining your insurance premium. Here’s how:

- Natural Disasters: Homes located in areas prone to natural disasters, such as hurricanes, earthquakes, or floods, face higher premiums. For example, a home in Florida, where hurricanes are common, will likely have a higher premium than a home in a state with minimal hurricane risk.

- Crime Rates: Areas with higher crime rates may have higher homeowners insurance premiums. This is because insurers consider the risk of theft, vandalism, or other crimes to be greater in such areas.

- Fire Hazards: Homes located in areas with dense forests or near industrial facilities may have higher premiums due to an increased risk of fire.

Coverage Limits and Deductibles

Your coverage limits and deductibles significantly influence your premium. Here’s a breakdown:

- Coverage Limits: Higher coverage limits, which provide more protection in case of a loss, will result in higher premiums. For instance, choosing a higher coverage limit for your dwelling coverage will mean a higher premium, but you’ll be protected for more in case of significant damage to your home.

- Deductibles: A higher deductible means you pay more out-of-pocket for smaller losses, but you’ll enjoy a lower premium. Conversely, a lower deductible will result in a higher premium, but you’ll have less out-of-pocket expense for smaller losses.

Tips for Lowering Insurance Costs

Here are some practical tips for getting competitive quotes and potentially lowering your insurance costs:

- Shop Around: Compare quotes from multiple insurance companies, including State Farm, to find the best rates and coverage options that meet your needs. Online comparison tools can help streamline this process.

- Improve Home Security: Installing security systems, such as alarms, motion detectors, or video surveillance, can demonstrate a reduced risk to insurers, potentially leading to lower premiums.

- Consider Deductibles: Explore increasing your deductible to lower your premium. This can be a good option if you’re willing to take on more financial responsibility for smaller losses.

- Bundle Policies: Bundling your homeowners insurance with other policies, such as auto insurance, can often lead to significant discounts.

- Ask About Discounts: Inquire about available discounts, such as those for good driving records, multiple policy discounts, or home safety features.

- Maintain a Good Credit Score: In states where credit score impacts insurance premiums, maintaining a good credit score can potentially lower your rates.

Pricing Scenarios

Here are some examples of how different factors can impact your homeowners insurance premium:

- Scenario 1: A home in a high-risk hurricane zone with a high property value and low deductible will likely have a significantly higher premium compared to a home in a low-risk area with a lower property value and a higher deductible.

- Scenario 2: A homeowner with a history of frequent claims may face a higher premium compared to a homeowner with a clean claims history, even if their homes are similar in value and location.

- Scenario 3: A homeowner who bundles their homeowners insurance with their auto insurance may qualify for a significant discount compared to someone who purchases each policy separately.

Choosing the Right Coverage

Finding the right State Farm homeowners insurance policy is crucial to protect your biggest investment. It’s about more than just getting the cheapest policy; it’s about getting the coverage that best suits your specific needs and risks.

Understanding Your Needs and Risks

Before you start comparing policies, it’s essential to understand your individual needs and risks. This involves considering factors such as:

- The value of your home and its contents

- Your personal liability risks

- The potential for natural disasters in your area

- Your financial situation and risk tolerance

For instance, if you live in an area prone to earthquakes, you might want to consider earthquake insurance. If you have valuable art or jewelry, you may need additional coverage for personal property.

Evaluating Coverage Options

Once you have a clear understanding of your needs and risks, you can start evaluating different State Farm homeowners insurance policy options. Here are some key questions to consider:

- What are the coverage limits for your home and personal property?

- What are the deductibles for different types of claims?

- What are the exclusions and limitations of the policy?

- What are the available add-ons and endorsements?

- What is the cost of the policy and how does it compare to other options?

Recommended Coverage Levels

Here are some examples of different scenarios and the corresponding recommended coverage levels:

| Scenario | Recommended Coverage |

|---|---|

| Newly built home in a high-value neighborhood | High coverage limits for dwelling and personal property, low deductibles |

| Older home in a moderate-value neighborhood | Moderate coverage limits for dwelling and personal property, moderate deductibles |

| Home with valuable art or jewelry | High coverage limits for personal property, low deductibles |

| Home in an area prone to natural disasters | High coverage limits for dwelling and personal property, low deductibles, additional endorsements for specific risks |

It’s important to remember that these are just examples, and your specific needs may vary.

Outcome Summary

Choosing the right homeowners insurance coverage is a crucial decision for every homeowner. State Farm provides a robust and customizable insurance program, offering a variety of coverage options to suit different needs and budgets. By understanding the key components of their policies, including dwelling coverage, personal property protection, and liability coverage, homeowners can ensure they have adequate protection against unforeseen events. Remember to carefully consider your individual circumstances and seek professional guidance to select the coverage that best fits your unique situation.

FAQ Summary

What types of coverage are included in a standard State Farm homeowners insurance policy?

A standard State Farm homeowners insurance policy typically includes coverage for dwelling, personal property, liability, and additional living expenses. Dwelling coverage protects the structure of your home, personal property coverage safeguards your belongings, liability coverage provides protection against lawsuits, and additional living expenses cover costs incurred if you’re unable to live in your home due to a covered event.

How do I file a claim with State Farm homeowners insurance?

You can file a claim with State Farm by contacting their customer service line, visiting their website, or contacting your local agent. You will need to provide details about the event, including the date, time, and location. State Farm will then investigate the claim and determine if it’s covered under your policy.

What factors influence the cost of State Farm homeowners insurance?

The cost of State Farm homeowners insurance is influenced by a number of factors, including your location, the value of your home, the coverage limits you choose, your deductible, and your credit score. You can often get a discount on your premium if you bundle your homeowners insurance with other types of insurance, such as auto insurance.