Home Insurance State Farm is a trusted name in the insurance industry, offering a range of coverage options to protect your biggest investment. With a long history of providing reliable and comprehensive insurance solutions, State Farm has earned a reputation for its customer-centric approach and commitment to helping homeowners navigate the complexities of insurance.

This guide explores the ins and outs of State Farm home insurance, from understanding the different types of coverage to determining the factors that influence your premium. We’ll delve into the benefits and limitations of each coverage type, provide insights into State Farm’s claims process, and offer tips for obtaining the best possible rates.

State Farm Home Insurance Overview

State Farm is a leading provider of home insurance in the United States, known for its long history, strong financial stability, and customer-centric approach. Established in 1922, State Farm has grown into a trusted and recognizable name in the insurance industry, serving millions of customers across the country.

State Farm’s Key Offerings and Services

State Farm offers a comprehensive range of home insurance products tailored to meet the diverse needs of its customers. These offerings include:

- Dwelling Coverage: This coverage protects the physical structure of your home against various perils, such as fire, windstorm, hail, and vandalism. It covers the cost of repairs or rebuilding your home in the event of damage.

- Personal Property Coverage: This coverage protects your belongings inside your home, including furniture, electronics, clothing, and other personal items. It covers the cost of replacing or repairing damaged or stolen property.

- Liability Coverage: This coverage protects you from financial liability if someone is injured on your property or if your actions cause damage to someone else’s property. It covers legal expenses and any settlements or judgments against you.

- Additional Living Expenses Coverage: This coverage helps cover the costs of temporary housing, meals, and other essential expenses if your home becomes uninhabitable due to a covered event. This allows you to maintain a comfortable living standard while your home is being repaired or rebuilt.

- Optional Coverages: State Farm offers a variety of optional coverages to enhance your home insurance policy, such as flood insurance, earthquake insurance, and identity theft protection. These optional coverages provide additional protection against specific risks that may not be covered by standard policies.

State Farm’s Customer Service and Claims Handling Process

State Farm is committed to providing exceptional customer service and a smooth claims handling process.

- 24/7 Customer Support: State Farm offers 24/7 customer support through phone, email, and online chat. You can reach out to a representative at any time to get answers to your questions, report a claim, or make changes to your policy.

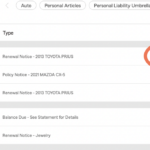

- Online Account Management: State Farm provides a user-friendly online portal where you can manage your policy, pay your premiums, view your policy documents, and file claims online. This convenient platform allows you to access your account information and manage your policy at your convenience.

- Streamlined Claims Process: State Farm has a streamlined claims process designed to make the experience as smooth and efficient as possible. You can file a claim online, by phone, or through a mobile app. State Farm will assign a claims adjuster to your case, who will assess the damage and guide you through the process of getting your home repaired or rebuilt.

Types of Home Insurance Coverage

State Farm offers a variety of coverage options to protect your home and belongings. Understanding the different types of coverage and their limitations is crucial for ensuring you have adequate protection.

Dwelling Coverage

Dwelling coverage protects the physical structure of your home, including the attached structures like garages and porches. It covers damages caused by covered perils, such as fire, windstorms, hail, and vandalism. The amount of coverage you choose determines the maximum amount State Farm will pay for repairs or rebuilding your home.

For example, if your home is insured for $250,000 and a fire causes $100,000 worth of damage, State Farm will pay up to $100,000 for repairs or rebuilding.

Personal Property Coverage

Personal property coverage protects your belongings inside your home, such as furniture, electronics, clothing, and jewelry. This coverage typically extends to your belongings while they are stored in a detached garage or shed on your property.

For example, if your home is burglarized and your belongings are stolen, personal property coverage would help you replace those items.

Liability Coverage

Liability coverage protects you financially if someone is injured on your property or if you cause damage to someone else’s property. This coverage helps pay for medical expenses, legal fees, and other related costs.

For example, if a guest slips and falls on your icy driveway, liability coverage would help cover their medical expenses and any legal claims they might make against you.

Additional Living Expenses

Additional living expenses coverage helps pay for temporary housing and other expenses if you are unable to live in your home due to a covered loss. This coverage can help cover costs like hotel stays, meals, and laundry.

For example, if your home is damaged by a fire and you need to stay in a hotel while repairs are being made, additional living expenses coverage would help cover those costs.

Factors Influencing Home Insurance Costs

Your home insurance premium is determined by a number of factors. Understanding these factors can help you make informed decisions about your coverage and potentially save money on your premiums.

Location

Your home’s location is a major factor in determining your insurance costs. State Farm, like other insurance companies, considers factors like:

- Natural disaster risk: Areas prone to hurricanes, earthquakes, wildfires, or floods have higher premiums due to the increased risk of damage. For example, a home in coastal Florida might have higher premiums than a home in a more inland location.

- Crime rates: Areas with high crime rates generally have higher premiums because of the increased risk of theft or vandalism.

- Local fire department response time: Areas with slower fire department response times might have higher premiums due to the increased risk of significant damage in the event of a fire.

Property Value

The value of your home is directly related to your insurance premium. A higher-valued home typically means higher premiums because the potential cost of rebuilding or repairing the home in case of damage is greater. This includes the cost of rebuilding your home to its current market value, taking into account factors such as:

- Construction materials: Homes built with more expensive materials, like brick or stone, generally have higher premiums than homes built with less expensive materials, like wood.

- Square footage: Larger homes typically have higher premiums than smaller homes because there is more to insure.

- Amenities: Features like pools, decks, and garages can increase your premiums due to the potential for additional damage or liability.

Coverage Level

The amount of coverage you choose also impacts your premium. More comprehensive coverage, such as replacement cost value, which covers the full cost of rebuilding your home, will generally cost more than actual cash value coverage, which pays the depreciated value of your home. State Farm offers various coverage options to suit your needs and budget, including:

- Dwelling Coverage: This covers the structure of your home, including the attached garage, decks, and porches. You can choose between actual cash value (ACV) or replacement cost value (RCV) coverage.

- Personal Property Coverage: This covers your belongings inside your home, including furniture, electronics, clothing, and other personal items. You can choose between ACV or RCV coverage.

- Liability Coverage: This protects you from financial loss if someone is injured on your property or if you accidentally damage someone else’s property.

Risk Factors

Certain factors can increase your insurance premiums, such as:

- Age of the home: Older homes may have outdated electrical wiring or plumbing systems, increasing the risk of fire or water damage. State Farm may require upgrades to meet safety standards, which can affect premiums.

- Home maintenance: A well-maintained home with regular inspections and repairs is less likely to experience damage, resulting in lower premiums. State Farm may offer discounts for preventative measures like smoke detectors, fire extinguishers, and security systems.

- Credit score: While not always used, some insurance companies, including State Farm, may use credit scores to assess risk. A good credit score generally means lower premiums. This is based on the idea that individuals with good credit history tend to be more responsible and financially stable.

- Claims history: A history of filing claims can increase your premiums. State Farm, like other insurance companies, tracks claims history and may adjust premiums based on the number and type of claims filed.

State Farm Home Insurance Discounts

State Farm offers a wide range of discounts to help homeowners save money on their insurance premiums. These discounts can be applied to your policy based on factors such as your home’s features, your safety measures, and your personal habits. By taking advantage of these discounts, you can potentially lower your monthly payments and save a significant amount of money over time.

Discounts Based on Home Features

Discounts based on home features are designed to reward homeowners for making their homes safer and more secure.

- New Home Discount: This discount is typically offered for homes that are less than 10 years old. Newer homes are generally built with more modern safety features and materials, which can reduce the risk of damage or loss.

- Home Safety Features Discount: Installing security systems, fire alarms, and other safety features can significantly reduce the risk of theft, fire, and other hazards. State Farm offers discounts for homeowners who have these features installed in their homes.

- Roof Type Discount: Certain types of roofing materials, such as impact-resistant shingles, are more durable and resistant to damage. Homeowners with these types of roofs may qualify for a discount.

- Energy-Efficient Features Discount: Installing energy-efficient features, such as solar panels or energy-efficient windows, can reduce your energy consumption and lower your insurance premiums.

Discounts Based on Safety Measures

Safety measures taken by homeowners can also qualify them for discounts.

- Smoke Alarm Discount: Installing working smoke alarms in your home is essential for fire safety. State Farm offers discounts for homeowners who have properly functioning smoke alarms.

- Sprinkler System Discount: Homes with sprinkler systems have a lower risk of fire damage. State Farm offers discounts for homeowners who have sprinkler systems installed.

- Burglar Alarm Discount: Installing a burglar alarm can deter theft and protect your belongings. State Farm offers discounts for homeowners who have burglar alarms installed.

- Home Security System Discount: This discount is offered to homeowners who have a monitored home security system that includes features such as motion sensors, door and window sensors, and a 24/7 monitoring service.

Discounts Based on Personal Habits

Your personal habits can also influence your insurance premiums.

- Good Driver Discount: If you have a good driving record, you may be eligible for a discount on your home insurance. This is because a good driving record indicates a lower risk of accidents, which can potentially affect your home insurance.

- Multi-Policy Discount: Bundling your home and auto insurance policies with State Farm can save you money. This discount is offered for having multiple policies with the same insurer.

- Loyalty Discount: State Farm rewards long-term customers with loyalty discounts. The longer you’ve been a State Farm customer, the higher your discount may be.

Customer Reviews and Ratings

State Farm is one of the largest and most well-known insurance companies in the United States, with a significant presence in the home insurance market. It’s essential to understand what customers are saying about their experiences with State Farm home insurance before making a decision.

To get a comprehensive picture of customer sentiment, we’ll delve into reviews and ratings from reputable sources. We’ll also compare State Farm’s performance to other major home insurance providers to see how it stacks up against the competition.

Customer Reviews and Ratings from Reputable Sources

State Farm home insurance consistently receives positive ratings from independent review platforms and consumer organizations. Here’s a summary of what customers are saying:

- J.D. Power: State Farm has consistently ranked highly in J.D. Power’s annual Home Insurance Satisfaction Study, often placing among the top providers. This recognition indicates customer satisfaction with the company’s claims process, customer service, and overall experience.

- NerdWallet: NerdWallet, a personal finance website, has given State Farm a high rating for its home insurance policies, citing its competitive pricing, comprehensive coverage options, and strong customer service.

- Consumer Reports: Consumer Reports, a non-profit organization known for its independent product testing and reviews, has also given State Farm positive ratings for its home insurance, highlighting its financial stability and customer satisfaction.

Comparison to Other Major Home Insurance Providers

State Farm’s performance in customer reviews and ratings is generally on par with other major home insurance providers. Here’s a comparison to some of its key competitors:

| Provider | J.D. Power Rating | NerdWallet Rating | Consumer Reports Rating |

|---|---|---|---|

| State Farm | High | High | Positive |

| Allstate | High | High | Positive |

| Liberty Mutual | High | High | Positive |

| Geico | High | High | Positive |

| Farmers | High | High | Positive |

It’s important to note that these ratings can vary depending on the specific factors considered and the year of the study. However, they provide a general indication of how State Farm compares to its competitors in terms of customer satisfaction.

Common Themes and Concerns in Customer Reviews

While State Farm generally receives positive feedback, some common themes and concerns emerge from customer reviews. These include:

- Claims Process: Some customers have reported challenges with the claims process, including delays in processing or difficulty in getting their claims approved.

- Customer Service: While many customers praise State Farm’s customer service, others have reported issues with responsiveness or difficulty in getting their questions answered.

- Pricing: Some customers have found State Farm’s premiums to be higher than those offered by other providers, especially for those with higher-risk properties or a history of claims.

State Farm Home Insurance Policy Details

Understanding the specifics of your State Farm home insurance policy is crucial for ensuring you have adequate coverage in the event of a covered loss. Here’s a breakdown of a sample policy to help you grasp the key elements.

Deductibles

Deductibles are the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible generally translates to lower premiums, while a lower deductible means higher premiums. It’s essential to choose a deductible you can comfortably afford while still maintaining adequate coverage. For instance, if you have a $1,000 deductible and experience a $5,000 covered loss, you would pay $1,000, and State Farm would cover the remaining $4,000.

Coverage Limits

Coverage limits represent the maximum amount State Farm will pay for a specific type of covered loss. It’s vital to ensure your coverage limits are sufficient to rebuild or repair your home and replace your belongings in the event of a disaster. For example, if your dwelling coverage limit is $250,000 and your home sustains $300,000 worth of damage, you would be responsible for the remaining $50,000.

Exclusions, Home insurance state farm

Exclusions are specific events or situations that are not covered by your policy. Understanding these exclusions is essential to avoid surprises during a claim. Common exclusions include:

- Earthquakes

- Flooding

- Acts of war

- Intentional damage

While some exclusions can be added as endorsements for an additional premium, it’s important to be aware of what is and isn’t covered by your base policy.

Endorsements

Endorsements are additional coverage options you can add to your policy to tailor it to your specific needs. Some common endorsements include:

- Earthquake coverage

- Flood insurance

- Identity theft protection

- Personal property replacement cost coverage

These endorsements can increase your premium, but they can also provide essential protection for situations not covered by your standard policy.

Importance of Understanding Policy Terms and Conditions

Reading and understanding your policy terms and conditions is crucial to ensure you know exactly what you’re covered for and what your responsibilities are. This can help you avoid surprises during a claim and ensure a smooth claims process. Here are some key aspects to focus on:

- Covered perils: This section Artikels the events or situations that are covered by your policy. For example, it might list fire, theft, windstorm, or hail as covered perils.

- Exclusions: This section details the events or situations that are specifically not covered by your policy.

- Duties after a loss: This section Artikels your responsibilities after a covered loss, such as reporting the claim promptly, taking steps to prevent further damage, and providing necessary documentation.

If you have any questions or doubts about your policy terms and conditions, don’t hesitate to contact your State Farm agent for clarification.

Getting a Quote and Buying State Farm Home Insurance

Getting a quote for State Farm home insurance is straightforward and can be done online, over the phone, or in person at a local State Farm agent’s office. The process involves providing information about your home and your insurance needs, allowing State Farm to calculate a personalized quote.

Obtaining a Quote

To obtain a quote, you will need to provide State Farm with information about your home, such as:

- Address

- Square footage

- Year built

- Type of construction

- Roof type

- Number of bedrooms and bathrooms

- Security features

You will also need to provide information about your insurance needs, such as:

- Desired coverage amount

- Deductible amount

- Additional coverages you want, such as flood or earthquake insurance

State Farm will use this information to calculate your premium, which is the amount you will pay for your home insurance policy.

Purchasing a Policy

Once you have received a quote and decided to purchase a policy, you will need to provide State Farm with some additional information, such as:

- Your driver’s license number

- Social Security number

- Payment information

You will also need to sign some documents, such as the policy application and the insurance agreement. Once you have completed these steps, your State Farm home insurance policy will be in effect.

Tips for Getting the Best Possible Rates

There are a few things you can do to get the best possible rates on your State Farm home insurance:

- Shop around and compare quotes from multiple insurers. This will help you ensure that you are getting the best possible price for your coverage.

- Increase your deductible. A higher deductible will mean you pay more out of pocket if you have a claim, but it will also lower your premium.

- Improve your home’s security. Installing security features such as alarms, smoke detectors, and deadbolt locks can help lower your premium.

- Bundle your insurance policies. State Farm offers discounts for bundling your home insurance with other types of insurance, such as auto insurance.

- Ask about discounts. State Farm offers a variety of discounts, such as discounts for being a good driver, having a good credit score, and being a member of certain organizations.

Claims Process with State Farm

Filing a claim with State Farm is designed to be a straightforward process, aiming to provide assistance and support during challenging times. The process involves reporting the claim, gathering information, and receiving compensation.

Reporting a Claim

You can report a claim with State Farm through various channels:

- Online: State Farm’s website offers a convenient online portal for reporting claims, accessible 24/7.

- Mobile App: The State Farm mobile app allows you to report claims quickly and easily from your smartphone or tablet.

- Phone: You can reach State Farm’s customer service line by phone to report a claim and receive immediate assistance.

When reporting a claim, you will need to provide essential details, such as your policy information, the date and time of the incident, and a description of the damage.

Claim Processing and Compensation

Once you report a claim, State Farm will initiate the processing phase. This involves:

- Claim Assignment: A claims adjuster will be assigned to your claim to investigate the incident and assess the damage.

- Damage Assessment: The adjuster will conduct an inspection of your property to determine the extent of the damage and the cost of repairs or replacement.

- Claim Review and Approval: State Farm will review the claim and determine the amount of compensation you are eligible to receive based on your policy coverage and the assessed damage.

- Payment Processing: Once the claim is approved, State Farm will process the payment, either directly to you or to the repair or replacement contractor.

State Farm aims to process claims efficiently and provide prompt compensation to policyholders.

Claims Handling Procedures and Customer Support

State Farm strives to provide exceptional customer service throughout the claims process. They offer:

- 24/7 Claims Support: State Farm’s claims team is available 24 hours a day, 7 days a week to assist you with any questions or concerns.

- Dedicated Claims Adjusters: Your claim will be handled by a dedicated claims adjuster who will guide you through the process and provide personalized support.

- Transparent Communication: State Farm keeps you informed throughout the claims process, providing updates on the progress of your claim and addressing any questions or concerns you may have.

State Farm’s commitment to excellent customer service aims to make the claims process as smooth and stress-free as possible for policyholders.

Conclusion

Navigating the world of home insurance can be overwhelming, but with State Farm by your side, you can have peace of mind knowing that your home is protected. By understanding the intricacies of your policy, utilizing available discounts, and proactively engaging with State Farm’s customer service, you can ensure that your home insurance experience is seamless and beneficial. Remember, choosing the right home insurance is an essential step in safeguarding your financial well-being and securing the future of your property.

Essential Questionnaire: Home Insurance State Farm

What are the different types of coverage offered by State Farm?

State Farm offers a variety of coverage options, including dwelling coverage, personal property coverage, liability coverage, and additional living expenses coverage. These coverages provide protection against various risks, such as fire, theft, and natural disasters.

How can I get a quote for State Farm home insurance?

You can obtain a quote for State Farm home insurance online, over the phone, or through a local State Farm agent. You will need to provide information about your home, such as its location, size, and value, as well as your desired coverage levels.

What are the benefits of choosing State Farm home insurance?

State Farm is known for its comprehensive coverage options, competitive rates, and excellent customer service. They also offer a variety of discounts and have a strong reputation for handling claims efficiently and fairly.