Home insurance new york state – Home insurance in New York State is essential for protecting your biggest investment. Navigating the complexities of coverage, premiums, and claims can be daunting, but understanding your options is key to securing the right protection for your home. From mandatory coverage requirements to the nuances of policy limits and deductibles, this guide will empower you to make informed decisions about your home insurance.

New York’s unique environment presents specific challenges for homeowners, including the potential for natural disasters like hurricanes and blizzards. Knowing how to mitigate risks, prevent claims, and navigate the claims process effectively can significantly impact your peace of mind and financial well-being.

Understanding Home Insurance in New York State

Home insurance is essential for homeowners in New York State, as it provides financial protection against various risks that can damage your property or cause personal liability. This guide will help you understand the different types of coverage available, the mandatory requirements, and the factors that influence your insurance premiums.

Types of Home Insurance Coverage

Home insurance policies in New York State typically include several types of coverage. Understanding these coverages can help you determine the right policy for your specific needs.

- Dwelling Coverage: This coverage protects the physical structure of your home, including the walls, roof, and foundation, against damage caused by covered perils such as fire, windstorms, and hail. The amount of dwelling coverage you need depends on the replacement cost of your home.

- Other Structures Coverage: This coverage protects detached structures on your property, such as garages, sheds, and fences, against damage caused by covered perils. The amount of coverage you need will depend on the value of these structures.

- Personal Property Coverage: This coverage protects your belongings inside your home, such as furniture, electronics, clothing, and jewelry, against damage or loss caused by covered perils. You can typically choose from actual cash value (ACV) or replacement cost value (RCV) coverage for your personal property. ACV coverage pays the depreciated value of your belongings, while RCV coverage pays the cost to replace them with new items.

- Liability Coverage: This coverage protects you from financial losses if someone is injured on your property or if you are held liable for damages caused by your actions. For example, if a guest trips and falls on your icy sidewalk, liability coverage can help pay for their medical expenses and legal fees.

- Additional Living Expenses Coverage: This coverage helps pay for temporary living expenses if your home becomes uninhabitable due to a covered peril. This coverage can help pay for hotel stays, meals, and other essential expenses while your home is being repaired or rebuilt.

- Flood Insurance: While not typically included in standard home insurance policies, flood insurance is available as a separate policy. It is essential if your home is located in a flood-prone area, as it can protect you from significant financial losses if your home is damaged by flooding.

Mandatory Coverage Requirements, Home insurance new york state

New York State requires homeowners to have a minimum amount of liability coverage. This requirement is designed to protect homeowners from financial ruin if they are sued for damages caused by their actions. The minimum liability coverage requirement is:

$100,000 per occurrence and $300,000 aggregate

This means that your insurance policy must cover at least $100,000 in damages for each incident and a total of $300,000 in damages over the entire policy period.

Factors Influencing Home Insurance Premiums

Several factors can influence your home insurance premiums in New York State. Understanding these factors can help you make informed decisions that can potentially lower your premiums.

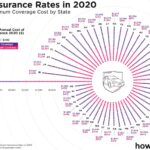

- Location: Your home’s location is a major factor that affects your premiums. Homes located in areas with a higher risk of natural disasters, such as hurricanes, earthquakes, or wildfires, will generally have higher premiums.

- Home Value: The value of your home is directly related to your premiums. Homes with a higher value will generally have higher premiums because they represent a greater financial risk to the insurance company.

- Construction Type: The type of construction used to build your home can also affect your premiums. Homes built with fire-resistant materials, such as brick or concrete, may have lower premiums than homes built with wood framing.

- Credit Score: Your credit score is often used by insurance companies to assess your risk as a policyholder. Individuals with good credit scores typically qualify for lower premiums than those with poor credit scores.

- Deductible: Your deductible is the amount of money you agree to pay out of pocket before your insurance coverage kicks in. A higher deductible generally results in lower premiums, while a lower deductible leads to higher premiums.

- Coverage Limits: The amount of coverage you choose for your home and belongings can also affect your premiums. Higher coverage limits generally result in higher premiums.

- Safety Features: Homes with safety features, such as smoke detectors, fire alarms, and security systems, may qualify for discounts on their premiums.

- Claims History: Your claims history can also affect your premiums. If you have filed multiple claims in the past, you may be considered a higher risk and may face higher premiums.

Choosing the Right Home Insurance Policy: Home Insurance New York State

Finding the right home insurance policy in New York State is essential to protect your most valuable asset. This process involves careful consideration of your individual needs and the available options. This guide provides a step-by-step approach to selecting the best policy for your situation.

Understanding Your Needs

Before you start comparing policies, it’s crucial to assess your specific requirements. This involves understanding the value of your home, the personal property you need to insure, and the potential risks you face.

- Determine the value of your home: This includes the cost of rebuilding or replacing your home in case of damage or destruction. Consider factors like the size, construction materials, and location of your home.

- Evaluate your personal property: Make a detailed inventory of your belongings, including furniture, appliances, electronics, and jewelry. This helps you determine the coverage you need for personal property.

- Assess potential risks: Consider factors like the location of your home, its proximity to bodies of water, and the history of natural disasters in your area. This helps you determine the specific coverages you may need, such as flood insurance or earthquake insurance.

Comparing Insurance Providers

Once you understand your needs, it’s time to start comparing different insurance providers. Here are some key considerations:

- Coverage options: Compare the types of coverage offered by different insurers, including dwelling coverage, personal property coverage, liability coverage, and additional living expenses coverage. Make sure the policy covers the risks you’ve identified.

- Premiums: Obtain quotes from multiple insurers to compare premium rates. Consider factors like deductibles, coverage limits, and discounts offered by each provider.

- Customer service and claims handling: Research the reputation of each insurer for customer service and claims handling. Look for providers with a history of fair and efficient claim processing.

- Financial stability: Check the financial stability of the insurer by reviewing its ratings from independent organizations like AM Best. Choosing a financially stable insurer ensures that they will be able to pay your claims in the event of a loss.

Policy Limits and Deductibles

Understanding policy limits and deductibles is crucial when selecting a home insurance policy.

- Policy limits: These are the maximum amounts that your insurance policy will pay for covered losses. It’s essential to choose limits that are sufficient to cover the value of your home and personal property.

- Deductibles: This is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible generally results in lower premiums, while a lower deductible means higher premiums. Choose a deductible that you can afford to pay in the event of a claim.

It’s important to note that deductibles and policy limits can vary significantly between insurers. Carefully review the terms and conditions of each policy to understand these factors.

Protecting Your Home from Common Risks

Living in New York State, you’re exposed to a unique set of potential risks that can impact your home. Understanding these risks and taking proactive steps to mitigate them is crucial for protecting your property and ensuring peace of mind.

Natural Disasters

New York State faces a range of natural disasters, from hurricanes and floods to earthquakes and winter storms. These events can cause significant damage to your home, leading to costly repairs and disruptions to your life.

- Hurricanes and Floods: Coastal areas are particularly vulnerable to hurricanes and the subsequent flooding they often bring. Strong winds can damage roofs, windows, and siding, while heavy rainfall can lead to basement flooding and water damage throughout the house.

- Winter Storms: Heavy snowfall and freezing temperatures can pose challenges for homeowners. Snow accumulation on roofs can cause structural damage, while frozen pipes can burst, leading to significant water damage.

- Earthquakes: While not as frequent as other natural disasters, earthquakes can occur in New York State, particularly in the western and southeastern regions. These events can cause tremors that can damage foundations, walls, and other structural components.

Theft

Unfortunately, theft is a common risk for homeowners in New York State. Burglaries can occur at any time, and the financial and emotional impact can be substantial.

- Burglary: This involves the illegal entry into your home with the intent to steal property. Thieves often target homes that appear vulnerable, such as those with unlocked doors or windows, or lacking visible security systems.

- Theft of Valuables: Items like jewelry, electronics, and cash are particularly attractive to thieves. It’s essential to secure these valuables in safes or lockboxes, and consider using home security systems to deter theft.

Preventing Common Home Insurance Claims

Taking preventative measures can significantly reduce the likelihood of home insurance claims.

- Regular Maintenance: Regular maintenance of your home’s systems, such as plumbing, electrical, and heating/cooling, can prevent costly repairs and potential hazards.

- Safety Measures: Simple safety measures, such as installing smoke detectors and carbon monoxide detectors, can help prevent fires and ensure your family’s safety.

- Security Measures: Consider installing a home security system, including alarm systems, motion detectors, and security cameras. These measures can deter theft and provide valuable evidence in case of a break-in.

- Storm Preparedness: Prepare for potential natural disasters by securing loose objects in your yard, trimming trees near your home, and having a plan for evacuation if necessary.

Role of Home Maintenance in Mitigating Insurance Risks

Proper home maintenance plays a crucial role in preventing costly repairs and reducing insurance claims.

- Roof Maintenance: Regular inspections and repairs of your roof can prevent leaks and water damage. This is particularly important in areas prone to heavy snowfall or hurricanes.

- Plumbing Maintenance: Prevent frozen pipes and leaks by insulating pipes, ensuring proper drainage, and addressing any plumbing issues promptly.

- Electrical Maintenance: Regular inspections and repairs of your electrical system can prevent fires and other hazards.

- Heating and Cooling Maintenance: Ensure your HVAC system is properly maintained to prevent breakdowns and ensure energy efficiency.

Navigating the Claims Process

Filing a home insurance claim in New York State can be a stressful experience, but understanding the process and following the right steps can help make it smoother. This section provides a detailed explanation of the claims process, advice on filing a claim effectively, and insights into the role of insurance adjusters.

Understanding the Claims Process

The claims process typically begins when you notify your insurance company about the damage to your home. You can usually do this by phone, email, or through their online portal. Once you report the claim, the insurance company will assign an adjuster to investigate the damage. The adjuster will examine the damage, assess its extent, and determine if it is covered under your policy. They will then provide you with an estimate of the cost to repair or replace the damaged property.

Filing a Claim Effectively

To file a claim effectively, it is essential to be prepared and organized.

- Document the damage: Take photos or videos of the damage, and keep receipts for any expenses related to the incident. This documentation will help support your claim and ensure you are reimbursed for all eligible expenses.

- Contact your insurance company promptly: Delaying reporting the claim can jeopardize your coverage, so it is essential to contact your insurer as soon as possible after the incident.

- Be honest and cooperative: Providing accurate information and cooperating with the insurance adjuster will help expedite the claims process and ensure you receive a fair settlement.

The Role of Insurance Adjusters

Insurance adjusters play a crucial role in the claims process. They are responsible for investigating the damage, determining the cause, and assessing the extent of the loss. They will also review your policy and determine which covered perils are responsible for the damage.

- Understanding the adjuster’s role: The adjuster is not your advocate. They work for the insurance company and are tasked with protecting the company’s interests. While they are obligated to be fair and unbiased, it is important to remember that they are there to assess the damage and determine the extent of coverage.

- Communicate effectively: It is essential to communicate effectively with the adjuster. Be clear and concise when explaining the damage, and ask questions if you are unsure about any aspect of the process.

- Negotiate the settlement: The adjuster will provide you with an initial settlement offer. You are not obligated to accept this offer, and you have the right to negotiate a fair settlement that reflects the full extent of your losses.

The Importance of Documentation

Thorough documentation is essential for a successful claims process. This includes:

- Photographs and videos: These can provide compelling evidence of the damage and its extent.

- Receipts and invoices: Keep receipts for all expenses related to the incident, including repairs, temporary housing, and any other out-of-pocket costs.

- Policy documents: Review your policy carefully to understand your coverage and the specific perils that are covered.

- Correspondence: Keep copies of all correspondence with the insurance company, including emails, letters, and phone records.

Resources and Support for Homeowners

Navigating the world of home insurance can feel overwhelming, but you don’t have to go it alone. New York State offers a wealth of resources and support to help homeowners make informed decisions and navigate potential challenges. This section provides a comprehensive guide to accessing these valuable resources.

Government Agencies and Consumer Protection Groups

These organizations play a crucial role in safeguarding your rights as a homeowner and providing guidance on insurance matters.

- New York State Department of Financial Services (DFS): The DFS regulates the insurance industry in New York and provides valuable information on home insurance policies, consumer rights, and complaint resolution.

- Website: https://www.dfs.ny.gov/

- Phone: (212) 480-6400

- New York State Insurance Department (NYID): The NYID is a division of the DFS, specifically dedicated to overseeing insurance matters. They offer resources on policy choices, claims handling, and consumer protection.

- Website: https://www.dfs.ny.gov/insurance/

- New York State Division of Consumer Protection: This division advocates for consumer rights and provides information on various issues, including insurance-related matters.

- Website: https://www.dos.ny.gov/consumer/

- Phone: (800) 697-1220

- National Association of Insurance Commissioners (NAIC): This organization represents state insurance regulators and offers information on insurance policies, consumer rights, and industry trends.

- Website: https://www.naic.org/

- Better Business Bureau (BBB): The BBB provides ratings and reviews for businesses, including insurance companies, helping you identify reputable providers.

- Website: https://www.bbb.org/

Finding Reputable Insurance Agents and Brokers

Choosing the right insurance agent or broker is crucial for finding the best coverage at the right price.

- Seek Recommendations: Ask friends, family, and neighbors for recommendations of agents they trust.

- Check Credentials and Experience: Ensure the agent or broker is licensed and has experience in home insurance.

- Research Online: Use online resources like the BBB or the NYID website to check an agent’s reputation.

- Get Multiple Quotes: Compare quotes from several agents to ensure you are getting the best deal.

- Ask Questions: Don’t hesitate to ask questions about the agent’s experience, their approach to finding coverage, and their fees.

Final Summary

Protecting your home in New York State requires proactive planning and informed decision-making. By understanding the intricacies of home insurance, you can secure the right coverage, mitigate risks, and confidently navigate the claims process should you need it. Remember, a well-informed homeowner is a protected homeowner.

Common Queries

What are some common risks faced by homeowners in New York State?

Homeowners in New York face risks such as natural disasters (hurricanes, blizzards, floods), theft, vandalism, and fire.

How can I find a reputable insurance agent or broker in New York?

You can seek recommendations from trusted sources, check online reviews, and contact the New York State Department of Financial Services for a list of licensed agents.

What is the role of an insurance adjuster in the claims process?

An insurance adjuster investigates your claim, assesses the damage, and determines the amount of compensation you are eligible for.