Home insurance for manufactured homes in Washington State presents a unique set of considerations. While these homes share many similarities with traditional houses, they also have distinct features that impact insurance coverage and costs. Understanding these differences is crucial for homeowners seeking adequate protection and peace of mind.

Manufactured homes in Washington are subject to specific regulations and building codes, influencing their design and construction. Additionally, the state’s diverse geography and potential for natural disasters like earthquakes and wildfires play a significant role in determining insurance premiums. This guide will delve into the intricacies of home insurance for manufactured homes in Washington, providing insights into coverage options, cost factors, and best practices for navigating the insurance process.

Home Insurance Basics for Manufactured Homes

Home insurance for manufactured homes is a crucial protection against unexpected events that can damage your property. This type of insurance provides financial coverage for repairs or replacement of your home, as well as personal belongings, in the event of covered incidents like fire, theft, or natural disasters.

Coverage Elements

Understanding the essential coverage elements of manufactured home insurance is vital for ensuring adequate protection. The policy typically covers:

- Dwelling Coverage: This protects the physical structure of your manufactured home, including the frame, walls, roof, and attached fixtures. The coverage amount is typically based on the replacement cost of your home, which is the cost to rebuild or replace it with a similar structure.

- Personal Property Coverage: This covers your personal belongings inside the manufactured home, such as furniture, appliances, clothing, and electronics. Coverage is typically based on an actual cash value (ACV) basis, meaning the amount paid is based on the depreciated value of the items.

- Liability Coverage: This protects you from financial responsibility if someone is injured on your property or if you accidentally damage someone else’s property. Liability coverage can help pay for medical expenses, legal fees, and other related costs.

- Additional Living Expenses: This covers temporary housing and other expenses if you are unable to live in your home due to a covered loss. This coverage can help pay for hotel stays, meals, and other essential living expenses.

Standard Homeowners Insurance vs. Manufactured Home Insurance

While there are similarities, key differences exist between standard homeowners insurance and manufactured home insurance:

- Structure Coverage: Standard homeowners insurance typically covers the entire structure of a traditional home, including the foundation. However, manufactured home insurance often covers only the dwelling itself, excluding the foundation, which may be covered separately under a foundation policy.

- Personal Property Coverage: Both types of insurance cover personal belongings, but manufactured home insurance may have specific limitations or exclusions for certain types of items, such as high-value jewelry or antiques.

- Liability Coverage: The liability coverage offered by both types of insurance is generally similar, but the specific limits and exclusions may differ.

- Additional Living Expenses: The coverage for additional living expenses can vary between standard homeowners insurance and manufactured home insurance. Some policies may have specific limitations on the duration or amount of coverage.

Exclusions and Limitations

Manufactured home insurance policies often have specific exclusions and limitations:

- Foundation Coverage: As mentioned earlier, the foundation of a manufactured home may not be covered under the standard policy and requires separate coverage.

- Flood Coverage: Flood insurance is typically not included in manufactured home insurance policies and must be purchased separately through the National Flood Insurance Program (NFIP).

- Earthquake Coverage: Earthquake insurance is usually not included in standard manufactured home insurance policies and may require a separate policy, depending on the location and risk.

- Wear and Tear: Manufactured home insurance typically does not cover damage caused by normal wear and tear, such as fading paint or cracked windows.

- Neglect: Damage resulting from neglect or lack of maintenance is generally not covered by manufactured home insurance.

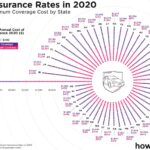

Factors Influencing Home Insurance Costs for Manufactured Homes

The cost of home insurance for a manufactured home in Washington State can vary significantly depending on several factors. Understanding these factors can help you make informed decisions about your insurance coverage and potentially save money on your premiums.

Location and Proximity to Natural Hazards

The location of your manufactured home plays a significant role in determining your insurance costs. Insurance companies assess the risk of potential damage from natural disasters, such as earthquakes, wildfires, floods, and landslides. Homes located in areas with a higher risk of these hazards will generally have higher premiums.

For example, homes situated in areas prone to earthquakes, like the Puget Sound region, will likely have higher earthquake insurance premiums compared to homes in areas with lower seismic activity. Similarly, homes located in wildfire-prone areas, such as Eastern Washington, may face higher premiums due to the increased risk of fire damage.

Choosing the Right Home Insurance Provider

Finding the right home insurance provider for your manufactured home in Washington state is crucial. It ensures you have adequate coverage at a competitive price. Carefully comparing different providers and understanding the intricacies of their policies is essential.

Comparing Insurance Providers

It is essential to compare different insurance providers specializing in manufactured homes. Each provider offers unique coverage options, premiums, and customer service experiences. This comparison helps you find the best fit for your specific needs and budget.

- Specialized Manufactured Home Insurance Providers: Some insurance companies focus specifically on manufactured homes, offering tailored policies and a deep understanding of their unique characteristics.

- General Insurance Providers: Many general insurance providers also offer coverage for manufactured homes. However, their policies might not be as comprehensive or competitively priced as those offered by specialized providers.

- Online Insurance Comparison Websites: Websites like Policygenius, Insurify, and others allow you to compare quotes from multiple insurance providers in one place. This can save you time and effort while ensuring you get the best rates.

Reading Policy Details and Comparing Quotes

Reading the fine print of insurance policies is crucial. This helps you understand the coverage provided, exclusions, and any limitations. Comparing quotes from different providers is essential to ensure you are getting the best value for your money.

- Coverage Limits: Pay close attention to the coverage limits for different aspects of your manufactured home, including dwelling coverage, personal property, liability, and additional living expenses.

- Deductibles: Higher deductibles generally lead to lower premiums. Determine the deductible amount you can comfortably afford in case of a claim.

- Exclusions: Carefully review the policy exclusions to understand what is not covered. Common exclusions might include flood damage, earthquakes, or certain types of personal property.

- Discounts: Check if the provider offers discounts for security systems, fire alarms, or other safety features. Bundling your home and auto insurance with the same provider can also lead to significant savings.

Negotiating Premiums and Seeking Discounts

Negotiating premiums with insurance providers is possible. This might involve highlighting your good driving record, credit score, or any other factors that make you a low-risk customer. Additionally, exploring available discounts can further reduce your premium.

- Shop Around: Getting quotes from multiple providers allows you to compare prices and negotiate a better rate.

- Loyalty Discounts: Many insurance companies offer discounts to long-term customers. Staying with the same provider for several years can lead to significant savings.

- Safety Features: Installing security systems, smoke detectors, and other safety features can make your home less risky and qualify you for discounts.

- Bundling Policies: Combining your home and auto insurance with the same provider can often result in lower premiums.

Common Risks and Coverage Considerations for Manufactured Homes: Home Insurance For Manufactured Homes In Washington State

Manufactured homes, while often more affordable than traditional stick-built homes, face unique risks that require specific insurance considerations. Understanding these risks and the available coverage options is crucial for protecting your investment and ensuring peace of mind.

Common Risks Specific to Manufactured Homes

Manufactured homes, due to their construction and often location in mobile home parks, are susceptible to certain risks that may differ from traditional homes. These include:

- Wind Damage: Manufactured homes, often with lighter construction materials and a lower profile, are more vulnerable to wind damage, especially in areas prone to strong winds or tornadoes. This can lead to roof damage, siding damage, or even the entire home being blown off its foundation.

- Foundation Issues: Manufactured homes are often placed on a concrete foundation, which can be susceptible to cracking, shifting, or settling, especially in areas with unstable soil conditions. This can lead to structural damage, uneven floors, and potential safety hazards.

- Fire: Like any home, manufactured homes are vulnerable to fire. However, the close proximity of units in mobile home parks can increase the risk of fire spreading to neighboring homes. This can be exacerbated by older electrical wiring or inadequate fire safety measures.

- Theft: Manufactured homes, especially those located in mobile home parks, can be targets for theft. This can include theft of personal property, appliances, or even the entire home.

Importance of Coverage for Personal Property, Liability, and Additional Living Expenses

Your home insurance policy should cover not only the structure of your manufactured home but also your personal belongings and potential liability risks.

- Personal Property Coverage: This protects your belongings inside the home, such as furniture, clothing, electronics, and other valuables. It’s essential to ensure your policy provides adequate coverage for the full value of your possessions.

- Liability Coverage: This protects you if someone is injured on your property or you are held liable for damages to someone else’s property. It can cover legal defense costs and any settlements or judgments against you.

- Additional Living Expenses (ALE): If your home becomes uninhabitable due to a covered event, this coverage helps pay for temporary housing, meals, and other essential living expenses while your home is being repaired or rebuilt. This is crucial for maintaining your standard of living during a difficult time.

Optional Coverage Options for Manufactured Homes

While standard home insurance policies offer essential coverage, certain optional add-ons can provide additional protection against specific risks:

- Flood Insurance: If your manufactured home is located in a flood-prone area, flood insurance is crucial. This coverage is not typically included in standard home insurance policies and must be purchased separately through the National Flood Insurance Program (NFIP).

- Earthquake Insurance: In earthquake-prone areas, earthquake insurance is a valuable addition to your policy. This coverage protects your home against damage caused by earthquakes, which can be significant and costly.

Understanding Claims Processes and Procedures

Knowing how to file a claim and navigate the process is crucial for manufactured home owners in Washington state. Understanding the steps involved, documenting damage effectively, and communicating clearly with your insurance provider can help ensure a smooth and successful claim resolution.

Steps Involved in Filing a Claim

Filing a claim for damage to your manufactured home involves a series of steps designed to assess the situation, document the damage, and determine the extent of coverage.

- Contact your insurance provider immediately after the damage occurs. Inform them about the incident, including the date, time, and nature of the damage. This is important for initiating the claims process and potentially protecting your property from further damage.

- File a formal claim. Your insurance provider will provide you with a claim form or guide you through the online filing process. Be sure to provide accurate and complete information about the damage, including details about the cause of the damage and any contributing factors.

- Schedule an inspection. Your insurance provider will arrange for an independent adjuster to inspect the damage and determine the extent of the loss. This inspection is crucial for determining the amount of coverage you are eligible for.

- Review the adjuster’s report and negotiate the settlement. The adjuster will provide a report outlining the damage and the estimated cost of repairs or replacement. You have the right to review this report and negotiate the settlement amount if you disagree with the findings.

- Receive payment for the claim. Once the claim is approved, your insurance provider will issue payment for the repairs or replacement of the damaged property. Payment may be made directly to you or to the contractor handling the repairs.

Documenting Damage and Communicating with Your Insurance Provider, Home insurance for manufactured homes in washington state

Documentation is crucial for supporting your claim and ensuring you receive the appropriate compensation. Clear and detailed documentation can also help expedite the claims process.

- Take photographs and videos of the damage. Capture the damage from multiple angles, including close-up shots of any specific details. This visual evidence will help support your claim and demonstrate the extent of the damage.

- Keep a detailed record of the damage. Create a written log of the damage, including the date, time, location, and a description of the damage. Include any details about the cause of the damage and any actions you took to mitigate the damage.

- Keep all receipts and invoices. Maintain copies of any receipts or invoices related to repairs or replacement costs. These documents can help justify the amount of your claim and ensure you receive reimbursement for all eligible expenses.

- Communicate clearly and promptly with your insurance provider. Respond to all inquiries promptly and provide all necessary information in a timely manner. Clear and consistent communication can help prevent misunderstandings and delays in the claims process.

Understanding Policy Limits and Deductibles

Your manufactured home insurance policy Artikels the limits and deductibles for various types of coverage. Understanding these terms is crucial for determining your financial responsibility in the event of a claim.

Policy limits represent the maximum amount your insurance provider will pay for a covered loss.

Deductibles are the amount you are responsible for paying out-of-pocket before your insurance coverage kicks in.

- Review your policy carefully. Understand the specific limits and deductibles for each type of coverage, including dwelling coverage, personal property coverage, and liability coverage.

- Consider your individual needs and budget. Choose a policy with limits and deductibles that align with your financial situation and the value of your manufactured home. A higher deductible typically translates to lower premiums, while a lower deductible results in higher premiums.

- Understand the impact of deductibles on your out-of-pocket expenses. Remember that you will be responsible for paying your deductible before your insurance coverage kicks in. This can significantly impact your financial responsibility in the event of a claim.

Final Wrap-Up

Securing the right home insurance for your manufactured home in Washington is essential for safeguarding your investment and protecting your family. By understanding the unique aspects of manufactured housing, carefully comparing insurance providers, and staying informed about coverage options and potential risks, you can make informed decisions that provide the best possible protection. Remember to review your policy regularly, consider optional coverage for specific risks, and keep open communication with your insurance provider to ensure your needs are met.

Helpful Answers

What are the main differences between insurance for manufactured homes and traditional homes?

Insurance for manufactured homes often has specific coverage requirements and limitations compared to traditional homes, such as differences in coverage for the foundation and potential for depreciation.

How do I find a reputable insurance provider for my manufactured home?

Research providers specializing in manufactured homes, read reviews, compare quotes, and ask about their experience with manufactured housing claims.

What are some common risks associated with manufactured homes in Washington?

Common risks include wind damage, foundation issues, seismic activity, and wildfire hazards, depending on the location.

Can I get flood insurance for my manufactured home?

Yes, flood insurance is available for manufactured homes in Washington, especially in areas with a high risk of flooding. Contact the National Flood Insurance Program (NFIP) for more information.